American Cronyism

How bailouts are corroding America's economy

Over the Great Financial Crisis, US public debt increased by c. $3tr, from 64% to 84% of GDP. Over Covid-19, it increased by $5tr and reached 124% of GDP. In both instances, the financial services sector was bailed out, each time avoiding a reckoning for excessive risk-taking and further entrenching moral hazard, stoked by the Fed with c. $7.5tr in QE since 2008. Financial markets went up 3.5x over the same period, yet growth remained sluggish and real wages lagged. The country’s institutions played a critical role in this outcome - an economy that has morphed from capitalism into corporate socialism, where the losses of the few are borne by the many

After Silicon Valley Bank, another crisis shapes out on the horizon. Excessive risk taking has once again created vulnerabilities for an overlevered economy, which will likely be unable to digest the resulting credit losses without government support. As such, the US faces a critical juncture, to decide whether to continue on the path of the past decade, or learn from previous mistakes

This post lays out why the US is facing another bailout wave, how its institutions have evolved to shape these bailouts in favor of assets owners, and why this is to the detriment of everyone, including asset owners themselves, in the long run

As always, the post closes with a current outlook on markets. I remain max long the front end of the US Treasury bond curve, where entry timing has proven on point, and have added to equity puts, as monetary plumbing now shows severe distress, indicating significant risk of further accidents ahead

As predicted in many recent “Next Economy” posts (e.g., here, here or here), there are now many signs that the US economy is slowing sharply

Over the past weeks, retail spend data, purchasing manager surveys and various employment data (e.g. claims, challenger layoffs, ADP) all missed estimates

The comparison of inventories to new orders from the ISM Manufacturing Survey remains instructive. This ratio determines industrial production in the coming months, and now tracks as low as previous severe recessions (e.g. 2008, 2020)

More so, with a likely rise in unemployment as well as tighter lending conditions, it is bound to fall further, likely hitting the historical lows of the last inflationary boom-bust cycle in 1974

However, there is a disturbing difference to 1974: back then, debt levels were negligible, today they stand at 370% public and private debt to GDP

The combination of a stalling economy and high debt levels historically always lead to mass defaults and other credit events. For the US today, with Silicon Valley Bank as prelude, the next source of trouble is taking shape - US office real estate. It only requires some very basic math to see why:

There is c. $1.5tr of office commercial real estate (CRE) debt outstanding, with a typical loan-to-value of 50-60% and an average duration of ~5 years. The late 2010s saw a building boom driven by low interest rates. However, office occupancy has dropped to 40-50% post Covid-19 as people prefer to work from home

I could write much more on it, but that is all you need to know. What is a building worth that is only 40% occupied, within a highly cyclical part of real estate that has been overbuilt, going into an economic downturn? - the answer is “not much”

Headlines about distressed office real estate situations now appear on a weekly basis, with many more to come

There will likely be hundreds of billions of mortgage losses in office CRE. Now, these are daunting numbers, but could be digested if the fallout was limited to this area only

However, contagion will very likely occur, both because the office real estate lenders are often also lenders to other parts of real estate, and because some of these other parts appear equally vulnerable

An area primed for contagion is multifamily residential real estate (i.e. apartments). This real estate class shows typical bubble characteristics, with huge building activity over the past years, again driven by low interest rates1

$300bn of multifamily debt expires this year and next, and as lenders (many of them regional banks) now tighten their belts in fear of office CRE losses, they also increase lending standards for multifamily, as this comment by the CEO of multi-family trust Lument illustrates2

The likely developments in office CRE and multifamily represent the classic asset bubble-bust cycle which historically so often has involved real estate. George Soros summarised this well in his treaties on Reflexivity:

However, contagion won’t be limited to real estate. In an overlevered economy, one doesn’t need to look far for further dominos. As I laid out before in “Incentives and Inequality”, levered loans are another likely area of distress

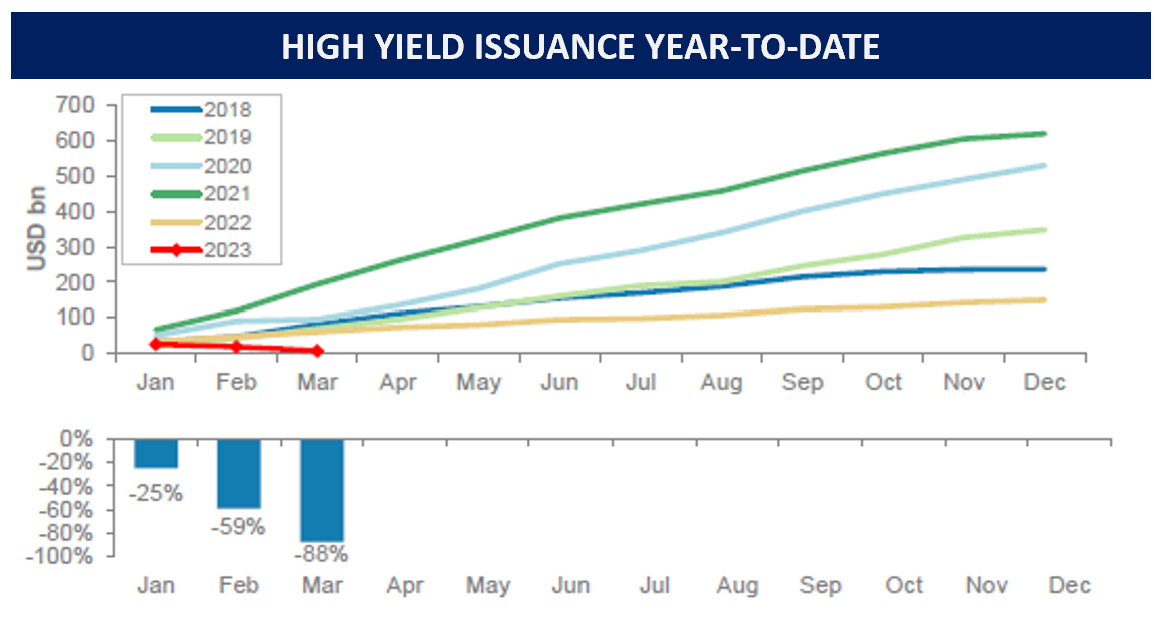

Levered loans are c. $1.5tr in size, again with ~5 year average maturity, so c. $600bn will need to be refinanced this and next year. Using the public High Yield market as proxy for current refinancing appetite, this credit segment appears firmly closed

Summary: Over the next 1-2 years, the US economy likely faces hundreds of billions of credit losses, with office CRE, multifamily and levered loans as likely leading sources

As these losses likely overwhelm the US economy’s capacity to absorb them, tremendous bailouts are again likely necessary, from support for individual financial institutions to eventual wholesale liquidity provision via QE or similar measures

Some have quickly noticed and are positioning themselves. In the below tweet New York real estate developer Scott Rechler demands a government backstop for commercial CRE debt, akin to similar programs during the GFC or Covid

On its own, this is not hugely noteworthy and just a reflection of how a democracy works. People demand what’s in their self interest, and a prudent legislature creates a balanced response that maximises the outcome across everyone’s demands. However, in this case it is is not as simple:

First, as an operator in a highly-levered asset-based industry, Rechler benefited enormously from the ultra-easy interest rate regime of the past decade that revalued asset prices upward without corresponding economic growth. It appears that he does not now offer to use these excess earnings to patch the hole

Second, Rechler’s voice is not equal among many, it carries much more weight. He sits on the board of the New York Fed, the respective regional branch of the Federal Reserve. In other words, he directly advises the institution that decides on the next wave of bailouts

Is this a case of the fox being asked to guard the geese? Let’s have a closer look at the New York Fed’s Board of Directors, which per its own disclosure aspires to “represent the public” and a “diversity of viewpoints”

What we see is a very uneven “representation of the public”, or even the business public. Three CEOs of regional banks (yes the sector that begged for deregulation a few years ago and is currently blowing up for exactly that reason) and three CEOs of large corporations who massively benefited from QE

These are balanced by two CEOs of non-profits and a union representative, neither experts on QE or bailouts nor as Class C directors really in the driving seat

Whenever the Fed decides to print money to finance bailouts (as it did just in March by providing c. $400bn in emergency lending to regional banks), it will find an echo chamber amongst its own advisory boards, staffed with representatives who massively benefit from these bailouts

On that note - it is most natural for people to talk their book, consciously or subconsciously. I would not blame anyone for doing so and very likely do the same. This is about the way the institutions are shaped

The influence sphere around the NY Fed is a good example of what I perceive lies at the heart of the crisis in American capitalism - an institutional structure where asset owners yield too much influence and shape policies in their favor, to the long-term detriment of the economy, and eventually to the detriment of the asset owners themselves

A pivotal step in this development occurred in 2010, when the US Supreme court narrowly rejected corporate spending limits on political candidate elections (Citizens United v. FEC)

After that, political donations went parabolic, with the 2020 senate race raising 4x what was raised in 2008. It appears obvious to all but the naïve that donors want something in return

With that in mind, a few weeks ago, San Francisco congressman Ro Khanna had Tech investor David Sacks host a fundraiser for him. David Sacks is an ardent Libertarian and Ro Khanna was previously the chair of Bernie Sanders’ presidential campaign - an odd couple, until one ponders how Ro Khanna championed the Silicon Valley Bank bailout in Washington, with Sacks as significant beneficiary

Keep in mind, it cost the US Treasury (i.e. the taxpayer) $29bn to ensure the FDIC could cover SVB-related costs. Meanwhile, the top SVB 10 depositors who were made whole are large tech and crypto companies sitting on QE windfall gains who share a total of $13bn deposits all irresponsibly placed in one bank with plenty of red flags3

Ro Khanna is not the only one looking odd in the SVB bailout, the twists of which Sid Prabhu has documented impeccably in this thread. California governor Gavin Newson also did not make the most impartial impression

But all this is truly topped by Supreme court judge Clarence Thomas, who accepted the equivalent of millions (!) worth of luxury travel from Texas billionaire Harlan Crow, who also bought a house off him

As supreme court judge who decided on such important decisions as the above referenced Citizens United case which increased the possibility of influence for donors like Harlan Crow, Clarence Thomas should be impartial above all doubt. Indeed, in Europe, benefits a small fraction of the size would be considered grounds for dismissal. German President Christian Wulff in 2012 had to resign because he accepted a meagre €400 hotel stay paid for him by a business person

Businesses and wealthy individuals exert influence because they want rules changed in their favor. That is natural, everyone does, it does not make a wealthy donor a bad person

What is problematic that no checks and balances exist to limit the influence. As a result, those with the highest donations are heard the most, and over many decades US institutions and with them the economy have gradually transformed towards favouritism for large asset owners, from QE to Super-PACs or large bank depositors

The issue is, as economies resemble natural organisms that in the long run balance around a mean, these policies are eventually detrimental even to the 0.01%, as could be seen in 2022 when asset prices deflated amidst high inflation, and will be seen in the coming decade where the probability of stagflation ranges high

This brings us to the question, who pays for it?

The answer is - everyone, including the top 0.01%. This occurs via two main dynamics

First - Productivity decline. An endemic bailout culture interrupts Schumpeter’s process of creative destruction, where dynamic new businesses take the place of ossified old ones. The consequence is a dysfunctional economy that suffers from a decline in productivity. This long term chart shows how US productivity ranged around c. 1% p.a. for most of the past 150 years, with a significant step down during the inflationary 1970s and since the Great Financial Crisis

Second - Political division. People are highly sensitive to perceived societal fairness. If a neighbor makes a buck through PPP fraud, or the badly managed bank gets bailed out after lobbying from partial politicians, public anger is stoked. The political climate declines and radical voices on either side attract a bigger audience

Conclusion:

America is still an incredible engine of progress, with jaw-dropping innovation from AI to Biotechnology. But in self-reinforcing ways its institutions have changed into an asset-owner echo chamber that lead to an unproductive economy and political division

The Great Financial Crisis and Covid-19 have left a deep mark on the nation’s psyche. As the next wave of bailouts awaits, decision makers in both business and government need to ask themselves whether they want to perpetuate the existing dynamics or bring the country onto a different, healthier path

What does that mean for markets?

As always, below is my personal attempt at connecting-the-dots for my own investments. Please keep in mind - I may be totally wrong, nothing is more important than risk management, and none of this is investment advice

As predicted in The Wile E. Coyote Moment is Coming and referenced above, I see data now confirming a significant slowdown for the US economy

This pairs with tighter lending standards which is troubling for a highly levered economy in constant need of refinancing

This combination also means that the risk of additional accidents is very high

Putting both together, this means rather than further hikes, the US economy will likely soon be in urgent need of new liquidity, as traditional liquidity providers are unwilling or impaired while credit rolls over

As uncomfortably high inflation readings are likely into early summer, this prevents the Fed from supporting the economy, something it has previously always done at this stage of the cycle

I see rate cuts then take place over the summer, once unemployment has likely increased (in my view, May or June will likely mark the first negative NFP print) and inflation has likely declined to a 3% year-on-year measure, providing some space for rates to come down and still be above the inflation rate

In 2H I see a high likelihood for deflationary CPI prints, which then opens the path to significant cuts, possibly towards the zero-line. However, the economy likely needs new liquidity, which rates cuts won’t be able to provide. For that reason all roads lead to an eventual return of QE, or similar measures. But much likely has to happen before that

As discussed in several previous posts, I expect an inflation resurgence after QE returns, but this is still far down the line (2H ‘24?)

This brings me to the following portfolio allocation:

I remain max long US Treasury bonds, where I have shifted any long end exposure to the front end of the curve

The risk I see for the long end is that the Fed cuts rates while inflation still lingers, e.g. in sticky core services. The market would perceive the cuts as inflationary down the line, and sell 20-30 year bonds, which are outside the Fed’s policy control. See “Emerging States of America” from past June for more on this topic

Should the long end not go down while rates are cut, then the stimulative transmission of cuts to the real economy is hampered. This would be an enormous challenge for both the economy (e.g. housing is financed by 30-year mortgages) and markets, especially duration assets. This is likely, eventually, solved by yield curve control (ie. the Fed buys long end bonds to bring those yields down)

With this context in mind, I have added equity puts over the past few weeks (see last post), using markets squeezes such as late March or the CPI release for entry points

From next week, liquidity will reverse from tail- to headwind as the Treasury General Account refills, after a near $800bn spend-down over the past 6 months. Meanwhile, QT continues and the RRP has attracted fresh funds as the 1-month T-Bills market goes haywire (see below), in my view a dangerously poorly understood dynamic

Further, it is very notable that the spread between 1-month and 3-month Treasury Bills has blown out to a historic extreme. Financial institutions use 1-month T-Bills as highest-quality collateral for lending transactions between another (eg interest rate swaps). 1-month T-Bills are currently yielding 3.9%, vs a 4.8% Fed Funds rate (and also 4.8% in the RRP which offers better daily liquidity), a huge spread, wider then during the heights of the subprime crisis. This means that the demand for highest-quality collateral has gone up significantly, and conversely both counterparty trust and willingness to accept lower quality collateral is way down, with negative consequences for lending and liquidity. There are $1.6tr 1-month T-Bills expiring next month, so it takes huge demand to move the market this way. Foreign demand appears very high (Japan?), but also US domestic dealer banks. A big red flag that shows things are far from well in the banking sector4

On that note, I can see the case for gold and bitcoin in the long run, as again all roads lead to a return of QE. However, I believe the path to it is likely a lot more arduous than many market participants expect, especially while inflation readings are still high. I may be wrong with this view, but that’s why I patiently wait for another time to engage in the “QE trades”

A final word - It is not all doom and gloom. AI is a true revolution for the knowledge economy, which my team and I at Sophia now experience every day with the application of GPT-4 and other tools. In the end, the world always wins, even if the immediate path is challenging

DISCLAIMER:

The information contained in the material on this website article is for professional investors only and for educational purposes only. It reflects only the views of its author (Florian Kronawitter) in a strictly personal capacity and do not reflect the views of White Square Capital LLP and/or Sophia Group LLP. This website article is only for information purposes, and it is not intended to be, nor should it be construed or used as, investment, tax or legal advice, any recommendation or opinion regarding the appropriateness or suitability of any investment or strategy, or an offer to sell, or a solicitation of an offer to buy, an interest in any security, including an interest in any private fund or account or any other private fund or account advised by White Square Capital LLP, Sophia Group LLP or any of its affiliates. Nothing on this website article should be taken as a recommendation or endorsement of a particular investment, adviser or other service or product or to any material submitted by third parties or linked to from this website. Nor should anything on this website article be taken as an invitation or inducement to engage in investment activities. In addition, we do not offer any advice regarding the nature, potential value or suitability of any particular investment, security or investment strategy and the information provided is not tailored to any individual requirements.

The content of this website article does not constitute investment advice and you should not rely on any material on this website article to make (or refrain from making) any decision or take (or refrain from taking) any action.

The investments and services mentioned on this article website may not be suitable for you. If advice is required you should contact your own Independent Financial Adviser.

The information in this article website is intended to inform and educate readers and the wider community. No representation is made that any of the views and opinions expressed by the author will be achieved, in whole or in part. This information is as of the date indicated, is not complete and is subject to change. Certain information has been provided by and/or is based on third party sources and, although believed to be reliable, has not been independently verified. The author is not responsible for errors or omissions from these sources. No representation is made with respect to the accuracy, completeness or timeliness of information and the author assumes no obligation to update or otherwise revise such information. At the time of writing, the author, or a family member of the author, may hold a significant long or short financial interest in any of securities, issuers and/or sectors discussed. This should not be taken as a recommendation by the author to invest (or refrain from investing) in any securities, issuers and/or sectors, and the author may trade in and out of this position without notice.

As mentioned in previous posts, there is no housing shortage in the US. Today there are more homes per capita as during the subprime mortgage bubble

NB: >50% of all multifamily debt is non GSE-backed

This is in my view different to the many small/medium sized startups who banked w SVB and where a lower level of bank sophistication can be expected

CFTC S&P 500 speculative net positions Is extremely one sided (bearish) already . Florian, do you think this could be a risk to short equity position?

I don’t know how I found you on Twitter, which led me to your Substack, but I drop everything I’m doing to read every new post. 🙏