Summer Views

A brief update on where I currently stand

While I am enjoying a brief summer pause and working on a larger piece on Reflexivity, I’ve been asked for an update on my current views, which I summarise in today’s brief post

As outlined in May in “A Heretical Thought” and “Preparing for a Cyclical Turn”, and further recently in “No Free Lunch”, the US economic cycle *appears* to be turning up

Recent labor market data such as ADP, jobless claims, Challenger and JOLTs has all come in strong, while forward looking WARN data suggests a possibly even tighter labor market in the Fall

At the same time, US consumer wallets have grown again, as inflation abates while wage gains remain high. Recent retail data has been encouraging (see yesterday’s Amazon Q2 earnings)

Finally, manufacturing is showing signs of life, with strong recent factory orders and some leads indicating a possible trough either near- or even behind us. I’ve shown the below chart of forward looking ISM Purchasing Manager Survey components several times before, it continues to improve

The driver behind this development is likely, as discussed before:

The unparalleled US government spending, with an 8% deficit this year, while unemployment remains near historic lows

The stimulative effects of higher rates in a high government debt/gdp economy, as interest payments continue to pour money into the economy

Either have more than offset the drag from monetary policy so far. This is in some contrast to Europe, which does not sponsor programs equivalent to the CHIPS, IRA or Infrastructure Act and where excess savings were mostly created by consumers staying at home, rather than the printing press

As detailed in several recent posts, the above world view lead me to favor the underowned sectors Energy, Banks and China Tech on the equity long side to ride the economic turn, vs well-owned Europe on the short side. The posture caught the right trend - Energy, Banks and China Tech were the best performing sectors in July, while Europe was lagging. So now, what’s next?

My views on asset markets remain largely in place, as more data confirms the re-acceleration I first described in May. There are some new nuances in particular around Tech and Bonds, so please read on for a brief summary of views per asset class below

The following section is for professional investors only. It reflects my own views in a strictly personal capacity and is shared with other likeminded investors for the exchange of views and informational purposes only. Please see the disclaimer at the bottom for more details and always note, I may be entirely wrong, may change my mind at any time and this is definitely not investment advice

Energy - In a classic case of Reflexivity, the universal recession expectation lead to historically high speculative short interest in Oil and Oil Products, while Oil and Oil Services equities have been shunned by hedge funds for the same reason. Equally, on the corporate side, bearish views on both the oil price and the economy further entrenched the underinvestment in new production the sector has already been plagued with. Now, instead of a recession, a pickup in growth appears on the cards, so a perfect storm evolves. Physical demand improves, supply is too low and the markets scrambles to get out of shorts or to put on exposure, driving prices higher

Banks - I received much pushback for my positive views on US large cap and regional banks. This sector is hated and everyone expects another Silicon Valley Bank-style tantrum. For the same reason, in another classic case of Reflexivity, banks have worked hard to avoid another panic due to higher rates e.g. by hedging exposure or cleaning up risky exposure. Meanwhile, the steepening yield curve brings income gains to the sector not seen in decades. Yes, loan losses will matter, but that point may be further away than commonly assumed, especially if the economy picks up now (I may be wrong with this view of course). I believe the loan loss story will emerge when the sector is well owned again, and we are still far from that. Today, Banks remain heavily shorted while their income prospects are rapidly improving. It not a certainty by far, but the fuel is there to push prices significantly higher

China Tech - Recent stepped up measures by the Chinese government to support both domestic consumption and the local stock market underline why I find it unlikely that China wants its own economy to implode . I would expect more to come, and see unloved China ADRs as key beneficiaries with their domestic exposure

Staples - This sector has recently fallen out of favor under the expectation of disinflation, which would hurt the topline of most staples companies (e.g. beverages, snacks, cereal etc.). In contrast, the bond market is telling us that a higher nominal growth world lies ahead. Is that right? Only time will tell. Either way, I believe equity investors could now look for stocks that match the bond market’s outlook and, aside of Banks and Energy, Staples would fit the bill

Bonds - I’ve pointed out the vulnerability of US Treasuries just before the recent sell-off below:

While the strong move over the past few days speaks for some consolidation, I do not think long-end rates have seen their high yet, until either the notion of economic re-acceleration is invalidated by weak data, or some governmental reaction provides support, e.g. via guiding to a higher than 20% cap on bills issuance (which would support long-term bond yields)

High-Beta Tech - The equity sector most vulnerable to higher yields is Unprofitable Tech, which coincidentally also had a tremendous run in July as Hedge Funds covered shorts to a historic degree, and many shorts where in this area. With that bid now likely gone and with rates as renewed headwind, the downside has opened up, and I had highlighted the risk of a steep sell-off in this area in late July. I continue to view this as most vulnerable area for now

US Large Cap Tech - The US Tech giants are an unreal engine of innovation. They also share characteristics with Staples companies as beneficiaries of a higher nominal growth world due to their tremendous pricing power and market position. While many perceive AI as a fad, I notice its potential every day as our team saves much time using ChatGPT for coding, which today, for now, seems the most tangible area of benefit. I appreciate that it is unclear how the future AI monetisation pie might eventually be shared, and that more certain value might lie in today’s picks and shovels providers. Either way, the issue with Large Cap Tech is that now everyone is long them, so marginal buyers are much harder to find

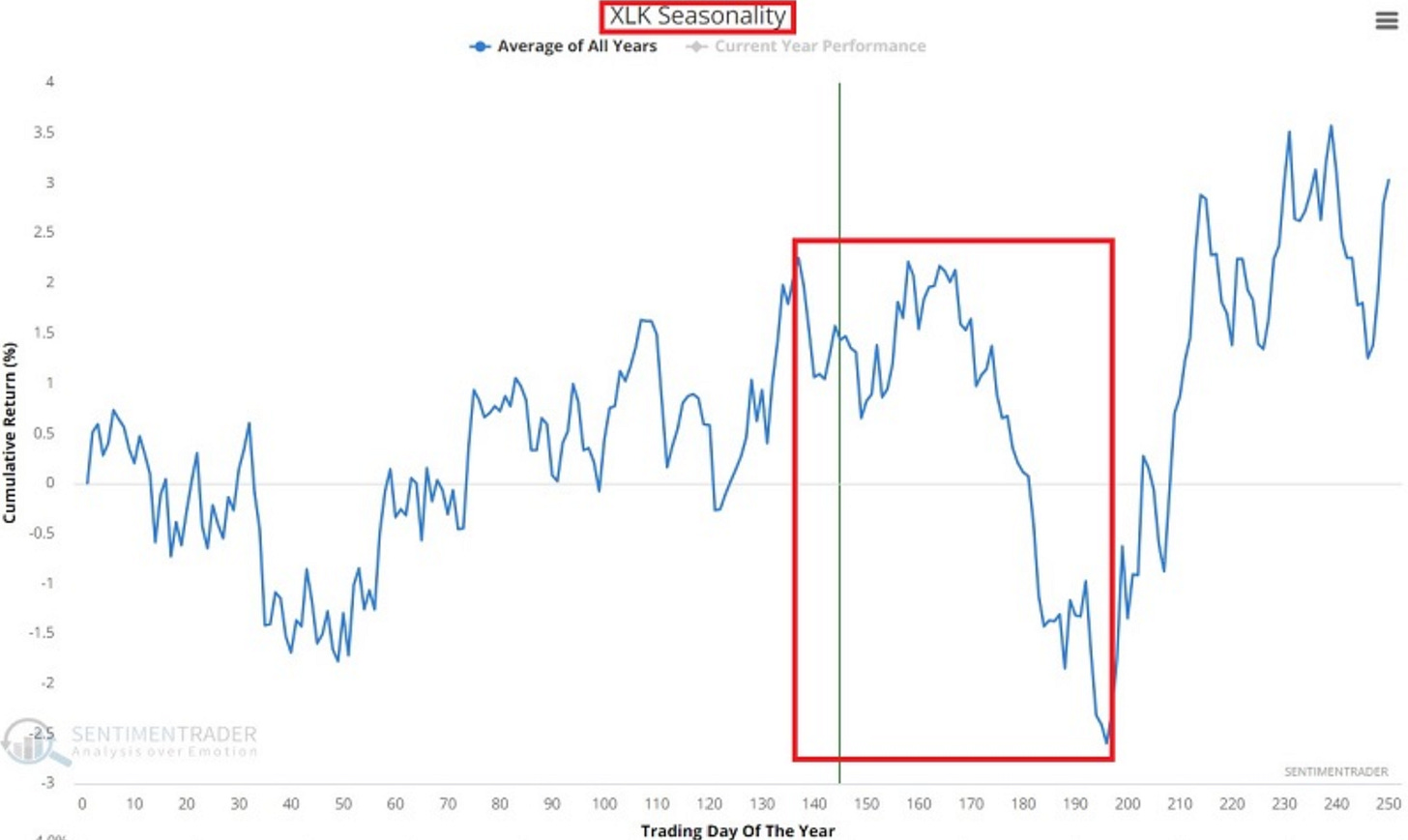

This is the more pertinent when keeping in mind seasonality for Tech which is weak over the summer (XLK = S&P 500 Info Tech)

I think it likely (not certain!) that we see Large Cap Tech wobble in August and September, with some mix of higher yields and lofty expectations possibly then pointed to as culprits, to provide a buying opportunity once some crowding wears off

Goods vs Services - Flight and hotel prices are now at nosebleed prices, all while Covid revenge travel is likely past us. Goods have been in deflation since the ‘20/’21 lockdown splurge on them has passed. US consumer real income is growing, suggesting capacity to move spend around. What if the shift from goods to services reverses now? I think there is a decent chance that the retail holiday season comes in better than expected - something retailers are not prepared for…

Equities - Putting all of the above together, I see an equity market that on a sector basis is lead by the intersection of nominal growth beneficiaries and/or early cycle exposure, such as Energy, Banks, China or Staples, while Large Cap Tech and especially Unprofitable Tech lag on higher yields. The latter also probably caps upside for indexes in general. I’d expect markets to stay weak into late September and would think running some moderate degree of net short to make sense. Finally, I would expect some rotation back from services to goods within Consumer sectors

Some further thoughts on other asset classes

US Dollar - Positioning and market views remain very bearish the Greenback, which makes me think as usual the opposite happens, with higher US real yields providing the possible narrative for investors to exit their US Dollar shorts. Add to that a tighter USD liquidity picture as the TGA refill is now complete and Treasury spending is not offsetting QT anymore. Longer term, the outlook for the US Dollar is certainly bearish with the enormous US government deficit ahead for years

Europe/Emerging Markets - Europe probably will grow slower than the US but won’t fall into stone age. Emerging Markets should do well if global growth picks up. I like the latter and have gone less bearish on the former

Gold - The barbaric metal is very crowded as per CFTC and other positioning data, which makes me wonder where marginal buyers will come from. A period of re-accelerating economic growth, and with it rising real rates is also historically not a favorable context. With these headwinds in mind, Gold has so far done remarkably well, and its fans rightly point to the seemingly unsustainable US deficit as a reason for prices to eventually go higher. I could see an interesting entry should speculative longs ever be forced to give up, e.g. by a selloff

Putting everything together:

I see a world economy that is picking up steam again, lead by the US, where excessive government spending pre-emptively outweighed the fallout from higher rates.

I see a Fed and US Treasury gambling on inflation not re-emerging in ‘24 despite said deficit and lingering high liquidity. I am not certain this gamble will pay off

I see excessive US Dollar bearishness that probably needs to be washed out, before the Greenback declines again

I see Hedge Funds who panic-bought Tech and underown Banks and Energy, which makes me think market leadership is now with the latter groups

I see a bond market that still lures in many with the view of a return to deflationary pre-Covid-times. I believe that group needs to give up before yields can turn lower, and the trend is higher for now

I see equity investors with one foot out of the door, which makes me think a large sell-off is unlikely and market weakness will eventually get bought, possibly when the window of seasonal weakness closes in late September/early October

Where could I be wrong?

The economic reacceleration I describe might be a mirage, or it may be aborted, e.g. by the lagging effects of rate increases which could still come

Manufacturing weakness has not translated into job losses yet. This may still come, if there is no rebound in goods demand

The slowdown in Manufacturing has so far not spilled over into other parts of the economy, contrary to history, as residential and commercial construction (IRA!) remained supportive. Conversely, a pickup in Manufacturing may not halt or reverse an overall economic decline that could be driven by Services

More broadly, it is certainly possible that a recession arrives just as everyone gives up on it. However, I still see plenty of bearishness around which makes me think that many aspects of the financial system still work actively to prevent the recession outcome (more on that in the next post on Reflexivity)

With the future uncertain, I will continue to let data from markets and the economy inform my views of where the puck is most likely going, and share these with my readers whom I thank for their interest and support!

DISCLAIMER:

The information contained in the material on this website article is for professional investors only and for educational purposes only. It reflects only the views of its author (Florian Kronawitter) in a strictly personal capacity and do not reflect the views of White Square Capital LLP and/or Sophia Group LLP. This website article is only for information purposes, and it is not intended to be, nor should it be construed or used as, investment, tax or legal advice, any recommendation or opinion regarding the appropriateness or suitability of any investment or strategy, or an offer to sell, or a solicitation of an offer to buy, an interest in any security, including an interest in any private fund or account or any other private fund or account advised by White Square Capital LLP, Sophia Group LLP or any of its affiliates. Nothing on this website article should be taken as a recommendation or endorsement of a particular investment, adviser or other service or product or to any material submitted by third parties or linked to from this website. Nor should anything on this website article be taken as an invitation or inducement to engage in investment activities. In addition, we do not offer any advice regarding the nature, potential value or suitability of any particular investment, security or investment strategy and the information provided is not tailored to any individual requirements.

The content of this website article does not constitute investment advice and you should not rely on any material on this website article to make (or refrain from making) any decision or take (or refrain from taking) any action.

The investments and services mentioned on this article website may not be suitable for you. If advice is required you should contact your own Independent Financial Adviser.

The information in this article website is intended to inform and educate readers and the wider community. No representation is made that any of the views and opinions expressed by the author will be achieved, in whole or in part. This information is as of the date indicated, is not complete and is subject to change. Certain information has been provided by and/or is based on third party sources and, although believed to be reliable, has not been independently verified. The author is not responsible for errors or omissions from these sources. No representation is made with respect to the accuracy, completeness or timeliness of information and the author assumes no obligation to update or otherwise revise such information. At the time of writing, the author, or a family member of the author, may hold a significant long or short financial interest in any of securities, issuers and/or sectors discussed. This should not be taken as a recommendation by the author to invest (or refrain from investing) in any securities, issuers and/or sectors, and the author may trade in and out of this position without notice.

Fantastic post, thanks for expressing your thoughts time and time again.

Thanks for your interesting points. I wonder if in all of this the US political cycle is also playing its part. Can the FED tightening get close to the election season or is the FED going to release the pressure a few months earlier than the political campaign starts?