Europocalypse

Europe and the UK are unprepared for the energy train wreck about to unfold

In East of Eden John Steinbeck describes how the Salinas Valley goes through cycles of growth. Seven good years with much rainfall are followed by seven dry years, to be repeated again. He then writes:

Steinbeck alludes to the collective inability to imagine shifts away from the most recent past. In early 1989, many could not imagine the Fall of the Berlin Wall later that year, and the epochal changes that came with it. Today, once again, few seem willing to engage with the epic shock that lies ahead for Europe

As regular readers might know, rather than being bullish or bearish, I follow a data-driven framework that I attempt to interpret with common sense. Today, it leads me to the unfortunately gloomy prediction implied in today’s title

This post walks through the reasoning in a few simple steps. As always, it closes with an outlook on what this might mean for markets

Let’s dive in - how did the whole thing start?

A failed energy policy made Europe and the UK1 very vulnerable to an external shock

Putin then created said external shock. First through Russia’s attack on Ukraine, and then by cutting off Russia’s gas supplies to Europe

As a consequence, the European gas price went parabolic

Ok, sounds bad, but what does it actually mean?

Europe is a heavy importer of natural gas. At 2021 prices (already elevated), the Eurozone’s energy import costs were €200bn p.a. or 1.6% of GDP. If gas settles at 200€/MWh, this number increases by €700bn to 7% of GDP. At 300€/MWh, it rises by €900bn to 8.5% of GDP

Similarly, in the UK, the collective 2021 household energy bill was £30bn, to increase to £170bn (~8% GDP) in 2023

In other words, at 300€/MWh, the Eurozone has to pay an astronomical additional €900bn or 7% of GDP, just to generate the same output as the year before!

Just to compare, in the huge 2009 Financial Crisis Eurozone GDP shrank by 4.5%

How this enormous cost is absorbed has tremendous implications for the future course of Europe. Because the region is unprepared, some grave mistakes are likely, here is why I think why:

Let’s start with this poster from London’s Stansted airport:

Amidst a European shortage of blue-collar workers, Ryanair is desperately looking for luggage handlers. It offers an annual salary of ~£25k, which is meaningfully below the national average of ~£38k

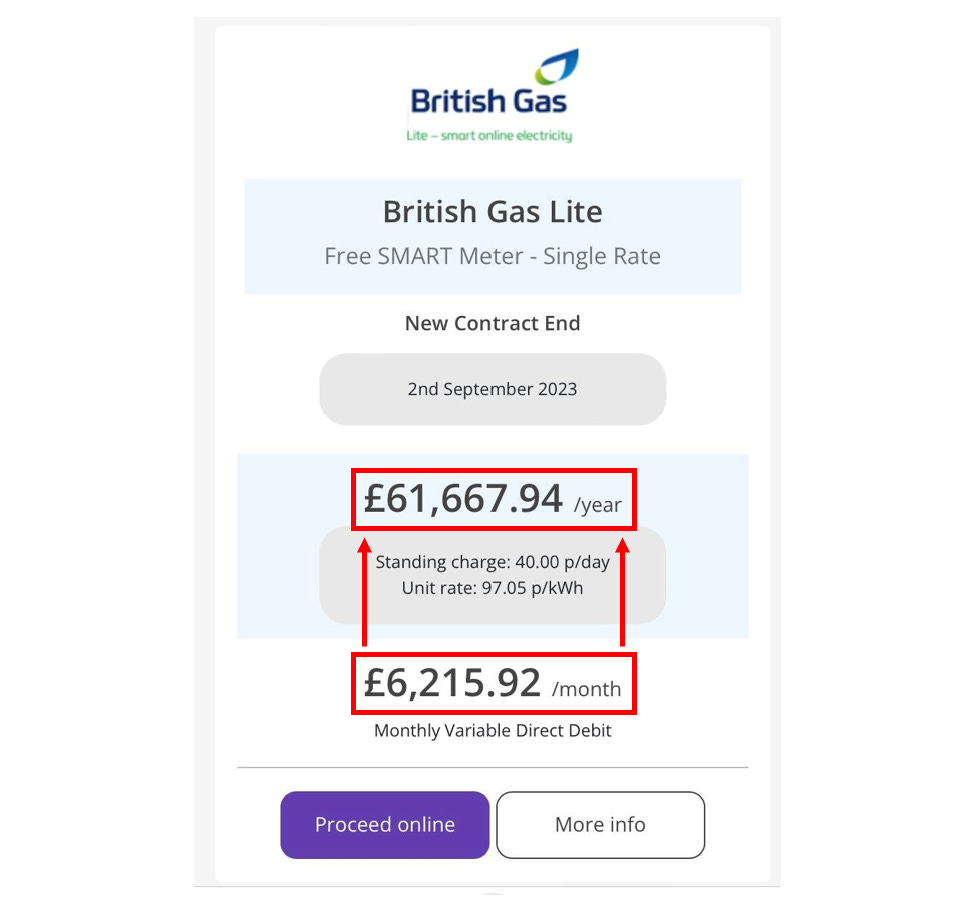

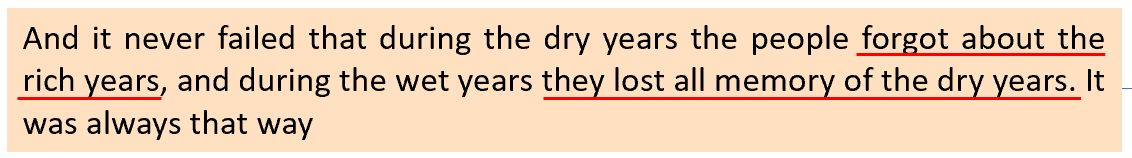

Now, in the UK, the combined typical household energy and gas bill will evolve as follows:

Having been at ~£1,000 annually for years, it increases increase to ~£3,800 p.a. in October, to be followed by two further bumps in January and April to over £6000 p.a.

NB: I am using the UK as example as it has the most transparent data. But the same logic applies to all European countries

UK median household income (post tax) is £31k per annum. Median means that 50% of households make LESS than that. Some, like luggage handlers, make ~£18k post tax (£25k net). Many make even less, including many pensioners, many of them alone

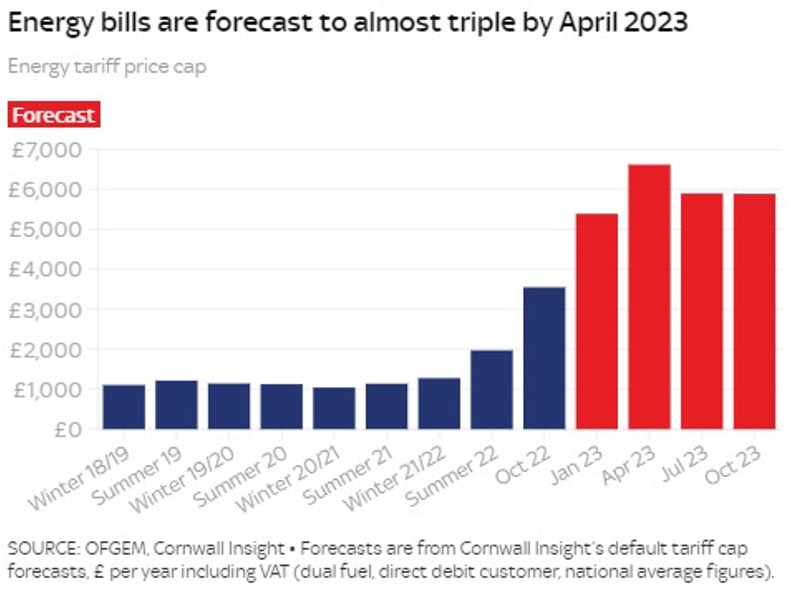

Below table shows the share of income going to energy next year for low income households - the numbers are frankly shocking

Low-income single parents will have to use 2/3s of their income, low income single adults' energy bills will exceed their income after housing costs

In other words, this is a social catastrophe. People will fight to see this mitigated, rightly so. There are two ways to alleviate the situation:

First - Higher wages. Here, we return to the luggage handler example. Due to the demographic cliff, deglobalisation and lower immigration, today’s labor market is very tight and much negotiating power now resides with workers. Evidence is solid for a price-wage spiral in the UK, in my view it likely also emerges in the Eurozone2

Second - Government subsidies. Across Europe, energy-related state support so far amounts to €280bn (~2% of GDP). Keep in mind, this is support earmarked BEFORE gas and power bills escalate this winter. Accordingly, expect much more to come as consumers’ costs rise

Summary: The coming energy price increases are a social catastrophe. To alleviate it, it is highly likely that both wages rise and governments provide much more support

Government support for lower-income groups is right, no question. Where it becomes tricky - how will it be financed?

At this point, I return to the introduction, and the collective unwillingness to imagine anything but the recent past

Nothing expresses that better than the chart below. It may be oversimplified, but it is what it is. Current Eurozone inflation runs at 9% p.a. (and is bound to go much higher), and ECB benchmark interest rates are still at 0% (!). They are still anchored to the past decade which was shaped by deflation rather than inflation

You don’t need to be a central banker, politician or economist to know that it doesn’t make any sense

Why? Here is the technical answer to what intuition already knows:

Low interest rates incentivise Europe’s governments to finance subsidies with more debt, likely creating more inflation down the road

Debt is newly created money. Newly created money into an inflationary economy means more inflation

Higher government deficits is how energy inflation turns into broad, lasting inflation

This playbook is well known from exogenous shocks in Emerging Markets

Summary: The ECB is keeping interest rates too low for too long. Higher long-term inflation is the likely consequence

More so, the sudden crisis evolution likely leads to unpredictable second order effects

This would resemble the equally unexpected Lehman bankruptcy in 2008, which unleashed a cascade of further blowups, until every major US Investment Bank had to be bailed out

Over the past week, the chain of events is emerging. Let’s walk through some examples:

Gas is the most important input good for fertilizer production. With spiralling gas prices, the list of European fertilizer plants shutting production increases

Lower fertilizer production today means lower food production tomorrow

Belgium is a cluster of heavy-industry. Companies from steel (Aperam) to flooring (Beaulieu) have shut down production

If the cost is not directly pushed to the consumer as in the UK, but absorbed by energy companies, these require bailouts. This morning it emerged that Vienna’s utility company has a €1.7bn hole that needs to be covered by the end of the week

The situation is evolving fast. Also today, Germany’s Uniper announced that it will require an additional €4bn in addition to the recent €9bn bailout

In Finland, the regulator Fingrid prepares its citizens for power outages over the winter

Finally, the energy price increases are a huge challenge for small enterprises, such as this pub in Bebington, UK. Have a look at their coming gas bill:

Summary: The European energy crunch will likely involve a litany of unexpected corporate emergencies, including many bailouts and defaults. More broadly, corporate profitability is likely to suffer enormously

The biggest risk here is scarring, i.e. a permanent reduction in output due to companies closures. Over COVID-19 governments avoided this with generous corporate bailouts, which subsequently added to inflation

Should high inflation become entrenched via prolific government spending, Europe’s government debt load becomes a huge issue. Why?

High inflation may require interest rates that are too high for various European governments to refinance themselves

The result would either be even higher inflation (if rates were not increased sufficiently) or sovereign defaults, or a combination of both

This turns up the Euro’s biggest challenge - the enormous range of government debt/GDP amongst its member states (see chart below, from 20% to 200%) with the same interest rate applied to all of them

It is no coincidence that Eurozone inflation is highest in the Baltics (e.g. Estonia July +22%), where the debt load is also the lowest. Estonia’s economy is less ossified by debt, so inflation unfolds with greater velocity. Accordingly, Estonia would require much higher interest rates than e.g. Italy or France

Notwithstanding, I also want to acknowledge that much progress has been made in reducing gas consumption

German industrial gas consumption currently runs ~20% lower vs recent years. This is mostly owed to lower production, but also importantly to efficiency gains, likely with scope for more to come. Nationwide consumption currently runs 5-10% amidst various public reduction initiatives (see here for examples)

Once should note that German gas storage has been filled faster than anticipated, with an 82% fill reached a month early. However please keep in mind that gas storage capacity only covers ~2 out of 6 winter months (250 TWh storage vs 750 TWh winter consumption)

CONCLUSION:

What would need to happen:

ECB and UK rates need to go much higher

The EU needs to be reformed, the financial union needs to be accompanied by a political union

Southern European debt is way too high and should be restructured

Government subsidies need to be revenue neutral, financed either with taxes elsewhere, or deficit reduction

What will likely happen:

Interest rate increases will remain behind the curve

EU reform happens, but only because it is forced by tremendous tension

Governments will assume more debt, and face defaults if inflation persists

Where am I wrong?

The Ukraine war ends and Russian gas flows resume (possible, at least it seems neither side is making much progress, though Western weapons definitely help Ukraine)

Deflation in other goods/services balances energy-related inflation (unlikely as everything requires energy, so input costs are up even with lower demand)

Governments balance subsidies with revenue-raising or deficit-reducing efforts (looking at the press over the last few days3 I also find that unlikely)

What does this mean for markets?

As always, below is my personal attempt at connecting the dots for my own investments. Please keep in mind - I may be totally wrong, nothing is more important than risk management, and none of this is investment advice. I share much of the data and context going into these decisions real-time on Twitter

Equities - we are entering the seasonally weakest period for equities right after a summer rally. At the same time, valuations vis-a-vis bond yields are stretched, margins under pressure and the Fed hawkish. I could hardly come up with a more negative scenario for equities and remain short US Tech (Nasdaq-100), Russell 2000 (IWM), Semiconductors (SMH), US Airlines (JETS), Homebuilders (XHB) and DAX as well as Banks (SX7P) in Europe (please see recent posts on more details on reasoning for each). At this stage, the only hope for equities is lower energy prices (I don’t think so, see on Oil below), as this would bring down bond yields (less inflation) and in turn boost valuation multiples

Oil - Oil is the ground zero for inflation. It is the real-time barometer of inflationary pressures, and a harbinger of its potential resumption. Europe’s energy crunch will likely generate an incremental ~1mbbl/d of oil demand from gas-to-oil switching at powerplants and some households, providing support to oil prices. Further, August US consumer data has been solid. Finally, recent Saudi/UAE statements suggest production cuts should prices fall. I think the path of least resistance for oil continues to be up (see recent posts) and I remain long oil

European Rates - As outlined above, my view is that EU rates are too low. Several ECB members seem to agree, and a 75bps hike for September has been floated. I remain short Schatz futures (German 2-Year)

Real Estate - While this asset class has historically done well in high-inflation times, these historical precedents have not been preceded by 0% interest rate regimes. In my view, Real Estate remains an epic global bubble, with much downside in particular in Canada, Australia and Germany, but also the US

Nuclear - To keep it very simple. Europe is short energy. Over a long enough time line all energy is fungible. Thus, turning off Nuclear reduces the European energy shortage, even if in the very short run it would only save little gas. Several Asian countries have U-turned on their Nuclear policies. I think the common-sense thing for Germany to do would be a 5-year extension, to allow for a longer build-out of alternatives and lower CO2 emissions vs the alternative coal

On a more general note:

A possible scenario for the remainder of the year to me seems a strong sell-off in September/October, followed by a year end rally, potentially coinciding with some pick-up in industrial demand following cleared inventories. Medium-term, a lasting turn of the market would require the economy to turn, something to occur more likely toward mid/end ‘23

The sad reality is that Carbon emission ambitions have taken a backseat and the 2050 Paris goals seem more elusive than ever before. However, there are two silver linings. First, as Europe learns to live with less energy, some of these savings may turn out to be permanent. Second, natural gas is cleaner than coal which is now preferred. It is also ubiquitous. Over the next 3-5 years, Russian gas should be replaced by other global sources, reducing again more polluting sources

Finally, I find it ominous at this stage that the chorus for a higher central bank inflation target (3% vs 2%) grows louder by the day (see FT reporting on Jackson Hole here, also before Oilver Blanchard, Liz Truss, Lars Calmfors, Howard Davis). This would tie into the complexity of excessive government debt and be reflected in higher long-term interest rates, with corresponding implications for many asset classes

I hope you enjoyed today’s Next Economy post. If you do, please share it, it would make my day!

For the purposes of this post, Europe includes the UK as their energy markets are interconnected

Labor shortages are most pronounced in the UK following Brexit, as such wage growth currently also tracks higher, with 4.7% annualised excluding bonuses in June

Actually UK immigration is currently running at historically high levels according to Professor Jonathan Portes.

UK labour force growth of 400,000 migrants each year is at least four times the assumption in The Economic Consequences of Brexit, published by the OECD just before the 2017 Referendum.

Jonathan Portes is Professor of Economics and Public Policy, King’s College London and Senior Fellow of UK in a Changing Europe.

https://bylinetimes.com/2022/08/30/the-governments-post-brexit-immigration-policy-is-a-rare-success/

Brilliant piece !!! EU top-managers finally become soviet stye bureaucrats with the instagram-politik, instead of real action. Except Hungary.