Europe and its Banks

Is an ugly duckling about to turn pretty?

European Banks are a mirror image of the European economic model. A blend of free market and “Strukturpolitik” (support to businesses motivated by broad political goals), they provide a key pillar to the continent’s industrial economy. For the same reason though, they’ve also been responsible for a never-ending list of scandals and poor decisions. If that wasn’t enough, the collapse of interest rates over the past decade also dramatically impaired their ability to generate revenues

European Banks are one of the most hated sector in the investment world. But after years of restructuring, with the advent of inflation their time to shine may finally have come

European Banks occupy a unique spot in the bloc’s economy

Many of them are (partly-) owned by federal or regional governments, and for decades they played an important role as trusted industrial partner who would prioritise stakeholder goals such as employment over short term profits

This contributed to the maintenance of economic structures through periods of crisis. Companies could avoid bankruptcy, and jobs were saved while banks in turn accepted lower returns on their capital

The privately owned banks in Europe had to compete with publicly owned banks, so returns were lower across the sector

From a traditional free-market, Anglo-Saxon perspective, this model seems prone to failure

However, one has to keep in mind that contrary to the US the European economic model is built on incremental improvement, not radical innovation

This is a reflection of the engineering mindset that has shaped the European industrial heartland, from Northern Italy to the Ruhr Area and Scandinavia

Deep technological, specific expertise allows for incremental improvement of an existing product to eventually become a world leader in the respective niche

For businesses and employees to flourish in this mindsets of perfection and to create the proverbial hidden champions, stable circumstances are required

They are reflected in life-long careers at the same company, companies owned by families for generations providing stable stewardship, and banks being trusted partners, providing debt financing in order to avoid equity dilution1

These economic character traits affected European Banks also in other ways

Because of its conservative, risk-averse nature, Europe generates more savings than it invests. These excess savings then need to be invested abroad, with banks as conduits

This particularly true for Germany. Its factories produce for global demand, but local consumers are hesitant to spend the proceeds of these efforts, instead putting them into savings accounts at local banks

So European Banks had trillions of domestic savings to invest abroad. But with misaligned incentive structures under part-governmental ownership, many were ill-equipped to do so in a professional manner

While there had been several historic warnings (e.g. WestLB/Boxclever 2003, BayernLB/Kirch 2002), this misalignment caused an outright economic catastrophe during the Great Financial Crisis from 2007-09

German regional banks were amongst the biggest buyers of US-subprime mortgages, and required hundreds of billions of bailouts when these went to zero

Only to be followed by the Euro-Crisis in 2012, when banks came under stress again as the cost of debt for the European periphery skyrocketed

As a consequence, regulators tightened the screws, capital ratios had to increase and painful multi-year restructurings followed. Many European banks retreated from loan origination, a void that was filled by direct lending funds

To make matters worse for the banks, between 2007 and 2021, interest rates collapsed. Using the German 10-Year government bond as benchmark, they went from ~+5% in 2007 to -0.5% (!) this summer

Banks make money by collecting the spread between the interest charge on their loans and the interest they pay for deposits. In a negative-rates environment, this spread shrinks substantially

With anaemic loan origination on top due to higher capital requirements and sluggish demand2, it’s no surprise that European banks were the worst sector in terms of market performance since 2007:

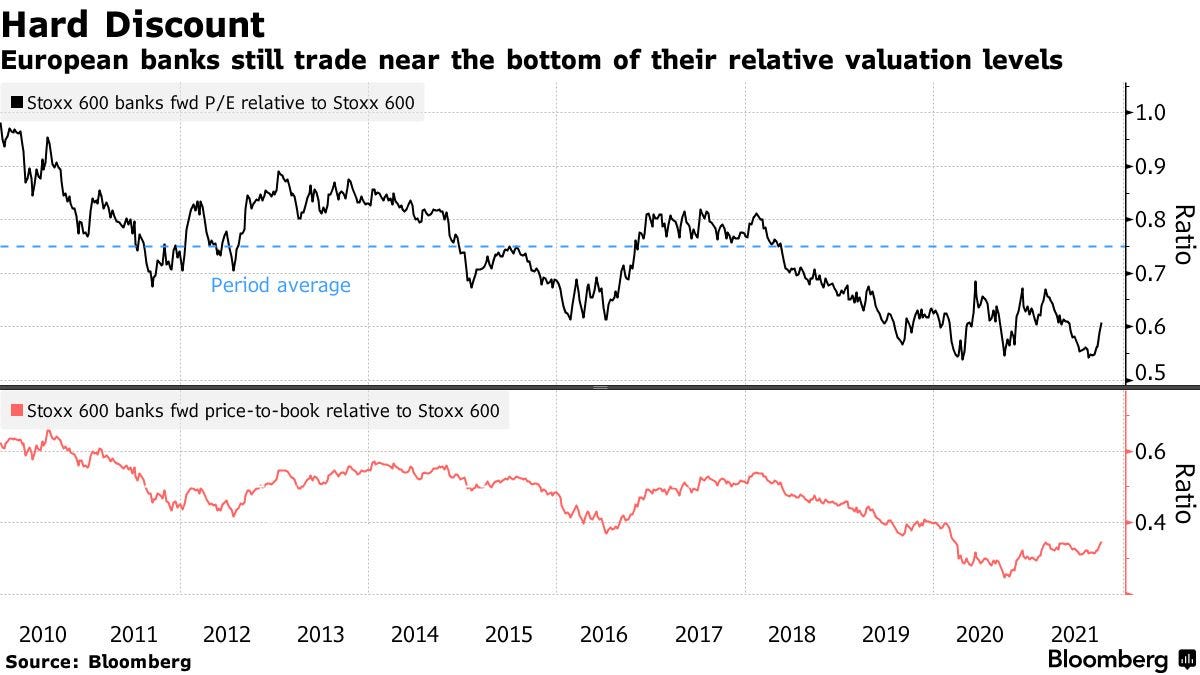

Relative valuations are also at an all-time low:

As discussed, we now live in an inflationary world. It’s a global phenomenon exported from the US, but felt anywhere in an interconnected global economy

The latest data continues to indicate a red-hot US labor market, with a record number of open positions

Wages increase at an accelerating pace, but labor force participation continues to decline, as many drop out of the labor market following the unprecedent surge in household wealth we’ve seen over the past 18 months

Looking at the headlines below, there seem many ways to pass time that are more fun that a 9-5 job, and the surge in wealth provides the means to keep them going…

It is likely that inflation will keep running as politics won’t stand in its way (see my last post). This represents a much-improved landscape for European banks just as they’ve made significant progress in tidying up their operations

Inflation means higher interest rates, and higher interest rates mean a higher spread between loans and deposits that banks can book as profit

After a decade of restructuring, loan books are mostly in decent shape, capital ratios solid and cost structures are lean as banks adjusted to negative rates by cutting cost. Any profit improvement will come with high operating leverage

Finally, with profit margins at decade highs in Corporate Europe, there seems enough room for companies to absorb higher costs from energy, wages or interest rates before bank loan quality would have to suffer

The biggest pushback to this thesis is that Southern European governments would be so levered that any rise in interest rates would lead to an economic collapse

It is true that the Southern European states carry enormous debt loads (e.g. Italy 158% debt/gdp , Greece 205%, Portugal 135%)

However, due to steady buying, the ECB now owns almost half of all European government debt outstanding. And it continues to buy more every day

It’s very simple: The ECB is owned by the European governments. So any interest the European states pay on the debt held by the ECB, they pay it to themselves. So the debt burden is much lower than headline numbers imply

Is this a very healthy dynamic, leading to sensible economic decisions? Probably not. But it certainly is the path of least resistance, as it is for politics to not stand in the way of inflation, which brings wage growth to low-wage earners

This dynamic weakens the Euro against other currencies, e.g. the USD. So in a way, all of the Eurozone might assume the traditional Southern European policy of competitive devaluation

Conclusion: In the seismic shift from a deflationary to an inflationary world there may be some unexpected winners. European Banks (as represented in the Stoxx Banks / SX7P Index) are one of them

This topic is well covered in the great book Varieties of Capitalism by Peter Hall and David Soskice

One should mention the impact of Fintech, which has made substantial inroads especially into retail banking (Revolut, N26 etc.). However, the big profit center business/corporate banking is still unthreatened