Crypto Carnage

Six lessons from the FTX blow up, plus a brief update on markets

This week, the collapse of leading crypto-exchange FTX shocked financial markets. Unprecedented in scale and in blue-chip context, my thoughts go out to those affected, many of them inexperienced retail investors. There are some universal lessons to be drawn from this situation, which I attempt to summarise in today’s post

As always, the post concludes with an outlook on markets where I explain why I remain very long this very unloved rally fuelled by universally bearish hedge fund positioning (for more context see previous posts in “The Last Inning” and “Is Inflation Good”). I also include a brief commentary on yesterday’s inflation data

Sam Bankman-Fried (“SBF”), founder and majority owner of Crypto-exchange FTX and affiliated crypto-hedge fund Alameda, was - until this week - the poster child of Crypto

Founded in 2019, FTX quickly grew to become one of the biggest crypto-exchanges with $5bn daily turnover, $16bn of customer deposits and best-in-class features and execution

Founded in 2017, Alameda grew into a hedge fund market-maker with $15bn in assets and the biggest individual industry counterparty

Unlikely many other crypto figures, SBF had the perfect pedigree. He’s a math wizard from MIT, his parents are both professors at Stanford. His first work stint was at Jane Street, a highly competitive prop trading firm

The meteoric rise did not go unnoticed. Blue-chip VCs fell over themselves to invest in FTX at stratospheric valuations (last round at $32bn January ‘22). SBF made it onto the cover of Fortune and Forbes magazine as the “next Warren Buffet”

But this week, within days, FTX and Alameda imploded, taking Crypto markets with them. What the hell happened??? The story is as old as financial markets:

Rather than running market-neutral trades typical for “market makers”, Alameda took huge, levered directional risk, assuming crypto markets would continue to rise

When crypto crashed in July, as the Fed raised rates and several large players such as Three Arrows, BlockFi or Voyager blew up, losses mounted

SBF then used customer deposits at exchange FTX to plug that hole. In classic Ponzi-style, what was likely a smaller hole to begin grew to $10bn as per this week. In other words, at least $10bn (!!) of the $16bn customer deposits lent to Alameda are likely gone. In my view, the number will likely be higher, given the leverage involved

The hollow edifice was exposed when a coindesk article leaked Alameda’s porous balance sheet and the founder of competitor exchange Binance started selling FTX tokens he owned, which were the fake piece that held the balance sheet together. Public reporting scared FTX customers, they pulled $5bn within days. FTX did not have their money anymore, so it is now insolvent

To better illustrate the scale of what happened, let me use to two parallels

You hold money in your Charles Schwab or Deutsche Bank account, thinking it is safe and ringfenced. Schwab or DB then takes your money, speculates and loses it all!

Lehman Brothers blew up because it was undercapitalised and held illiquid assets. MF Global blew up because customer funds were embezzled. This is a combination of both

There is plenty of more good coverage e.g., here or here, but rather than expand on the details, I would like to summarise some universal lessons from this episode. They all share in common the greed, fear, and herd behavior of our human nature deeply wired into our DNA

Let’s dive in:

1- Common Sense - If something doesn’t make sense, it is probably not right

Let me begin with stating that the idea of Bitcoin is beautiful. Decentralised, limited in supply, easily transferable and hard to confiscate. A close to ideal form of “money”, more so in the era of unhinged monetary policy experiments

However, in 2021, I spent several months researching the industry in search of a real-world use case, beyond Bitcoin’s store of value proposition. Something that improves everyday people’s lives, today, in a tangible way, without a better solution already in the market

After months of study, I frankly came away disappointed. All I found was costly and complicated solutions, that either “solved” fringe issues or were lightyears away from a competitive offering (but valued at hundreds of billon market cap)

It appeared to me that the primordial issue is entangled in its promise - decentralisation. Take cloud computing as an example and the below cost comparison of AWS vs Ethereum and Solana. Traditional offerors sell computing power at fractional cost because they are centralised. They benefit from the corresponding economies of scale, easy governance and other efficiencies which decentralisation all lacks. Ethereum Founder Vitalik Buterin acknowledged this conundrum before here

Whenever I brought up the lack of real-world use cases with industry people, I heard things like “It is the internet of the future” or “It is a new layer for the internet”, but no one could explain what these phrases actually meant. The conversation then frequently ended with deadbeat arguments like “All the young people are doing it” or “Facebook and Microsoft are betting on it, do we know more than them?”

But maybe Facebook (now Meta) and Microsoft were also in it because of the hype? Meta’s share price is down 75% this year, and announcements like the one below remain incomprehensible to me: What does that mean? Who needs this?

Common sense has long dictated that the crypto-industry is overhyped. The absence of convincing real-world uses cases remains a very loud tell. However, maintaining one’s common sense view can sometimes be very hard when everything shouts the other way

2- Value of Experience - The older you are, the wiser you get

I had mentioned that Alameda until recently ran $15bn of assets, with several turns of leverage likely on top. Let’s look at Alameda’s staff: SBF turned 30 this year. Current CEO Caroline Ellison is 28. Previous CEO Sam Trabucco was 29 when active, the remaining team is of similar age

Just like law or medicine, investing is an experience-industry. The best investors are often in their 50s, when they have seen enough cycles come and go. How did anyone think a small group of twenty-somethings could handle a multi-levered $15bn balance sheet, in an extremely volatile industry, without ever messing it up?

Investors used youth cult to justify fear-of-missing-out (“we don’t understand it but the young do”). In reality, start-up success dramatically increases with age

3- No one is infallible - Overperformance leads to overconfidence

Despite these red flags, the roster of FTX investors included the creme-de-la-creme of the Venture Capital industry, from Lightspeed to Iqoniq, Ribbit, Tiger Global and Sequoia - all firms with tremendous track records and spectacular gains in recent years

Here’s the issue with spectacular gains. They invariably breed complacency and overconfidence, just as hard work and tough times breed endurance and humility

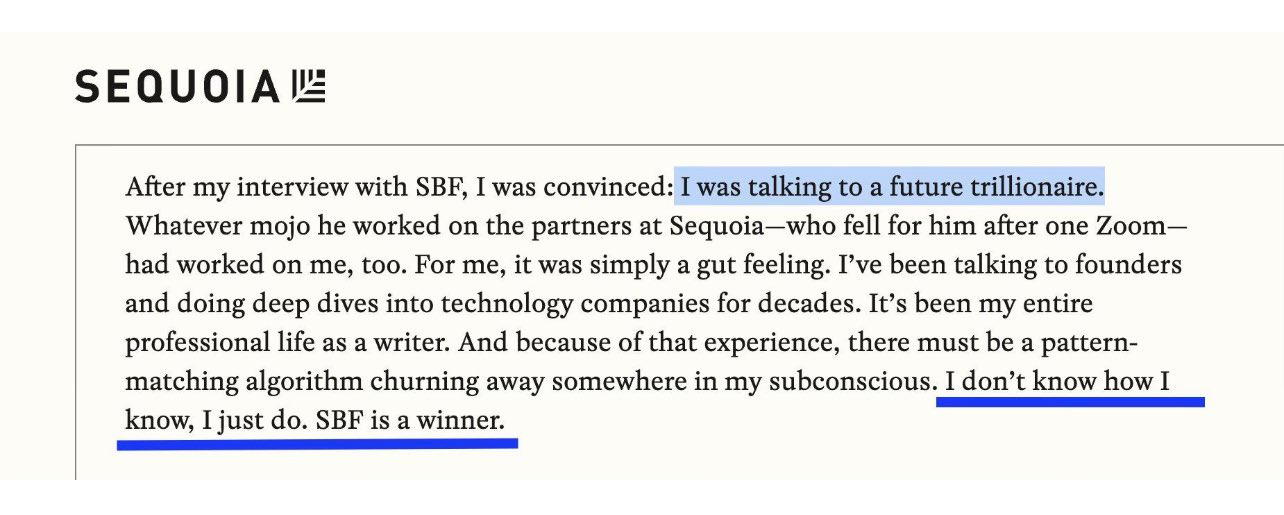

After years of astronomic returns, the VC industry has become very sloppy. There is no better example than Sequoia’s own PR article about FTX and SBF (Sam Bankman-Fried), which has now been taken down from its website. It is very telling, let’s look at the excerpt below

Full with hyperbole, low on substance (“after one Zoom”), “gut feel” replaced due diligence. It sounds like Sequoia’s partners had way too much of their own kool-aid - no wonder, the game had been too easy for too long. Human nature is very much at work here, we are wired to avoid the energy consumption needed for hard effort and yearn for the honey pot

Further, it is worth highlighting that SBF himself invested $500m into Sequoia and other VCs. Turns out it was money he didn’t have

I also want to point out the title imagery and wording of the - now removed - article. SBF is described as savior with a halo-like aura, an allusion to Jesus Christ

The conflation of crypto and religion has occurred frequently, see my post “Bitcoin and Religion” from June 2021, when Bitcoin was at 60k and Crypto promoter Anthony Pompliano’s Twitter background an interpretation of The Last Supper, where various Tech and Entertainment figures replace Christ and his Disciples

When gains come too easy, something is likely wrong. And when investing and religion are mixed, you better run for the hills

4- There is no free lunch - Easy money attracts bad actors

The intersection of spectacular gains, high retail participation (= gullible sheep) and lack of regulation attracted all sorts of black sheep to the crypto industry, from the founders of Tether to North Korean hackers

Binance, which after FTX’s implosion is the unrivalled exchange leader, has a criminal probe pending

Finally, there is this guy below. El Salvador’s president Nayib Bukele who introduced Bitcoin as local currency with the aim to turn the country into a crypto hub

Coming back to Common Sense - how could anyone think that the ruthless Dictator of a small Central American country known for its extreme homicide rate is the future of finance?

5- The value of regulation - Regulation is tedious and costly, but it’s there for a reason

It is frankly unbelievable that FTX and Alameda were allowed under one roof - an exchange and a hedge fund that gets privileged access to the exchange client data (not to mention squandering client deposits). The equivalent would be Citadel owning the New York Stock Exchange. An unethical setup, how did anyone think that’s ok? How did any of the VCs think that’s ok?

The bigger question is, where was the SEC in all this? Where was the CTFC which regulates futures, options and swap markets? Millions of Americans own crypto and lost their shirts. Why are regulators acting only now, after all the damage occurred. Two reasons:

First, politics. While crypto went to the moon it was popular. No one wanted to be the bad guy to pop the bubble. It is much easier to be tough after the crash. Second, lobbying. The billions sloshing around crypto also found their way into donations, with SBF the 2nd-biggest donor to the Democrat party. Below a picture from Caroline Pham’s Twitter. Pham heads the CTFC, the picture is now deleted…

Regulation is tedious and costly, but exists for a reason. Today’s crypto excesses are just the same as in traditional finance during the Great Depression 1929 or the Financial Crisis 2008. Today, regulation protects every-day people from bad actors in banks and funds repeating the same mistakes, over and over again

6- Sell when you can - It is not a panic if you are the first to sell

Whenever there is even only a whiff of liquidity issues, you have to hit the bid as soon as you can. Whether it is Bear Sterns, Lehman, the Icelandic Banks, Celsius, or now FTX, there were plenty of signs. If you’re early you get out unscathed, if you’re late, your assets are at worst gone or at best stuck in multi-year litigation

This applies to assets just as to general markets. I mentioned in recent posts how I bought a small holding of Bitcoin and Ethereum with a view on more lenient global central bank policy ahead. As highlight in “Is Inflation Good?”, I sold these at the first sign of FTX turbulence, when either were barely down on the day, now they are 25% lower, and - I believe - more to come

Conclusion: Human nature endlessly repeats, and the FTX episode is just another repetition of what has been done many times before

With this in mind, it is unfortunate that Crypto is currently a net-negative to society. A very small group of promoters enriched themselves to the gills, while millions of retail investors lost their shirt, in particular in lower-income segments where crypto was very popular during the Covid-boom

Meanwhile, true innovation is still only an abstract promise. Today, the world faces an energy shortage, a war in Europe and famine in many emerging markets. Imagine if all the talent and hours tied up in DeFi projects, Dogecoin or in blatant crypto-speculation had been applied to these huge, growing issues

However, people just follow incentives. In my view, the real culprit is the Fed with its unhinged monetary policy over Covid-19, which created the liquidity needed to chase fantasy coins in a giant global financial casino

And thus, ironically, the circle closes, as out-of-control Central Banks were indeed the original motivation for Bitcoin

What does this mean for markets?

As always, below is my personal attempt at connecting-the-dots for my own investments. Please keep in mind - I may be totally wrong, nothing is more important than risk management, and none of this is investment advice

First, some brief comments on Crypto and Venture Capital

Crypto sentiment is now extremely poor, usually a contrarian indicator after a 25% drop. However, this is a Lehman moment, just without a Central Bank to backstop the fallout. Many industry participants got wiped out either by FTX or by relationships with Alameda. They will have to cut or liquidate, which will take weeks of months of aftershocks. I do not think the low for crypto is in, in fact given the interrelation and huge role of Alameda I believe it could be much lower

On that note, last year I did due diligence on a large crypto lender. It had dozens of billions of loans outstanding against less than 1% equity (!). The biggest counterparty by far at the time (~20%) was Alameda

Medium-term, more regulation is likely, while institutional investors will shy away given the horrendous optics of the FTX implosion

More broadly, I believe Venture Capital likely to be the toughest industry within asset management to generate returns going forward. VCs allocated 20-30pc to crypto last year, a lot of that will be wiped out. Meanwhile, the Cambridge Associates Venture Index is only down 10% YTD, with public market comps down 60-80% or more. Yet, there is still a $290bn war chest and many startups run with plenty of cash. This oversupply of capital is poisonous to asset allocation, it creates impatience for the givers and spoils the receivers. At the same time, company fundamentals are often still skewed by circular bubble economics, as are mental models on when and how to act. The pendulum now likely swings to real assets, which experienced the reverse for the last decade

I repeat my humble view from last week that VCs likely benefit more from focussing on the potential megatrends of the next decade (energy, defense, climate) than try to resurrect the skeletons of the past bubble

Second, on markets. As explained in the two previous posts, after having been bearish and short all year, I went long a few weeks ago and had since added to positions. This frankly felt deeply uncomfortable, as I was universally told the market would see new lows soon

It was exactly that universal view, expressed e.g., below in a record ratio of Puts to Calls going into both the mid-terms and yesterday’s CPI print which lead me to maintain the long stance, with stop-losses trailing in close tow

This is similarly reflected in the market beta of Equity Long-Short Hedge Funds, which currently sits near all-time lows. This chart simply means that these funds won’t benefit if the market goes up, which is an issue as according to MS they are currently down ~15% YTD on average. Much fuel to the rally if hedge funds start to chase

Yesterday’s CPI print was the spark that lit the fire, but it could have been anything. The big consensus trades of the year, with many late entrants, are now unwound, from long dollar to short rates or short equities

My positioning remains unchanged, with longs in Energy (XLE/OIH/XOP/Drillers), Banks (XLF/SX7P), Homebuilders (XHB), Healthcare (XLV), Metals & Mining (SXPP), Biotech (XBI), China Tech (KWEB) as well as Gold, and currently no USD exposure (all equity risk, or gold)

Yesterday’s CPI print provided an asymmetric setup given universally bearish positioning. However, in my view, it remains highly unlikely that inflation is over

The data likely represented trend deviation to the downside, as extreme moves in used cars, furnishing and medical services excl. insurance are unlikely to continue, while wage growth remains high. More plausible seems the yo-yo like path I had described earlier this year (see “Is Inflation Over” from August) i.e. less inflation → more real income → more spending → more inflation, until higher unemployment truly slows consumer spending

If markets rally further (I think they do, may be wrong), that also likely improves consumer mood reflexively given the high interlinkage between the US consumer and financial markets, from stock-based compensation to 401ks. That way, looser financial conditions would indeed proof inflationary

Finally, China’s reopen is happening. As discussed last week, the official narrative changes only gradually given centralised CCP communication, while on the ground restrictions are loosened, see this morning’s updated travel rules

In fact, I deem yesterday’s market rally a sign of continued excess liquidity. Cash was deployed in a frantic way, creating an everything rally lead by the most down-beaten areas of the market. If cash was “scarce”, the reaction would have been very different

As this rally is driven by positioning rather than fundamentals, it will likely see most shorted names squeeze the most, amongst them many high-growth Tech names, from Carvana to Opendoor. Down 90%-95% from the peak, these can double in weeks. However, once the short squeeze is done, these names likely resume their underperformance as bubble damage likely lingers

I also want to highlight noteworthy developments on Ukraine. A high-ranking US general now publicly demanded peace talks, Russia signalled openness to such and Ukraine just liberated Kherson

Finally, it seems highly likely the economy continues to slow, as tightening in lending standards (see below), higher commodity prices, higher mortgage rates and a higher US Dollar impact economic activity with a 6-12 months lag. Thus, while I think the current rally could last until the next CPI print mid-December, I will track it very closely. The bear market seems unlikely over, with “the low” possibly coming in 1H ‘23

I hope you enjoyed today’s Next Economy post. If you do, please share it, it would make my day!

Your work is just amazing. Thank you so much. It helps me a lot for my investing process.

What do you think of the current dollar weakness? Is it just temporary? For me it does not make sense.

Thanks Florian - enjoyed your piece as always. Regarding China reopening Jim Bianco put out a short thread recently that makes sense to me to not re-open.

https://twitter.com/biancoresearch/status/1591934976274173952?t=QCFWAAz16W5iOq-ER-EuTA&s=19