In Plain Sight

While everyone is focussed on the US, Europe's economy is rolling over

In my last post “Unstable Equilibrium” I laid out how the US Regional Bank crisis created a self-fulfilling dynamic likely only halted by interest rate cuts, which remain elusive until inflation recedes. Indeed, the banks continue to dominate headlines, with regional lender PacWest informing of further deposit flight, and signs of distress at US Bankcorp (6th largest US bank), Comerica or KeyBank

While all eyes are on the US, trouble is brewing on the other side of the Atlantic, as European data worsened significantly in recent weeks. Does the old proverb again apply - when the US catches a cold, Europe catches pneumonia?

Today’s post walks through the reasoning and shines a light on a key dynamic: The ECB and the Fed have similarly tightened monetary policy, yet the underlying reasons for their inflation differ - a commodity price shock in Europe, and money printing in the US. As such, Europe’s buffers to absorb said tightening are not the same

As always, the post closes with my current outlook on markets

The latest bout of European economic data contained significant downside surprises. Most prominently, German factory orders fell 11% in April - a huge drop

Why is this important? Simple - factory orders represent future industrial production

Industrial production only accounts for 19% of German GDP, yet its swings create the business cycle and permeate more stable GDP components with a lag

Factory orders are a noisy data series that can be influenced by lumpy bookings. However, the magnitude is still stunning, while Eurozone Industrial production already shows visual signs of weakness

Now, the data is unsurprising when we take a step back. Regular readers will know that I follow a cyclical framework, where housing and manufacturing lead the business cycle

To recall, the sequence goes as follows: Higher interest rates → lower housing activity → lower manufacturing activity → lower services activity → broad slowdown. This then triggers interest rate cuts, which usher in the up-cycle

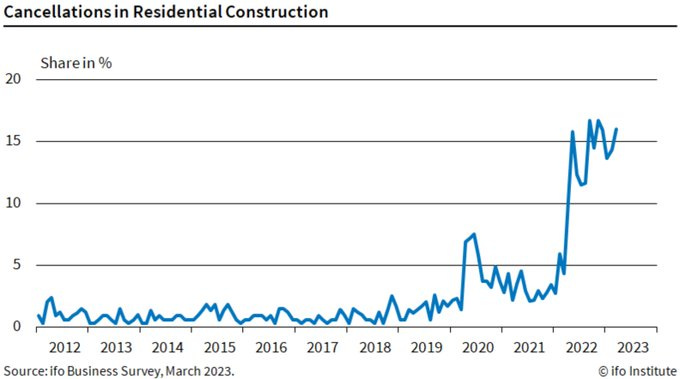

Given the ECB’s aggressive interest rate increases, housing has indeed ground to a standstill. Germany’s largest residential operator has halted all new built projects, and data shows a record number of cancellations e.g. in German residential construction. The same applies to most other European countries

With housing at a standstill, it is not surprise that the remainder of the economy eventually follows

But what about the consumer? Wages have gone up in response to inflation, and gas prices have come down - are consumers not a source of strength then?

Yes, wages have increased, but the increases still lag inflation. So real wages are down, a lot. Accordingly, while nominal sales are still holding up, consumers spend less money in real terms. In other words, volumes are way down

Higher nominal prices and lower volume means one thing - higher corporate margins. And indeed, that’s why European stocks are near all-time highs

In light of this, ECB chief Christine Lagarde suggested companies are to blame for “Greedflation”. I think she is right. Anti-trust enforcement been asleep for 40 years, many sectors today are highly consolidated, as a result pricing power is much higher today than it used to be

Either way, “Greedflation” is likely only a pyrrhic victory for European corporates. As companies prioritise price over volume, the latter feeds to lower production, and lower overall economic activity eventually follows

Summary: European economic data is rolling over hard, from factory orders to industrial production to retail sales

What’s behind this? The answer is simple

Both the ECB and the Fed tightened monetary policy drastically over the past 18 months. Rates increased 400bps (EU) and 500bps (US), QT reduced each Central Bank’s balance sheet

However, Europe’s inflation did not originate from money printing as for the US during Covid. Instead, it was mainly imported inflation from raging US demand via higher commodity prices, and then of course the gas price shock due to the Ukraine war

To paraphrase it - Europe tightened as much as the US, but has much less buffer to absorb it

As a result, European monetary supply aggregates are back to trend, and the US still far above. Yet, over the same period leverage increased faster than trend, so Europe is now highly likely already undersupplied with liquidity

With monetary policy this tight, European loan demand has collapsed, as the ECB Bank Lending Survey shows

At current interest rates, the private sector is not interested in credit. Why is that important? Credit creation leads economic activity

We see the relationship between credit and the economy more clearly in the below chart. It correlates M1 Money Supply and Eurozone GDP with a 12-month lag and suggests a meaningful GDP decline

However, there is also a good side. Inflation likely recedes substantially over the coming 6-12 months. Eurozone price expectations for many industries are nose diving, including for wage-driven services

Conclusion:

The ECB ran the same aggressive monetary response as the Fed, however the reasons for European inflation are very different

Without the same excess cash buffers, the monetary tightening likely impacts Europe’s economy earlier and likely more severely than the US

In an interconnected world, this likely also affects the US, where recent economic data (e.g. yesterday’s -31 Empire Fed Index) points to the hard landing thesis I’ve laid out in previous posts

An eventual policy pivot by the ECB is likely. This will then usher in a recovery in 2024, but we are not there yet

What does it mean for markets?

As always, below is my personal attempt at connecting-the-dots for my own investments. Please keep in mind - I may be totally wrong, nothing is more important than risk management, and none of this is investment advice

My main investment remains the 5-Year US Treasury bond (levered), as I continue to believe that fairly rapid disinflation and more banking stress favor substantially lower bond yields over the next 6-18 months. Some further thoughts based on today’s post:

Euro - Speculators have barely ever been so long the Euro, just as data worsens relative to the US, and while US liquidity continues to contract (=US Dollar positive). Newspaper headlines are full with the “demise of the US Dollar”, i.e. the view is consensus. I think this is overblown and I am short Euros

EU Rates - The ECB will likely be forced to cut interest rates soon. This likely benefits real estate companies like Vonovia, which is very oversold, or the Austrian 100-year bond which is near all-time lows. I am still waiting but watching these with interest

EU Equities - The DAX and SX5E are at or near all-time highs. Large index parts are cyclical, and Autos in particular stand out as high-cost discretionary items at the onset of a consumer-driven recession. I’ve entered shorts in SXAP (Autos) as well as DAX, and am considering SX7E (Banks) on lower rates + loan losses

Gold - Again, speculators are currently max long the barbaric metal, while real rates likely increase as inflation drops faster than Fed fund rates, and QE is still far off. I see downside for gold from here and lean towards opening a short position. Longer-term however the outlook for gold remains positive

Moving on to the US…

Consumer weakness - As discussed in previous posts, the current economic slowdown is consumer-lead, as inflation has pushed prices higher and now excess savings are depleted to pay for them (See “The Ferrari Economy”). Recent spending data confirms this trajectory, which likely intensifies when the student loan moratorium ends in July/August and 45m Americans re-start debt service payments

Within the respective consumer segments, it is notable that unemployment is rising fastest amongst higher-income households, while their pay growth is weakest. This links back to the SXAP (Autos) thesis above, where the US consumer is a critical demand driver

US equities enter one of the weakest seasonal periods over the coming two weeks, with Friday’s May options expiry historically a catalyst for wobbly markets. However, investor positioning remains pervasively bearish, which makes me think any dip over that period ultimately gets bought, for markets to rally into the summer until employment data turns negative. Should markets dip into late May, I will likely add tech exposure on the long side to the shorts laid out above, as investors likely continue to embrace the game-changing role of AI (see “The AI Revolution”)

I share your view on the Euro however I am struggling with sizing the trade as Debt Ceiling is kind of messing everything up at the moment. Economic surprise index EU vs US already on a downward trend. Maybe next week's PMI data will add some momentum. Thanks again for posting another great article. Looking forward to the next one!