A Warning

The bond market has woken up to the ballooning US deficit

In May ‘22 I wrote a piece called “The Emerging States of America”, pointing out the new era of excessive US government deficits, previously a feature of developing nations. This was followed by “Quantitative Frightening” in October ‘22, which discussed the global bond market tantrum at the time, triggered by the UK pension crisis. Back then, Janet Yellen reacted first with verbal intervention, and then by spending down the Treasury’s General Account from ~$900bn at the time to almost zero by early summer. This put to rest any bond market concerns about the US deficit. New issuance dropped off, while liquidity was provided

However, the US government has - for now - run out of ways to gloss over the deficit. New issuance particularly of the long end will be much higher in the coming quarters and - all else being equal - likely continue to drive up 10-30 year bond yields, which in turn likely weigh on all other asset classes. This post walks through the dynamics and what I see as most probable ultimate outcome

As always, the post closes with my current views on markets, which have been on point recently as the market continues to favor assets sensitive to better US economic growth, shows downside risk in equities as everyone is back in the pool (see “There is a Time to Buy, and a Time to Sell”), bids the US Dollar and increasingly avoids long-term Treasuries

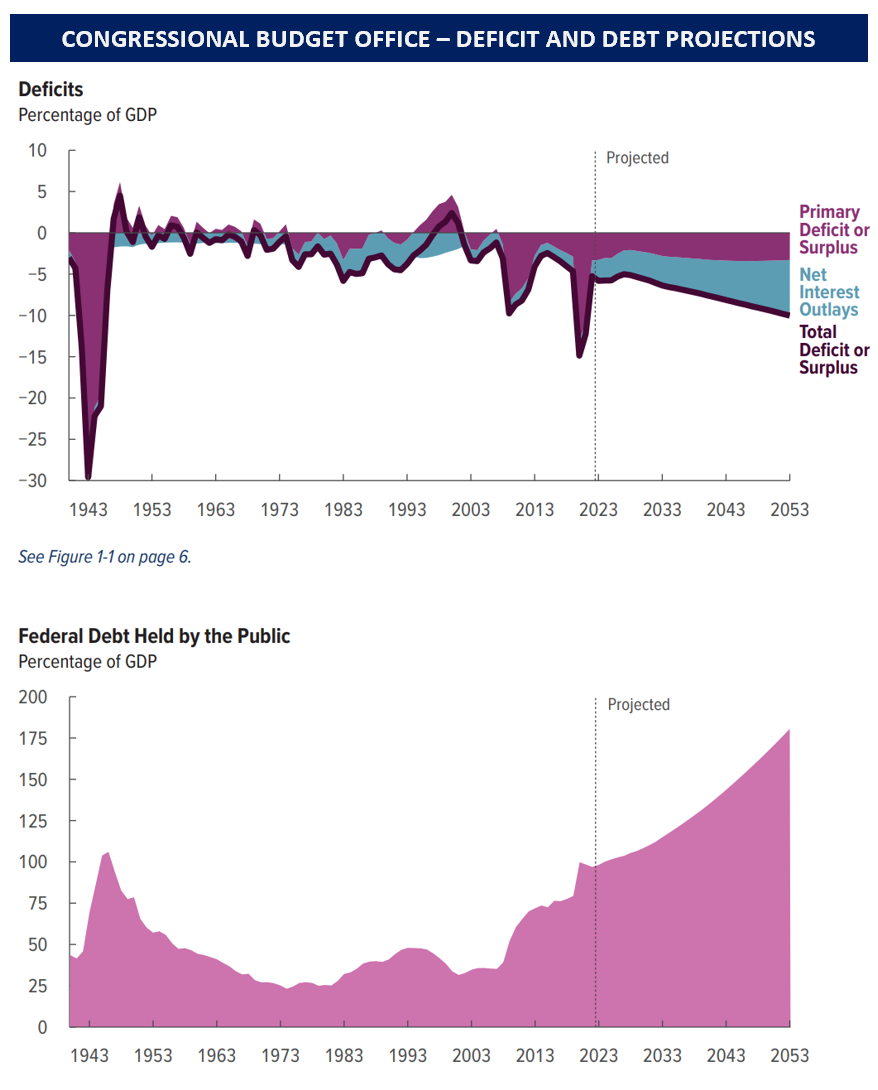

As laid out in various previous posts, the US government is currently running a deficit that is absolutely unprecedented for any time outside war or crisis. It likely clocks ~8% of GDP this year, a stunning number when one considers that unemployment tracks below 4% (!)

Deficit spending likely was the key reason for the US economy to avoid a recession so far despite the Covid-19 monetary antics. More so, for the better part of the last year, this historic novelty in its extreme appeared consequence-free. How so?

First, Janet Yellen’s decision to spend down the Treasury coffers (Treasury General Account/”TGA”) from $900bn in October ‘22 to near zero in May ‘23 simply meant that the market had to absorb very little issuance of new Treasury debt

Second, when the coffers where empty, the Treasury decided to refill the TGA by prioritising money-market friendly T-Bills. So the ~$350bn new issuance over the course of June and July was mainly funded by money-market funds, who used cash parked in the Reverse Repo Facility outside the banking system

Third, for much of ‘23, capital markets assumed that the US economy was either at or already in a recession. So market participants bid US long-term bonds and kept their yield low

Taken together, these three dynamics for almost a year muted the effects of the gargantuan deficit on capital markets. This is now changing, why?

First, the TGA gimmicks have run their course. T-Bill issuance will soon reach the desired threshold of 20% of US government debt outstanding, likely ending the market’s preference of T-Bills over the RRP. At the same time, the recently published Quarterly Refunding Statement contains a significant step-up in the sale of long-end bonds

Second, as US economic data consistently surprised to the upside, the market has gradually lowered its recession probability. The yield curve however is deeply inverted (= short duration yields are higher than long duration), which would make little sense if economic growth picks up

So now, both from an issuance as well as an economic growth perspective, the pressure is on 10-30 year yields to rise. Why is this important?

The long-end of the US bond market is the backbone of global asset markets. When 10-30 year US Treasury yields rise, the valuation of all other assets falls, as they are benchmarked to this “risk-free” alternative

This dynamic is massively aggravated by positioning. Fast money remains long bonds as measured by various positioning data and surveys. Take the JP Morgan client survey on Treasuries as an example…

… alternatively this question, also fielded from JP Morgan, which shows that basically no one intends to be short bond duration, …

… or CFTC data which shows “small speculators” still very long both 10- and 30-year Treasury futures. (I believe large speculator data to be skewed by basis trades and therefore likely meaningless)

It is not only positioning, add to it the fact that the ongoing ~$70-90bn of Quantitative Tightening are now, for the first time since last Fall, not offset by Treasury spending or funds from the RRP anymore

Please see “No Free Lunch” for details on this dynamic. In a nutshell, there is now nothing in the way anymore for QT to bring down the blue-shaded area in the chart below

Now, as bond yields rise, as usual narrative follows price, and the huge US deficit, which has been irrelevant for the past year gradually, then suddenly moves into the center of attention. Expect more headlines soon in this classic case study of Reflexivity, the interplay between markets and the economy, which work together to create an outcome opposite to what everyone thinks

In October ‘22, the stock market is near a crash as QT and higher rates drive up bond yields, bring down asset prices and with it recession probabilities. Everyone worries and sells equities

The US Treasury does not want a crash (no one does), so it starts spending down the $900bn in its coffers to provide markets with liquidity.1 The increased liquidity supports markets, the S&P rallies 30% from lows. By summer ‘23, recession probabilities come down. Everyone relaxes and buys equities again

The liquidity issues that everyone sold for when the S&P 500 was at 3700 were avoided. Now, as everyone is relaxed and long, they’re coming back

Summary: For the best part of the past year, capital markets managed to ignore the gargantuan US deficit as the US Treasury managed its cash coffers in a liquidity-positive way. This has now run its course and higher bond yields are back to creating turbulence and issues for markets

The trillion dollar question is of course, where do we go from here, how will all this be resolved? I see two alternative routes

US long-term bond yields keep going up as that large group betting on lower yields (see above) gets stopped out. This weighs on capital markets and creates turbulence, possibly coinciding with what is already a seasonally weak period for equities (Aug-Oct). At some point the US Treasury gets nervous and intervenes, either verbally, which may already be enough, or with action, e.g. by increasing the share of T-Bills from 20 to 30% to reduce pressure on the long end. Whenever that happens and the bond tantrum is over, all assets rally

OR

US economic data deteriorates from here. Especially unemployment data weakens substantially, jobless claims break out to the upside and other data also rolls over. This removes the economic- growth reason for higher yields, so the entire yield curve resets lower and the bond tantrum is resolved that way. In this case, the stock market likely bids growth over value, whether equities go up or down would depend on the severity of the slowdown. Keep in mind, it takes a lot of earnings decline to outweigh the multiple expansion from lower bond yields

Either way, my money is on Option 1, as I currently cannot see any of the economic weakness necessary for Option 2. In fact, as laid out before, I see signs of a re-acceleration of the US economy. However, I will remain open minded and adjust accordingly, should the data change

Why did I not include an option where the economy grows but the Treasury and/or Fed do not need to intervene?

Looking at the chart below, I find the trajectory of the US deficit and debt unsustainable and the true market-clearing yield likely to be much higher. Bar a productivity wonder (which AI could be), to me the most likely outcome seems that eventually bond yields are supressed, just like after WWII, and the debt is inflated away

Please keep in mind, many permutations of future outcomes are possible, and it is very early to make any educated guess. With that in mind, the world of structurally higher inflation still seems the most logical and probable outcome to me

What does it mean for markets?

The following section is for professional investors only. It reflects my own views in a strictly personal capacity and is shared with other likeminded investors for the exchange of views and informational purposes only. Please see the disclaimer at the bottom for more details and always note, I may be entirely wrong, may change my mind at any time and this is definitely not investment advice

Please see my last post “Summer Views” for a more detailed discussion for my current market stance, which in summary remains the same:

I am long US Banks, US Energy, some US Industrials and China Tech, sectors which are all underowned and key beneficiaries from a higher nominal growth world as well as an early cycle

I am short Europe because it is overowned and weak in comparison to the US. I am also still broad US indices, Unprofitable Tech and large-cap Tech as these areas are most vulnerable to higher bond yields

I am long US Retail vs short US Airlines, as I feel revenge travel may be past its peak, while deeply discounted goods may bring back life into the US high street for the coming holiday season

Within Europe, I am short Autos as that sector seems to now repeat what the broader goods sector has been through, just with a 1-year lag (i.e. overproduction into stuffed inventories)

I am currently running my equities book on a net-short basis. I would look to flip both to net-long, and to long Tech whenever the bond tantrum has run its course

Interestingly enough, I notice that large speculators have covered their S&P shorts into the recent market dip, rather than doubling down on their bearish views. This potentially shows a dynamic where the market keeps on buying the dip into a decline, opening the door for a larger step down whenever the dip-buying fuel is gone

In other asset classes, I continue to be short the Pound vs the US Dollar. I currently have no position in bonds, as I feel the higher bond yield view is expressed on a better risk-reward basis in equity sectors

The US Treasury bond market is the most important market in the world. It is not happy right now, and until it is happy again, turbulence is likely

DISCLAIMER:

The information contained in the material on this website article is for professional investors only and for educational purposes only. It reflects only the views of its author (Florian Kronawitter) in a strictly personal capacity and do not reflect the views of White Square Capital LLP and/or Sophia Group LLP. This website article is only for information purposes, and it is not intended to be, nor should it be construed or used as, investment, tax or legal advice, any recommendation or opinion regarding the appropriateness or suitability of any investment or strategy, or an offer to sell, or a solicitation of an offer to buy, an interest in any security, including an interest in any private fund or account or any other private fund or account advised by White Square Capital LLP, Sophia Group LLP or any of its affiliates. Nothing on this website article should be taken as a recommendation or endorsement of a particular investment, adviser or other service or product or to any material submitted by third parties or linked to from this website. Nor should anything on this website article be taken as an invitation or inducement to engage in investment activities. In addition, we do not offer any advice regarding the nature, potential value or suitability of any particular investment, security or investment strategy and the information provided is not tailored to any individual requirements.

The content of this website article does not constitute investment advice and you should not rely on any material on this website article to make (or refrain from making) any decision or take (or refrain from taking) any action.

The investments and services mentioned on this article website may not be suitable for you. If advice is required you should contact your own Independent Financial Adviser.

The information in this article website is intended to inform and educate readers and the wider community. No representation is made that any of the views and opinions expressed by the author will be achieved, in whole or in part. This information is as of the date indicated, is not complete and is subject to change. Certain information has been provided by and/or is based on third party sources and, although believed to be reliable, has not been independently verified. The author is not responsible for errors or omissions from these sources. No representation is made with respect to the accuracy, completeness or timeliness of information and the author assumes no obligation to update or otherwise revise such information. At the time of writing, the author, or a family member of the author, may hold a significant long or short financial interest in any of securities, issuers and/or sectors discussed. This should not be taken as a recommendation by the author to invest (or refrain from investing) in any securities, issuers and/or sectors, and the author may trade in and out of this position without notice.

The debt ceiling obviously also spent a role in the spend-down. However, had the Treasury and the Fed been serious about QT, they would have neutralised the positive TGA spend down effect with higher QT

Excellent analysis as always 👍

A text, why i am here for