A Dovish Powell

Implications from a very important FOMC meeting. How I adjusted my asset allocation, including Gold, Gold Miners, FTSE 100, Nasdaq, Dow Jones and Tesla

Yesterday’s FOMC meeting and in particular Jerome Powell’s press conference marked an important turning point in US Central Bank policy, with possibly substantial consequences for the coming years. This post lays out why, and how I have shifted my own asset allocation in response

To start, let’s briefly frame the context coming into said meeting:

US economic growth has decelerated from last year’s torrid pace, but continues to track at a very healthy ~2% real and ~6% nominal growth. Recent housing data is supportive, suggesting growth unlikely to fall off a cliff soon

Inflation has been on a downtrend for the second half of ‘23, but rebounded early this year. There are some arguments for this to be a seasonal effect…

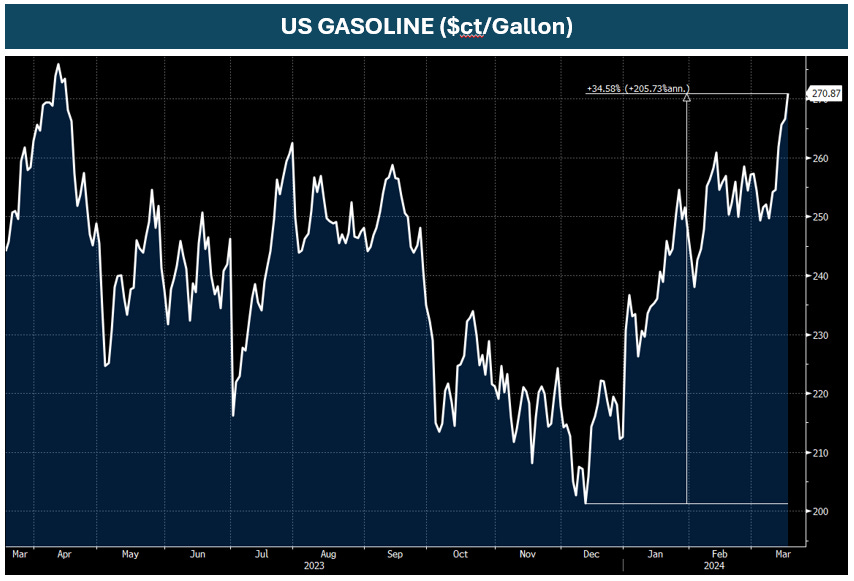

…but also some signs that are more lasting rebound could be on the cards, as goods inflation seems to have troughed, while gasoline and commodity prices are up

Finally, while headline data suggests a strong US labor market, with 275k new jobs generated in February, there are cracks under the surface in secondary employment data, such as the NFIB Small Business Hiring Plans

The FOMC meeting communication consists of two parts. A press release at 2pm EST which includes the committees’ economic projections, and the press conference with Chair Jerome Powell at 230pm. Let’s review each:

The press release represented a realistic reflection of the context laid out above, something I had predicted in detail coming into it here. FOMC members continued to forecast three cuts for ‘24, but more than before saw the possibility of only 2 cuts. Economic growth expectations as well as inflation for ‘24 were moved up, just as the Fed Funds rate forecast for ‘25, ‘26 and long term (“terminal rate”)

This could be described as a moderately hawkish outcome, acknowledging higher structural growth as well as the inflation uptick earlier this year. But the team’s press release is just a piece of paper, the real juice, as we all know, is always what the boss tells us - i.e. Jerome Powell

And his press conference was decidedly dovish. In particular the following:

He played down the early ‘24 inflation bump as seasonal

He dismissed the increase in the terminal rate as irrelevant

He introduced the taper of QT from June onwards, previously expected a ‘25 affair

He described financial conditions as restrictive

Why is the above so important? It is simple, Central Bank policy is all about credibility. If a Central Bank is not taken seriously by markets, then these will change their behavior, affect economic outcomes in their wake. Why is the Fed’s credibility at risk after yesterday? Let’s walk thru the above:

The early ‘24 inflation bump: Of course it is possible that the higher prices earlier this year are due to some seasonal effect. But it is not certain. It could well not be the case. As a Central Banker, inflation is your risk to manage. That includes acknowledging possible adverse outcomes and talking against them, not taking the more favorable outcome for certain

Higher terminal rate: US real and nominal GDP growth has been running on a very high pace. Yet, the terminal rate is still similar to the depressed pre-Covid years. Again, it does not sound good to ignore something that has obviously changed (e.g. due to high government spend, delevered households etc.)

End of QT: With markets at all-time highs and inflation at risk of picking up, why the need to end this early?

Restrictive Financial Conditions: Crypto meme coins are flying, and the dogwifhat coin project raise funds to advertise on the Las Vegas Sphere - does this sound like restrictive financial conditions to you?

In summary, Jerome Powell had all the possibility in the world to simply repeat the slightly hawkish stance of the FOMC press release. He actively chose not to. Why?

Before I come to the answer, an important thought to clarify: In today’s hyper-efficient financial markets, monetary policy is not set via the Fed’s actual rate decisions, but through their communication. If Powell talks dovish, bond markets the very same minute price in more cuts, and financial conditions ease without an actual rate cut ever occurring - this is why these press conferences are so important

He chose not to because the Fed is much more worried about economic growth and in particular the risk of higher unemployment, than it is worried about inflation. In his press conference, Powell mentioned the weakened secondary labor market indicators I mentioned above

From his point of view he is taking a gamble, with the goal to avoid an increase in unemployment at all cost

If he is lucky, the inflationary bump turns out to be seasonal and he stimulates the economy without a price to pay

If he is less lucky, then the dovish stance invites inflation down the line, as easier financial conditions feed through to more economic activity

Here is what’s important. Financial markets do not like Central Bankers playing “at risk”. They will assume some decent probability that inflation returns, and bid up real assets to protect themselves from this outcome

Ironically, this makes higher inflation more likely, as it drives up the prices of goods and services (e.g. people leave the labor force due to asset price gains like in ‘21, commodity and house prices go up etc)

This is why Central Bank credibility is so important, and why - in my view - it was unnecessarily put at risk yesterday. Yesterday, the Fed implicitly admitted that it shifted its inflation target to the 3-4% range from the historic 2%

This outcome is bullish for real assets and bearish for inequality (good luck with finding an affordable house to all Millennials whose parents won’t help them with it). In the short term it is also bullish for the economy, but in the long term higher inflation corrodes economic activity and historically very often has caused high unemployment

Conclusion: Jerome Powell chose to be very dovish while the risk of an inflation rebound still cannot be ruled out. Financial markets likely adapt by bidding up real assets

The following section is for professional investors only. It reflects my own views in a strictly personal capacity and is shared with other likeminded investors for the exchange of views and informational purposes only. Please see the disclaimer at the bottom for more details and always note, I may be entirely wrong and/or may change my mind at any time. This is not investment advice, please do your own due diligence

So what have I personally done with this information after the press conference? I sold the S&P put and took the US Dollar cash I had, which I feel is at risk of debasing, and swapped it for real assets. In particular:

Long Gold & Gold Miners: The former is self explanatory, the latter is at a multi-decade low relative to the gold price and could see a rapid up-move in price should gold continue its ascend. I also bought out-of-the-money calls in them

Long FTSE 100: The UK large cap index has broken out of its base, and could follow the DAX, Nikkei and other non-US benchmarks

Long Nasdaq 100 and Dow Jones: A higher inflation/financial repression regime is great for companies with high pricing power, low debt/net cash and high market shares. US large caps are the best companies in the world and should benefit accordingly. I also bought some short dated OTM S&P 500 calls

Short 30-year Treasuries: This is a hedge to the above, as the key risk I see is that no one wants to buy US long duration bonds anymore with a 7% deficit and a dovish Fed. However, the QT taper and bank reform changes supply/demand dynamics in a favorable way (probably deliberately so). Still, why own long-term US Treasuries?

Long Tesla: FSD 12 has been received well, humanoids will increasingly be an important story, the stock is high beta and has underperformed a lot. I also bought long-dated OTM calls here

Relative losers from this policy stance are further likely US Small Caps (Russell 2000), anything yield sensitive and also the US Dollar. However I’d expect other Central Banks to follow suit, so I see real assets as best hedge to the steady debasement of the Greenback

On a final note, I personally did not expect this very dovish turn at this juncture. Perhaps it is my German roots with some disciplined Bundesbank memory still in mind. But as Keynes used to say - When the facts change, I change my mind

Thank you for reading my work, it makes my day. It is free, so if you find it useful, please share it!

DISCLAIMER:

The information contained in the material on this website article is for professional investors only and for educational purposes only. It reflects only the views of its author (Florian Kronawitter) in a strictly personal capacity and do not reflect the views of White Square Capital LLP and/or Sophia Group LLP. This website article is only for information purposes, and it is not intended to be, nor should it be construed or used as, investment, tax or legal advice, any recommendation or opinion regarding the appropriateness or suitability of any investment or strategy, or an offer to sell, or a solicitation of an offer to buy, an interest in any security, including an interest in any private fund or account or any other private fund or account advised by White Square Capital LLP, Sophia Group LLP or any of its affiliates. Nothing on this website article should be taken as a recommendation or endorsement of a particular investment, adviser or other service or product or to any material submitted by third parties or linked to from this website. Nor should anything on this website article be taken as an invitation or inducement to engage in investment activities. In addition, we do not offer any advice regarding the nature, potential value or suitability of any particular investment, security or investment strategy and the information provided is not tailored to any individual requirements.

The content of this website article does not constitute investment advice and you should not rely on any material on this website article to make (or refrain from making) any decision or take (or refrain from taking) any action.

The investments and services mentioned on this article website may not be suitable for you. If advice is required you should contact your own Independent Financial Adviser.

The information in this article website is intended to inform and educate readers and the wider community. No representation is made that any of the views and opinions expressed by the author will be achieved, in whole or in part. This information is as of the date indicated, is not complete and is subject to change. Certain information has been provided by and/or is based on third party sources and, although believed to be reliable, has not been independently verified. The author is not responsible for errors or omissions from these sources. No representation is made with respect to the accuracy, completeness or timeliness of information and the author assumes no obligation to update or otherwise revise such information. At the time of writing, the author, or a family member of the author, may hold a significant long or short financial interest in any of securities, issuers and/or sectors discussed. This should not be taken as a recommendation by the author to invest (or refrain from investing) in any securities, issuers and/or sectors, and the author may trade in and out of this position without notice.

Well said. Highly agree. Surprised that you chose tesla over something like btc to express your views on debasement. Would love to know more on this if you would care to comment.

Thank you, very well written and well thought-out. Wishing your a great Post-FOMC day!