The Politics of Bitcoin

How political currents will determine Bitcoin's next step

Bitcoin is seen by many as the logical way out of a broken monetary system. It is also making inroads into the political system, recently finding unexpected champions in elected politicians such as the Mayor of New York. However, uncomfortable levels of inflation may force the US to soon deviate from the current path of ultra-accommodative monetary policy. This may, at least temporarily, stall Bitcoin’s ascent

Something peculiar is going on in the US

The economy is booming, the stock market is at an all-time high, corporate profits are at all-time highs and the labor market is in the best condition its ever been - that is, if you’re looking for a new job

Yet, consumer confidence is drastically depressed. It is tracking even worse than during Covid-19

In spite of the booming economy - which has historically always supported the incumbent - President Biden’s approval ratings are also exceptionally low, just as we are heading into the 2022 mid-term election year

What is going on?

The answer is simple: inflation

While many Americans are still bathing in the monetary shower of the past year, the 80% of the population who don’t own a lot of assets and spend most of their income are not having a good time

Yes, they got stimulus cheques. Yes, they see wage increases in a hot labor market. But these increases are outpaced by inflation, which is particularity high in some everyday goods such as gasoline, food, or rent

Real wages (i.e. nominal wages minus Inflation) are lower than before Covid-19

Nothing demonstrates this better than the evolution of rent costs, which represent up to 50% of lower income household expenditure

They’re now tracking at +13% y-o-y inflation and accelerating, driven by rampant demand as well as ultra-low interest rates on mortgages

If half your income goes to rent, and that rent goes up by 13%, that’s really painful

This is an unsustainable powder keg. If things continue the same way, the pain and anger will only increase

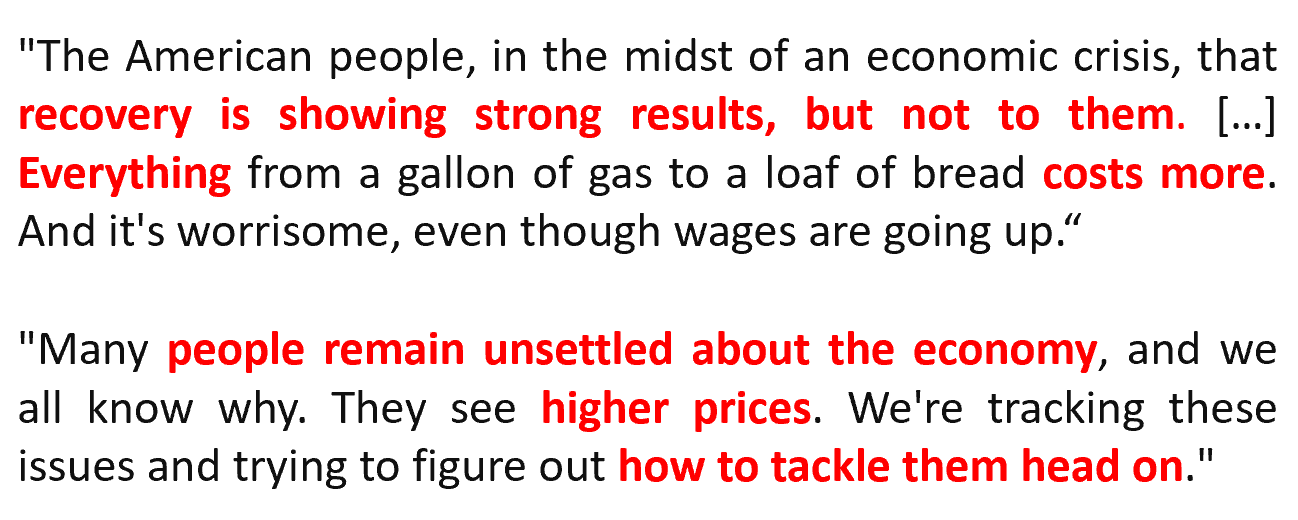

Politics is not oblivious to this. In fact, in a speech on November 5th, President Biden has for the first time acknowledged inflation as a problem and stated his intention to act against it

This is a major pivot from the previous language out of the White House, which labelled inflation as “transitory” problem that would pass

Now, as discussed before, the current inflation is not due to supply held back by Covid-19

It is caused by explosive demand. Retail sales continue to track significantly higher. Ports are congested because they are overwhelmed by the inflow of goods

So what can the government do, if anything at all?

There are some levers: It can support efforts to reduce port congestion. It could remove tariffs on Chinese imports. It could strongarm OPEC into producing more oil

But all of these are just cosmetic changes. The really big lever, the gigantic elephant in the room is this - real rates:

Real rates equal headline interest rates minus inflation. Let’s say we have 2% inflation and 3% interest rates = 1% real rates. At the moment inflation is running at 6%+, and short term rates are at zero, so real rates are at -6%

This means if you park your money in a safe government bond (at zero percent yield), in one year you will have lost 6% of your money in real terms

If you lose money with government bonds or other low-risk savings, you are inclined to spend the money instead, or to put it into riskier, higher-yielding alternatives (e.g. housing). Both are highly inflationary (see rent inflation above)

Real rates are currently deeply negative and as low as never before

At the same time, inflation hasn’t been as high in 50 years

At risk of stating the blatantly obvious - this makes zero sense

Now, the US administration finds itself already against the wall. And they have declared the fight against inflation a priority

What will they do? Expect them to apply substantial pressure on the Central Bank to use this big lever and raise rates to reign in inflation

But how did we get here? What do negative real rates achieve, what does high inflation achieve?

They reduce the burden of debt

There is a huge amount of debt in Western economies, and many perceive a sustained period of negative real rates as the only way to get rid of it

Indeed, this playbook called “financial repression” was used after WWII to remove the burden of the war debt

Many economists think that we’ll go through the same playbook now

The problem is, small households suffer overproportionally in such an inflationary world

And the starting point into this world has been one of great inequality, so the tolerance for further relative suffering is very low

If we continue to follow this playbook, the attraction of Bitcoin will be enormous

As a storage of value, Bitcoin is uncomplicated and accessible to everyone

It is sound and fair money with limited supply and no central meddling

With no other utility to blur its purpose, it has the highest beta to central bank money printing of which negative real rates are a proxy

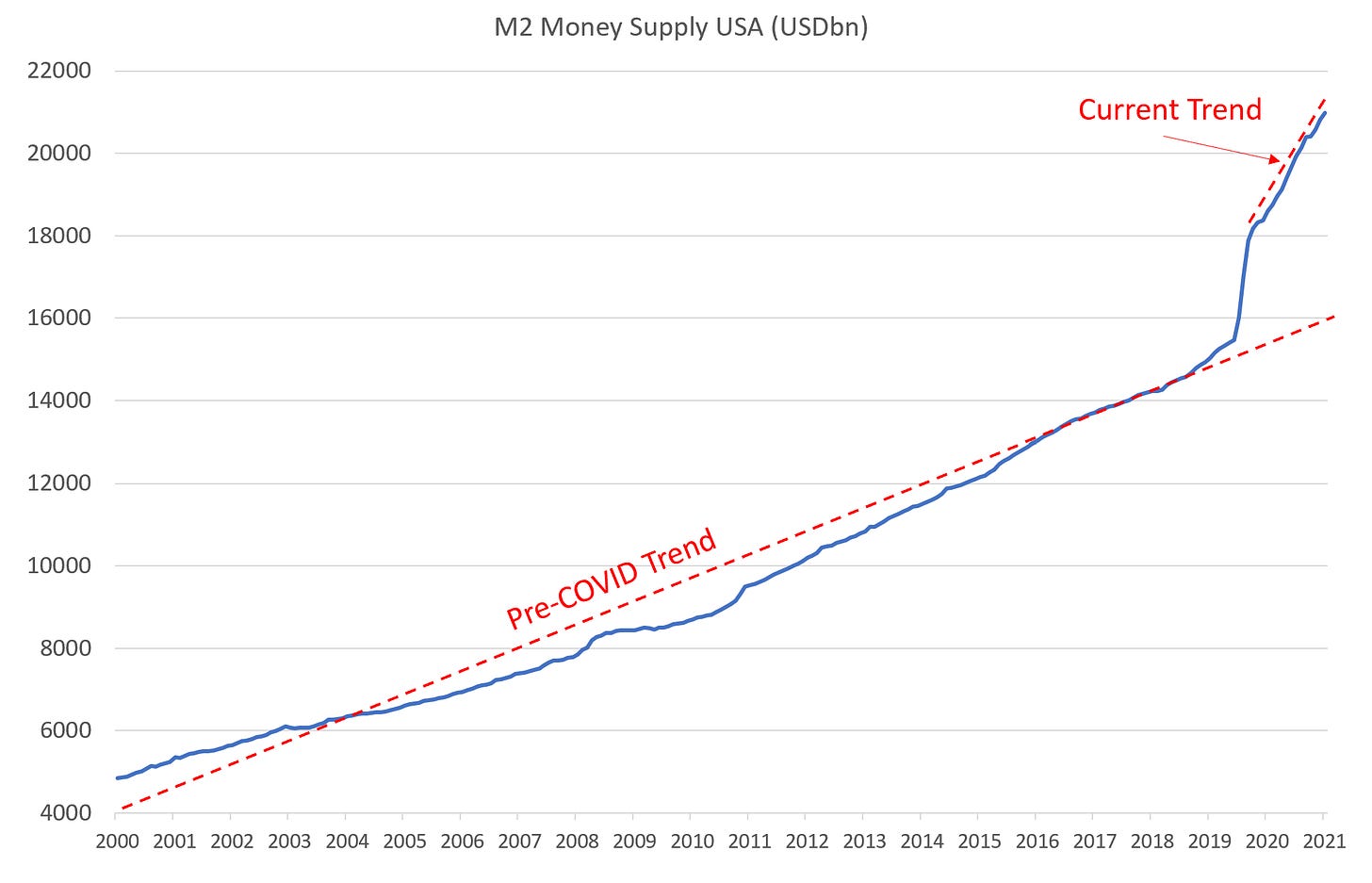

So Bitcoin, just like Gold, thrives in a world of negative real interest rate, where the stock of “Fiat” money (M2, see chart below) continues to increase, while its purchasing power is eroded

With a few more years of negative real interest rates, the 1 million USD per bitcoin its maximalist proponents suggest would not only be possible. It would almost be a mathematical certainty

This brings me to second development worth highlighting. Politicians have woken up to this combination of inflation eroding the standard of living and Bitcoin offering a way out for everyday people

Eric Adams is not alone. In addition, Ted Cruz, the mayor of Miami Francis Suarez, the governor of Colorado Jared Polis have recently made headlines by integrating Bitcoin into their political programmes

Money is power, currency is power. These statements are direct challenges to the government in Washington, and they are popular. Expect many more politicians to jump on the Bitcoin bandwagon if things continue unchecked

There are now 55m bitcoin wallets in the US and growing. Millennials who are most screwed by the system are the biggest fans. For them, participating in bitcoin provides a sense of purpose in a for many otherwise vacuous world (see Bitcoin and Religion from April).

If real rates stay low and inflation continues to roll, I would not be surprised to see a Presidential candidate in 2024 put Bitcoin as US-currency into her/his manifesto

To summarise, Bitcoin is the best defence against “financial repression”. So from here, it is a bet on continued negative real rates. But could society tolerate a prolonged period of negative real rates?

It will be very tough to pull through. We are only six months into the high inflation numbers and political tensions are already enormous

Putting the pieces together

The current administration wants to win the next election

The biggest issue on voters’ mind right now is inflation

The biggest lever to fight inflation is to increase interest rates

Politics follows the path of least resistance. The path of least resistance is to cave to the voices that lament inflation, which have grown into a deafening concert

Several central banks have already embarked on that path and taken markets by surprise, with the most prominent example Australia’s RBA

Their unexpected decision to increase short term rates caused substantial losses at many macro hedge funds and led Bloomberg to publish a piece called “Central Bankers Are Blowing Up Macro Hedge Funds”

The ECB is the most constrained central bank given the high debt load in Southern Europe. Here, the path of least resistance might be devaluing the Euro

In the near-term, an unexpected rates increase is the big downside risk for Bitcoin, as it is for other very frothy parts of the economy

Would an increase in rates lead to a slowdown or even a crash of the economy? Who knows. If it does, will the Central Bank react again with even more printing? Who knows. All of that is possible, and that would determine the long-term trajectory for Bitcoin. I’m just looking at the near-term path of least resistance

In any event, blockchain is so much more than Bitcoin. The innovation in the space continues. As many of you know, I am working on a business idea marrying yields on stablecoin deposits and e-commerce shopping cashback. I believe the pace of innovation is accelerating

Maple and Clearpool are the first steps towards crypto-based, decentralized lending without collateral. In Maple, pool delegates assess the credit quality of the counterparty and put a first-loss tranche of the own funds into the loan to align interests

Exporo in Germany offers fractionalised real-estate investments, with ownership documented on Ethereum instead of paper certificates locked in safes. If real estate ownership moves onto the blockchain, it is only a short step to facilitate mortgages the same way

It took only three days to form a DAO to participate in the Sotheby’s auction of the last privately held copy of the US constitution. The incredible formation speed is aided by the composability of the individual building blocks

Sandbox just raised 90m USD in a Series B to bring crypto and metaverse together, making it easier to monetise in-game experiences

Klima has developed a decentralised mechanism to acquire CO2 certificates. The idea is to fight climate change by buying up and then removing certificates from the market

I continue to be a big fan of stablecoins, which allow for a much faster and cheaper payments architecture (see my last post)

Conclusion: Bitcoin is a bet on continued high inflation and no political willpower to fight it. A negative near-term surprise may be possible. Irrespectively, innovation continues at an accelerating pace