Very Close Now?

An end to the hostilities in Ukraine may be in reach. What does it mean for markets?

As before, please continue to consider donations. With 2.5 million Ukrainians displaced, thousands dead and homes destroyed, the country needs our support. You can find the link to UNICEF Ukraine here

This past Monday, I had written how a cornered Putin appeared to choose the “rational” route of compromise instead of self-destruction, opening the path to a ceasefire. While any predictions come with a very wide error range, these dynamics evolved further, and a ceasefire could be imminent now

This post provides a brief update on the progress, followed by an outlook on the implications for markets and the economy

While Western media focussed on the fruitless high-level meeting between foreign ministers Kuleba and Lavrov in Turkey, negotiations continued in the background, on the track I had laid out in my last post

With the Russian military stuck, and according to some observers even close to defeat, the war has become a lose-lose situation for Russia with every day it grinds on

The first mention of actual positive developments came from Putin himself who on Friday stated “positive shifts” in now “daily” negotiations with Ukraine, according to a transcript released by the Kremlin of his conversation with Belarussian President Lukashenko

This was confirmed the day after by Ukrainian President Zelensky. In a press conference he mentioned progress in talks, a “fundamentally different approach” by Russia and suggested Israel could host peace talks and give security guarantees

As highlighted last week, Israeli Prime Minister Bennett assumed a key role mediating between the two parties. As such, the best sources to follow negotiation progress were the Israeli local press (e.g. here or here)

Yesterday, a flurry of positive statements emerged. They are from either side, which suggests key advancements have been made. Take Ukrainian negotiator Mykhailo Podolyak as example:

Or from the Russian side, negotiator Leonid Slutsky:

“According to my personal expectations, this progress may grow in the coming days into a joint position of both delegations, into documents for signing”

Keep in mind, this is not a done deal yet and can be derailed by unforeseen incidents

Last night, Russia bombed an army training center 10km near the Polish border, with 35 casualties, one of the worst attacks of the war

With the site having a history of US and NATO operatives training Ukrainian soldiers, it was squarely aimed at the West

However, taking everything into account, it seems possible that a ceasefire will be signed in the next few days. While there will be many political repercussions to be discussed, I just want to leave it at the following two:

The Ukrainian people have been nothing but heroic. They have stood up and fought. Their place will be in the West, no matter what kind of neutrality would be stipulated in a peace agreement

Russia and in particular its leadership are very badly hurt. As I had written in “The End of Putin”, it seems hard to imagine Putin surviving this disaster unscathed

For the economy and markets, the key question is, what happens with the sanctions?

The West needs Russian commodities. Sure, it’s especially Europe’s intent to reduce the dependency. But this requires multi-year projects, while the economic impact is felt now

If hostilities are over soon, I expect Western economic self-interest to guide decision-making. This would mean the reversal of most economic sanctions, while sanctions on individuals (oligarchs, political leaders) stay in place. The latter are very popular and their collateral damage is much more limited

When will Western companies re-open for business in Russia? It’s hard to tell, my best guess is also that it may be earlier than many think

The most problematic legacy of the conflict will be the squeeze in food prices. While the flow of most other commodities can easily be resumed, seeding in the world’s biggest grain market, the Ukraine, has been severely impaired by the war, and the next local crop yield will be bad

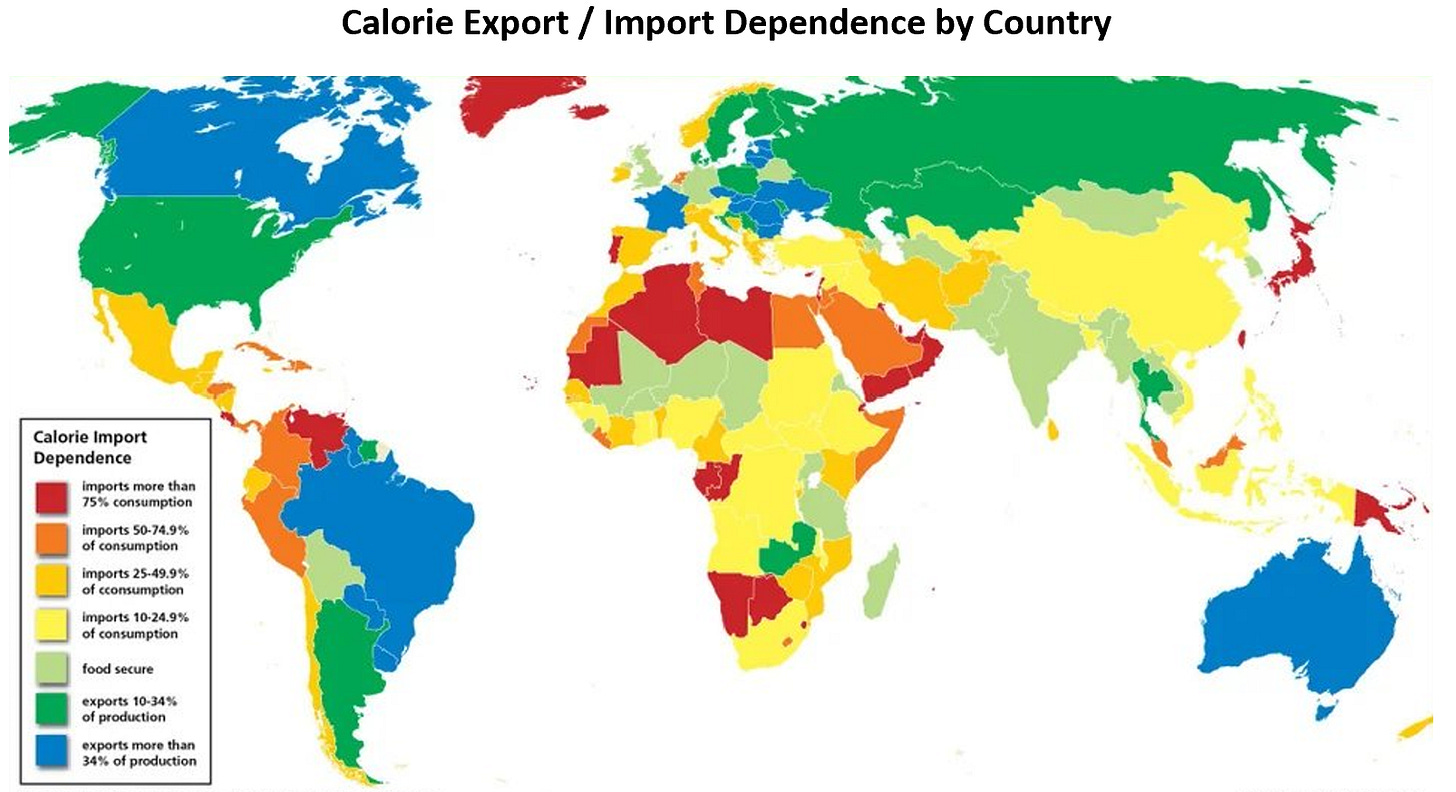

This creates more food price inflation, which is already very high. This will be bothersome in the West, but lead to dramatic consequences in some of the areas in red below, especially Africa and the Middle East

Aside from food, oil has been in focus. I think in the near-term the risks for oil are to the downside

As sanctions are likely dropped, Russian oil returns to the world market, solving the very near-term supply bottleneck

The revived Iran deal has been stalled by Russian demands, expect that to be solved subsequent to a ceasefire, providing some further short-term relief

More so, importantly, China is facing a Covid-resurgence. Cases are the highest since the beginning of the pandemic. Shanghai and Shenzen have gone into lockdown, Foxconn has halted its production lines. Given Omicron’s virality, this will likely extend to more regions and slow down economic activity. There are doubts about the efficacy of China’s home-grown vaccines, so this can develop into a bigger issue

Please keep in mind, medium term, the oil market faces extreme tightness, as discussed in “The ESG Time Bomb”. Additional spare capacity from Opec+ (Saudi, UAE etc.) seems a mirage and US shale drillers are battling with cost inflation and production bottlenecks

Notwithstanding, the US economy remains absolutely on fire, and in my view will continue to do so until the Fed slams the breaks hard

While Europe’s economy is deep in demand-destruction territory, with many industrials having halted production due to elevated natural gas/power prices (e.g steel maker Acerinox this weekend), the US is still far from that

For the US with its abundance of domestic natural gas, the most important metric to watch for potential demand destruction is not the power price for industrials, but the gasoline price for consumers. It is still far from levels that cause most consumers to drive less

All this sums up to a short-term reprieve for equity markets

I highlighted the DAX in my post last week. The day after, it staged its biggest one-day gain since May 2020. Given how oversold Europe has become, it should still have somewhat further to go

In general, market sentiment is extremely bearish right now, in particular for Tech. Historically, this has lead to relief rallies, which could be driven further by a declining oil price

Medium term though, the same story I frequently discussed holds. The underlying causes for US-inflation are still accelerating, which will lead to a re-set of interest rates, likely significantly higher than at current levels

In February, the best measure for wage gains, the Atlanta Fed wage tracker, accelerated to 5.8%, suggesting the dreaded price-wage spiral remains in full force

This will continue to weigh on asset prices, with any rallies likely to eventually reverse and the overarching downtrend to resume