Why I Am Worried About Europe

And what the US has to do with it

Europe and the UK are in a precarious state. They are likely to become the flashpoint of 2023 financial market turbulence, in particular as the role of the United States has changed, leaving Europe on its own to sort out domestic issues in energy and monetary policy. This posts walks through the most pressing dynamics and shines a light on the evolving US stance

As always, the post concludes with an outlook on current markets. As discussed in the two recent posts and several tweets, I remain short risk assets, with a focus on cyclicals and oil equities. I expect the selloff to intensify from here, with some signs pointing to a crash, as markets likely front-run what lies in store next year

To start though, I want to highlight a very positive development. Looking at recent German data, tremendous gas consumption savings have been achieved since the summer

Household gas consumption currently runs ~17% below the long-run average, adjusted for weather effects

Corporates saved even more, they use ~25% less gas than in prior years

What is particularly worth noting is that the industrial savings have not come at the expense of output, with 75% of German manufacturing businesses stating they could save gas without reducing production

Similar savings have been achieved in other countries such as Italy, so in spite of zero Russian gas flows, Europe appears decently prepared for an averagely cold winter, albeit with very high gas & power prices

However, it seems Murphy’s Law, where everything that can go wrong, eventually will go wrong, also applies to Europe. As anyone living in Europe or the UK can attest to, it has gotten unusually cold right now

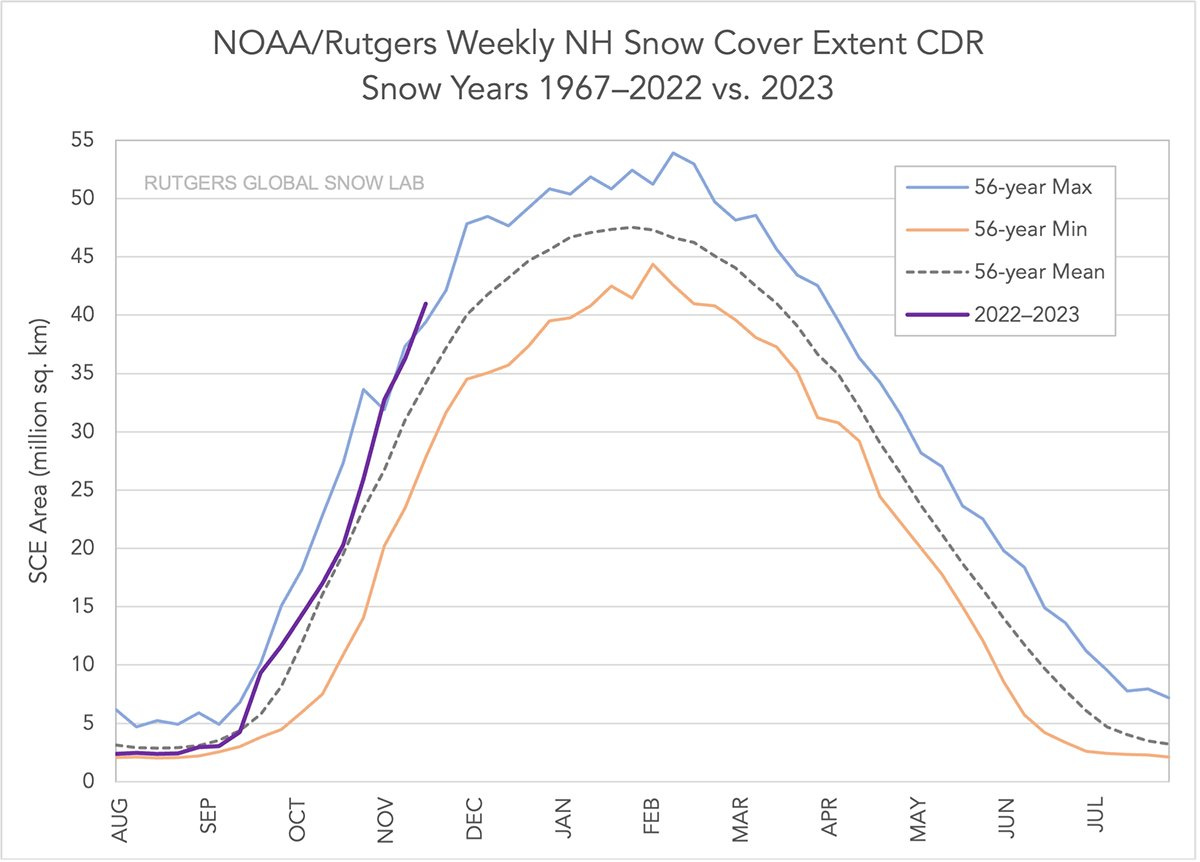

And looking at the current snow cover extent in the Northern Hemisphere, which has a high correlation with the subsequent intensity of the Northern winter, odds are that temperatures remain lower for longer

Colder weather means more heating, and with it more gas and power demand. In a cold winter, with current consumption patterns, gas storage levels will reach concerningly low levels, and gas and power price have once again risen from their already very elevated levels

Continuing with Murphy’s Law, French Nuclear capacity is at a near 30-year low due to unprecedented maintenance outages, and the Continent is currently experiencing a “Dunkelflaute” (German for no winds and no light) where Solar and Wind Renewables don’t generate power

Accordingly, this past week, the German state of Baden Wuerttemberg warned local citizens to temporarily reduce electricity consumption to avoid power shortages. French energy regulator RTE stated that France may face "some days" this winter with power cuts. Expect more, similar news if cold weather persists

With low input from Renewables and most of its Nuclear plants turned off, how does Germany currently get its power?

The answer is coal, which provided ~45% of the energy mix in recent weeks and lead to Germany emitting more CO2 per TWh in the last few weeks than heavily polluting India or South Africa

How did it get to this? The worst of all worlds, not enough power and high carbon emission? The “mess” can be traced back to Angela Merkel’s reign, as this Economist cover vividly illustrates

Two fateful decisions stand out

First - Merkel’s decision to exit Nuclear power in wake of Fukushima and a regional state election that was lost to the Green party over the Nuclear debate in 2011. This decision frankly has to be seen in the context of the time, where a vast majority of the German populace favored an exit. Either way, the mistake was in exiting before a sensible baseload or battery storage alternative was in place

Second - Greenlighting Nord Stream 2, the second North Sea gas pipe from Russia, amidst heavy German industry lobbying, instead of diversifying to other sources instead. This is particularly noteworthy, as Merkel continued to advance the project after the Donbass conflict broke out in 2014 and rogue Russian units had taken down the Malaysian passenger airplane with 298 mostly Dutch civilian casualties. It has been clear for a long time that Russia was a bad actor

Summary: A cold winter is likely, and it will likely strain European energy networks to their breaking point, and in some instances beyond. This vulnerability is the direct consequence of poor strategic decisions over the 2010s

As I’ve discussed in a previous post in August, the consequences go beyond just some winter afternoons without power. A brief recap:

The most direct effect is a much higher energy bill, as European gas and power price likely remain comparatively high for years

The ensuing inflation then faces the risk of becoming entrenched as the ECB is unable to raise interest rates high enough to combat it, while governments continue to issue more debt to fund emergency measures

Higher interest rates still impact consumers, in particular in countries with high private mortgage levels, especially if a large share of them have floating rates (e.g. UK, Sweden)

A few months later, we see European consumer pain in the data:

German consumer confidence has fallen off a cliff. Some observers note how German retail sales remain elevated. However, this is on a nominal basis only. Removing inflation and looking at volume only, the trend is clearly down

UK real retail sales paint a similar picture. I’ve drawn up a chart that compares the historical growth pattern with recent trends. Again, volumes decline sharp and fast

Regular readers may recall my emphasis on the economic cycle, and the role of inventories. With industrial production still high but retail volumes falling off, inventories build while consumers cut back further as energy bills increase in January, which reduces future output and potentially employment. Meanwhile, Central Bank tightening and a housing slowdown will weigh on growth with a ~6-12 months lag. Europe now is right on the precipice of a severe recession

Now, the business cycle comes and goes, however, long-term growth is heavily influenced by corporate investments

For these, energy costs are an important consideration. This obviously varies from business to business, the power bill is less important for insurer Allianz than for Aluminium smelter Alcoa. But the ECB sees an overall ~1.5% drag on potential output from higher energy costs. Some companies like BASF already announced their intention to scale back European investment

However, I do not see a mass de-industrialisation of Europe due to higher power costs. Many other variables play into these decisions, just as available skills, access to local markets, regional growth. But there is no doubt that on the margin this represents a challenge, in particular for energy-intensive industries

Summary: Higher energy costs together with unsound policy measures weigh on European consumers today, and likely on the corporate investments that determine tomorrow

But how could Europe even afford to make so many bad decisions, from energy to fiscal and monetary policy? It was in large part because the US had its back

The Federal Reserve’s huge Quantitative Easing programs provided Europe with the balance sheet capacity to lever up (see last week’s post “Incentives and Inequality” for details) without crushing the Euro

The US consumer buys European cars and handbags, while domestic demand has been sluggish for decades

US healthcare expenses fund breakthrough developments that European patients equally benefit from

US defence expenses, which are much higher than the European equivalent, provide security to the Continent and are the reason Putin hasn’t run over Ukraine. Finland’s PM Sanna Marin aptly summarises:

However, as turbulence also grows in the US, this unequivocal support shows cracks. I want to highlight three dynamics where a change in US stance now hurts Europe

First - The Inflation Reduction Act,

To stimulate its economy, in August ‘22 the Biden administration enacted a huge $370bn subsidy program for climate and energy industries

To keep pace, Europe and the UK would have to run a similar, costly subsidy program, or risk losing future manufacturing capacity to the US. Such a risk is already in the works with Northvolt, VW’s battery arm, indicating it would “rethink” plans for a new Germany plant based on both US subsidies as well as high European energy cost

Unsurprisingly, both EU Commission President Von der Leyen as well French President Macron are lobbying to see this changed

Second - Energy Policy

The Ukraine is financed and armed by the US. This is the right thing to do, as no one else stands in Putin’s way

However, one has to note that American industries are big conflict beneficiaries, both from defence by manufacturing weapons as well as from energy via current and future Liquid Natural Gas sales to Europe

America’s status as Europe’s key energy provider has further been cemented following the destruction of the Nord Stream 1 and 2 pipelines. These brought much of Russia’s gas to Europe via Germany, and on September 26th were destroyed via underwater explosions. The damage is likely permanent as saltwater corrodes the insides of the pipes once they are flooded, and reconstruction would take years. US Gas is needed to fill the gap, and given it arrives liquified by ship, it is much more expensive

The perpetrators of the incident remain unknown. One is tempted though to ask in the tradition of Roman Senator Cicero: “Cui Bono? - Who benefits?”

When we look at how Boris Johnson recently described Germany’s stance at the onset of the war - did the US and UK have doubts about the solidity of Germany’s commitment?

Third - The Strong US Dollar

For most of the 2010s, US and European monetary policy was harmoniously aligned as both regions hovered near the zero interest-bound, and Quantitative Easing was the method of choice to stimulate the economy further

That is different today. Inflation is rampant in both geographies, but the Fed raised interest rates much higher, with an US economy more resilient to rate increases. In response, European capital turns to the US

This is even more important as higher energy prices have dramatically worsened Europe’s current account balance. It needs US Dollars to import oil and gas

To attract capital and improve its current account balance, Europe needs to run a tight monetary policy with higher interest rates. The opposite is the case. ECB interest rates are at 2% while inflation is at 8%. Meanwhile, governments increase their already staggering debt loads to fund crisis subsidies. Of those, as the ECB points out, only a small share go to low wage earners

Conclusion: Europe is on the precipice of a severe recession and faces tremendous structural challenges. Without American support, a showdown is in the cards where Europe either “gets real” and addresses its issues, or faces long-term decline. The most pressing topics include:

European energy policy: This includes a temporary reversal of the German Nuclear power exit, expansion of domestic supplies such as North Sea gas and investment in complementary technologies such as large-scale battery storage

Euro common currency architecture: Without the US Fed’s implicit support, the scope of European monetary policy to address imbalances is likely very limited. In the medium term, either a fiscal union or a smaller Euro is required

Generally: Accepting that the way out of any crisis cannot always be more debt

The successful reduction in gas consumption gives reason for optimism that, when forced, the Old Continent can rise above its challenges

What does this mean for markets?

As always, below is my personal attempt at connecting-the-dots for my own investments. Please keep in mind - I may be totally wrong, nothing is more important than risk management, and none of this is investment advice

As discussed in the previous two posts, my view is the global economy likely faces a hard landing, and that markets likely now frontrun this development

I then expect Central Banks to intervene again in 1H 23, choosing inflation over a deflationary bust, which would be the alternative. Which is why then (not now) is likely the time to go all-in on the long-term winners of structurally higher inflation. Such intervention may be the first time Central Banks Digital Currencies (CBDCs) are used, which can be programmed for specific use (e.g. retail consumption instead of speculation)

The bar for intervention is likely high given pervasive inflation. As such I expect significant downside to risk assets across the board from here, as tight liquidity and a slowing economy come to a boil

In this context, I cannot emphasise the role of Oil enough as barometer of the world economy

As a measure of real economy activity: Measures of physical supply such as time spreads between front month and later delivery suggest plenty of oil around currently. Demand increasingly runs below expectations, likely driven by weakness out of Europe

As a measure of liquidity: Commodities including oil are financial instruments, and their trade involves financing in form of credit letters and guarantees, loans, US Dollar payment flows etc. When banks tighten their lending, commodity clients are amongst the first to be cut back given their higher risk nature. This is why historically a liquidity crunch as currently engineered by the Fed expressed itself in lower commodity prices, and what likely contributes to oil selling off

Oil unifies both real economy and liquidity dynamics that show concerning signs of stress. Further such signs can also be picked up in recent trading of long-term US Treasuries, which traditionally are a safe haven during market risk-off episodes

US Treasuries (TLT) are currently heavily bid out of safe haven concerns, when in fact they should have sold off following the hot wage growth data as part of the NFP release. The safe haven bid becomes clear when when comparing their recent performance to investment grade debt (LQD), which have lagged Treasuries significantly in the last two weeks

US Treasuries bonds are the most sophisticated asset market in the world, they likely already sense what equities are yet to realise

We have also seen two more private investment vehicles gate investor redemptions, a $14bn Starwood Real Estate REIT and a $50bn Blackstone Credit Fund. Such news likely increase investors’ desire to redeem from where they can, adding to market selling pressure

Further, as discussed in the recent post “A Frugal Christmas?”, more signs point to US consumer weakness, such as Johnson Redbook data which surveys 9000 physical retail stores. Sales post Thanksgiving dropped off more than common for this week of the year

If markets move towards concerns of a hard landing, with global debt levels at their peak, any sell off can quickly escalate as the Fed will be hesitant to come to the rescue due to persistent inflation

As such I remain short cyclical sectors into what I expected amplified turbulence ahead, with emphasis on Energy (XLE), Industrials (XLI), Commodities (XME, SXPP, DAX and Casinos (CZR/MGM). I have further added S&P 500 shorts as well as VIX Calls and XLE (Energy) as well as SMH (Semiconductor) Puts with short duration

Should a Risk-Off moment materialise, the only true safe haven is likely the US Dollar as markets scramble for cash to meet collateral obligations. As such, short-dated US Treasuries in my view seem the best way to weather any potential storm

Finally, one should always keep in mind, as with many things in live, markets are cyclical. After Winter, eventually comes Spring

I hope you enjoyed today’s Next Economy post. If you do, please share it, it would make my day!

Thank you for another insightful article, Florian. I subscribe to many investment services, including Kuppy's KEDM, and yours is one of the best. May I ask, do you short, for example, XLE, XLI , XME, etc, by using puts, or by buying an inverse ETF? If you short via puts, how do you choose the expiration date?

The UK tried to "choose inflation" under the Truss government, but the bond vigilantes seem to have forced it into austerity. So when you say CBs will choose inflation over a deflationary bust, which markets do you think actually have the option to do so?