Checking in on the Cycle

Two good and four worrying signs suggest the odds are still on for a hard landing. Plus: Why I expect European economic weakness to become the next dominant trade

Following last week’s post “There’s a Time to Buy and a Time to Sell”, markets have come off their highs. How they evolve from here very much depends on what the economy does next. Having recently explored the possibility of a cyclical upturn, today’s post follows up on the topic in more detail

In particular, I’ve dug deeper into US Retailer inventory dynamics and reviewed other recent data, to synthesise this into four worrying and two supportive cyclical dynamics. I further illustrate a bifurcation between US and European economic growth that today is likely in its nascence, but bound to expand further over the coming years

As always, the post closes with my thoughts on current markets. These are a never-ending sequence of “dominant trades” that define narratives and drive investor attention. AI was the most recent one, and is highly likely to return at a later stage. I believe the next “dominant trade” to be European economic weakness, which may express itself differently in both equity and bond markets

Let’s start with the four worrying signs for the economic cycle:

US Retailer Inventories

The US consumer is the world economy’s engine, and at the moment it is not very interested in buying goods. US Retailers anticipated elevated Covid-demand to persist, and have filled their inventories accordingly. Now they face sluggish demand

While some such as Abercrombie have made much progress in normalising stock, a more detailed analysis reveals that inventory on aggregate is likely still concerningly high

The below chart shows the aggregate inventory/sales ratio for the the largest publicly listed importers as proxy for US Retailer stock levels. It has come off the ‘22 high, but is still much higher than over the past decade. Little progress has been made over the past year

Why is this important? Consumer demand has tapered off, now retailers expect the current softness in consumer demand to persist. They are preparing for a lacklustre holiday season…

…and modest holiday sales expectation together with ambition to reduce inventory levels likely means one thing for the second half of the year - Retailers will order a lot less from their suppliers, so fewer goods will need to be produced

This reverberates through the entire manufacturing value chain, which brings me to the next dynamic

Corporate Results for Early Cyclicals

The drop off in Retailer orders due to destocking and weak consumer demand is felt first, and most pronounced, at the very beginning of the manufacturing value chain - at Chemicals companies. These produce the essential building blocks for your new garden grill, lego toy or televison

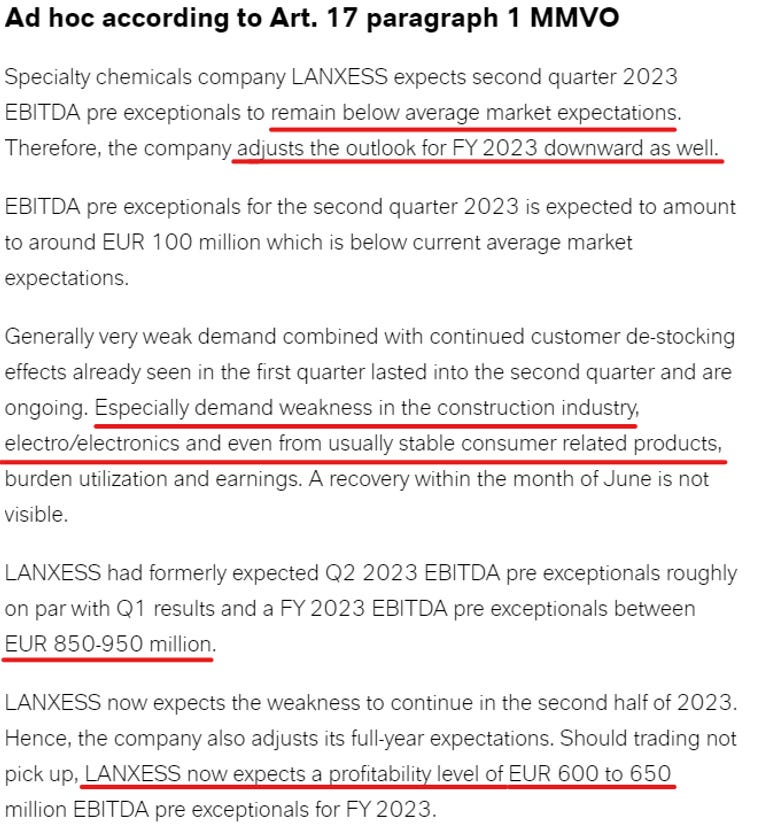

The last few weeks have seen a litany of profit warnings from Chemicals, comparable probably only to 2008. In Europe, first Croda and Victrex warned, followed by Steico and most prominently Germany’s Lanxess. Their ad-hoc release is very telling:

As is their share price, which has taken out the 2020 Covid lows:

Chemicals have historically been the canary in the coalmine for economic growth. They are flashing dark red signs right now, with an end of destocking likely only in sight towards the end of the year, or in early ‘24

US Bank Loan Growth

In a series of posts following the Regional Bank crisis, I pointed out how US loan growth was expected to weaken with a lag of ~2 months following the demise of Silicon Valley Bank. Last week’s H.8 release showed the first material decline in bank loans since, suggesting it is now getting harder for the corporate economy to refinance itself

Please note, as part of a weekly volatile time series, this drop may be an outlier and/or revert in future releases. Further, US loan growth was exceptionally high last year (+$1.5tr), so the recent decline (~$100bn) is not yet significant in comparison. However, the trend appears clear

The US economy is highly levered, and within it especially the corporate sector. While much debt has been termed out over the past years, as time passes both higher debt service cost as well as lower credit supply will start to bite

US Labor Market

The US labor markt has shown tremendous resilience over the past year. However some notable cracks have appeared

Comparing the evolution of continuing claims (= people who file for unemployment benefits more than once) to previous years, a divergence is apparent. The absolute level is still low, but the trend is visible and concerning

Further, the US unemployment rate, a datapoint only rarely subject to revision, jumped 0.3% in the last NFP survey. Historically, whenever it increased 0.3%, 9 out of 11 times it increased significantly more after

Finally, some recent survey especially in the service sector paint a concerning picture with regards to employment, such the Philadelphia Fed Services Employment component, which fell off a cliff. These regional surveys are volatile, the strong move is still notable

Taken together, there are now some visible cracks in the US labor market. Historically, these have predated sustained labor market weakness. This time may be different, but the risk is

Summary: (1) Very bloated Retailer inventories, (2) heavy profit warnings from early cycle corporates, (3) declining US bank loans and (4) visible cracks in the US labor market paint a picture of a challenged economy that faces imminent deterioration rather than improvement

In contrast, let’s have a look at some positive dynamics worth highlighting:

Artificial Intelligence

AI (see previous post “The AI Revolution”) is an incredible development that is likely to leave a profound economic impact. Efficiency gains across industries are likely considerable, from healthcare (example below) to law or robotics

In recent conversations, I’ve encountered plenty of anecdotal stories of businesses already implementing AI in their processes to save cost, and would think the adoption curve will be steep. However, it will take time until results are visible both in corporate P&Ls and broad economic

AI likely leads to substantial productivity gains that bolster economic growth and lower inflation, similar to the Personal Computer in the 1980s or Internet in the late 1990s - both periods of declining inflation and good economic growth. However, we are still in the very first innings. The first broad economic effects are likely only truly felt within 18-36 months (obviously much sooner in some parts of the economy, such as semiconductors, data centers etc.)

US Housing

As mentioned in my recent posts, the US housing market has done much better than expected, contrary to expectations

High mortgages have made the existing home market unaffordable, so homebuilders provide new supply at a discount to consumers whose credit-worthiness is bolstered by the residue of Covid-stimulus cheques. A very different dynamic to 2008 when consumers where overlevered and not interested to buy at any price

As a result, US housing starts are up sharply, a stunning 20% month-on-month in May to 1.6m units. While this figure may be revised lower as it is somewhat incongruent with other housing stats, it is nevertheless a market that currently supports the economy, rather than historically leading it into a downturn. Until or unless unemployment increases, there is little reasons for this to change

Summary: AI is likely to boost economic growth and lower inflation a few years down the line. The US housing market is currently supportive of economic growth, rather than the detriment it usually is at the current cycle stage. Either is constructive, however it is unclear whether the support is sufficient to prevent the US economy from falling into a recession - construction accounts for 4% of GDP, consumption for 70%

Turning to Europe, things are very different on the old continent. The ECB tightened monetary policy similarly to the Fed, however the reasons for European inflation are different, an energy shock vs money printing in the US

More so, the transmission of this tight monetary policy into the economy is much more effective in Europe. Instead of the US 30-years at a fixed rate, many European mortgage markets typically run on much shorter duration (e.g. 7-10 years) and often variable rates

With that in mind, it is no surprise that German construction activity is cratering, with permits falling off the proverbial cliff

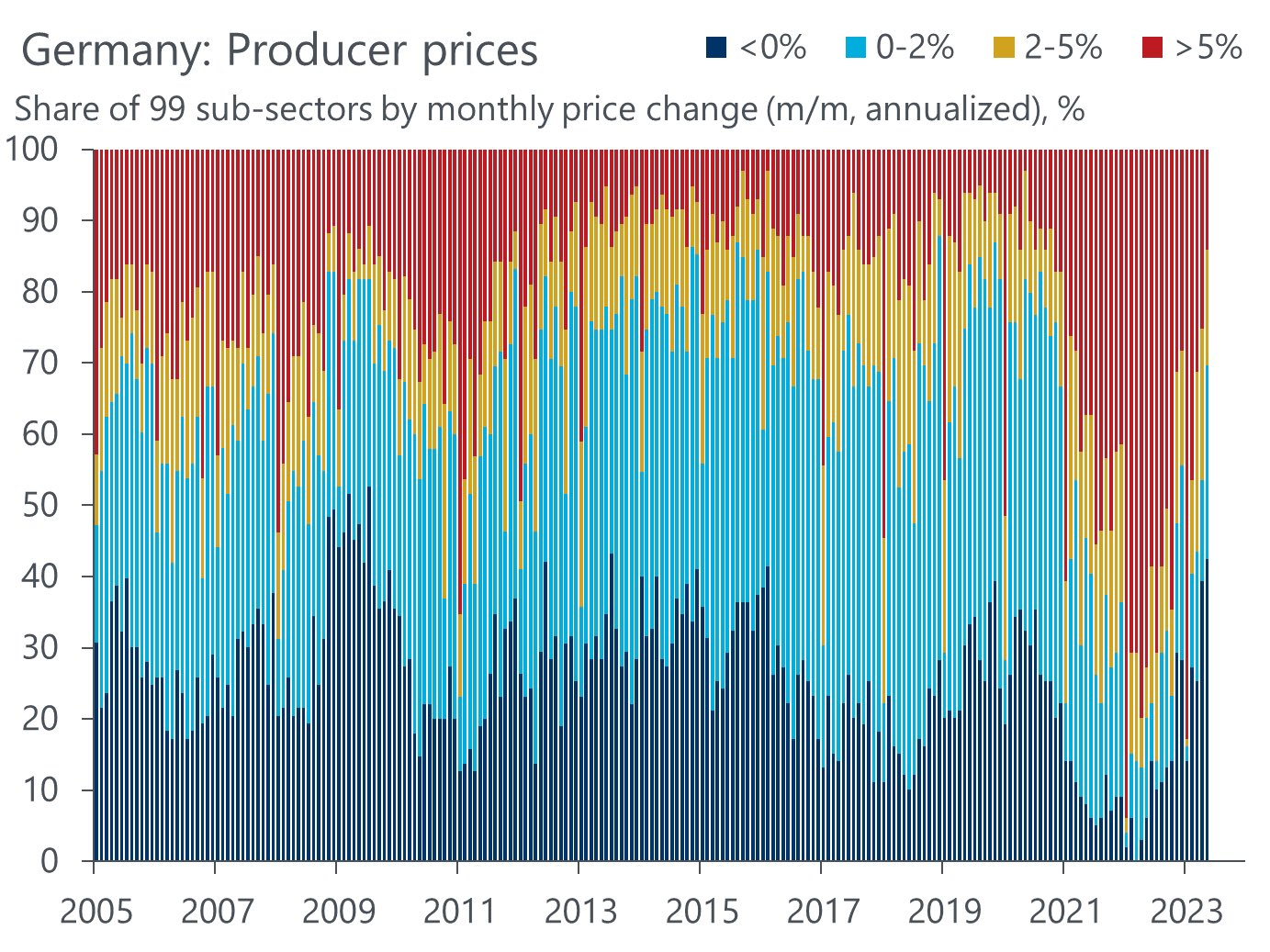

The inflation outlook for Europe and also the UK is shaped by these dynamics. I expect European disinflationary trends to be much more pronounced, as can be seen e.g. by German Producer Prices, which have revert back to almost zero growth year-on-year

In fact, about 40% of producer prices are now in deflation, a share that has rapidly risen over the past months. This exceeds the energy share in the PPI and is a clear sign of anaemic demand

And it is not only Germany, also the much lambasted UK faces a price trend outlook that is frankly deflationary

Summary: European growth trends are very weak, and the degree of monetary tightening, a more immediate transmission of monetary policy and the different inflation origin make a European hard landing much more likely than for the US

Conclusion: What to make of all this?

For Europe, the signals seems clear to me. A hard landing is ahead. For the US, it all boils down to the evolution of unemployment

If the labor market stays tight until the end of destocking, then any slowdown will be shallow and short-lived

If the labor market cracks, it will turn into a longer recession

The jury is still out on it. I lean towards the labor market cracking unfortunately. However, I have to acknowledge that today’s cycle dynamics remain very different, so I remain open-minded

What does this mean for markets?

As always, below is my personal attempt at connecting-the-dots for my own investments. Please keep in mind - I may be totally wrong, nothing is more important than risk management, and none of this is investment advice

As laid out today and in recent posts (e.g. “In Plain Sight”) I see markets mispricing downside risks to the European economy. In fact, hedge funds, which are usually a great group to fade in terms of trading, are now record overweight Europe and record underweight the US as per recent GS Prime Broking data. This tells me that an asymmetric setup exists, where a large group of market participants needs to “convert” to a new view, should European growth disappoint as I expect

More broadly, I have noted that global bond yields have failed to make new highs despite a series of hawkish events, which suggests to me that a soft landing and/or “higher for longer” interest rates are largely in the price, while any downside surprises could lead to more pronounced moves

Taken all that together, I currently own 10-year UK Gilts, 30-year German “Bundesobligationen”, 5-year US Treasuries as well as puts on various EU cyclicals where profit warnings could occur. I also own an outright DAX short, against which I intend to set an US long in the near future, likely taken from the AI winners (e.g. Google), should these sell off into month end. This pair would then create the inverse of the current hedge fund positioning

I also want to note that UK Gilts have ticked the “newspaper headline rule”, which in the past has often been a good contrarian indicator. If it’s on the cover of the Daily Mail, everyone and their mother will know about it, and it’s often in the price

My expectation is that following AI, European economic weakness becomes the next dominant trade for global capital markets. As always, please keep in mind, I could be wrong in conclusion, timing - or both