The Paradox

Why the Fed faces some very uncomfortable choices ahead

I had written in my last post and a recent twitter thread that next week’s US Inflation number likely comes in hot, owed to the reset of many contracts, bills and wages at the start of the year. Indeed, consensus estimates and inflation swaps (a decent forecast measure in the recent past) now point to a ~0.5% month-on-month/6.1% annualised headline print

As these uncomfortably high numbers make the rounds in financial markets, investors are once again rattled by the inflation ghost, even if further forward looking measures suggest a cooling off by the Spring

However, the next upturn will eventually arrive. If the structural parameters of inflation are still there, inflation likely resurges again quickly. In this context, wage growth plays a critical role, and it is the Fed’s ambition to bring it down to more moderate levels

However, wage growth likely turns out more sticky than expected, even if an increase in unemployment occurs. This likely presents a formidable challenge for the Fed later this year, when high rates have further decimated the corporate sector and unemployment is on the rise

Today’s post walks through the outlines of this challenge and the decisions that are possibly taken. As always it closes with an outlook on current markets

Why is wage growth so important to inflation?

It drives what is commonly described as the “sticky” parts of inflation, mostly services excluding housing, where wages are the key cost input. Think of getting a hair cut, or having your child taken care of in nursery

They are a benchmark of how much structural inflation is left, when cyclical categories such a food or gasoline have fallen sharply or even turned deflationary. If sticky inflation is high in the depth of a recession, you can be sure that it comes back with a vengeance once the cycle starts again

For this reason, the Fed is bent on slowing the economy to the degree that unemployment increases, which then likely breaks wage growth. That way, the inflation problem would be solved

But looking at historical data, wage growth likely turns out much stickier than expected

Let’s take the Great Financial Crisis as an example. This recession started in December 2007, and unemployment went from ~4.5% at the time to 7% in late 2008

It was only around then, a year later, that wage growth started to buckle. It truly softened only in the second half of ‘09, when unemployment reached almost 10%

The reason has likely to do with some lack of fluidity within the labor market. A laid-off Google engineer in San Francisco is unlikely to want to be a flight attendant in Dallas, etc. Therefore, a marked and prolonged increase in unemployment is possibly necessary

If the Fed was true to its word, it would likely need to hold rates at the currently restrictive level well into next year, until wage growth breaks down. However, there is a huge issue:

Today’s global economy is very levered. Total public and private debt amounts to $300 trillion, most of it in US Dollars, where the Fed sets the interest rate. With an average duration of ~5 years, every months about $5 trillion need to be refinanced - a staggering amount

Within that, corporates are of particular relevance. Just taking US corporate debt as an example, it sits at a generational high, mainly as a consequence of the past easy-money decade

In light of this debt, the tightening that has occurred so far likely already has tremendous consequences for the corporate sector

If historical relationships hold, and there is no reason to believe they wouldn’t, then today’s tightening in bank lending standards is likely followed by a substantial corporate default wave over the coming 9-12 months

However, this contraction of credit is only due to the monetary tightening that occurred last year.

It still excludes the additional interest rate hikes in 2023, as well as the further deterioation in the economic outlook which also affects banks’ lending behavior

Now, all this would be less problematic if the economy re-accelerated from its current lows. Regular readers will know that I do not agree with this view, as laid out in “Hard Landing, Soft Landing or Moon Landing”

Many lead-lag relationships suggest further weakening ahead, such as the increased cost of capital as measured in the 2-Year Treasury rate delta, which points to a continuous decline in order activity from the manufacturing sector

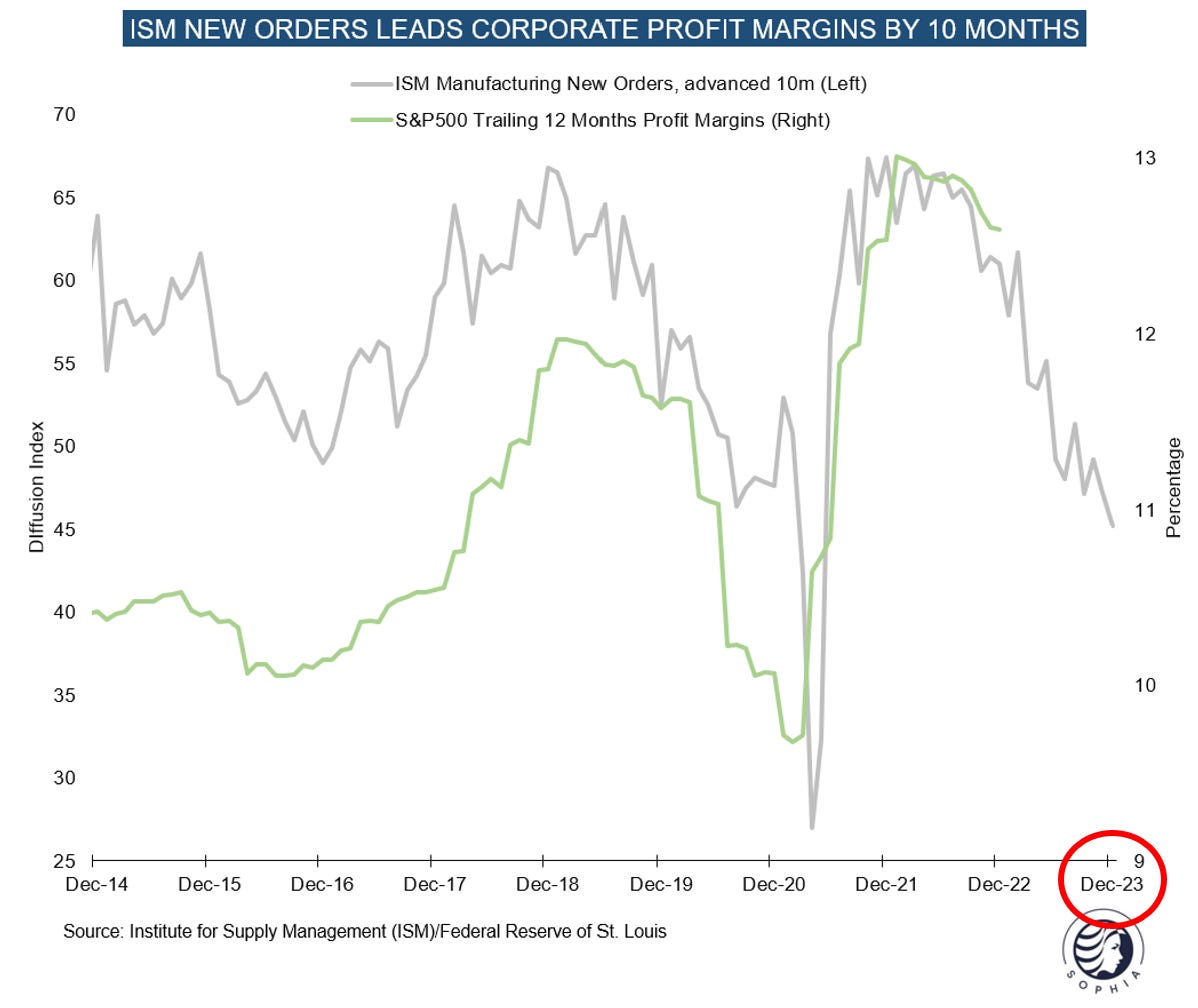

Fewer orders mean lower profits for corporate profits. I expect them to decline well into late this year, and probably early next year

How will companies respond to this assault on their margins from all sides? Highly likely with layoffs

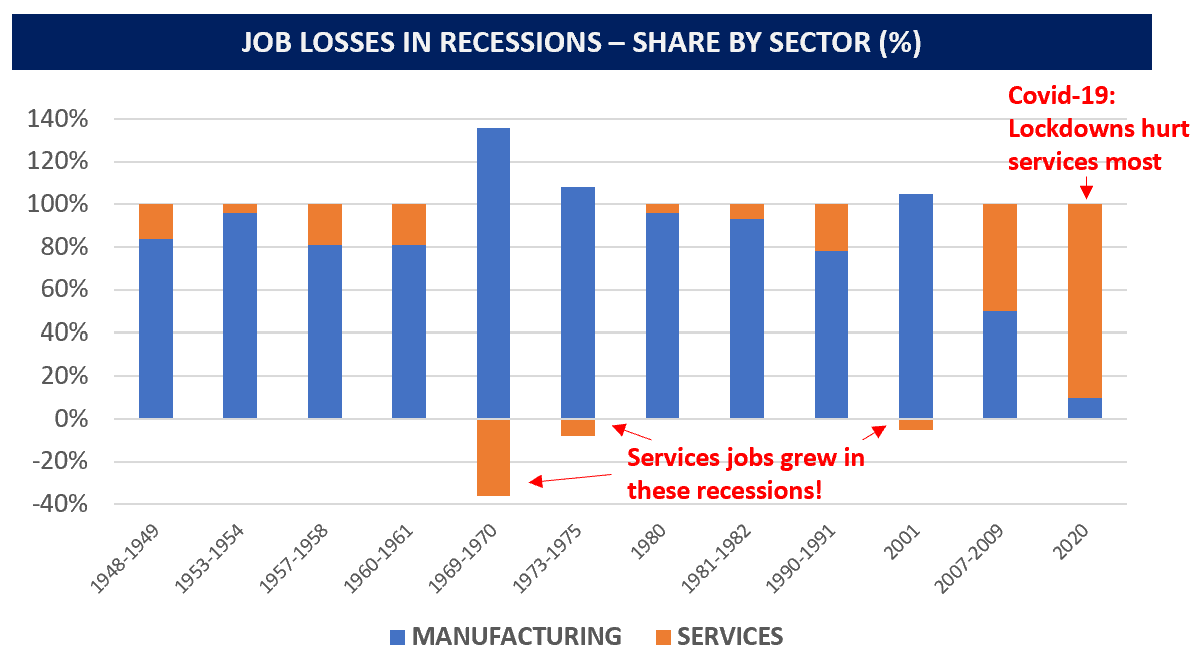

For this reason, I expect unemployment to increase over the coming quarters, mainly driven by cyclical industries, as historically was almost always the case

So while for consumers monetary conditions may still not be tight enough, or at the very least may have to be held tight for longer, corporates are likely to get increasingly crushed by the high rates

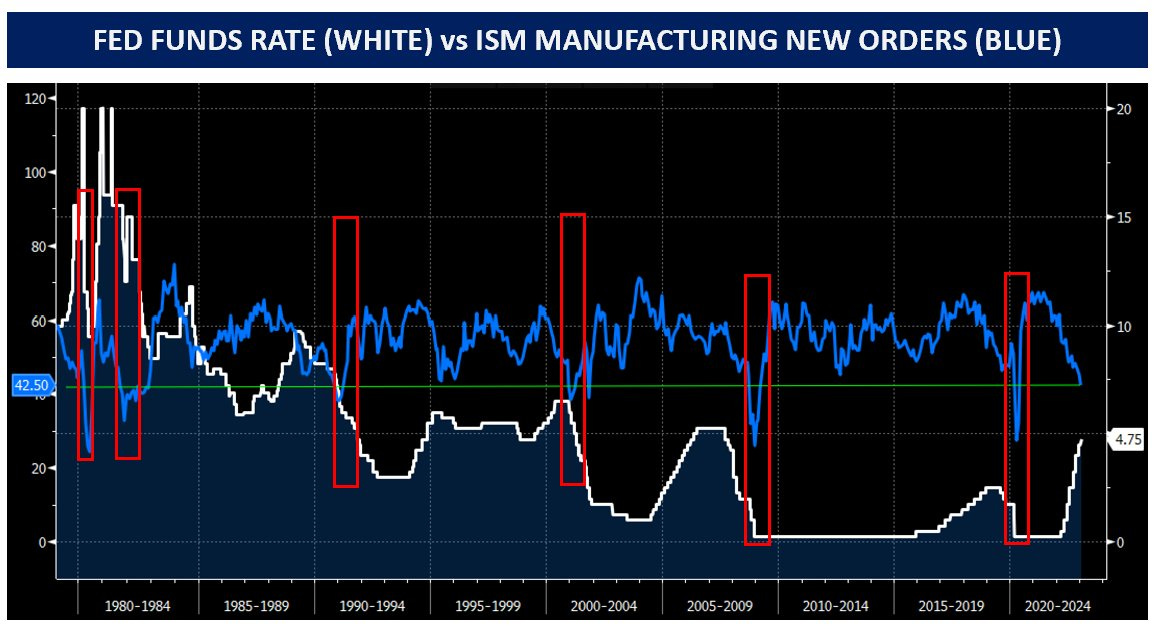

A stark contrast illustrates that well. When the ISM Manufacturing New Orders index was as low as today, historically the Fed had always already cut rates - even under Paul Volcker (!)

This brings me back to two topics spelled out over the course of “Next Economy”

First, the transition of power from Capital to Labor, as the bulk of the monetary adjustment is likely to be carried by corporate profits, and thus by extension their shareholders. This is the flipside of the past decade, where $8 trillion of QE and ultra-low rates assigned an ever-larger share of the economic pie to Capital

Second, and the inability of the Fed to raise rates high enough, or at least maintain them high for long enough without causing mass corporate defaults, and extreme financial strain on governments

Conclusion: The Fed faces an - in my view - unsolvable paradox

To bring wage growth down, it would likely need to hold interest rates high for an extended period of time

However, for the corporate sector interest rates are already way too high. With every additional month, the debt amount to be refinanced at prohibitive cost increases. A likely dramatic increase in defaults likely follows later this year

Equally likely is an increase in unemployment. However, it may take much longer than expected to bring wage growth down

After two decades of rampant inequality, there is little political tolerance for a period of pain and austerity (see “The Most Important Chart for Markets”). For that reason I expect the following sequence of events

The Fed responds to the current tight labor market data and likely again elevated inflation data with more “higher for longer” commitments

Going into Spring and early summer, these extremely aggressive monetary conditions (“hiking in a recession”) lead to a jump in defaults, higher unemployment and possibly a credit event that may shake the financial system

This then likely forces the Fed to relent and pivot, which it will likely have to do so aggressively in the later half of the year. The long lags of economic policy continue to unfold, and the tightening that is done today shows up in coincident data only then

Inflation then returns when the cycle turns up. Due to the high debt load, its structural reasons could not be defeated without causing a financial meltdown

In summary, we are likely in for a very volatile year, where prudence and patience with regards to capital markets likely remains the best advice

What does this mean for markets?

As always, below is my personal attempt at connecting-the-dots for my own investments. Please keep in mind - I may be totally wrong, nothing is more important than risk management, and none of this is investment advice

As laid out last week, I have been running a “60/-40” book with long bonds and short cyclical equities, providing mutual hedging for a variety of scenarios. Following the release of the Bloomberg economist consensus for February I dissolved the long-term bond part (see this recent Tweet for details) and remain short equities for now

My current sense is that US Treasuries, especially the long end, will see a shake out as the market panics about the return of inflation, and the Fed reacts to coincident data with ever more hikes (a clear policy mistake in my view - we do not need more hikes, we need patience to see the old ones work)

This shake out likely provides another great entry point for a long Treasury bond position. I intend to re-enter TLT and long-term Treasuries then, and would look for loud and noisy headlines on the Treasury market for that moment, should it come (please bear in mind I can always be wrong)

For anyone not wanting to trade actively, I can only repeat, mantra-like, my core assumptions:

The bear market is likely only over once the economy turns, which is unlikely before the end of the year

With 4.5%, short-duration treasuries pay a handsome yield, and are a low-stress investment

In other words: Be greedy when others are fearful, and fearful when others are greedy. Narrative follows price, and with the January equity rally, everyone got greedy again

Once again you hit it out of the park!

Florian:

A few comments:

1) "The bear market is likely only over once the economy turns, which is unlikely before the end of the year" . I think the market is forward looking. Usually stock market bottoms before the economy bottoms?

2) You are on the sideline from entering TLT because of temporary inflation fear. But if this is true, shouldn't it hurt your short cyclical trade? Inflation fear = market thinks FED not doing enough = higher forward looking price for commodities = higher stock price for cyclical?

3) Another reason for sidelining TLT is that bloomberg consensus is high for Jan CPI. But shouldn't that mean high CPI is already priced in (consensus publicly known)? If priced in, unless CPI runs even hotter than consensus, how is it bad for TLT?