Capital vs Labour

How recent events underscore a shift in balance

Following last week’s post on the European Energy crisis, I would like to highlight some political responses to it that demonstrate a significant change in tone. It underscores my belief that politics will do little to stand in the way of inflationary pressures (see my post “A Flashing Warning”). After forty years of dynamics favouring capital in its relation with labour, the balance is shifting

To recall, capital and labour are usually in a healthy state of tension. Both are needed as contributors to economic growth, yet when one side becomes too powerful, in the end both suffer

Over the past forty years, capital had been massively revalued upwards by the collapse of interest rates into negative territory1

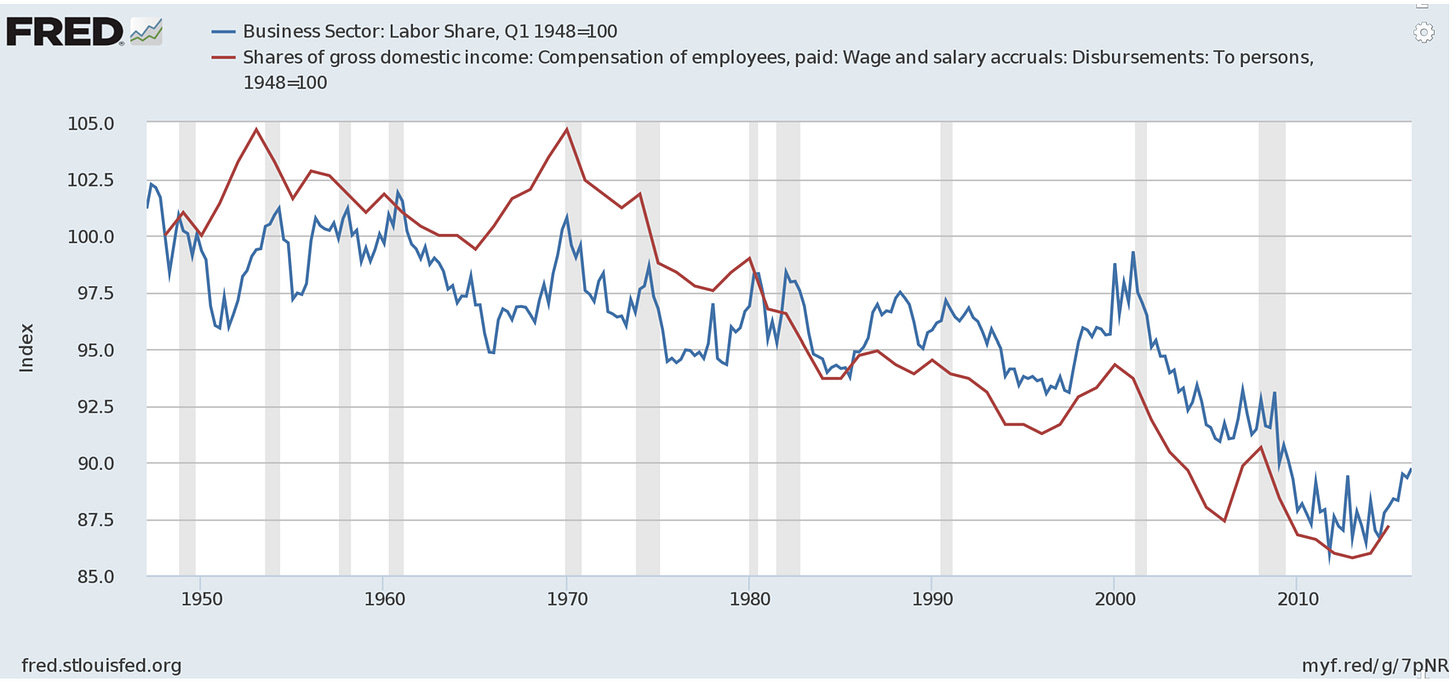

Labour compensation growth (i.e. what people are getting paid) was curtailed by the emergence of global employment competition after the fall of the Iron Curtain and the opening of China. Thus, the share of labour compensation within overall GDP has fallen to decade lows:

It is important to note that this dynamic brought much prosperity to developing nations, such as lifting hundreds of millions of Chinese out of poverty

But in the West, the resulting inequality has been the source of many tensions, and emboldened politics - as discussed - to conduct more drastic monetary and fiscal intervention than ever before, with COVID-19 as catalyst

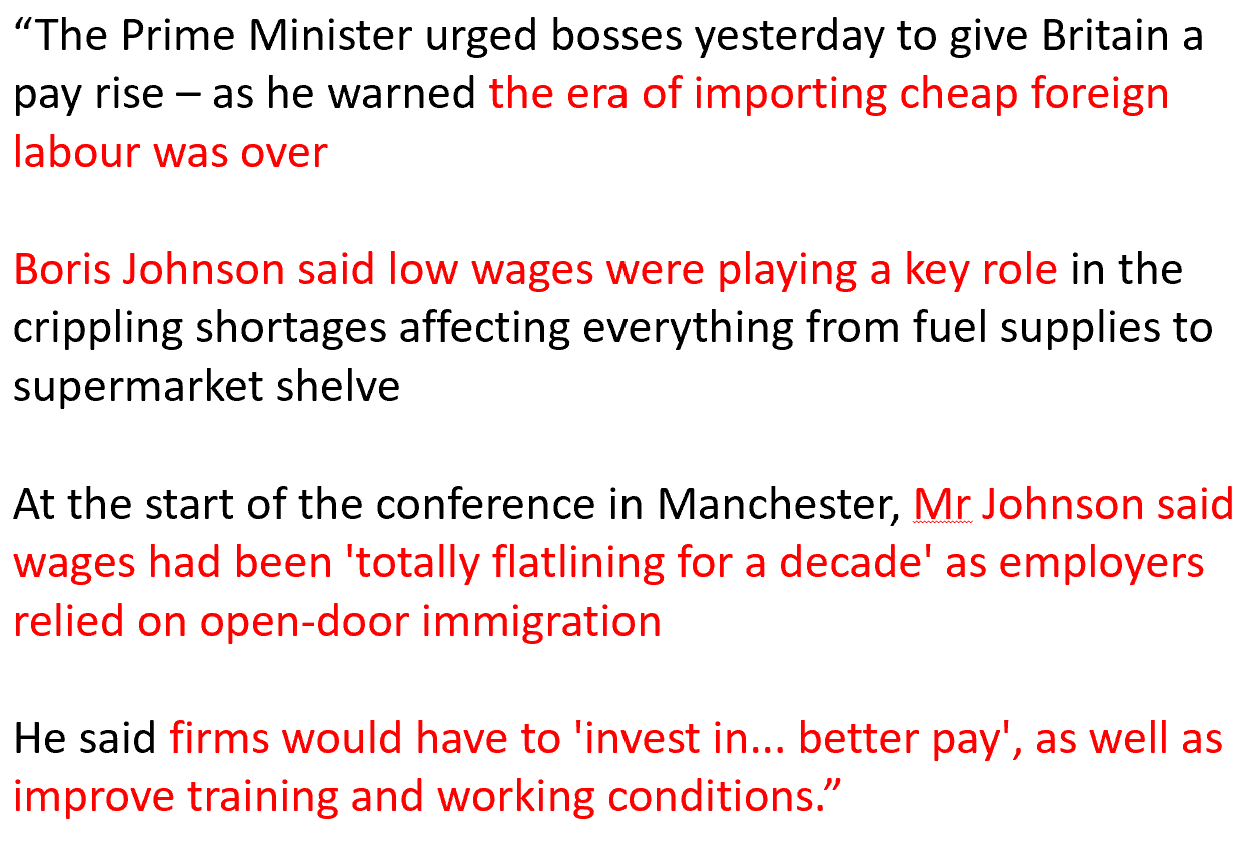

Following the dramatic fuel supply issues at British gas stations, with the root cause in the shortage of truck drivers who had left the country following Brexit, the expectation was clear:

The government would support businesses, set heaven and earth in motion to help fill this shortage of drivers, with the most obvious route to “import” back truck drivers from the continent, reversing previous immigration policies

This was especially expected from a government run by the conservative Tory party, with its long tradition of economic reason in the tradition of Margaret Thatcher

However, the man with the wild hair had other plans

Britain’s prime minister Boris Johnson stated the following, using the Tory party’s annual conference as forum:

For a metropolitan, business-minded reader, the conclusion seems clear:

Johnson’s reaction is textbook economic nonsense. With a domestic skilled labour shortage and no one to fill it from abroad, the gap only closes by prices going up and quality going down

It takes a years/decades to build a vocational training system that can provide the relevant skills, it doesn’t happen overnight

We can be sure that Boris Johnson knows this. However, his electorate includes more than the big cities. In fact, he came to power by sweeping the so-called red wall - the working class counties in Northern England that had traditionally voted Labour

And guess what, these voters will be delighted by this new policy direction. It brings them employment opportunities and higher wages, something they hadn’t seen in decades

Now, if all this happens at the expense of stock market valuations, inflation and maybe even economic growth, so what? This demographic doesn’t own shares, and the forty years of economic boom from 1980-2020 went past them anyways

It’s ironic that the loudest proponent of this new policy direction comes from the party of Margaret Thatcher. But Boris Johnson is an instinct-politician who’s more interested in winning elections than winning ideological battles. He sensed early that the winds were changing…

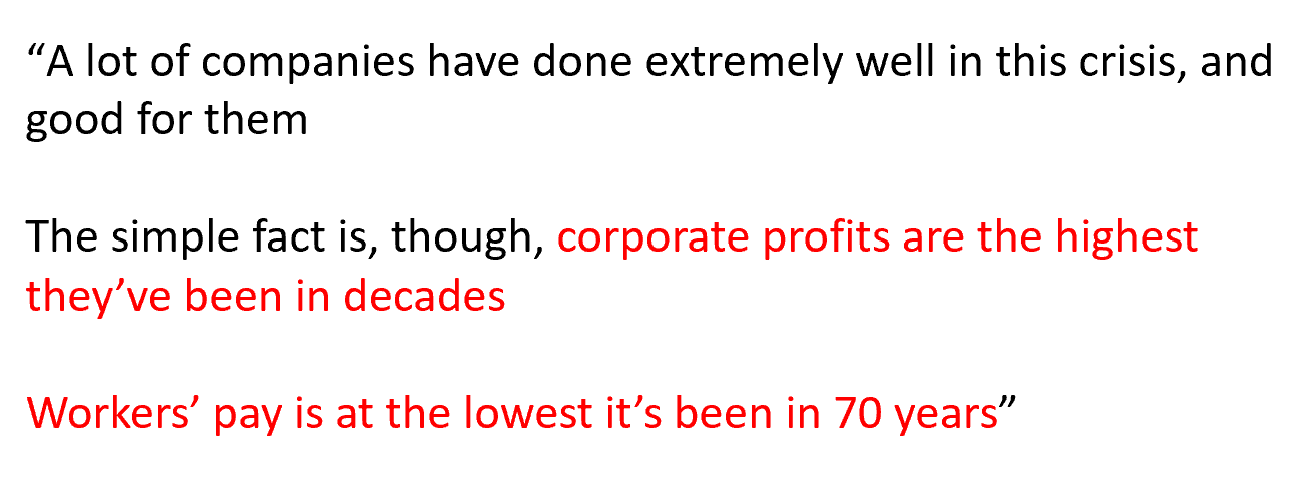

In the US, things are not too dissimilar. This is what Joe Biden had to say at a speech in May:

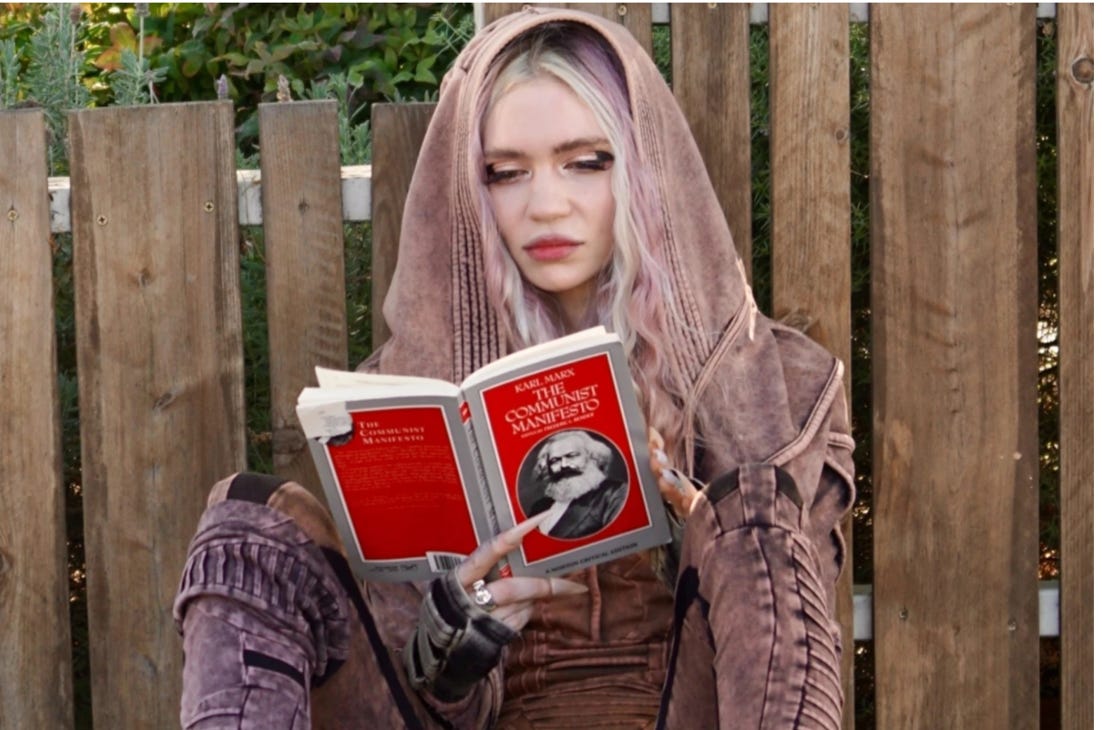

American youth culture, which as everywhere is a rebellion against its parental generation combined with the desire to find causes greater than oneself, has pivoted to the left

It’s not only debates on wokeness, but also images like the one below - paparazzi shots of Elon Musk’s wife this weekend, artist Grimes parading the streets of L.A. with an edition of Karl Marx’s “Communist Manifesto”

Something that would not have gone down well in the early 1980s, when the tide had just turned away from labour being too powerful within the capital vs labour balance

In summary, the political climate has become supportive of inflationary policies

However, the problem with these policies is that it requires painful political choices to eventually bring inflation down again. So the path of least resistance is to let it run

No one knows better than former President Jimmy Carter, who presided over the highly inflationary late 1970s. This an excerpt from a NYT article in 1978:

What does this mean for markets and investments?

First, higher inflation means higher interest rates. And if interest rates go up, that will be negative for most financial assets, in particular so-called long duration assets (high growth tech etc.)

I believe central banks are cornered and cannot remain as accommodative. However, the investment world is “long duration”, so this will be a painful adjustment process

Second, the rapid input cost inflation will squeeze corporate margins, as not everything can be passed on to consumers

It doesn’t require a rocket scientist to understand that sky-high energy prices and increasing labour costs aren’t good for corporate profits

This twin dynamic is why I mentioned cash in my last post as a storage of value, even if that may sound counterintuitive. If we see a reversal of the past decades, there are not a lot of places to hide, and cash keeps the ability to benefit from lower prices later

It’s very visible that the winds for the S&P 500 have changed, which has turned from an accumulation to a distribution trend. In other words, many are trying to get out and fewer are trying to get in

I expect interim rallies to continue to be sold, until the majority of market participants turns negative - and I believe we are still far from that

Commodities are benefitting, as mentioned a few weeks ago here. Aside from commodity equities indices I recommend looking at DBC ETF, which provides provides exposure to 13 different commodities, without potential equity market beta

Conclusion:

Inflation is with us now. It may be for a while. Many people are now benefitting who have been left behind before. If anyone is betting on politics to stop it, they may be disappointed

On a real basis in the US and on a nominal and real basis in Europe