The AI Revolution

Why real-world use cases suggest AI is the real deal

Since its release in November ‘22, ChatGPT has grown to 100m users faster than any application in history. It firmly established Artificial Intelligence (AI) as Tech mega-trend, now the topic dominates headlines on a daily basis

Is the hype warranted? In my view, the litmus test in assessing a new technology are common sense, real-world use cases. As such, regular readers will remember my scepticism towards Crypto, where I struggle to see practical applications beyond Bitcoin’s monetary debasement story (which is, to be fair, a big story), or the Metaverse, which seemed a sad form of dystopian escapism. AI however appears the real deal. I think the excitement is warranted, and that it has the potential to transform our economies

This article walks through several stunning real world use-cases across industries, illustrates how my team at Sophia have included AI in our daily workflow, and follows with an outlook on how AI likely affects the economy from here

As always, the post concludes with my current markets views. As regular readers know, I remain max long US Treasuries since early March, which continue to be the trade, and have added to equity puts, as signs of market instability increase while the debt ceiling debate approaches

Let’s start with two basic questions:

How does AI work?

AI encompasses technologies that simulate human-like cognitive functions. The most prominent are large language models (LLMs) such as ChatGPT, which are a nothing but a giant exercise in statistics. Let’s look at a step-by-step example:

We ask an LLM model to complete a sentence for us, e.g. “Eggs are laid by…”

Computers can only handle numbers, so the LLM translates this word-based query into numeric chunks of characters called tokens, e.g. “Egg” = token 456 or “by” = token 2675.

The LLM trained itself using a vast body of input data, in GPT’s case the public internet. In our example, it will know all sentences online that start with “Eggs are laid by…”, to find out that 50% of such sentences are finished by the token equivalent of “hens”, 30% by “chicken”, 10% by “birds” etc.

The LLM then picks the answer with the highest probability to complete the sentence. It returns to us with the answer “Eggs are laid by hens”

The same principle can then be expanded onto much more complex queries, which are answered step-by-step in a probabilistic way. GPT-4 can process queries with up to 32k tokens. This brings us to the next basic question

Why now?

Even with the above simple example, one premise is clear: the larger the body of information the LLM is trained on, the better its answers will be

However, the larger the body of information and the larger the model size, the greater the required computational power and cost for training

Just to compare the evolution between GPT iterations: GPT-2 (2019) was a 1.5 billion parameter model trained on 40 GB of text, while GPT-3 (2020) had 175 billion parameters trained on 570 GB of text (Parameters are probability weights as in the hens/chicken/birds example above). GPT-4 parameters are not disclosed but assumed to be again similar magnitudes higher than its immediate predecessor

Advances in computing power have enabled an inflection point, where GPT-4 now returns answers qualified enough to be taken seriously by users

So now we’ve covered the basics, but it’s still very theoretical

As many of you know, I put strong emphasis on common sense in the judgement of anything, including technological advancement. Accordingly, to assess the potential of AI, I went through current real-world use cases to see whether they make sense

Below is a summary by industry with some - in my view - mind-blowing examples:

Creative Industries

Why is this industry suitable for AI? Music, image and film are essentially very dense sequences of information arranged in a harmonic way. As such, they are predestined to be replicated by AI

Current examples:

Image generation programs produce output based on stylistic instructions within moments. We generated the below picture with Midjourney, with this weekend’s coronation in mind, using the prompt: “Make me a picture of King Charles in the style of the Wes Anderson movie -The Great Budapest Hotel-”

The quality of these images has reached live-like properties. Photographer Boris Eldagsen's image "The Electrician" recently won the Sony World Photography Awards with a picture generated by AI. The jury did not notice until the artist’s revelation

Videos are logically next, and Synesthesia is one of the companies providing AI-based video solutions. There are still sufficient tells it is not real, however the ElevenLabs voice clone is already good enough to pass biometric tests, it only requires a 2 minutes recording of your voice to train it

Music isn’t far off. A song recently has shot to fame online that features both Drake and the Weeknd, only that neither contributed to it. Entirely AI generated, it would have all chances to smash the charts

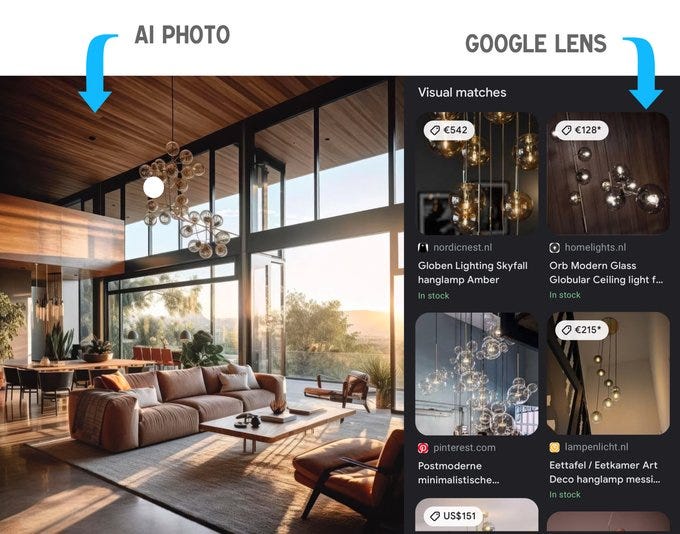

Outside of entertainment, creative applications also stretch into fields such as interior design. Below picture shows an AI-imaged room design on one side, with options to buy the respective furniture on the other

Law

Why is this industry suitable for AI? The legal profession comes with extensive data (laws, previous court decisions, case information) that usually follows coherent logic. At the same time, extracting said logic is very laborious, time consuming and often requires expensive expert advice

Current examples:

To start, attorneys can speed up internal work by asking GPT the same sort of questions they might ask a junior associate, e.g. “Which courts in this jurisdiction have presided over similar cases and how have they decided?”

However, AI also provides powerful use cases on the client side, especially with regards to drafting legal documents. Below excerpts of a video show a commercial lease draft produced by ChatGPT - it takes minutes to draft the contract, no lawyer is needed, no legal fees paid

This field of basic legal tasks - too complex for consumers but trivial for lawyers - is pretty much endless and ideal for AI. Another example: it is now possible with one click to automatically generate a 1000-word lawsuit against robocallers

Medicine

Why is this industry suitable for AI? Similar to law, medicine is an industry with large samples and complex, but often logical relationships. Due to sheer volume, this body of data exceeds any human’s capacity to interpret it. AI can be a tremendous help, from diagnostics and detection to the new application of known compounds and the discovery of new compounds

Current examples:

Google’s Isomorphic Labs has mapped out the predicted 3-D structure of every one of the 200m known proteins - a database called AlphaFold

The University of Toronto and Insilico Medicine developed a liver cancer treatment in record time using AlphaFold

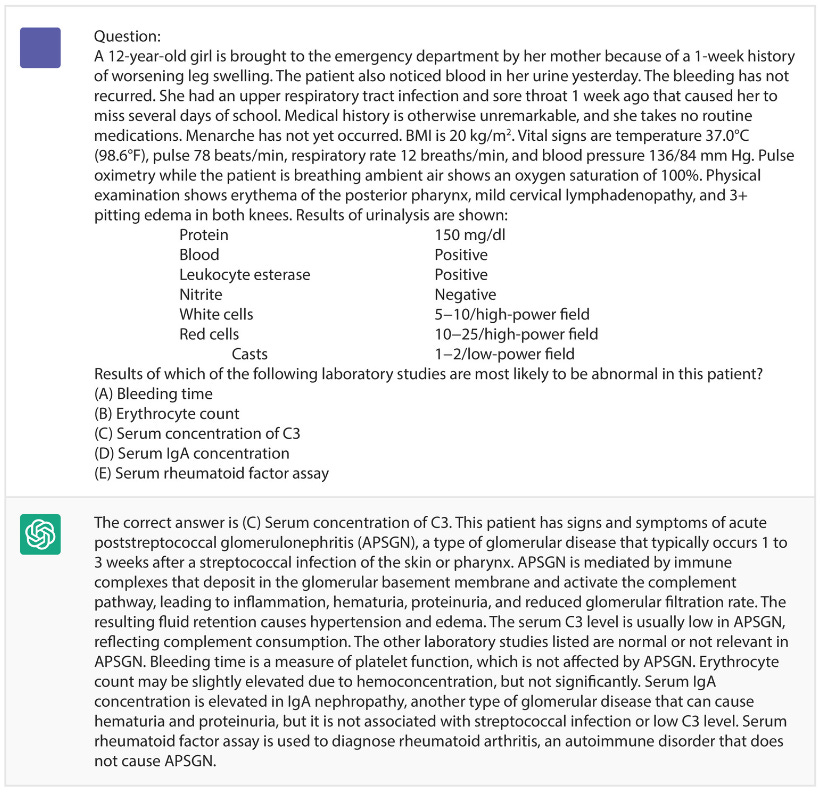

For diagnostics, AI can access an existing body of knowledge in ways a human never could, which is very helpful for doctors to corroborate their own conclusion. The below screenshot shows ChatGPT giving a precise diagnosis to a complex medical issue, provided within moments.

Finally, wearable tech is another area of obvious AI impact, where patterns implying health problems can be detected early. Apple’s Quartz service based on Apple Watch health data is scheduled to launch in 2024

Automotive

Why is this industry suitable for AI? Billions of cars drive on the world’s roads every day, creating a huge data set of driving patterns that could be used to efficiently and safely predict driving decisions. Self-driving cars would free up labor and reduce the number of cars needed

Current examples:

The quest for a self driving car today is synonymous with Tesla, which has claimed to be on the cusp of a full-self-drive (FSD) release since the mid-2010s

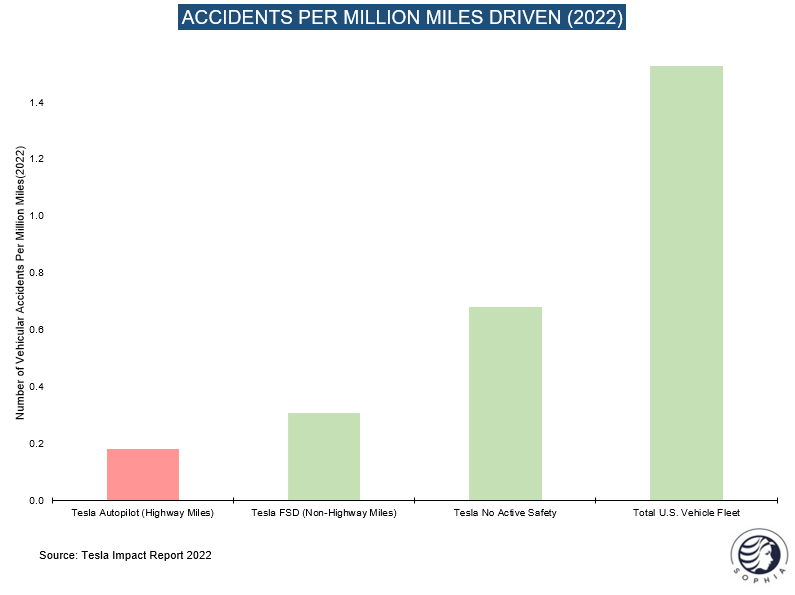

While according to Tesla’s own statistics, FSD + a human is already safer than human driving, the release date for a truly fully autonomous version (level 5 ie. no human) has continuously been pushed back given the tasks’ complexity - while ChatGPT only analyses text, FSD needs to solve dynamic image recognition

While many remain doubtful of any near-term breakthroughs, Elon Musk insists on a full FSD release possibly even this year. There are legitimate reasons to doubt his claims, and I myself have been critical of Tesla in the past

However, I see no reason why an eventual breakthrough wouldn’t be possible, and expect a watershed moment similar to the release of ChatGPT in the coming years

Finance

Why is this industry suitable for AI? Like law, finance involves vast amounts of data, which help understand the financial past and economic history. In turn, this understanding provides tremendous edge as human behavioural patterns repeat themselves

Current examples:

Within that effort, my team and I at Sophia have incorporated GPT in our workflow on a daily basis. To start, it helps us answer rapidly specific questions that used to consume hours of analyst work. An example on past oil price moves below…

…or here a quite technical request on subordinated European bank debt

We also found it useful in determining historical relationships and running regressions on them (e.g. “what is the lead role of PPI vs CPI, and how has it evolved over time?”). Further, we’ve also experimented with Agent GPTs, which started as an open-source attempt to make GPT-4 autonomous and have since become the fastest growing Github open-source project ever

Now, what are Agent GPTs? For these, a human sets a goal (i.e. “analyse historical participation of foreign investors in US Treasury auctions”) and the agent autonomously creates subtasks to achieve that goal (e.g. “collect historical data on US treasury auctions” etc.)

There are still some clear limitations with Agent GPTs. One of the most frequent issues with LLMs are “hallucinations”, where the AI confidently states information which is false - removing a human from the loop can compound this issue

It is also hard to limit the scope - in our example, the Agent GPT tasked itself to hire consultants and contact the US treasury to complete the goal

Nevertheless, we believe that Agent GPTs eventually resemble junior research analysts - at a fraction of the cost

At Sophia, given its potential, we aim to stay at the forefront of the intersection of AI and investing. To that purpose, we actively work with AI start-up Alep that is building an AI research assistant specially designed for investment professionals. My colleague Denis Piffaretti is also one of the co-founders of Towards AI, a platform providing education and resources to over 300,000 AI practitioners

The examples above all share one commonality - research tasks can be completed faster than before. In other words, we saved time and our productivity increased. However, the “killer app” from our point of view is something else, and that brings me to the last industry segment

Finally - Coding

Why is this industry suitable for AI? Today, the world around us largely runs on computation. However, only 30m people speak one of its various languages, from Python to Julia or C+. GPT can help - it can code for you. It thereby provides an interface into computation via a natural language that everyone speaks

Current examples:

Our data work, which you frequently see featured in these posts or Sophia’s Twitter feed, is based on Python. GPT allows us to produce and analyse data much faster than before. But how?

Assist in writing code – Rather than creating code from scratch, we use ChatGPT for code templates or to check how existing code can be written more efficiently (e.g. use less memory, run faster, more easily adjustable etc.)

Debugging – Some code runs produce unexpected output. These are difficult to fix as you have to walk through each line to locate the problem which is extremely time-consuming. Using ChatGPT, we can search for examples producing similar errors and see how other coders have solved the issue. Taking a step further, Agent GPTs can debug themselves autonomously

The benefits of GPT for coding extends beyond data crunching, some notable examples are GPT composing a website from a few simple prompts, or the video below, where GPT creates a video game:

Conclusion

In my view, the hype around AI is warranted. Plenty of real-world use cases exist, and progress is both fast and fascinating

Given the exponential nature of its development, notable further breakthroughs are likely over the coming years, with self-driving cars as most prominent case

We are still in early innings, and it is certainly true that output still often comes with flaws or inaccurate statements (“hallucinations”). However, solutions are underway to address this (e.g. Scite.AI or Perplexity.AI)

The scenarios of an unhinged AI becoming a threat to humanity seems, if anything, distant. However concerns about malware are warranted, and the risk that the internet will be flooded with fake videos, photos, and news needs to be taken seriously and addressed

What does it mean for the economy and markets?

As always, below is my personal attempt at connecting-the-dots for my own investments. Please keep in mind - I may be totally wrong, nothing is more important than risk management, and none of this is investment advice

AI impact on the broad economy

Contrary to some forecasts I do not at all expect mass unemployment from AI. None of the technological advances of the past two centuries had that effect, from steam engine to computers or refrigeration. I see it as likely complementary tool that frees up work which will be applied elsewhere. Productivity should go up, possibly similar to the late 1990s when internet was mass-adopted and a period of high productivity ensued

Why is productivity important, in other words the ability to produce more over a given time? It increases the standard of living as businesses can pay higher wages without increasing prices. These higher wages can be spent on more goods and services, lifting employment elsewhere

Winners and losers

AI’s exponential growth makes it hard to predict, as we generally struggle to imagine non-linear developments. However, a winner-takes-all appears likely for general AI, as people will be able to easily compare different offerings and chose the better one, similar to search engines where Google today commands 90%+ market share in many regions

This speaks for the likely winners to be primarily found amongst the US Tech largecaps, which host both huge amounts of data as well as engineering talent (Microsoft, Google, Meta, Tesla, etc). I have some sympathy for a disruptive role of open source, however do note the hurdle of exponentially increasing training costs

It is very hard to tell at this stage who will win the race. The easy view would be to point as Microsoft as winner and Google as loser given the formers involvement in OpenAI and its integration into search engine Bing, which is now stealing market share from Google. However, Google owns original AI company DeepMind and is generally perceived as the leader in AI research (in fact LLMs like OpenAI's GPT-4 were only possible thanks to its Transformer breakthrough which it shared openly)

Over the medium term, one thing is certain - AI will drastically increase the need for computing power. Again, the large caps are working on internal solutions and one can’t rule out lower supplier dependency going forward. Nevertheless, some of the leading semi-conductor companies we researched appear well positioned for future demand

While AI likely boosts productivity and is an overall positive for the economy, it will doubtlessly disrupt many existing business models. This week, education companies sold off following the earnings miss from homework help company Chegg which it attributed in part to ChatGPT. “No code” offerors such as Wix and Squarespace are also likely to be significantly impacted

Tech investing is bubble prone, especially around hot themes like AI. Therefore, I will wait to buy AI beneficiaries in a sell-off, which I continue to deem likely this year

Finally, a brief update on my current portfolio

My positioning remains unchanged, the core position is max long US Treasuries (emphasis on 5-yr duration), with reasons laid out in detail in previous posts. In addition, I own equity puts across various mainly cyclical sectors

Admittedly, I almost lost faith in the equity puts after markets rebounded violently last week after a brief selloff. However, I’ve seen both pervasive bear capitulation and upside froth since (see chart below with S&P 500 1-month call skew) - this was possibly required to open a path to the downside. So I’m keeping them and have in fact added after the earlier Debt ceiling x-date was published on Monday night

I continue to expect “risk-off” over the coming months driven by a materially slowing economy (discussed here or here), the debt ceiling debate and recurring regional bank stress (see this previous post which predicted the banking crisis unlikely to be over)

That period could then be followed by a rally on the back of Fed policy changes, e.g. ending QT, or hints at rate cuts later in the year, both possible at the June or July FOMC. I would be looking to go long risk possibly around that time

While the April CPI print may still be uncomfortably high, inflation likely declines after for the remainder of the year (see here), to only come back at a later stage (2H24?). Unemployment likely increases in the coming months, as the chart below illustrates. Continuing claims, which are hard data, show a steady rise since late last year. It is likely in my view that non-farm payroll data, which is survey based, catches up soon

On that note, market views on Europe remain overly optimistic. The ECB April bank loan survey showed what could be described as nothing but an implosion in credit demand from the private sector. This leads economic activity and does not bode well for the second half of this year

Finally, a word on commodities. I had pointed out in many previous posts how this stage of the cycle is not one where to own commodities incl. oil. It is no surprise that these sell off as money supply contracts and industrial demand declines. I do not think the bottom is in for the space, even though the multi-year outlook remains positive as supply is underinvested

Historically, with the exception of 1981 (when valuations were at rock bottom), the market always sold off once unemployment increased. I see no reason for it to be different this time

Great write up Florian! Those examples you used really opened my eyes to the possibilities of GPT. I hope as you follow the space you can share any interesting AI companies/stocks that you feel have potential (although I'm sure it will take awhile to figure out the winners and the losers in this space). Thanks for sharing your thoughts!

I do research and publish on machine learning. The AI hype is just that. Predicting the next sequence of words is no different than the autocomplete algorithms that Microsoft, Google, and Apple have been using. All ChatGPT has done is to autocomplete an entire paragraph instead of just a sentence.

The AI hallucination problem has not been solved. It likes to make crap up! Why would a company whose reputation is built on trust use ChatGPT on its customers and on itself?

There’s a reason that Google was not as aggressive on LLM applications as a startup with no reputation to protect