The Last Inning

Treasury buybacks may be imminent, which could save markets for a while

An important development is under way in the US that is likely to alter the current course of asset markets, at least for a few months

Triggered by a near-death experience in the US Treasury market, the path appears to have opened for Treasury buybacks, as mentioned before in “Quantitative Frightening” or “Tremors”

If enacted, these likely put a bid under asset markets that could last several months. As a political decision from the US Treasury, enacted together with the Federal Reserve, a launch before the mid-term elections would make strategic sense for the current administration. Elections are won in the suburbs, where equity-driven 401k plans determine retirement wealth

This post walks through the reasons why I deem such a move likely. As always, it closes with an outlook on current markets, where I explain how I am positioned for this

Please note, all “Next Economy” research follows a strictly data-driven approach. My team and I tracks hundreds of datapoints, we share them freely in the spirit of open source on Twitter

As a regular reader, you may be familiar with the “doom loop” I illustrated in various recent posts between lower exchange rates for Asian countries and lower demand and thus higher yields in particular for long dated US Treasuries

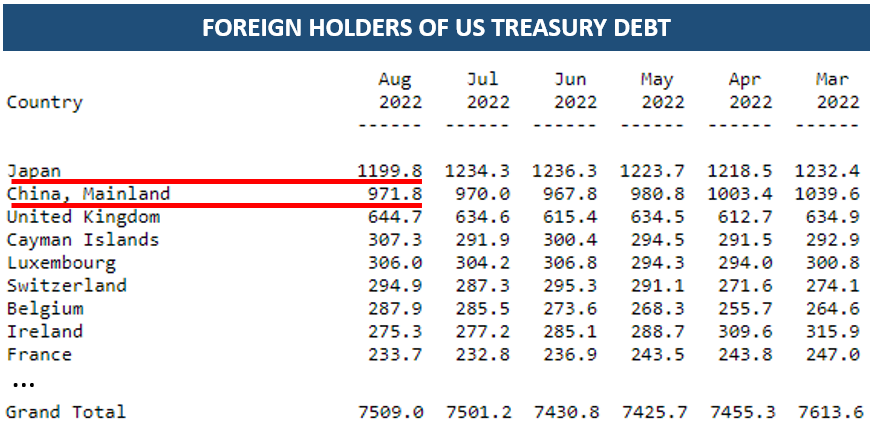

A brief refresher: Japan and China are some of the largest holders of US government debt…

… however, in contrast to the Fed, Japan in particular runs a very dovish monetary policy, fixing the yield of its 10-Year bond at 0.25%. With a tremendous debt pile and yawning government deficit, the country would struggle with higher rates

US interest rates are significantly higher on a real and nominal basis, so capital leaves Japan. As a consequence, its local currency, the Yen, devalues. This increases domestic inflation. Why? Japan imports most of its energy and food

The BOJ does not want that, so to prevent its currency from devaluing, it tries its hand at currency intervention

For this, it has $1.13tr US Dollar reserves available, split between $130bn of cash and $1tr in US Treasuries. So far, it has spent ~$60bn on various interventions as shown in the chart below. About ~$40bn likely funded with cash, and ~$20bn with US Treasuries sales

The result has been underwhelming - the Yen continued to appreciate

Now we get to the doom loop part. With every intervention, US Treasury yields rise, in particular once the USD cash runs out. Then, they have to be funded entirely with US Treasuries sales

If USTs are sold, this increases their yield and thus the yield difference to Japanese bonds, inviting more capital flight out of Japan and an even lower Yen → the cycle goes back to the start

Japan could solve its capital flight by giving up on Yield Curve Control and let the 10-Year yield be determined by the market, or at the very least set it higher than 0.25%. But not only would this cause havoc with domestic government finances, it would also blow out US Treasuries yields as Japanese buyers re-route to domestic bonds. A global financial earthquake would follow

This seems unlikely for now. So, in reality, the only entity able to stop the doom loop is the world’s economies true central bank - the Fed. How? By pushing US long-term interest rates lower and thereby lowering the yield differential to Japanese bonds

However, since the summer, the opposite is the case. The Fed scaled up its Quantitative Tightening program to $95bn per month. Thus, the biggest owner of US Treasuries drastically reduced its role

With foreign buyers incapacitated due to their weak FX, the Fed out of the market and US domestic banks restrained by regulation, few buyers are around for long-term USTs, where the buyer takes on the full long-term inflation and solvency risk

More so, while there is plenty of liquidity stuck in the $2.2tr Reverse Repo facility, investors prefer to use bank deposits to match the liquidity needs from a shrinking Fed balance sheet. This lowers bank reserves and thereby shrinks the liquidity available to the real economy. The Fed expected the QT liquidity drain to be offset by the RRP instead of reserves. This was so far obviously wrong

As a result, liquidity dried up and significant strains appeared in the market for long-term US Treasuries (10-Year+ duration)

We can measure this stress in in bond trading metrics, such as the Bid-Asks spread as shown below, which is currently wider for long-dated treasuries than for investment grade corporate debt…

…or in aggregates of various liquidity measures as show in this chart below

The US Treasury market is the most important asset market in the world. All risk assets are priced off this “risk-free” alternative. If it ceases to function, the financial system fails

With such poor liquidity, it only takes a small shock caused a limited amount of forced selling for the UST market to become very disorderly. In other words, we are a just a small crisis away from a systemic melt-down

Now, as mentioned in my last post, these strains did not escape US Treasury secretary Janet Yellen, who is responsible for selling the government’s debt:

With the issue on the government’s radar, this past Friday, after several days of heavy selling in USTs, something peculiar happened:

First, a Wall Street Journal article by Nick Timiraos appeared where expectations for further aggressive rate hikes were dialled down. The Fed has on several previous occasions used this reporter to pass messages on to the market

This was followed by a huge intervention in the Japanese Yen where the BOJ sold ~$30bn US Dollars and brought the exchange rate down to 145 at its low from 152 before. According to Japanese officials, this was coordinated with the Fed

Finally, in the evening, non-voting Fed governor Mary Daly spoke at a fireside chat at Berkeley University

In this chat, she gave some very noteworthy comments:

She reiterated the WSJ article message about dialing down the pace of rate hikes

She highlighted how rents are coming down, which standard CPI measures would not reflect

Most importantly, she said the Fed could buy bonds again to stabilise US Treasury markets. This could coincide with other measures to fight inflation and importantly, it would not be QE (spoiler alert- it is)

The Monday after, Janet Yellen gave a speech, in which she dropped clear hints of her intention to address Treasury market dysfunction:

After the speech, she was quizzed by reporters on what plans she had in mind. She highlighted the poor liquidity in the 20-Year bond, and how buybacks could help

To me, the sequence of events appears clear:

The Fed and the Treasury, who work closely together, became very concerned about the intensifying sell-off in long-term US government bonds and the corresponding systemic risk

They agreed that something had to be done, and initiated the political process of getting it done, which includes preparing the market via coordinated messages

As outlined, much points to buybacks as vehicle of choice to calm Treasury markets. Now - the question is, what does that actually mean?

By conducting Treasury buybacks, the US Treasury - via the Fed - buys long-duration bonds (10 or 20-Year plus) and finances these purchases by selling short-term bills (<1 Year). That way, liquidity is provided to the now illiquid long end, which increases the capacity to absorb shocks and forced selling. On the other hand, there is plenty of demand for short-term T-bills, as these by definition don’t carry any duration risk (e.g. the path of inflation over the next 20 years)

With buying netted-off by new issuance, the money supply remains constant. Nevertheless, the exercise would provide a big boost to risk assets:

Long-term interest rates are lowered as a new buyer appears, and as markets price in that these bonds are backstopped by the government. Risk assets are priced off long-term US bond yields, lower yields boost valuations across the board

The increased supply of bills pushes up their yield, likely enough to incentivise funds to leave the $2.2tr RRP. This provides additional liquidity to asset markets

From a political perspective, it’s an easy sell: The procedure is revenue and money-supply neutral. Everyone likes higher asset prices. The argument of fixing “financial stability” sounds plausible. Anti-inflation measures such as higher short-term rates can continue in parallel

However, away from the spin, the sad reality is that long-term treasury markets are illiquid because private buyers do not want to own long-term debt of an overindebted nation with a $1tr running budget deficit. This is not a “financial stability” intervention, it is a bailout for the government. It does not come for free, higher asset prices mean more inflation down the line, especially via the oil and commodity channel

It also represents a redistribution from the private sector to the government. If short term rates are increased, private sector borrowing slows. Meanwhile, the government can finance itself with long duration debt

On November 1st, the Treasury Borrowing Advisory Committee meets to discuss GSIB bank survey results on Treasury buybacks, which had been sent out earlier this month. I could imagine a formal decision after, in time for the midterms on Nov 8th

I find it highly likely that more headlines are leaked before, to let markets front-run the program

In terms of size, I would expect ~$200bn, roughly the equivalent of two months of QE

Either way, it appears that Fed has shown its hand, and a line in the sand was drawn last week

There is much talk about whether f the “Fed Put” still exists in equity markets, ie. the moment where the Fed steps in to stop a drawdown. This is the wrong lens. Yes, a “Fed Put” exists, but it applies to the US Treasury market. We now know its strike price, it lies at ~4.4% for 30-year debt

Here is the obvious issue: Higher asset prices loosen financial conditions and are therefore inflationary. US data is still way too strong for any accommodative policy

Credit card data throughout October continues to track well, the US Consumer keeps spending

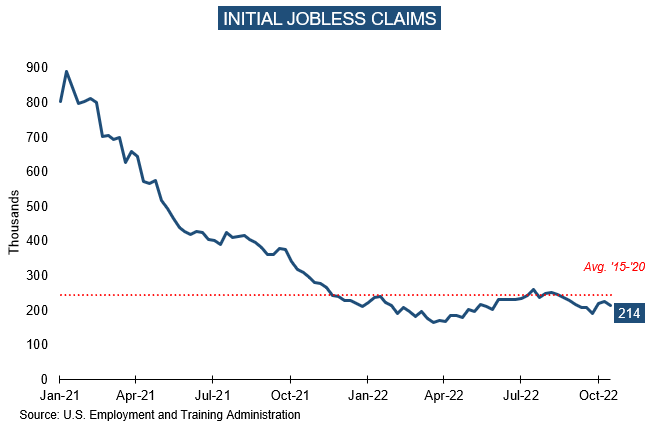

Unemployment lead indicators such initial jobless claims remain at very low levels

It remains unclear how much unemployment will rise this cycle. I’ve put together a comparison with previous recessions and how various labor market metrics tracked at their onset. You can see today’s labor market is much tighter than in the past

Unsurprisingly, the Cleveland Fed’s inflation forecast for October remains uncomfortably high

Despite Mary Daly’s assurances that interventions in US Treasury markets under the pretext of “financial stability” would not affect inflation, it seems common sense to me that they do

I would therefore expect any loosening in financial conditions due to higher asset prices to be subsequently fought again, with some time lag in between

As such, any market rally likely eventually reverses. We’re unlikely to have seen “the low”

What does this mean for markets?

As always, below is my personal attempt at connecting-the-dots for my own investments. Please keep in mind - I may be totally wrong, nothing is more important than risk management, and none of this is investment advice

Equities - I have turned constructive on equities, and I believe that the stock market would rally hard on any specific news of Treasury buybacks. In addition, we are now leaving the blackout period for corporate buybacks (corporates can only buy back stock after their earnings releases have passed). At their peak, this should provide ~$5bn of equity demand per day, mainly over November

Further, hedge funds are positioned extremely bearish, with net and gross exposure at long-term lows. Hedge funds are not the only investor group active in equity markets, but given their grown size and high turnover they play an outsized role. Over the past two years, hedge fund positioning has become a near-perfect contrarian indicator. They would need to chase any rally, or have to explain to their clients why they missed it. Another source of incremental demand

To play this, I am predominantly buying exposure in sectors that I believe to be structural winners of the next decade (Oil & Gas, Oil Services, EU Banks), so I can just leave them in the book in case things turn out differently. I am also putting emphasis on sectors with high short interest. These likely squeeze in any rally. Some overlap with oil & gas here, also Biotech (XBI), ARKK and in particular Housing (XHB), which is the most shorted sector and directly correlated to 30-Year interest rates.

Further, I’ve bought China Tech ADRs (KWEB) which have been dramatically fire-sold earlier this week following the CCP’s plenum, with eight funds liquidating holdings on Monday. To be clear - this is a small, technical trade on liquidity dynamics (no one left to sell). Long-term, Chinese stocks are uninvestable due to the jurisdictional risk

Bonds - Treasury buybacks would create a strong (temporary) bid for long-term US bonds. As such I have exited my shorts here (TLT), which has been a good trade. I am looking at a long position in the 20-year bond which is likely at the center of any buyback activities

Crypto - I am also buying Bitcoin as a pure play on the liquidity dynamics. The coin has gone sideways since the summer and does not seem crowded. I would think many pick it as their vehicle of choice, should Treasury Buyback news transpire. Who knew…!

US Dollar - A line in the sand for US Treasury bonds also represents a line in the sand for the US Dollar. It should weaken, unless contrary political action is taken. Gold looks attractive to me here

Please keep in mind, I continue to believe that markets only, finally trough as the economy troughs, which I expect in mid/late 2023. Corporate earnings likely deteriorate substantially from here, and lead industries are falling off a cliff (see container stats at LA Port below). However, stocks are valued on BOTH EPS AND MULTIPLES. Lower bond yields could boost multiples now, and sliding earnings may only be a Q1 story

Finally, where could I be wrong? Investing is never without risk, and these are alternative scenarios:

Markets front-run Janet Yellen so much that it obliviates the need for intervention, in particular if the mid-terms have passed - This is possible

The administration gets uncomfortable with any intervention in light of sticky inflation, and only implements measures after significantly more stress in USTs - I believe a line in the sand has been drawn last Friday, as shown by the concerted response. This assumption may be wrong, however

Events in Ukraine take a dark turn (dirty bomb etc.). - This is hopefully avoided. However, liquidity dynamics would likely supersede such an event

I hope you enjoyed today’s Next Economy post. If you do, please share it, it would make my day!

Excellent Analysis.

Another Superb note.. So much great insights.. Ty for Sharing. I do want to ask you about the following comment you made

" The increased supply of bills pushes up their yield, likely enough to incentivise funds to leave the $2.2tr RRP. This provides additional liquidity to asset markets"

It is my understanding that the $2.2tr in RRP already receive a rate from the Federal reserve close to the Fed fund rate. Why do you think they would be incentivised to come out of the RRP?

With gratitude

A.