Front and Back of Mind

A brief check-in on capital markets

In my last post “Labor Day” I described how the strong Non-Farm Payroll data for January appeared to have decided the battle between labor market worries and accelerating growth in favor of the latter, for now

Subsequent data further supports this view, which lead me to split today’s brief update into two parts: What the market sees right in front of it, and what it may focus on soon as a consequence

Let’s start with “Front of Mind”, what imminently lies ahead:

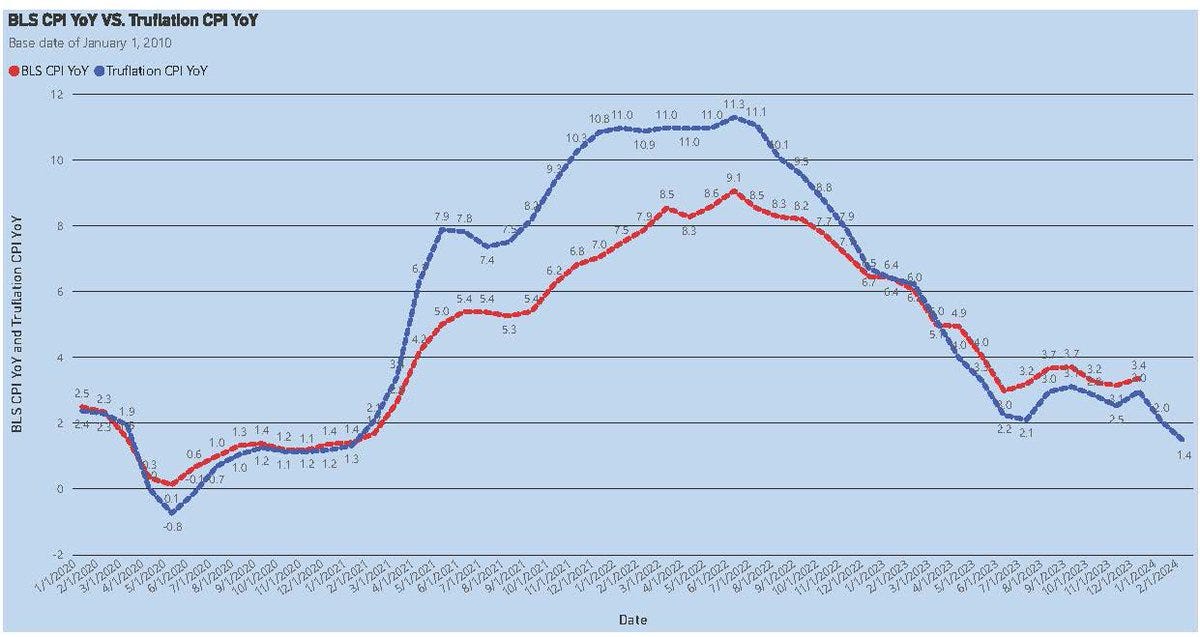

The near-term inflation trend remains soft, and after a possible January bump due to annual contract resets Truflation’s live readings suggest further disinflation into February…

…further, yesterday’s initial jobless claims data has put any imminent labor market worries further to rest the most recent slight increase was reversed…

…at the same time, growth remains strong. The US economy exited 4Q ‘23 at a stellar 3.3% real GDP growth rate, which is set to continue for 1Q ‘24…

…while many lead indicators suggest growth acceleration into the coming months, such as the ISM Manufacturing New Orders component…

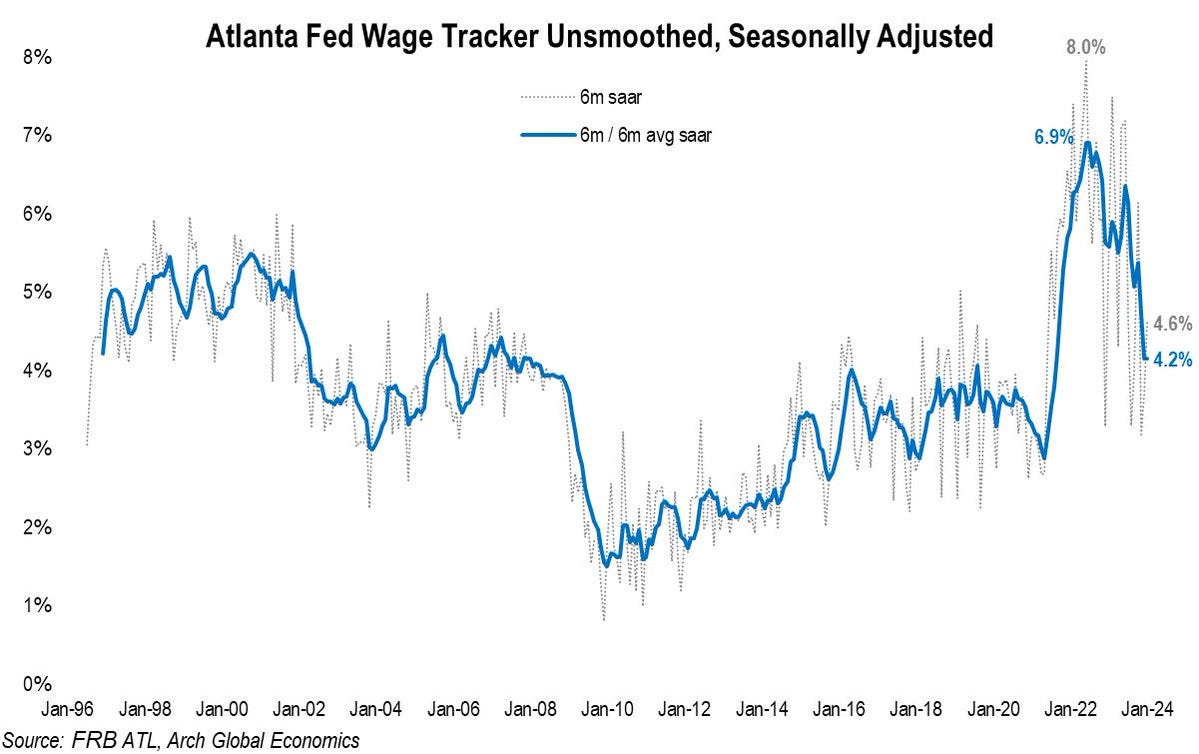

…and finally, wage growth appears to ease back into historical line

Summary: Very strong economic growth with odds of acceleration, accompanied by disinflation and moderating wage growth - one is hard pressed to come up with a more benign context

Moving on to “Back of Mind”, what could await past the near-term

The key question is, as the economy re-accelerates out of a high-growth context, will inflationary pressures resurface? Several forward-looking measures suggest the risk is real, such as the ISM Services Prices Paid…

…or the pick-up in Gasoline prices year-to-date. It is absolutely still small in the bigger picture, but the direction of travel notable and consistent with a pick-up in growth

1-year forward inflation expectations can be seen as the aggregate of these various other inflation leads. They have made a new high, as this subset of capital markets now expects inflation to hover at close to 3% for the coming year, much higher than just a few months ago

Summary: Looking past the near-term narrative, the outlines of an inflation rebound are increasingly visible

Where does that leave us?

Rather than a detailed walk through various assets, today I want to single out what I perceive as the obvious mismatch in light of the above:

Historically, the 10-year yield has tracked nominal GDP closely, as this great chart by @supermacro illustrates well

The reason is simple- if rates (and with it the rest of the curve) are set considerably below nominal growth, then a credit boom would ensue that quickly leads to instability and overheating (= borrow as much as you can at 4% yield to invest in 6% growth)

The 2010s were the exemption, as the Fed surpressed long-end yields via QE to stimulate sluggish growth suffering from the legacy of the ‘08/’09 credit meltdown

Keeping it simple, right now, the 10-year yield is at 4.1%, while US Nominal GDP runs at 6%, with upside risk in the near-term. Does that make sense?

To me, it doesn’t. It tells me that any rallies in the long-end of the US bond curve (eg due to inflation revisions today or a lower than expected January CPI) should be sold, until we see data that suggests growth is slowing down

As I said in my last post, higher yields are not a headwind per-se for many equities if they march higher due to growth. But they will likely continue to be a serious headwind for vulnerable areas such as CRE or Regional Banks

Thank you for reading my work, it makes my day. It is free, so if you find it useful, please share it!

Having just read this a week later, with the knowledge that both CPI and PPI are looking more and more like they have bottomed, it seems the real question about growth is whether the government can continue to run its 7% deficit to pump it up. the greatest fear we should all have is that inflation continues this recent trend higher but the growth train derails. as such, higher 10-year yields make sense, but equities may have some trouble

My usual caveats. I would take current GDP estimates with a heavy grain of salt considering contracting GDI. Truflation is still trending down heavily, and could continue (I'm just not sure how much money banks are going to start creating soon). Aggregate hours worked keeps going down (will see how much was weather next month). A lot has to change before I consider reacceleration a real possibility.

I would take into account that real growth may be less than the headlines presume and inflation more in line with truflation. If that's the case, we have a VERY restrictive fed funds rate that would continue to be even after slight cuts.

Worth keeping in the back of the mind.