On Blind Spots

Why I've bought Chinese equities today

The following section is for professional investors only. It reflects my own views in a strictly personal capacity and is shared with other likeminded investors for the exchange of views and informational purposes only. Please see the disclaimer at the bottom for more details and always note, I may be entirely wrong and/or may change my mind at any time. This is not investment advice, please do your own due diligence

The economy and markets are frequently taken aback by developments that with hindsight may appear obvious, yet until the occur are poorly anticipated - the proverbial blind spot in the mirror

I believe China to currently feature as such a blind spot right now. The recent disinflation in the US and Europe is in good part owed to a the world’s second largest economy stuck in a deflationary morass, with the Chinese government having made no effort to revive its economy. Western observers have taken any possible Chinese demand revival out of the equation, and basically forgotten about the Middle Kingdom

Instead, I think we could now see Reflexivity at work there. The local stock market has imploded, with the latest leg down earlier this week driven by aggressive forced selling on high volume

This kind of price action in the past has typically triggered governments and Central Banks to act forcefully. The worry is it gets worse and spirals out of control, so something must be done

This is why the odds are now higher that China will provide its economy with meaningful stimulus (as opposed to the piecemeal support provision so far)

Should this be the case, we can expect an forceful bid across the global commodity complex, which has languished over the past year as the global goods economy slowed, and the “swing consumer” China went into an economic winter

As discussed, there are many signs that the global goods economy is turning, from US housing starts to destocked US retail inventories

Should Chinese demand improve with the aid of local stimulus, we can expect commodities as well as oil to rally higher, with the corresponding effects on Western inflation, just as everyone got certain of its demise

This comes at a time when ownership of commodity and energy stocks sits at a low…

…and the market expects the Fed to cut ~6 times this year

With all this in mind, I have today added Chinese equity exposure in anticipation of a technical rebound from oversold levels, stimulus, or hopefully both. This adds up to my current positioning as follows:

Small long some producers of commodities with very tight supply/demand balances, hedged with a Russell 2000 short. Long Chinese Equities and Long Oil Majors vs short US Large Cap Tech (see last post),

Equity downside exposure via US index put spreads with Spring expiry

Volatility upside via Vix call spreads with Spring expiry

Some Cash (i.e. T-bills)

Still looking for an entry into humanoid robotics over the coming weeks/months. Likely when the incentive structure debate for the CEO of the world’s most controversial auto maker reaches a boiling point

Long Chinese equities is a “knife-catching” exercise that comes with risk, and it can always go lower

But sentiment is extreme, selling has been forced, and many American hedge funds entered this trade at the start of the year, to be now down 12% on it already, which makes me think they are cutting and have contributed to the selling

For bonds, this possible development would mean more pressure on yields as the market awaits the Treasury’s next Quarterly Refunding Statement, with the deficit number due on the 29th January and the detailed split between bills and coupons on the 31st

I think it is unlikely that bond investors would want to take any risks before said announcement, which would likely indicate that yields especially on the long end continue to drift up until then

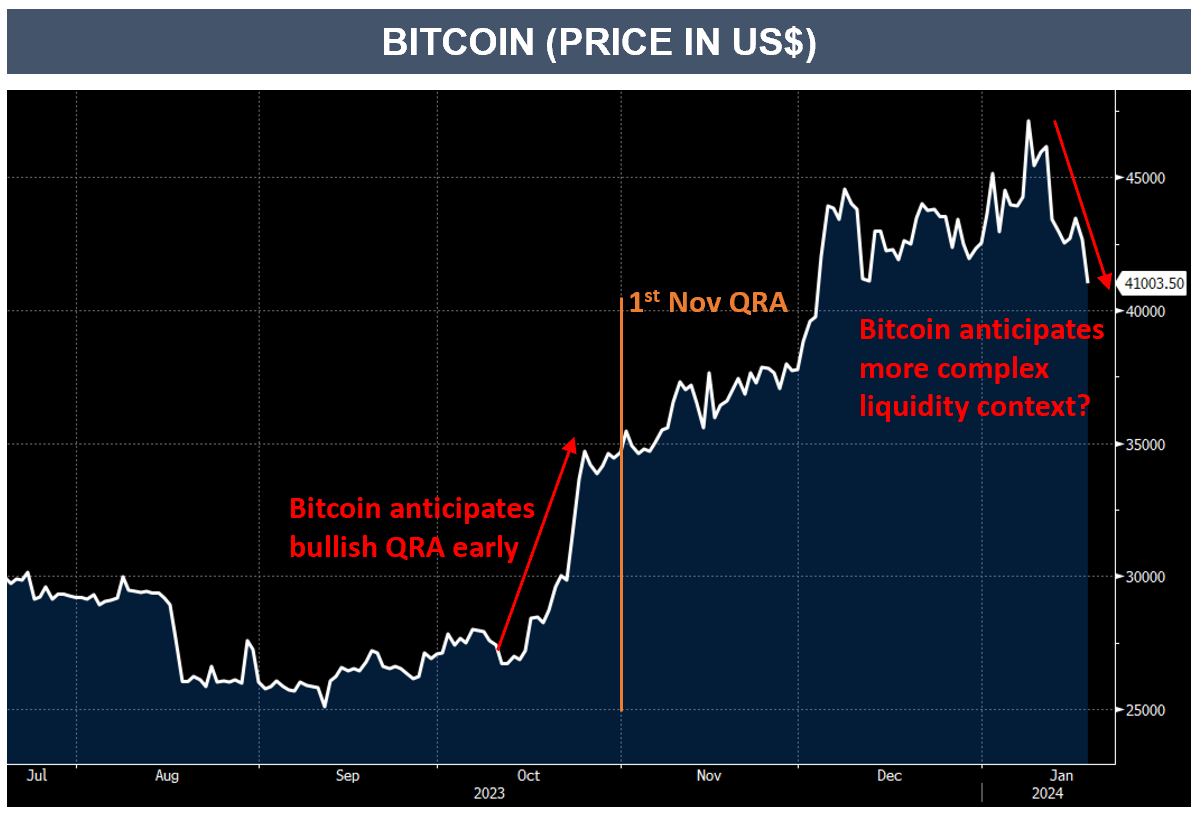

I also think Bitcoin, the asset with the highest sensitivity to financial markets liquidity, is foreshadowing a tighter liquidity context into this once again pivotal event, just like it anticipated looser liquidity conditions already a month before the most recent QRA on November 1st, which ushered in a stunning 2-months rally in all assets

Said tighter liquidity context could be triggered by higher oil and commodity prices, which could force the Fed to delay or walk back its current commitment to rate cuts

Thank you for reading my work, it makes my day. It is free, so if you find it useful, please share it!

Very interesting. Liquidity is a mystery to me as it seems there are a number of different definitions; bitcoin as an overall liquidity gauge is a useful idea.

that certainly is a fast falling knife to catch, but I think the thesis is sound. I, too, like commodities and producers and am ultimately negative bonds, although much of that depends on the Fed's short term commentary. Powell's pivot seems more and more like the outlier, not the new direction. but if that is what we hear again at the end of the month, I suspect that a risk rally will be back