Europe vs the US

A tale of two very different halves

In my most recent post, I pointed out how recent data favors the US over Europe, while investors are positioned the opposite way, overweight Europe and underweight the US. This post expands on the growing economic divergence between the two regions, lays out its origin and suggests a likely future trajectory

As always, the post closes with my current views on markets, where I explain why I’ve added longs in US Large Cap Banks and Energy to DAX shorts and longs in UK 10-year bonds, reflecting the US>Europe view expressed today and in recent posts

I wish all my American readers a Happy 4th of July!

When we review the recent bevvy of economic data, two dynamics stand out:

On the one hand, US data continues to come in better than expected, defying all notions of a slowdown or recession

On the other hand, European data surprises to the downside, considerably so. No wonder the mood on the old continent is increasingly gloomy, with riots in France and the rise of the far-right AFD party in Germany

What is going on? Why is Europe doing so much worse than the US? And why seems the cyclical playbook that I laid out frequently before to unfold as predicted in Europe, but clearly not in the US? The answer can be summarised in three reasons:

Origins of Inflation

During Covid-19 alone, the US provided significantly more economic stimulus than the EU and the UK both during Covid and last year’s energy crisis together. Trillions of US Dollars were freshly printed and distributed via stimulus cheques and other means. While some has since been destroyed via QT, much of it still floats through the US economy

The below chart illustrates the differences well. M2 Money Supply may be a flawed measure in many ways and not identical across regions, but it illustrates directionally well how much more new money has been created in the States vs Europe. M2 in its majority consists of household and corporate deposits, which is where the printed money ended up

This drove ravenous US consumer demand, which created high inflation at home, with some spillover effects across the world. European inflation however was largely driven by the energy price shock. Below chart shows the extreme degree to which gas prices (the main driver of power prices) rose in Europe vs the US

Yet, both the Fed and the ECB pursued the same aggressive monetary policies. With the sources of inflation different, the EU now shows much higher vulnerability towards the same monetary policy shock

Summary: Europe never had the same monetary buffer as the US, yet the ECB pursued a policy that was just as aggressive as the Fed’s. As result, monetary policy weighs much heavier on the Old Continent

Different resilience to interest rate shocks

Following the Great Financial Crisis in ‘07-’09, the US did its homework to increase the ability of its economy to withstand shocks. Bank balance sheets were tidied up, regulation improved and most importantly leverage parameters in the residential housing market got adjusted

Today, >90% of US residential mortgages, which account for ~80% of consumer debt, are both mostly very long term (30 years) and fixed interest. As a result, monthly payments are predictable, managable and not impacted by the current increase in rates

This is in stark contrast to many European countries, where mortgages are usually both much shorter (eg Germany 7-10 years) and often floating rate, or in part floating rate (e.g. UK after first two years). As a result, monetary policy transmits much more imminently to consumer spending

We see the different policies reflected in the very different performance of the respective housing markets

In the US, residential construction activity has turned a corner. This is in stark contrast to the German housing market, where building permits are cratering

Same for house prices - they are down by a record in Germany, and now up (small) in the US

Summary: After the financial crisis, the US buffered its economy against interest rate shocks. As a result, monetary policy transmits differently and less effectively in the US than in Europe

Inflation Recovery Act

Under both President Biden as well as his predecessor, US industrial policy turned domestic-focussed and interventionist. It started with Trump’s China tariffs to protect the American industrial base, and extended into active subsidising of home-shoring via the Inflation Recovery Act

The results of which can be seen in the dramatic increase in construction spending related to manufacturing. This creates a massive countercyclical trend in a sector that would usually now contract under the weight of high interest rates

Industrial construction is usually highly cyclical. When interest rates rise, expansion programs become more costly so companies reduce them. We see the opposite now, driven by heavy investment in chips and green tech

Europe lacks a similar program. Whatever one thinks of its merits, as a result corporate investments are directed to the US, so the supportive counterbalance within the US economy to some degree comes at the expense of Europe

Summary: The IRA (and to a lesser degree the US Infrastructure Act) create economic growth within commercial construction, a sector that historically was one of the first to cave under high interest rates. This also neuters any negative ripple effects from that sector into other areas of the US economy that would traditionally occur

Conclusion:

Due to (1) high cash levels, (2) an economy made resilient to rate increases and (3) heavy government-driven investment into infrastructure and manufacturing, the US economy proves much more resilient to the economic downturn than Europe and the UK

This is mostly a deliberate response to the political turmoil of the late 2010s. Stimulus cheques were printed in a panic-response to avoid a repeat of the Great Financial Crisis, and Manufacturing subsidies are squarely aimed at the left-behind regions and “deplorables” demographic that may have decided the 2018 election

Europe has shown much more lethargy in addressing the imbalances of globalisation. Its own crop of disgruntled demographic is now growing at an unprecedented pace. At the same time, the old continent will likely be hit much harder by the weight of tight monetary policy. Europe likely has to respond to the US industrial policy challenge one way or another, or risk falling even further behind

What does this mean for markets?

The following section is for professional investors only. It reflects my own views in a strictly personal capacity and is shared with other likeminded investors for the exchange of views and informational purposes only. Please see the disclaimer at the bottom for more details and always note, I may be entirely wrong, may change my mind at any time and none of this is investment advice

I continue to view European economic weakness as underpriced by markets, at the same time acknowledging the current strength of US economy and the asset price momentum, which is unlikely to end in the near term. I see the chance for lagging US sectors to catch up to the rest of the market, in particular those with cyclical tilts such as Banks or Energy, but also the Dow Jones

I had mentioned in my last post that I intended to add US equity long exposure in late June, which I have now done with a long position in US Large Cap Banks as well as Energy, which sits against a DAX short and a UK-10 Year rate long, as well as some puts on European cyclicals with domestic sales focus. I am leaning towards further adding a Dow Jones long, which is stuffed with nominal growth beneficiaries, something I can see the market chasing now after a long sideways consolidation, as “higher for longer” reaches equities. I am net long on the equities side as I expect dips to be bought at least until mid July, and potentially mid August

This creates a barbell strategy that is to some degree hedged, as banks benefit from the perception of a “higher for longer” regime, and energy represents a hedge against an inflation resurgence which the market may now play, warranted or not. At the same time, the UK rates position and the DAX benefit from European economic downside, so the setup emphatically puts US > EU in focus. With regards to Large US Banks as well as Energy, either are entirely underowned by Hedge Funds, which is usually the best investor group to profitably trade against, while the jump in UK Rates has just made it onto the cover of the Daily Mail, usually (but not always) a sign that a trade, in this case to sell Gilts, is extremely crowded

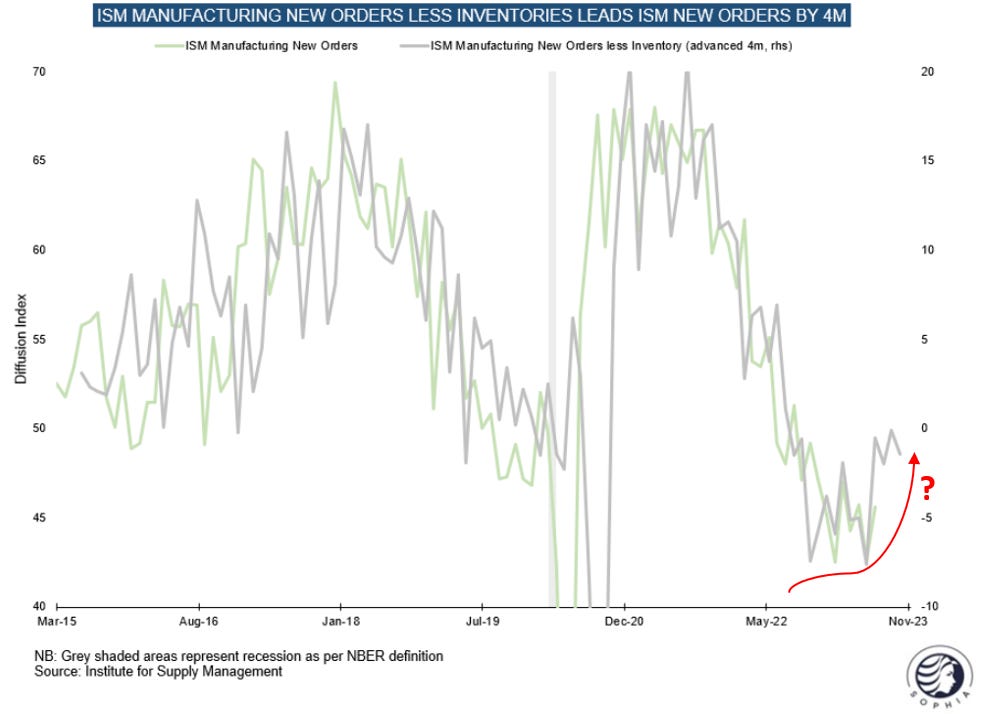

On that note, I also want to highlight that ISM New Orders vs Inventories has inflected upwards, a lead metric I last discussed about a month ago in “A Heretical Thought”. Further, the decline in June WARN notices suggests the US labor market could have retightened, and PC and Laptop shipments, a very early cycle lead, jumped in Q2. This may signal the first value chain to end the pandemic bullwhip. For the same reason, it may also carry less signalling power during the current cycle. However, while the global economic trend remains downwards, there are certainly some signs of life in the US business cycle if one cares to look for them. Headfake or not, I see a decent likelihood that the market picks them up in the near-term. A long US banks and energy book caters to that, while economic downside is hedged with Gilts and DAX

I continue to find it highly unlikely that the US economy won’t pay a price for the monetary excesses of the Covid period. The settling of said bill may come in 2024, stretched over time with persistent below-trend growth at high inflation, or for some miraculous reason never as someone else pays (e.g. Europe…) or AI defeats inflation. Until that clarity arrives, I will continue to lean with the markets, instead of against them

Thanks for your analysis! Just wonder why don't you express this take via fx, short euro long usd, for example?

Thanks, Florian! Based on your analysis, ECB should reduce rates sooner than the Fed, so EUR should depreciate against USD, do you agree?