On a Personal Note

Plus what might be the surprise for 2023

As the year draws to a close, I want to take this opportunity to thank my readers for their interest in “The Next Economy”. Today marks the 70th post, it has been a good journey, with ~160k words and ~770 charts since April ‘21. Readership has grown 10-fold this year, and the average open rate is ~65%

I very much enjoy writing these posts; sharing (hopefully) useful information gives me purpose and drive. It also opened my eyes to the tremendous and fast-growing swarm intelligence of social networks, from which I benefited greatly - so this is my small contribution in return

With the Holidays around the corner, it seems a good moment to look back at some “Next Economy” highlights, and draw a few broader observations. The post closes with what I believe might be the economic surprise for ‘23

First, let’s start with the highlights:

In the very first post, “Inequality, Politics and a Watershed Moment” in April 2021, I predicted that we would enter a period of higher inflation. At the time, most economists and financial markets were still oblivious to the inflation shock to come. The US 10-Year bond yielded 1.6%, its German equivalent -0.3% (now 3.7% and 2.4%)

In “Bitcoin and Religion” that same month, I anticipated the burst of the crypto bubble. Bitcoin was at >60k back then (now 17k)

In September ‘21, “The European Energy Crisis” spelled out the impending drama of Europe’s power & gas architecture, which the Ukraine war escalated dramatically the following Spring. German wholesale power prices were at ~100 €/MWh (now 270 €/MWh)

November ‘21’s “House Money” previewed the Tech selloff that dominated much of this year. At the time, the Nasdaq was still at 4,600 and VCs signed 200x EV/Sales Series As

“The End of Covid” in December ‘21 predicted how the Omicron wave would likely mark the last major Covid disruption, based on South African data. Today, in the West, Covid has moved well into the rear-view mirror

A series of post in December ‘21 and January ‘22 (e.g. “Don’t Fight The Fed”) highlighted how Cash would most likely be the best place to invest, in spite of high inflation, and how equities would likely do very poorly. It turns out that the best asset class of ‘22 was indeed - Cash. Meanwhile, the S&P 500 is down 20% year-to-date

Around the same time, “The Blind Spot” laid out how interest rates might reset structurally higher for the next decade. While today this has become consensus, at the time the US 30-Year yield was at 2% (now 3.7%)

“The ESG Time Bomb” this February shed light on the growing strains on energy supply caused by ESG policies, including underinvestment in natural resources. Oil hit $130 in the months after

In “It’s All One Big Trade” in May ‘22 I described how many hedge fund strategies had become to crowded, with the alpha moving to the capital allocation level, essentially a macro call. Equity hedge funds have suffered another bad year in ‘22

In various posts on inflation, I accurately described its progress over the year, including the Summer slowdown, its resurgence in the Fall and the most recent sharp drop-off (e.g. “From Hot to Cold in 90 Days”, “Is Inflation Over?”, “Is Inflation Over? Pt. 2”)

“Capital vs Labor Pt 2” in September ‘22 and its prequel a year earlier highlighted the power shift towards Labor after 40 years of Capital being in the driver’s seat. This month, the UK saw the highest strike activity since the 1980s

“Quantitative Frightening” that same month described the tension between high inflation and a high global debt load, something reiterated in “The Last Inning”, where I predicted that verbal intervention in US Treasury markets would lead to a sharp equity rally - I received much push back for this view at the time

Finally, in “A Frugal Christmas?” last month I pointed out how the US Consumer showed signs of slowing down, with excess savings likely to run out soon

I’ve also gotten things wrong. In particular, the events in Ukraine progressed differently to what I had expected

I could not imagine the war to break out in the first place, and at some point in March it appeared that a ceasefire would be imminent (“Very Close Now?”). Today we’re further from a resolution than ever before

Throughout, I’ve put my own money where my mouth is, and shared - in real-time - my own trades that corresponded to these views

2022 has been good, and these trades have generated a +40% return on my personal book. As I scaled up throughout the year, much of the gains came in H2, which was a considerably more challenging investment environment (the S&P500 is at the same level today as in July ‘23, with much chop in between)

Now, on to the broader observations:

2022 was the year when ideologies died. Think of Liz Truss’ tone-deaf tax cuts for the wealthy at a time of increasing UK poverty, the German Green’s refusal to extend Nuclear power amidst an energy shortage, or Bitcoin maximalists with quasi-religious beliefs. A much more volatile world likely makes dogma increasingly unaffordable

The antidote to ideology is common sense. Sounds easy, but in practice is often hard amidst group pressure and herd mentalities. This applies to culture just as much as investing, where strong returns are found by going down untrodden paths or against the crowd, which at the time might feel deeply uncomfortable. The removal of the Fed as buyer of last resort ended the following-the-herd strategies, and will make investing much more complicated for the next decade. It seems likely that financial services and the asset management industry shrink as a % of GDP in years to come

Many asset managers operate in very crowded silos. The industry has grown ~25x since the late 1990s, much faster than GDP, and many strategies barely have any alpha left. This didn’t matter as long as the market went up, but we’re now looking at a different period ahead. In my view, the highest probability of survival likely lies in flexibility. Capital will move aggressively to chase returns, creating many dislocations on the way. For public market investors, switching between styles and assets classes likely proves beneficial. For private equity, opportunities likely sit within distressed debt, which will likely prove the mirror image to the past PE boom. Unconstrained investors will likely see major advantages in a very volatile world

Anything human is cyclical. We are unable to maintain a stable equilibrium, and as such public opinion, markets and the economy often oscillate between opposing poles like a pendulum. Whether it is cultural views taken to extremes, asset bubbles or political beliefs, the world moves on, corrects and overcorrects. Everything moves in cycles, the current tough times will eventually be followed by better times

However, especially in the US, one notion seems to be persistent. It is the little guy who pays. First massive inequality fuelled by QE, then record inflation which is much tougher for the poor, and now it is meant to be layoffs, again toughest for the poor. For this reason, I think there is very little public support for the extended period of high unemployment needed to cool inflation

Finally, last year opened my eyes to the tremendous swarm intelligence provided by social media platforms such as Twitter or Substack. Thousands of highly skilled experts on a huge range of topics, from US Housing to LNG, Covid or Central Banks share their knowledge for free, motivated by the public recognition of their experience. This creates a swarm intelligence that is impossible to beat, even for the largest organisations. Investors who participate will have a major advantage. I believe the future of investing to be open-source, a new discipline that sits at the crossroads of traditional asset management and publishing

Sophia LLP, my new venture, builds on this approach. We manage assets for institutional clients the traditional way, and share our research process freely in the spirit of open source. Under Sophia’s Twitter account, you can find countless charts and datapoints we use to form our own views, and which we intend to expand over time

Now, at this point, of course the question is, what might be the surprise for 2023?

My sense is that in the New Year, US inflation likely falls faster than many expect. In fact, we are likely to get some deflationary CPI prints in the first months of ‘23. Below the key chart behind this view, from my last post “Is Inflation Over? Pt. 2”

Over the next quarters, the US Consumer likely runs out of excess savings. This coincides with high Goods inventories, leading to heavy price cuts until inventory is cleared. Slightly different dynamics apply for Services (see here), but some discounting should also be expected, e.g. for flights

Subsequently, prices should resume their uptrend in line with wage growth, unless high unemployment interrupts that dynamic. As discussed above, I believe there to be little political will for an extended period of high unemployment. As such, labor income should not fall much during this deflationary period and wage growth and with it inflation resume soon after (Phase 3 in chart)

Further, I believe that high global leverage combined with a deflationary period creates a toxic mix for credit markets, with a wave of defaults likely, that eventually triggers Central Bank intervention via QE or other means. This would increase inflation in the phase 3 following the inventory clearance - a strong yoyo effect

If these assumptions are correct, 2023 will likely be a year for Bonds, in particular the first half of the year, and in particular inflation-linked bonds (TIPS), which benefit from a decline in nominal yields relative to inflation expectations

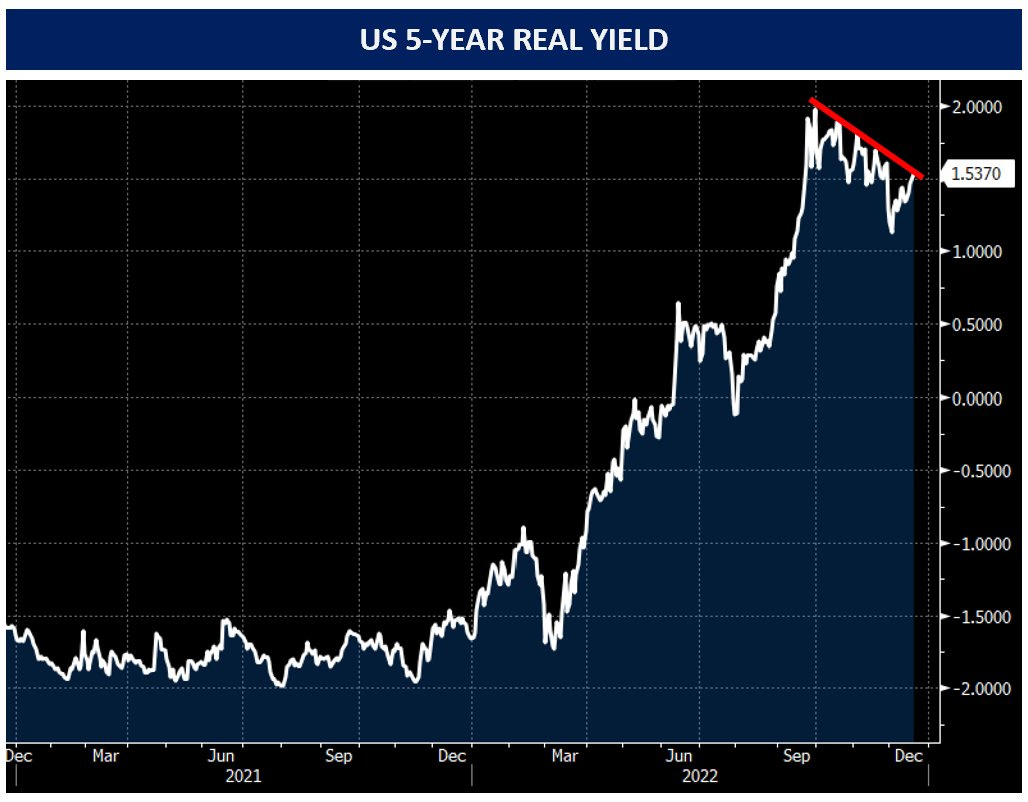

With credit distress looming large, I believe we are past the point of maximum Central Bank hawkishness. This hawkishness can be measured via real yields, which are nominal yields minus inflation expectations. If Central Banks are very aggressive, they increase nominal yields above inflation, if they become less aggressive than before, the real yield declines - I believe we are at this point now

Inflation-linked bonds trade on this real yield, so if real yields roll over, TIPS will perform well

Should the world economy see a hard landing that Central Banks respond to by printing more money, with subsequent higher inflation, TIPS appear an ideal instrument to protect and grow capital. They would appreciate as nominal bonds decline in response to the hard landing, and would also appreciate as Central Banks supress real yields to kick start and support the economic upturn

Is the moment to go long TIPS and Bonds already now, or do yields have another last squeeze in them?

The timing is not certain, as the Treasury General Account gets refilled once the debt ceiling is lifted, which increases Bond supply. Further, US real income improves with lower inflation as long as unemployment does not go up, thus spending could hold up longer than expected, denying or postponing the notion of a “hard landing”

I personally think the economy rolls over soon, but may be wrong with this view. Either way, the setup appears very asymmetric for TIPS. I have a hard time imagining real yields going higher from here, with credit events already under way and inflation abating (for now, see chart above)

Accordingly, I have bought TIPS and bonds into this week’s BOJ-induced Treasury sell off. My book now holds ~36% TIPS (2052 maturity), 13% 20-30 Year US Treasuries (TLT) and the remainder 1-Year T-Bills. I will likely add further to TIPS and bonds, should the opportunity arise

After a leg down in equities also materialised as expected, I have covered equity shorts and entered a small trading long position in US Tech (Nasdaq). The tell to cover shorts was when equities did not fall further on the bad news of the Bank of Japan modifying its yield curve control, and the VIX Index, which measures expected market stress, actually declined

My outlook remains the same: I expect the economy to trough in the 2nd or 3rd quarter of ‘23. Central Banks likely have to return to the printing press once again given the global debt load. The winners of the next decade are likely the losers of the last decade (commodities, industrials, value, distressed debt etc), especially as global politics become more polarised. Meanwhile, volatility likely remains high and the investment environment complex

I wish you and your families Happy Holidays, a Merry Christmas to those who celebrate it, and Happy New Year!

Happy Holidays, Merry Christmas. Regardless how the 2023 markets will be , I wish and your family great health and happiness! Thank you for sharing with us.

Just Thank You ! Best Research out there, well versed and understandable and nearly unbelievable: It’s Free. Thanks again for helping normal people to understand investing and finance !