There is a Time to Buy, and a Time to Sell

Equity markets have gotten frothy again

In my last two posts I explored the possibility of a cyclical upturn for the US economy later this year, in light of universal conviction in a recession, and consensus usually being wrong. Sometimes markets move very fast, and subsequently the Russell 2000, which represents US cyclicals, rallied ~10% within a week, to the most overbought ever if measured in standard deviations above its 50 day-moving average

It didn’t stop there. The move coincided with a mass capitulation of sell-side analysts, who scaled up equity price targets and reduced recession probabilities across the board. More so, other positioning and sentiment metrics show how, in short order, everybody has jumped back into the pool

Today’s post walks through these dynamics and explains why the risk-reward for equities is now poor, and historically this has been a good time to sell. It does not mean that the market crashes, just that more volatility is likely from here, and that downside risk has gone up significantly. Further, with a contrarian mind, as consensus has now tossed the recession risk out of the window, I see the odds of a hard landing increase once again

NB: Since this post is all about markets, there won’t be the usual markets section at the end

The past week provided a stunning avalanche in change of sentiment. Let’s walk through some examples:

Bank of America upgrades equities and declares the bear market over

They are followed by Credit Suisse, who state that “the risk of a near-term recession has decreased” and that this “decrease in economic tail risk supports higher stock multiples”

Goldman’s economics team downgrades its recession probability to 25%; its equity strategists increase their S&P 500 price target to 4500 (before 4000)

Why is this notable? With no skin in the game, sell-side strategists and economists are notorious for their pro-cyclical views. They are typically bullish when the price has gone up, and bearish after markets sold off

Just look at Goldman’s S&P 500 forecasts over the past two years - the bank can deem itself lucky that its very profitable traders don’t follow its own recommendations

Capital markets are all about the incremental buyer or seller. For markets to move in one’s favor, it requires a large pool of participants to “convert” to one’s view. But how can we measure where everyone stands? There are various ways, all with their flaws in isolation, but powerful when they align. Let’s walk through them:

Magazine covers are great way of telling where market consensus lies. Journalists are paid for readership and not for correct market calls, they usually capture what everybody’s talking about. Looking at this weekend’s Barron’s cover, its clear what’s the talk of the investing town

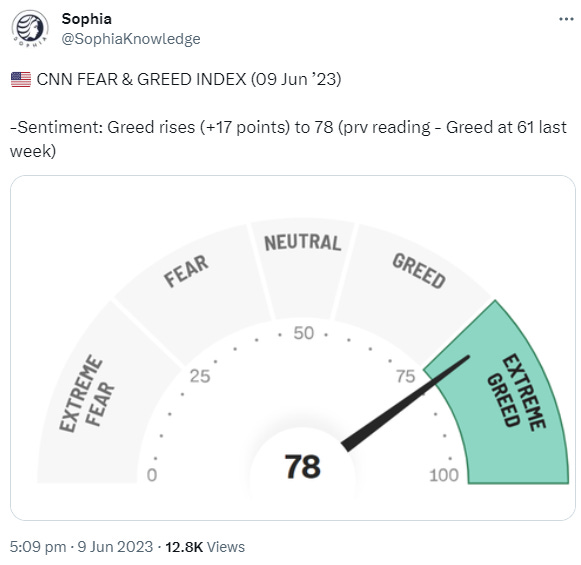

There are also many numerical sentiment measures. One of the best is the CNN Greed & Fear model, which tracks market internals that reflect investor views, such as put/call ratios or junk bond demand. It has reached “extreme greed”

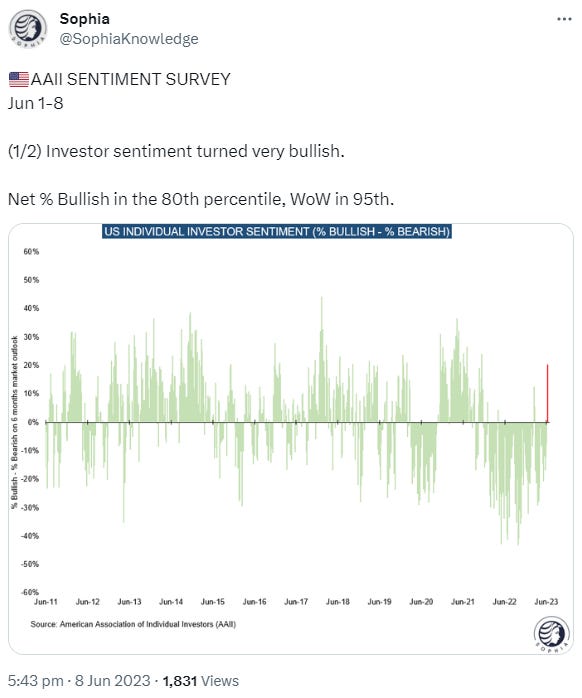

Similarly, the American Association of Individual Investors surveys its members on their market views every week. It just showed a historically large swing from bearish to bullish

Not only what investors say can be measured, also what they do: Active professional investors increased their exposure substantially, as measured by the NAIIM portfolio exposure survey. Keep in mind, this reading can still go higher, and 3-week forward returns following a NAAIM >90 reading are positive

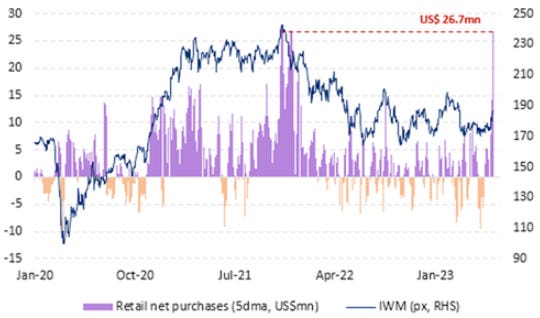

Retail buying is another good contrarian indicator. It was off the charts last week, in particular in cyclical stocks. Retail investors are historically exceptionally poor in their market timing, reliably selling at lows and buying at highs…

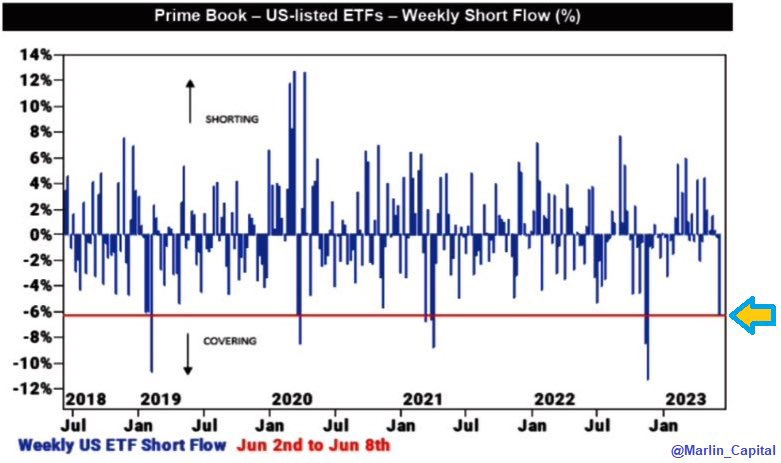

Hedge funds are no exception with pro-cyclical behavior. They covered macro products such as the SPY or QQQ ETF to a historically high degree last week…

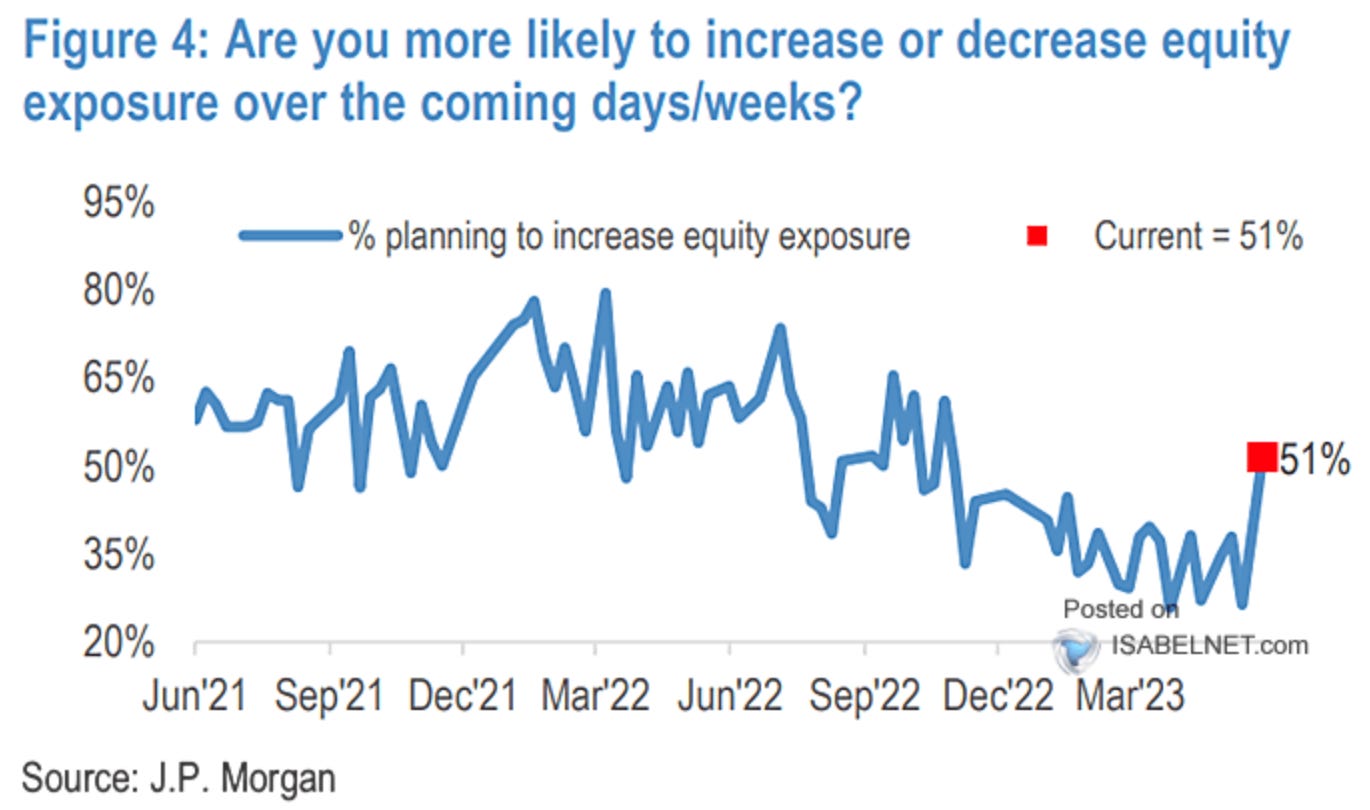

…they have also finally expressed their intention to increase equity exposure further

Summary: In a short amount of time, market positioning has moved from universal conviction in a recession to bullish, everyone is jumping back into the pool. Warren Buffet recommends to “be fearful when others are greedy”. This is likely decent advice again. Historically, the risk-reward in equities at such junctures has been poor, and it has frequently been a good time to sell

Does that mean stocks have to crash next week? Absolutely not. But the incremental buyer is now harder to find, which at very least suggests higher volatility, and a tougher time in achieving further upside

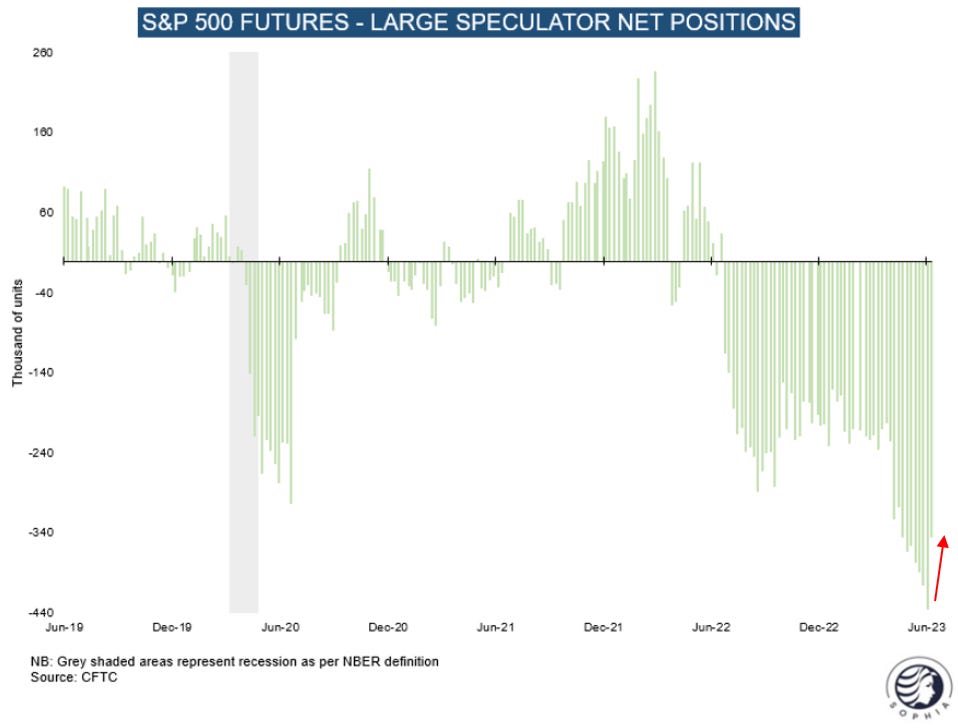

Is this a good moment to short? Not yet, in my view, but possibly soon. The S&P 500 futures short base is still substantial and needs to decline further (NB: the data below is per last Tuesday, so that may have happened by now). More so, whether stocks just wobble or actually decline meaningfully very much depends on what both monetary policy and the economy will do from here

Yesterday’s hawkish FOMC meeting, guiding to two more hikes in ‘23, has made clear the path of least resistance for interest rates continues to be higher, unless or until economic data worsens. This could be tomorrow, in three weeks or in three months, until then, the global “rates tantrum” I mentioned in “A Heretical Thought” likely continues. This is now a headwind again for equities. For the foreseeable future, the Fed will read strong economic data synonymously with higher inflation and turn the screws tighter in response. Further equity upside likely requires economic data weak enough to imply lower inflation, but not so weak to suggest lower earnings. I am not ruling out this possibility of “immaculate disinflation”, even though I’d assign low odds to it

So what will the economy do, can a recession truly be avoided? The key to markets for the second half of ‘23 lies in the evolution of both unemployment and the economic cycle. With recession probabilities now universally taken down, I am moving mine up again, with the coming posts exploring this again in more detail

Also, why do you think the CFTC S&P 500 large speculator net positions be so negative when other indicators are so bullish? Does this indicator really indicate overall sentiment or just some technicality like market making/hedging (after all, every short there's a long on the other side)?

Hi Florian, hope you are well. Been following you for a while. Thanks for sharing such insightful analysis and commentary, really helpful as always!