Is Tech the New Subprime?

Animal spirits and excessive leverage once again provide for a toxic cocktail

The past decade saw an unprecedented boom in the Technology sector. Accelerated innovation, low interest rates, absence of growth elsewhere and herd behavior led to excessive valuation levels and overallocation of capital to this segment of the economy. At the same time, leverage in the financial system increased to an all-time high. The unwind of this overallocation will likely lead to significant, and potentially disorderly, destruction of capital.

Technology investments have done spectacularly well over the past decade. Why?

Technological breakthroughs accelerated. Never in economic history has it been so easy to turn an idea into a business and scale it across a broad audience

Software is breaking down many tedious and capital-intensive processes into steps that are affordable for founders. With its hyperfast dissemination of information, the Internet has dramatically reduced the cost of reaching millions of people instantaneously

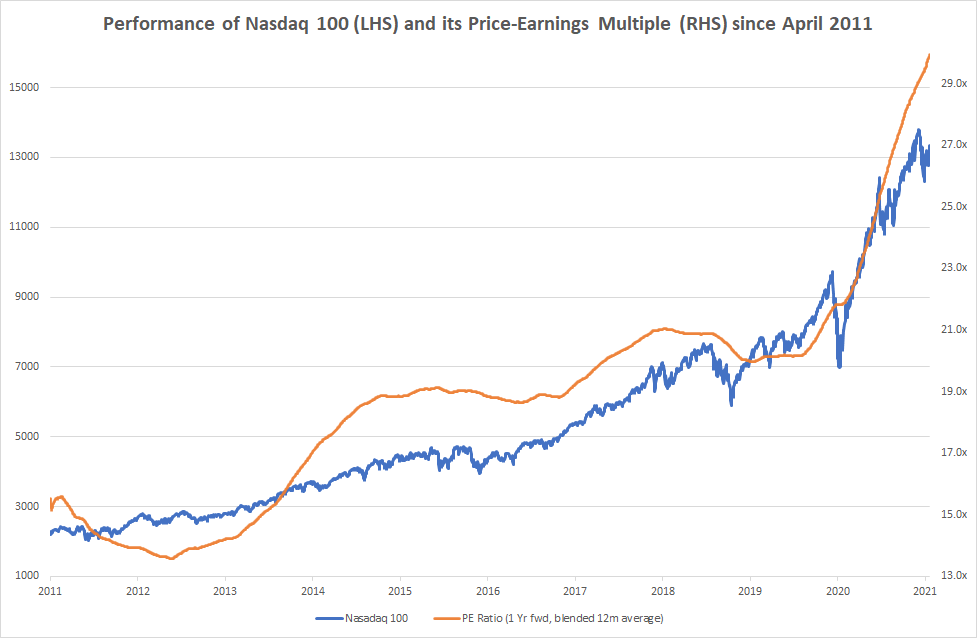

Ever-falling interest rates made high-growth investments more and more valuable. The lower the interest rates, the higher the Net Present Value of future earnings

This dynamic escalated when interest rates became firmly anchored in real negative territory in response to the COVID-19 shock in Spring 2020

Stagnating Old Economy. Traditional mass-market companies struggled to expand their revenues in a world shaped by over-indebtedness and stagnating real median wages. So Technology was coveted as it was one few sectors offering growth, which is what investors need in order to achieve capital appreciation

The lack of growth in the Old Economy also created a big source of demand for new technologies. They offered a way to grow profits by rationalising processes. Unsurprisingly, 61% of Series-C+ startups in the US in 2020 were B2B products, many of which typically cut costs, and also jobs

That all sounds great, so why is there a problem? The problem lies in what is commonly referred to as “animal spirits.” Rapid expansions attract the very primal forces of greed and fear, in this case, the Fear Of Missing Out

The longer something works well - and Technology investments have worked really well for a very long time - the more widespread the enthusiasm, and the more people lower their guard with regards to its risks, creating a bubble

These powerful subconscious forces influence everyone’s thinking, not just uninformed, inexperienced or naïve people. While much has been written recently about the bubble in retail-driven SPACs, concept and fantasy stocks, overenthusiasm may be more endemic and may also have affected institutional parts of the financial world. Some examples:

In August 2020, the prestigious and very successful venture capital firm Andreesen Horowitz published an essay called "When Entry Multiples don't matter". Yes correct, the title implies that it doesn’t really matter how much you pay for a great high-growth asset. While the body of the text was more nuanced, it certainly points to a very optimistic mindset

The highest-growth Software-As-A-Service companies, a sector typically traded by large institutional investors, reached valuation levels of ~58x EV/Sales as recently as February. The highest-quality company in this area, data warehousing provider Snowflake, traded on 140x LTM EV/Sales then. It’s worth spelling out what that means - a company that achieved $592m sales in 2020 was worth over $80bn (!)

There are plenty of signs the US venture capital market is extremely hot. The median Series-A valuation tripled from $5m to $20m from 2010-19 and then almost doubled in the last two years to $38m. Pre-emptive rounds are the norm and founders are inundated with offers for capital

In some ways, these decisions have their justification in a world where interest rates remain at ultra-low levels forever and we find ourselves trapped in a deflationary state. If all you can get is 0.5% on your government debt investment, maybe a 150x Price-Earnings multiple (= 0.66% earnings yield when inverted) isn’t so bad an alternative.

But as laid out in last week’s post, we find ourselves at a watershed moment with the political mood decisively changed, and it is political decisions that shape the economic paradigm.

The US in particular is embarking on a new trajectory that may express itself in higher economic growth, more wage bargaining power, more inflation, and higher interest rates

In such a world, capital has more alternatives to go to and therefore will become more scarce

Many growth assets right now are priced for a lower-rates-forever world. These valuations will have to adjust to the new reality

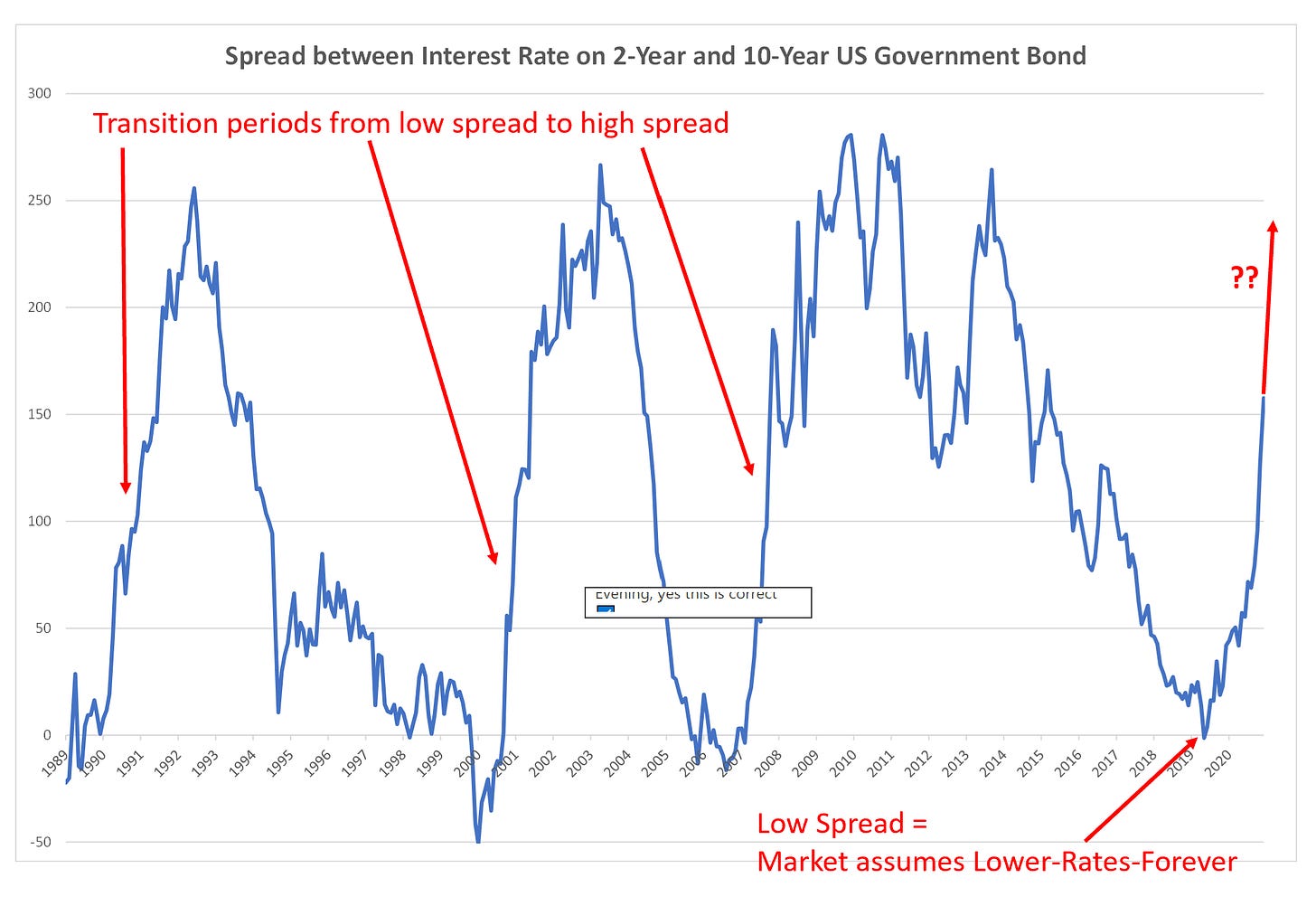

The landscape is already changing, as illustrated in the chart below. It displays the spread between the interest rate of the 2-year and the 10-year US government bond. A narrow spread suggests that the market expects the future landscape to be similar to the present. Conversely, a wide spread indicates a different economic setting in the future

Ok, so there is a bubble in Technology. It will normalise as rates go up. So what’s the big deal?

Again, it comes down to debt:

Because debt is so cheap, leverage in the financial system is at all-time highs, as shown in the chart below, using FINRA margin debt as a proxy (FINRA is the organisation summarising all brokers and broker-dealers in the US)

You can also see the previous tops in this metric, they occurred before the stock market crash in 1987, the New Economy bubble in 2000 and the subprime housing bubble in 2007

Because Technology has been the hot topic and a one-way street for the past decade, it is likely that much of this leverage has found its way into this sector, just as leverage found its way into US real estate before the subprime bubble. In fact, there may be several parallels:

In a somewhat pyramid-like structure, leverage is taken out and recycled into an asset class that seems to only ever go up. The higher valuations create more valuable collateral and allow for more debt to be assumed, which can then again be recycled into the same assets

Technology, like real estate, is a broad sector with huge variations in quality. While SPACs may indeed be today’s equivalent of “subprime” - an area where many investments will turn out to be worthless and written off - there are strong companies like Facebook, Google, Microsoft and many others that might be today’s “prime real estate” with little if any damage

A de-levering process is usually accompanied by institutional liquidity events that come out over time, as declining valuations uncover excessive risk-taking. The subprime crisis started with the blow-up of two Bear Stearns CRO hedge funds in 2007. The Lehman collapse occurred over a year later.

In the last week of March 2021, Archegos, a $80bn hedge fund focussed on Technology investments, blew up, the first major liquidity event of this episode. If Technology valuations continue to decline, it is likely to be followed by similar occurrences

However, there are also important differences to the subprime crisis:

Systemic risk is much lower today than it was 14 years ago. Banks are better capitalised and controlled, which means a credit crunch will be unlikely, even though e.g., several investment banks just lost a combined $10bn in the Archegos blow-up

Real estate is in many ways a stagnant asset. In contrast, Technology has enormous secular tailwinds, and these tailwinds are accelerating. As valuation levels come down, they may find support in these tailwinds

So to answer the question in the heading: it is unlikely that we’ll see another crisis similar to the mortgage meltdown in 2007-9. The institutional structures are much stronger and Technology will continue to change the world at an increasing pace. But the combination of de-levering and declining valuations will cause much pain, with the likelihood of more disruption ahead.