A Heretical Thought

What if there is no US recession?

While a very narrow part of equity markets enthusiastically celebrates AI, the consensus in media and financial markets for this year is an US economy in recession. Indeed, there is no doubt that the US is slowing, and I’ve said myself many times that we are gravitating towards a hard landing

Yet, the economy and financial markets share an unusual characteristic with quantum physics - the Observer Effect (last discussed in this post). Just as the observer influences the outcome of quantum experiments, everyone’s view on the economy shapes what happens next, making predictions unstable and creating results often contrary to consensus expectations - a process summarised by George Soros as “Reflexivity”

Germany last year is a good example. Following Russia’s attack on Ukraine and the corresponding gas crisis, commentators were certain of a recession for 2022. In response, the government provided subsidies, companies became more efficient and a recession did not occur that year (only to come in Q1 ‘23, when everyone had turned optimistic again)

With that in mind, today’s post explores the “unthinkable”, an outline for the possibility that the US avoids a recession this year. Yes the consumer is slowing, and some parts of the economy already trade like it is 2008. But some dynamics are unprecedent, and deserve a second look

As always, the post closes with an outlook on current markets. Should the outcome I explore today come to fruition, implications for asset allocation will be substantial. Further, I describe what I see as the potential for another “global bond tantrum” following last year’s UK Gilts-lead episode

While AI-related stocks party like it’s 1999, the cyclical components of the market, from industrial commodities to the Russell 2000, reflect a dark economic outlook

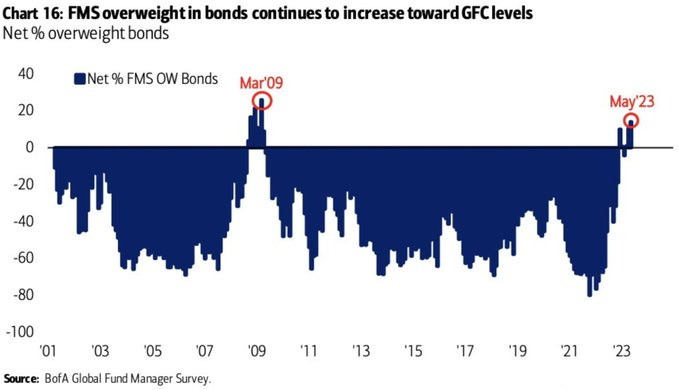

Looking at Bank of America’s most recent Fund Manager Survey, this is comes as no surprise. Current recession expectation are only surpassed by the Financial Crisis or Covid-19

Importantly, the chart also shows investors are typically quite bad with the timing of their recession expectations

In March 2009, the Great Financial Crisis had already been under way for 1.5 years. In fact, the S&P 500 printed its secular low that month. Similar applies for Covid-19’s peak anxiety moment in the Spring of ‘20

With a contrarian mind, I went out to see where consensus could be wrong again with the recession call for 2023. Regular readers will be familiar with my cyclical framework, where manufacturing leads broader economic activity. Within that, a particular role pertains to “New Orders”, which leads industrial production

New Orders as measured by the ISM Purchasing Manager Survey have been in a downtrend for 19 months, a historically long stretch. The key question is - where is the trough? There are some reasons to believe it is near. Let’s walk through them

First, the ratio of New Orders to Inventories has turned up, implying higher future production. Companies cut Inventory in expectation of a slowdown and now New Orders exceed it (cf. recent commentary from Walmart or Target)

Second, when commodity and other input prices decline, corporates face less margin pressure. A reason why Prices Paid leads New Orders with a long lag. Again, historical correlations suggest that a trough may be near

Third, there are now undeniable signs of life in Housing. Residential construction leads the business cycle, and activity has picked up as measured e.g. via the NAHB Homebuilder Confidence Survey which again leads New Orders

Housing in particular is very notable. It’s historically the most interest rate sensitive sector. With an unprecedent rate rise, it was everyone’s expectation (including mine) that the sector would crater. But something else happened:

The US spent the aftermath of the Great Financial Crisis making its economy resilient against interest rate shocks (“Dodd-Frank”). As a result, residential mortgages are now overwhelmingly fixed-rate 30-year maturities, available only to consumers with good credit scores

As interest rates rise, monthly payments aren’t affected (very different to e.g. the UK or Sweden). Due to the high credit scores there are no distressed sales. Higher rates did have a dramatic effect on affordability for new buyers. Accordingly, with no forced sellers providing large price cuts, existing home sales collapsed

But people still need houses, so who fills the gap? Builders, who construct new homes to then sell them at a discount to the existing home market. This solves the affordability issue

As a result, single-family home (“SFH”) activity has been rising all year, defying expectations of a slowdown implied by historical patterns

Sure, real estate is a vast sector that goes beyond SFHs. As discussed before, Multi-Family shows many bubble characteristics and the CRE Office issues are well known. At the same time, non-residential construction remains on fire due to the Inflation Reduction Act (IRA) as well as Infrastructure Act

Summary: There are *some* reasons to believe that manufacturing activity has troughed. Further, housing activity so far defied expectations due to consumers’ resilience to interest rate shocks

But that’s not it. There are some more reasons why this time *could* be different

First, as alluded to in the introduction, the economy is reflexive. If everyone expects a recession, it may not come. Why?

CEOs also read the news. If they expect a recession, they pre-emptively adjust their organisation by cutting cost, reducing inventory, laying off etc. But when demand is better than expected, they need to ramp up again. Recession Talk has been going on for more than a year now, so businesses had plenty of time to prepare

Second, the role of the US government is very different this time around. In essence, we are facing the highly unusual combination of high inflation and high government debt. This creates self-reinforcing dynamics that are not on everyone’s radar

To start, with ~7% debt/gdp, the fiscal deficit is absolutely unprecedent outside war or recession (!). Government spend was 9% higher in Q1 ‘23 vs the year before, providing stimulus to the economy in a way few models grasp

Further, with >100% debt/gdp, the interest paid by the government to the private sector is substantial. Together with interest paid on bank reserves and the RRP, it amounts to c. $1.1tr this year, almost ~5% GDP (!). It would be even higher if all government debt was refinanced to current rates

Now, some of that goes to the Fed, who owns ~25% of outstanding US debt. Much of it goes to large asset owners how won’t spend much. But as banks increase deposit rates and gross cash balances are still high incl. for low end consumers1, this is again a subsidy to the economy on few people’s radar

With this in mind, we see some unexpected results. Take corporate profits as an example

The first quarter earnings season was much better than expected, despite the significant drag from lower investments or household savings. Why? Government spend more than made up for it

Sure, but what about the debt ceiling? Will it put an end to profligate government spending?

On that note, I again need to point out reflexivity at work. The GOP is much less aggressive in their insistence on cuts than in prior episodes (such as 2011). No wonder - who wants to be blamed for cutting spending into a presumed recession?

Summary: The universal expectation of a recession, a record high government deficit as well as substantial interest payments on government debt may support the economy in unexpected ways

So it’s all good, recession off and boom ahead? Not so fast, unfortunately… there are still many dynamics that work towards a hard landing

First, the biggest one - the Fed

The Fed has hammered the economy with interest rate increases, and will “keep at it” until either inflation has come down or a financial calamity erupts

Below chart shows the lead-lag relationship between the change in Cost of Capital and New Orders. It points to a much lower and later trough in activity than other variables. Does it apply this time? The base case is yes. However, there are some arguments for a weakened correlation: corporate nominal incomes are high, and some of the drag is balanced by government deficit spending, such as the IRA and infrastructure stimulus

It’s a bizarre situation: One part of the government (the Fed) cools economic activity, while the other part (deficit spending) stimulates. How will it shake out - I do not have an answer for now

Second, inflation

High government spend comes at the cost of higher inflation. Indeed, some longer inflation leads show a concerning pick-up in prices. The US median asking rent leads current rental prices by ~12 months. It implies higher rents ahead, to a degree that few have on their bingo card

Third, the credit crunch

There is no doubt that lending across the US (and Europe) is grinding to a standstill, in particular for corporates. This crunch is lead by US Regional Banks (see this post), but also simply driven by a lack of demand due to prohibitively high rates. It takes time to feed through the economy and I cannot easily explain it away. I would however point to small business credit availability still tracking at digestible levels, not comparable e.g. to 2008. Of course, it could still decline to that

Conclusion:

The US economy is in a downturn. Some parts are in obvious recession (durable goods excl. autos), some are slowing (consumer), some are holding up (industrial production) and some are even growing again (single-family housing/non-residential construction)

However, the downturn *could* be much less severe than expected, as reflexive recession expectations, excessive government deficits and high interest payments on government debt provide unexpected support

At the same time, there are *some* signs of a trough for New Orders in Manufacturing, suggesting economic activity *could* pick up in the Fall

Should this be the case, the Fed will likely lean against it, as it will likely perceive better-than-expected activity as inflationary. It might respond with even higher rates in an attempt to force a recession

With parts of the US economy resilient to higher interest rates, and higher rates pouring back into the economy via government debt payments, inflation may pick up again - in spite of the Fed’s efforts - after a possibly deflationary trough in the months ahead (cf. rents above)

Finally, dynamics are very different in Europe and the UK, where monetary policy is similarly aggressive, however fiscal spending lags far behind the US

I have not made up my mind to the most likely path ahead. I appreciate the the above is a controversial view, when even the Fed itself expects a recession. So I may be early or simply be wrong with the views expressed today

However, I would not rule out that once again things end up very differently vs. consensus expectations, just as the did in 2009 and 2020

What does it mean for markets?

As always, below is my personal attempt at connecting-the-dots for my own investments. Please keep in mind - I may be totally wrong, nothing is more important than risk management, and none of this is investment advice

Bonds - I exited my 5-yr bond position last week, and in several tweets (here and here) since have warned of what I expect to be another global rates tantrum, similar to October ‘22, when UK pension funds became distressed. Any debt ceiling resolution will be followed by a wall of supply, while investors are overweight bonds (see below) and need cash to chase AI-stocks at the expense of all other assets. I believe another great trade in bonds is lining up whenever this tantrum reaches its peak

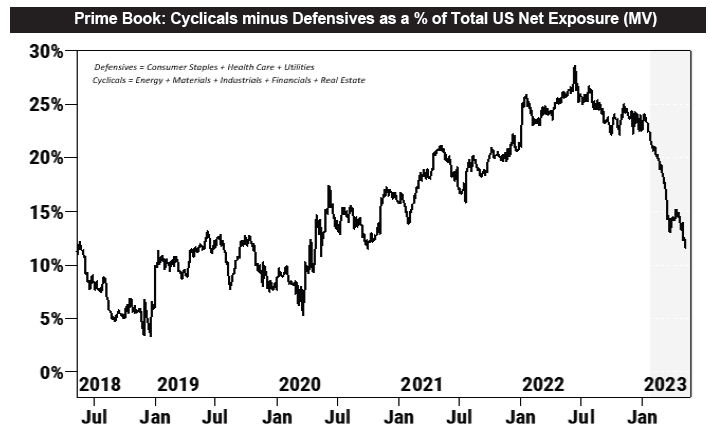

Equities - Investors expect a recession, and are also positioned that way. They are massively long Defensives (Staples, Healthcare, Utilities) and short Cyclicals. Any improvement in the US domestic outlook would cause a painful rotation

This is also reflected in CTA positioning, which is extremely underweight the Russell 2000

We are probably not there yet, but I am looking very closely at a long cyclicals position. You want to buy cyclicals when the ISM Manufacturing PMI troughs. A sell-off owed e.g. to a last minute debt ceiling standoff could provide a good short-term entry point. However, cyclicals may only truly inflect when commodities turn up (see below, maybe late June/July)

Finally, I notice that the market remains very short equities, as per most recent CFTC data. However, this data is from past Tuesday, given the aggressive market moves since it may have changed

Euro - The market is also still very short US Dollars and long Euros as afterglow to this Spring’s dollar debasement narrative. As discussed, European data is rolling over faster than the US, for which reason I remain short Euros. The same applies to Gold, which I remain short as it is over owned and faces near-term headwinds (e.g. debt ceiling resolution, higher real rates, no QE coming soon etc.)

Commodities - Are we near a trough? It does not seem so yet. China has shown no interest in additional stimulus and momentum is still down. However, speculators are now very short many commodities (e.g. copper and oil), I could see a buyable low soon, e.g. if copper reaches its 2022 trough in the coming months

Please keep in mind, should the US recession be off, it does not necessarily mean that stocks go up, as interest rates may once again rise. Instead, a heavy rotation into cyclicals could occur. A bond tantrum also won’t remain without consequences. Some interesting times lie ahead

DISCLAIMER:

The information contained in the material on this website article is for professional investors only and for educational purposes only. It reflects only the views of its author (Florian Kronawitter) in a strictly personal capacity and do not reflect the views of White Square Capital LLP and/or Sophia Group LLP. This website article is only for information purposes, and it is not intended to be, nor should it be construed or used as, investment, tax or legal advice, any recommendation or opinion regarding the appropriateness or suitability of any investment or strategy, or an offer to sell, or a solicitation of an offer to buy, an interest in any security, including an interest in any private fund or account or any other private fund or account advised by White Square Capital LLP, Sophia Group LLP or any of its affiliates. Nothing on this website article should be taken as a recommendation or endorsement of a particular investment, adviser or other service or product or to any material submitted by third parties or linked to from this website. Nor should anything on this website article be taken as an invitation or inducement to engage in investment activities. In addition, we do not offer any advice regarding the nature, potential value or suitability of any particular investment, security or investment strategy and the information provided is not tailored to any individual requirements.

The content of this website article does not constitute investment advice and you should not rely on any material on this website article to make (or refrain from making) any decision or take (or refrain from taking) any action.

The investments and services mentioned on this article website may not be suitable for you. If advice is required you should contact your own Independent Financial Adviser.

The information in this article website is intended to inform and educate readers and the wider community. No representation is made that any of the views and opinions expressed by the author will be achieved, in whole or in part. This information is as of the date indicated, is not complete and is subject to change. Certain information has been provided by and/or is based on third party sources and, although believed to be reliable, has not been independently verified. The author is not responsible for errors or omissions from these sources. No representation is made with respect to the accuracy, completeness or timeliness of information and the author assumes no obligation to update or otherwise revise such information. At the time of writing, the author, or a family member of the author, may hold a significant long or short financial interest in any of securities, issuers and/or sectors discussed. This should not be taken as a recommendation by the author to invest (or refrain from investing) in any securities, issuers and/or sectors, and the author may trade in and out of this position without notice.

On a “net cash” basis including debt most consumers are worse off, see “The Ferrari Economy”

Another way recession expectations stave off recessions: the heavy buying of longer-dated bonds keeps long-term financing rates suppressed, which is stimulative to various types of real estate and other debt-dependent activity.

What are the chances that the US does not have a recession if China and Europe have one? It’s a rhetorical question. 😁

I expect a global recession.