Crash, Inflation Hedge or Nothing to See?

A review of US housing, the sector at epicenter of inflation

The US housing market is arguably the most important asset market in the Western world. With a 40% contribution to the Consumer Price Index, it’s the biggest single ingredient to the supply side of US inflation, which in itself drives money flows far beyond US borders. Further, 66% of Americans own a home, so the ups and downs of housing have considerable impact on the real and perceived wealth of the US consumer, the engine of the world economy

Rapid house price and rent increases fuelled inflation (see here and here previously), which the Fed now fights aggressively. As a result, mortgage rates have doubled from last year’s lows of ~2.7% to 5.35% today, the highest level since 2009. This begs the question, what are the consequences of this drastic move? Interpretations range from an impending crash to housing as an inflation hedge, to “nothing-to-see”

Given the sector’s tremendous importance, the outcome is a critical component for the direction of the world economy. This post walks through the main arguments of the debate, provides a conclusion and, as usual, derives implications for markets

Let’s start with the three main arguments for a continuously strong housing market

1- Inventory is very low

You may have read reports of crowds of people touring newly listed houses, or houses selling significantly over list price following bidding wars

Looking at the chart below, this is unsurprising. Inventory tracks at a record low, there are simply no houses to buy!1

2- Consumer balance sheets are in great shape

Regular readers will be familiar with the next chart, it shows the "net debt” position of the US private sector, using M2 as a proxy for cash. US households are excellent financial shape

Further, historically ~40% of homebuyers are cash buyers (25% this past February). For everyone else, after the subprime crash, lending standards were tightened significantly. As a result, most mortgage holders today have high credit scores

And last year, many used the opportunity to refinance when the Fed pushed rates down. Consequently, mortgage debt service costs are historically low

3- The labor market is on fire

The US Unemployment rate is currently at 3.8%, near historical lows. The ratio of vacancies to unemployed has never been as tight. This is important for housing, as no job, no mortgage, and if you’re unemployed you generally have less money to spend

Taken together, this seems to sums up to a very healthy backdrop, and simple conclusion:

Higher mortgage rates would reduce the pool of buyers as the higher cost prices some out of the market. This would bring the market back into balance. Prices would continue to rise, just at a healthier pace

But as usual, things are not as simple…

First, let me start with a basic statistic that serves as a big, bright red flag

The number of US real estate agents is at a record high. It’s higher than during the subprime bubble and twice as high as the in the late 1990s

However, the number of houses clearly did not double over that time frame, nor did the population. So either this used to be a very inefficient industry, or it’s now very frothy

Parallels come to mind to the Computer Sciences degree boom during the New Economy bubble, or the blockchain developer boom last year

Is this indicative of froth? Let’s take another look at the inventory data. We do need more houses, right?

Just yesterday Paul Krugman in his NYT column repeated the call for more housing construction, arguing that too few houses had been built since 2009. A much-reported realtor.com study makes similar arguments

However, these views only look at the supply side of the market. But the demand side has also contracted. Lower birth-rates and immigration have slowed population growth

Let’s look at a metric that takes both supply and demand into account

If we divide the total number of housing units by population, we get a pretty clean look at the picture2

And what we can see is in fact no shortage at all. The last time there had been as many housing units per population was just before the subprime bubble burst3

So what’s going on? How can we reconcile this data with a market that is literally empty, with no inventory? The answer is two-fold, in my view

First, psychology: When house prices continuously rise and inflation is on newspaper covers, no one wants to sell. The only inventory on the market is from people who have to sell, e.g. because they’re moving, or because of the three D’s of real estate (divorce, death and debt)

Second, Fed policies: Ultra-low rates have forced people to adopt real estate as alternative to government bonds. This is true for mom-and-pop investors who keep their old home after moving, just as much as for big pension funds who buy thousands of units

This trend is clearly visible in data. The share of investors in the US housing market tripled from ~6% in 2000 to >18% most recently

This data represents corporate/institutional investors only. Add to that individual investors who own some units in addition to their own home

While institutional units do end up on the rental market, individual investor units often remain vacant or sparsely utilised

A simple observation supports further suspicion around inventory dynamics. In 2019, the ratio of housing units to population was worse than it is today. However, back then, there were no reports about an inventory crisis

What changed since? Money printing, inflation and panic-buying, but not more people needing homes

Summary: The true “inventory” number is likely much higher than current market statistics suggest

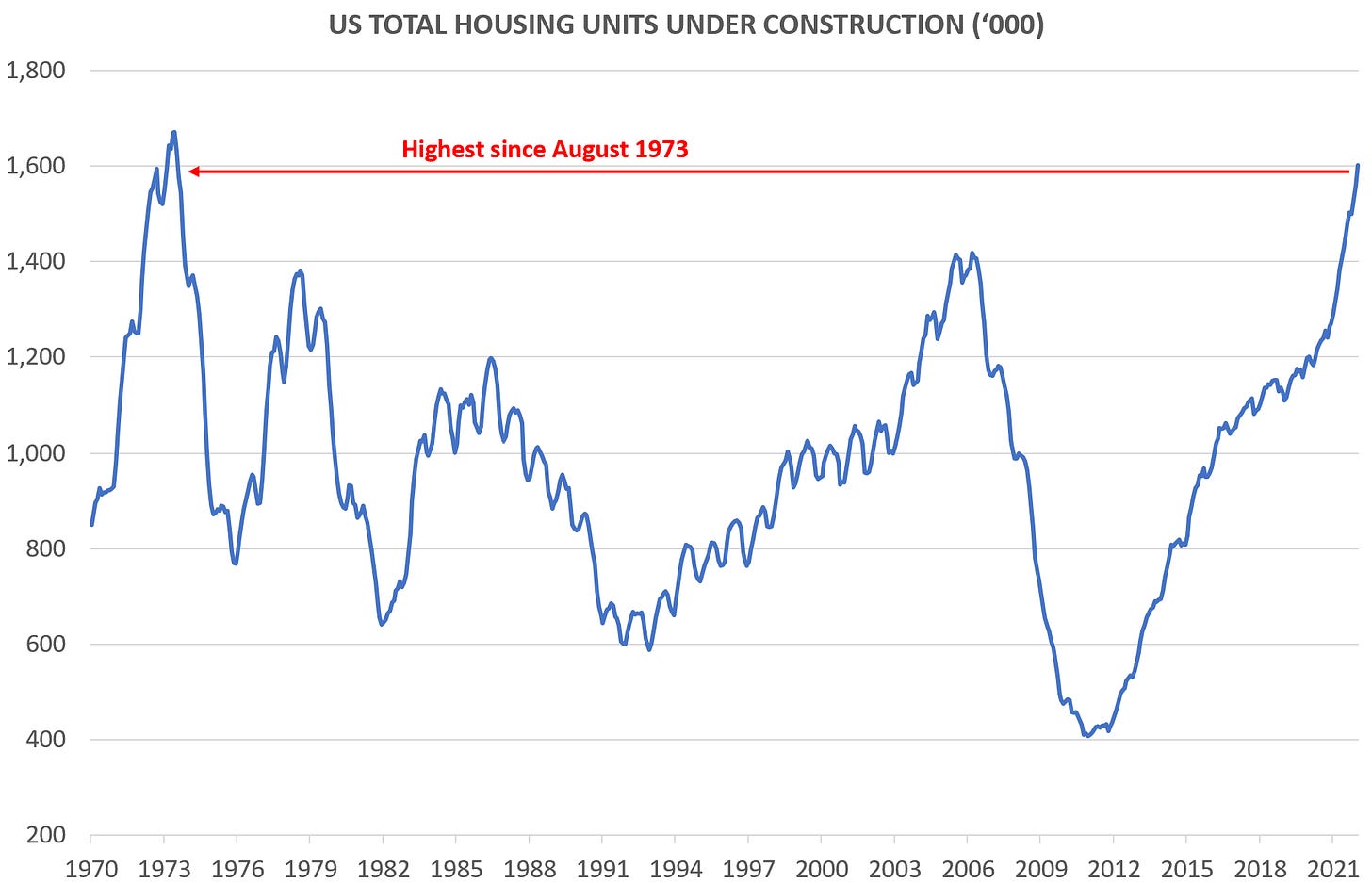

It doesn’t end here though. The ebullient environment has encouraged homebuilders to ramp up their activity. Housing units under construction are at their highest level since 1973 (!)

Recall my recent post about similarities between today and the 1970s. The previous peak of August 1973 occurred just before the Saudi oil embargo started that plunged the Western world into stagflation. Is a similar collapse on the cards soon? (See on homebuilders in markets section)4

CONCLUSION:

Let’s recap all of the above:

The economy is strong and consumers sit on healthy balance sheets. This makes forced sellers unlikely, even if the economic outlook worsened

However, there is likely a lot more housing inventory than headline numbers suggests

This is likely withheld from the market in a collective belief that real estate prices continue to appreciate, and as alternative to bonds

If prices stop rising, this belief is challenged, which will free up supply. Equally, if interest rates rise, money will be re-orientated to government bonds which reduces demand

Further, considerable supply will hit the market over the next year as current construction is completed

From this follows:

Because of the likely absence of forced sellers, a housing crash akin to 2008/9 seems unlikely

However, higher mortgage rates and additional supply will put pressure on the market. As people typically rather wait than sell houses at lower nominal prices (unless they are forced to), the most likely scenario seems an extended period of sideways prices, until the market is balanced again

Sideways nominal prices represent declines in real terms. Interestingly enough, this is also how the housing market performed during the early 1980s when Paul Volcker raised rates to bring down inflation, a relevant parallel to today’s Fed efforts

There is downside risk to this assessment if a glut of finished houses coincides with a recession, be that because of decisive Fed action, or a stagflationary crunch

There is upside risk to this assessment if the Fed acts irresponsibly and turns the money printer on again. Please note that currently seems unlikely as it would lead to hyper-inflation, however it cannot be ruled out further down the line

These are conclusions for the broad market. Individual pockets may be affected more dramatically

The rotation back into bonds will have a much more pronounced effect where the main source of demand was to “park money”, and less a living necessity. I expect considerable downside in second homes and luxury apartments

We are already in the early innings of this dynamic, as the headline below suggests:

What does this mean for markets?

From this, implications flow for the various real estate sectors

Homebuilders (ETF:XHB) are at the epicenter of said dynamics. A slowdown in housing would dry up their existing business, and leave them with a glut of homes under construction. More so, homebuilders typically don’t match the demand most needed by the market, they often emphasise higher margin upmarket developments. While the sector appears cheap on Price/Earnings, these earnings can evaporate quickly. I see the risk-reward firmly to the downside here

The various residential REITS should mimic the development of the broad housing market, most likely a nominal sideways and a decline in real terms. Highly levered structures should fare worse as rising rates increase financing costs. There is some upside if inflation spins out of control, but this is not a near-term scenario

Many conclusions are transferrable to Europe, where particularly in Germany more leverage is at play

The German 10-Year has risen from -0.5% to 0.9% over the past three months. If it continues its ascent, which is very possible given Europe’s deficit spending, I think it is likely that some turbulence occurs

Please see my comment on German real estate from last week. The Bundesbank has recently warned on domestic real estate exposure. Over 10% of all residential loans are >100% LTV. Higher rates drive asset prices down. I see particular risk for German banks with high domestic RE exposure such as Commerzbank

Beyond real estate, I would like to add these observations to complement recent posts:

I had mentioned the emergent divergence of consumer spending between necessary and indulgent. Netflix’ Q1 results provide a further mosaic piece in that direction, with shares down 33% after a record number of subscribers cancelled. While some of this can be attributed to a reversal of WFH dynamics, in a Kantar UK survey cancelling clients stated “wanting to save money” as primary reason

This does not bode well for some of the other FANGs such as Apple. Google may not be a safe haven either, with ad-spend intentions down as corporates face cost-inflation and e-commerce sales dropped 6.4% in March

As discussed last week, commodities are at a crossroads where positive secular trends meet near-term headwinds for durable goods that over time likely amplify into a broad recession. In addition to the lead indicators I mentioned last week, it is noticeable that Indeed’s job openings, which are a good proxy for the monthly JOLTS data, have trended down recently

China’s role remains pivotal, but the government’s likely futile zero-covid fight against Omicron creates an unpredictable path ahead. Either way, China’s ability to stimulate its economy is currently more limited than in the past, as cutting rates or a Yuan devaluation would increase import costs and drive capital towards higher-rate regions such as the US

This has been aggravated by the rapid move in mortgage rates. US residential mortgages are usually non-transferable, so anyone selling their house now to up- or downsize would give up advantageous rates

There are a myriad of dynamics affecting US housing, from baby boomers that don’t want to trade down to migration trends influenced by weather and WFH. I still deem this measure representative, as the overarching dynamics of low rates and inflation are likely more powerful, and their effect is felt nationwide

There are reasons that speak for a natural expansion of this ratio over time, such as a trend towards smaller household sizes. However this unfolds over decades rather than short term

Please note that housing completions have lagged construction because of supply bottlenecks. This has currently lengthened completion times to 9-10 months from 7 months. Houses are still getting done, it just takes longer

Excellent article - it resolves the question of supposed record-low inventory. However, I disagree that the average person's balance sheet is in good condition. I have read the exact opposite from numerous people, and throw in surging inflation, it's going to take a toll on savings. One more thing to add... LA county just extended their eviction moratorium for rental non-payment until June 2023, so that's likely going to cause a lot of mom and pop landlords struggling even more and maybe having to sell, especially if they have an adjustable rate mortgage. That will add to inventory, unless the corporates swoop in and scoop them up, of course.

Any thoughts on the UK housing market?