Two Pivotal Events

Both monetary and fiscal policy is facing big decisions next week

The US economy used to be predominately guided by monetary policy. With the parabolic rise of both government debt and the budget deficit, fiscal policy has become an equally important determinant

Next week, the path for either will be forged. On January 31st, the Fed will be updating the market on its policy intention at its regular January meeting. On the same day, the Treasury releases how it intends to finance the deficit for Q1 ‘24. In particular, it will disclose what share will be covered by short-duration bills representing a liquidity boon for markets, and what share will fall to long-duration coupons, which are a drag on financial conditions

Today’s post assesses each policy vector. As always, it closes with my current outlook on markets

First, let’s look at the Fed:

The Fed has guided to rate cuts for 2024, as it is worried that too high rates will start to cause economic damage as inflation has basically collapsed

They seem to have a point. Truflation, which provides a real-time reading of US domestic inflation, has cratered to new lows

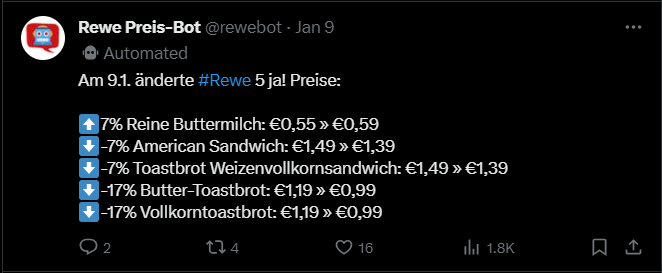

In Europe, one can argue that some geographic pockets and economic segments are in fact experiencing deflation, as below price trend snippet from German supermarket conglomerate Rewe shows

Finally, commodities just cannot rally, indicating weak industrial demand (or possibly a languishing China)

It seems straight forward - inflation is dead, rates are too high, so the Fed cuts soon. But as always, Reflexivity complicates the picture. Since the Fed changed its tone in the Fall of last year, interest rates across the curve have fallen, anticipating its intention

This has very quickly stimulated some rate-sensitive sectors, in particular US residential housing, which seems off to the races (see Single Family Housing start below)

Housing is a key swing sector for the goods economy, more housing starts mean more construction activity in 3-6 months, and more fridges, washing machines and bedroom linen in 6-9 months

Together with the end of destocking in US retail I frequently mentioned, this implies meaningfully higher activity levels from the goods economy going forward

And while Truflation, German supermarket prices as well as the Bloomberg commodity index are mostly spot data describing what is happening today, financial markets are forward looking

And they start to anticipate this activity improvement by moving their long-term inflation expectations upwards:

This puts the Fed into a somewhat awkward position

Current data suggests that it should cut rates quickly, as inflation is running way below current nominal rates (~1.5-2% vs 5.3%)

However, inflation expectations trending north tell us that the market anticipates higher economic activity in the near future, and likely higher inflation if financial conditions are loosened further

Summary: If the Fed cuts rates aggressively early in the year, the market will likely respond by pushing inflation expectations up to an uncomfortable level. At the same time, nothing in the data warrants aggressive cuts yet. Thus, the path of least resistance for the Fed appears to push cuts back until either economic data worsens, or inflation expectations have cooled off again

Second, the Treasury

With a record fiscal deficit outside of war or economic crisis, the Treasury has become a de-facto “second Fed”, or possibly even the primary driver of financial markets liquidity conditions. Recall, in late October, the Treasury surprised everyone by deciding to issue a lot more short-term bills than expected, which unleashed the tremendous rally asset markets experienced since. So what will it decide on January 31st?

If we follow the private market advisory teams’ (“TBAC”) logic as articulated in October, then more coupons should be issued now, as the term premium has reverted to negative territory (see below), suggesting coupons are very cheap from the government’s point of view. Further, at the last QRA equity markets were very strained, now they are bouyant, suggesting the market could handle the issuance

To keep in mind, the government is currently issuing bills at a ratio of ~66% to ~33% coupons. This would be the same as you buying a car on loan, and financing two thirds of it with the debt you need to repay every few months. As this is obviously not a prudent practise, the Treasury per its own guidance aims for ~20% of the total debt stock to consist of short-term bills

However, the ratio is clearly a political decision, and we are in an election year. Why would Janet Yellen do anything that hurts capital markets, and with that the economy? The arguments to hold coupon issuance steady at a low share of issuance, instead of increasing it, would be as follows:

The economy is currently fragile, therefore now is a bad moment to increase coupons

The Fed will cut rates, so why not wait with coupon issuance until rates have come down

Summary: What political decisions have in common is that they often appear random, as ultimately it will be one person deciding on incentives that do not follow commercial logic. For that reason I have no view as to what the outcome will be, if pressed I would assume coupons are held steady vs the previous quarter

What does this mean for markets?

The following section is for professional investors only. It reflects my own views in a strictly personal capacity and is shared with other likeminded investors for the exchange of views and informational purposes only. Please see the disclaimer at the bottom for more details and always note, I may be entirely wrong and/or may change my mind at any time. This is not investment advice, please do your own due diligence

How can we relate these two policy vectors to current markets? I think as follows:

The Fed drives the front end of the yield curve:

Here, the probability of a March cut is at ~50%, which as per today’s data seems reasonable. If the next major economic data point is soft, especially employment, we will get a cut in March. In its absence, the cut will be pushed out. The 2-year seems fair value, after a string of positive data maybe odds are now for some downside surprises

The Treasury drives the long end of the yield curve:

Here, since 1st Jan, yields have backed up from ~3.9% to 4.3% for the 30-year, in anticipation of higher coupon issuance. As discussed, the QRA result is a black box, my guess is that a moderately bearish outcome for bonds may have been discounted for now

Equities have rallied tremendously, as AI and related semiconductors pulled the market up

Typically, in the next stage the rally broadens to lagging sectors, in this case Smalls Caps which are yield sensitive. Should bonds have found some stability here, this group should catch up

Accordingly, I have made the following adjustments to my exposure:

I’ve covered the Russell 2000 hedge for the long tight commodity producers on Friday

I have added some ARK Innovation exposure this morning. This yield sensitive group is down 10% ytd, and in my view a decent catch-up play to the broader index, especially if bonds remain steady. In particular, hedge funds regrossed since the start of the year by adding mainly short exposure. ARK is a proxy for the “most shorted” stocks which often squeeze after such regrossing events

I am keeping the Chinese equities, but have reduced them to a lower level into that Friday late evening squeeze in the US. That hopefully allows me to add should another round of sell-offs be coming. I have also reduced the oil longs to free up some more cash

I have exited the downside bets and Vix calls on Friday around lunch time as I believe breaking the S&P 500 all-time high likely sets of a fair amount of algorithmic buying, trained to capture this historically bullish occurrence. I still see equity weakness in the Spring as probable, but have to admit these downside bets were too early (and early is the same as being wrong…)

In light of the above in pockets deflationary Eurozone trends, I have bought some German 10-year bonds, which have retraced quite a bit since the start of the year

More broadly, I am keeping exposure very light into the 31st January, and my cash balance remains high. Even if the year should unfold as a strong bull year, I would think it likely that there are better entry points ahead

Thank you for reading my work, it makes my day. It is free, so if you find it useful, please share it!

1. Actually, I think January 31st QRA determines how the Treasury finances Q2, not Q1. After all, a third of it would have already passed.

2. I didn't know the Treasury aims to only issue 20% of the total debt stock in short-term bills. That's good to know!

3. I don't think the arguments to delay increased issuance based on the economy sticks: it isn't any more fragile than it were when JY increased issuance in late July.

Thanks Florian. Question about income taxes on your short-term trading, I am sure you have answered this before for others. Do you live in a jurisdiction that is more advantageous to tax on short-term trading, or do you just accept taxes as a cost of business? Thanks in advance!