Hard Landing, Soft Landing or Moon Landing

Where the economy stands, and why I am back to short equities

Currently there is an intense debate on the trajectory of the economy. Views range from a serious recession, a.k.a. hard landing, to a soft landing or even to a “no landing” (i.e. continuous growth)

As equity markets started the year euphorically and narrative always follows price, the overwhelming view is now that of benign outcome, aided by lagging data such as the Q4 +2.9% US GDP print. This post shows why I believe this likely to be misplaced, and why a hard landing likely unfolds over the coming months and quarters, together with a rise in unemployment and a material decline in corporate profits

It further illustrates the very tough job the Fed faces. If it tightens too little, it entrenches inflation. If it tightens too much, it crashes an overlevered global economy. To stay with the analogy, its endeavour resembles the moon landing in both challenge and complexity, however with less faith in the “astronauts” given their prior mistakes

A hard landing and the corresponding rise in unemployment is an individual tragedy for many, and as such an outcome I neither applaud nor find desirable. But, as laid out today, it is what the data tells me. As a result, I have reverted to a short equities stance, which I detail in the markets section

This post focuses on the US, which leads the world economy. Therefore, any conclusions should also apply to Europe, and to a fair extent to what is still the world’s factory, China

My view of a hard landing rests on five interlinked reasons. Let’s dive in:

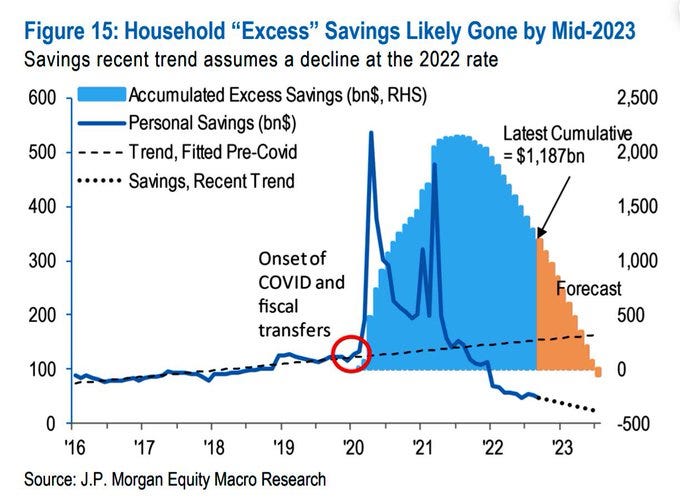

First - The US Consumer has financed consumption out of savings, but these are now running dry

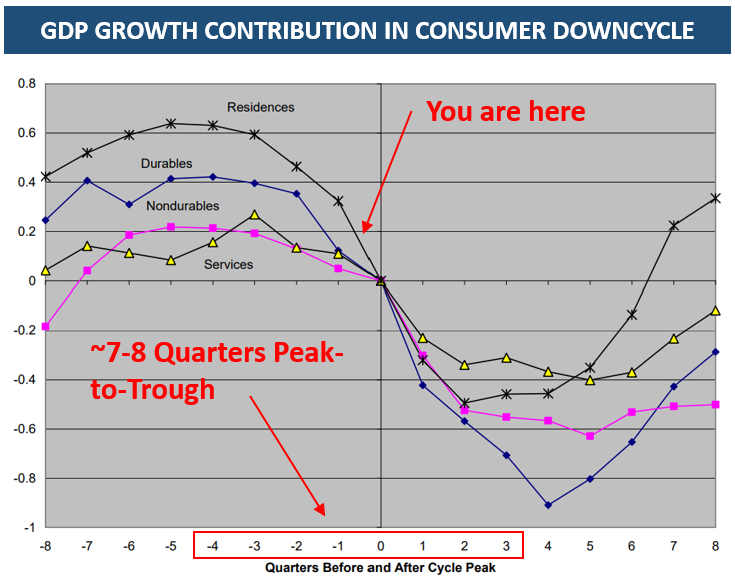

Consumers spent more than their wages could afford, financed by savings. As these savings run out, demand declines. Regular readers will be familiar with the chart below, which illustrates the dynamic1

However, depleted savings alone are not reason enough for a hard landing. So let’s dig further:

Second - Corporates overproduced, thinking elevated demand would persist. But demand has declined, and now they hold too much inventory

With ample inventory, corporates need to reduce production. In turn, they order fewer pre-products from other corporates. This effects spans across the entire value chain, from the retailer to the early stage supplier

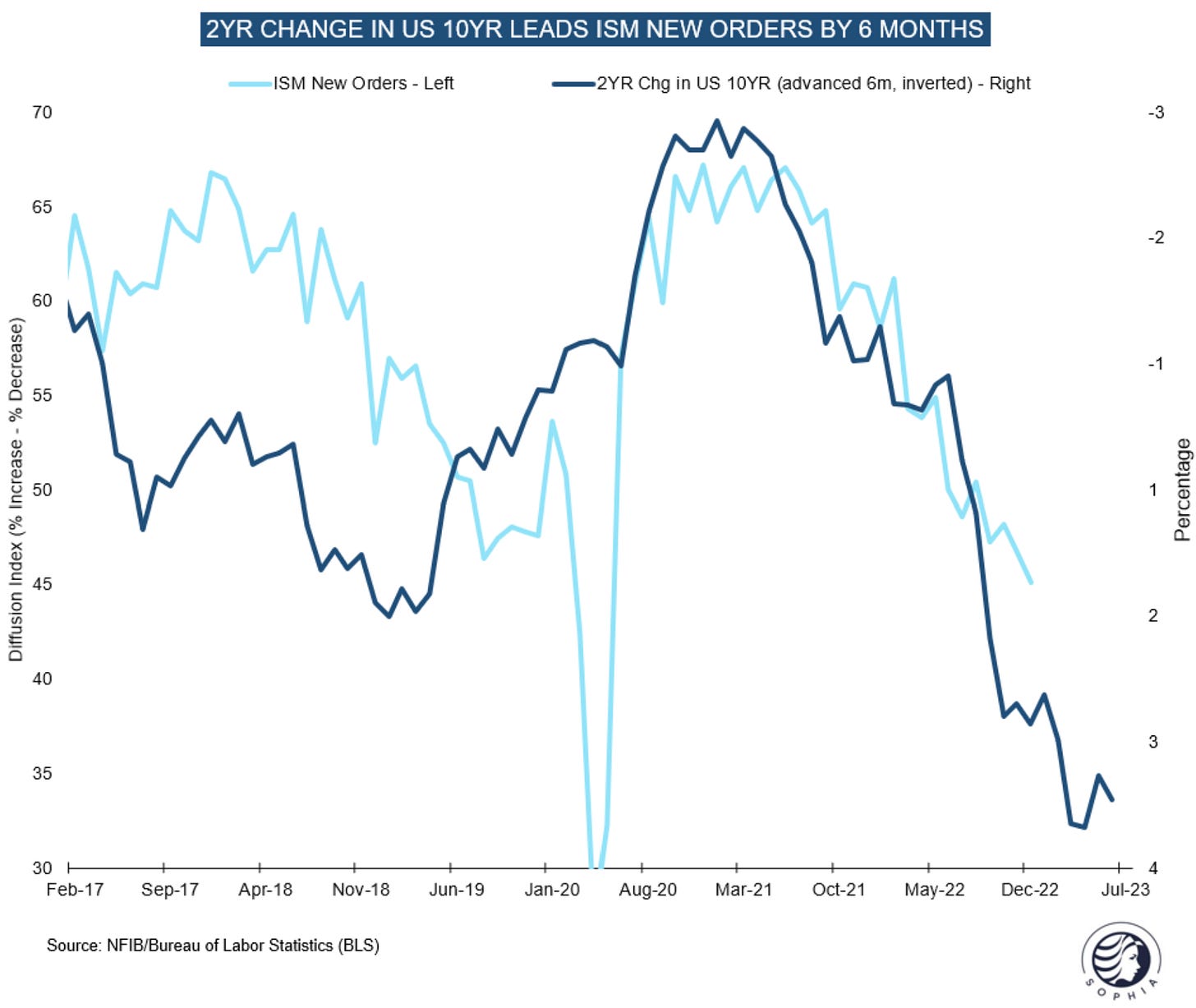

These “new orders” are tracked in various purchasing manager surveys. As shown in the chart below, they have fallen off a cliff (dark blue line)

Fewer new orders across the corporate world means less business. Accordingly, a decline in corporate profitability is in the cards. Profits follow new orders with a ~10 month lag (light blue line)

Current earnings season commentary confirms this prediction, from Dow Chemical to Microsoft, Intel or Union Pacific Railways. Importantly, the trend is still amplifying. Just take yesterday’s Dow Chemical’s results as an example: The company guided for “things to get worse sequentially”, with “continuation of de-stocking pressure”. The market expected stabilisation. Keep in mind, chemicals are inputs for much industrial production; they lead the value chain and thus the economic cycle

Now, you may ask, why is manufacturing so important given it is only a small part of the economy, with most of it services. First, many services businesses are in fact cyclical and their demand related to the businesses cycle, just think of Delta business class flights or Google Ads. Secondly, historically, swings in manufacturing alone were enough to cause recessions and corresponding declines in services spending. Someone laid off at Ford might get a hair cut less often than before, or downgrade their mobile phone plan. Please see “Consumer Cycle, Not Business Cycle” for details

Third - If their profits are under attack, how will corporates react? Most likely as they always have - with job cuts

I have long held the view that the job market is more robust this time around, as baby boomers retire and immigration slows. However, the data is unambiguous, and now more signs indicate layoffs ahead, such as material declines in overtime hours, temporary staff or manufacturing hours worked (see “The Most Important Chart for Markets”)

Small businesses employ half of American workers, as such the NFIB survey which asks their hiring plans contains important information on the future evolution of unemployment. As the chart shows, this lead variable with a historic correlation of ~0.8 predicts broad layoffs by Q2

Similarly, a recent survey by the National Association of Business Economics found that a higher share of businesses now intend to cut jobs vs hiring, a novelty since the 2020 Covid-lows

This is corroborated by a plethora of firms who announced layoffs with their earnings over the past week, including Microsoft, 3M, SAP, IBM, Ford, Kone or Hasbro

As mentioned recently, most open positions are in small enterprises. They have less buffer to weather downturns, so these open positions may disappear soon

Fourth - The slowdown is likely aggravated by the now very tight monetary policy

The relationship is very straightforward here. Many companies, especially SMEs, are highly levered

Typical corporate loan duration is ~5 years, and most loans have been made at rates much lower than today. The longer rates stay high, the higher the share of corporate debt to be refinanced at currently prohibitively high rates

Corporates react to this dynamic with cost cuts, which is one of several reasons why we see the relationship between higher interest rates and economic activity play out with a lag. The chart below depicts the correlation between higher interest rates and new orders, which point to weaker corporate activity into late 2023

More so, as the economy weakens, banks increase lending standards to reduce their risk of loan losses. This again makes it harder for companies to refinance, which is why I expect a significantly higher default rate over the next 6-12 months

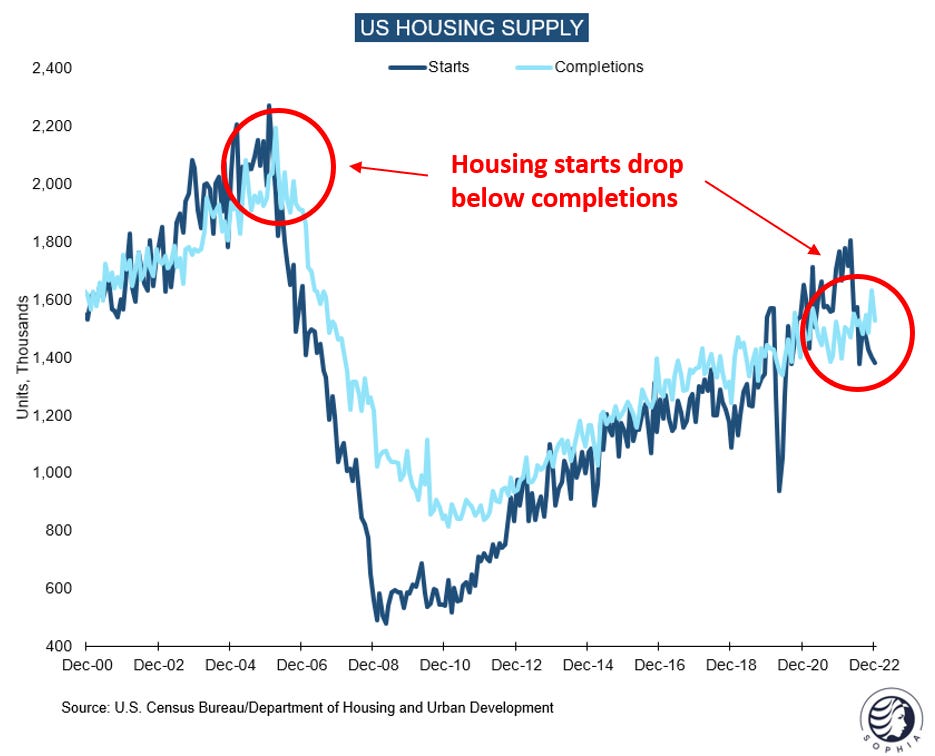

Fifth - Housing has slowed materially, but the effects on the economy are likely to hit only now

While home sales and house prices declined since Spring ‘22, construction employment actually held up, as housing starts grew faster than completions (suggesting more future work for builders)

This ratio just turned negative, and as such, builders are likely less busy going forward, with layoffs to begin now

Now, as the economy slows, long-term interest rates decline, making mortgages more affordable. Indeed, we have seen an uptick in mortgage applications in January

However, the hit to housing demand from a hard landing likely outweighs the boost from lower mortgage rates, so I do not expect a lasting turn around in the sector

Let’s summarise - we have five intertwined dynamics that increasingly weigh on economic activity

Depleting consumer savings

High inventories which lead to declining new orders

Declining new orders, which lead to lower corporate profits, which lead to layoffs

An interest rate shock that forces levered corporates to cut cost, which amplifies the above dynamics

A slowdown in housing that reached an inflection point

Regular readers will be familiar with my cyclical view of the economy (see “Consumer Cycle, not Business Cycle”). Therein, we now likely enter the steeper stages of the cycle’s down leg

Where things get spicy is when we look at the monetary policy stance into this cliff edge

The Fed’s very belated aggressively hawkish stance led to a rapid contraction in the monetary base in the second half of 2022, which aggravates all the dynamics outlined above

Why? Because in a recession everyone is scrambling for liquidity, from households to corporates and governments (lower tax intake!)

Therefore, Central Banks traditionally expand liquidity at this stage of the cycle. Even the Fed’s much-lauded role model Paul Volcker had in 1981 already cut rates, when lead indicators declined as much as they did now. Today, the Fed is still hiking

It seems highly likely to me that a course correction soon follows, with rate cuts and a return to QE later in the year

Finally , should I be right with the views expressed in today’s post, we will have seen the third major Fed policy mistake in as many years

First, it overstimulated the economy and created inflation. Second, it waited way too long to fight to inflation. Third, it now likely overtightens into a deep downturn

What does this mean for markets?

As always, below is my personal attempt at connecting-the-dots for my own investments. Please keep in mind - I may be totally wrong, nothing is more important than risk management, and none of this is investment advice

Equities - As in laid out in the two previous posts, I’ve held a constructive view on equities since the start of the year. However, regular readers will know that I track a variety of positioning metrics to judge where the majority of market participants stands. Many of these are now in extended territory, such as the NAAIM active manager survey depicted below. The market’s narrative has shifted to expectations of a soft landing, with many expecting a new bull market as various S&P 500 trendlines such as the 200-day moving average are breached. Historically, markets did poorly when the economy deteriorated as laid out in this post. Together with now one-sided positioning, that gives me reason to expect market weakness ahead, as such I am short equities again, with emphasis on cyclicals and sectors with high US consumer exposure

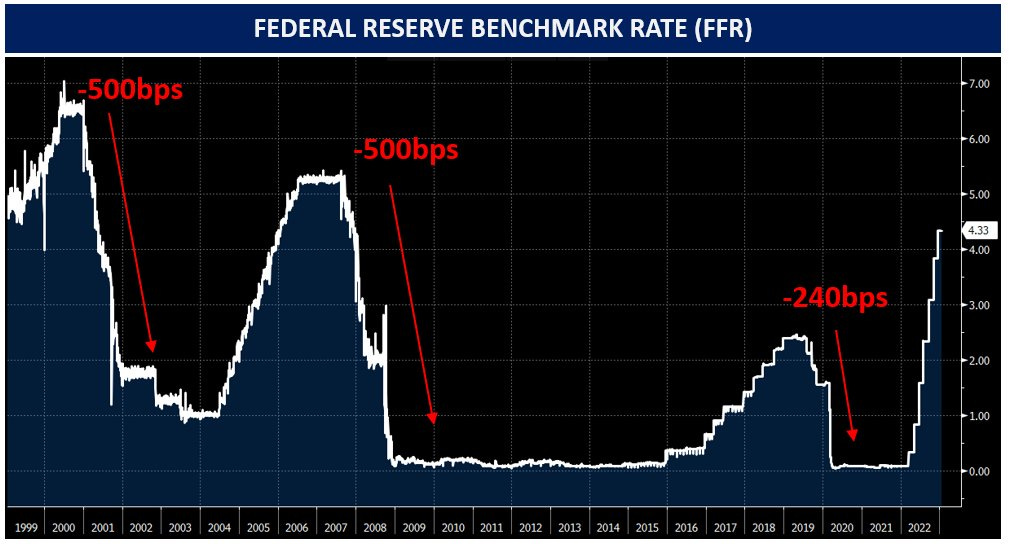

Bonds - In a hard landing, US Treasuries will be bid in a flight to safety. After a strong start to the year, they have now consolidated, so I’ve taken the opportunity to re-established longs, in particular in TLT (20-30 year treasuries). I also want to point out the following: The market assumes a Fed Fund Rate of ~4.5% at year end (vs 4.5% today). Given what I believe is about to unfold, I find that highly unlikely. In the past three recessions, the Fed cut between 240-500bps, and in the past two it cut to the zero bound. SOFR December ‘23 or March ‘24 96 or 97 call options offer a way to express this view, as do long positions in 2-Year Treasuries

Bitcoin - I think Bitcoin sells off if/when “risk off” returns, a period where US Dollar cash and Treasuries are typically most coveted. However, it could be one of most attractive assets once the Fed not only cuts rates but also returns to QE, for which I frankly currently see no other way

Credit - As outlined above, both credit spreads and defaults likely increase materially in the coming quarters. This as many have piled into this asset class again. I would be very careful here

Commodities - Please keep in mind, commodities are cyclical, and while many commodity investors are laser-focused on the supply side, given their price inelasticity, small demand changes can cause large price swings. As such, I would be cautious on the sector that had a big run following China’s reopen, a trade that now feels somewhat tired. I believe commodities will be back to shine when the Fed returns to QE, where both an upward inflection in economic activity as well as ample liquidity likely unite to a very supportive background. This could be toward the end of the year

My broad view remains the same. US-Dollar cash pays 4.5% interest with positive real rates. For anyone looking for a stress-free way to invest, this is a much better offer than being trapped by bulls and bears in equities, which historically only ever turned shortly before the economy improved

DISCLAIMER:

The information contained in the material on this website article reflects only the views of its author (Florian Kronawitter) in a strictly personal capacity and do not reflect the views of White Square Capital LLP and/or Sophia Group LLP. This website article is only for information purposes, and it is not intended to be, nor should it be construed or used as, investment, tax or legal advice, any recommendation or opinion regarding the appropriateness or suitability of any investment or strategy, or an offer to sell, or a solicitation of an offer to buy, an interest in any security, including an interest in any private fund or account or any other private fund or account advised by White Square Capital LLP, Sophia Group LLP or any of its affiliates. Nothing on this website article should be taken as a recommendation or endorsement of a particular investment, adviser or other service or product or to any material submitted by third parties or linked to from this website. Nor should anything on this website article be taken as an invitation or inducement to engage in investment activities. In addition, we do not offer any advice regarding the nature, potential value or suitability of any particular investment, security or investment strategy and the information provided is not tailored to any individual requirements.

The content of this website article does not constitute investment advice and you should not rely on any material on this website article to make (or refrain from making) any decision or take (or refrain from taking) any action.

The investments and services mentioned on this article website may not be suitable for you. If advice is required you should contact your own Independent Financial Adviser.

The information in this article website is intended to inform and educate readers and the wider community. No representation is made that any of the views and opinions expressed by the author will be achieved, in whole or in part. This information is as of the date indicated, is not complete and is subject to change. Certain information has been provided by and/or is based on third party sources and, although believed to be reliable, has not been independently verified. The author is not responsible for errors or omissions from these sources. No representation is made with respect to the accuracy, completeness or timeliness of information and the author assumes no obligation to update or otherwise revise such information. At the time of writing, the author, or a family member of the author, may hold a significant long or short financial interest in any of securities, issuers and/or sectors discussed. This should not be taken as a recommendation by the author to invest (or refrain from investing) in any securities, issuers and/or sectors, and the author may trade in and out of this position without notice.

While there is some boost to consumer earnings from the inflation-linked January reset e.g. in social security benefits or minimum wages, many bills also step up with the New Year. Either way, any increase in real income corresponds to a decrease in corporate profitability, to which these likely respond with cost cuts, including layoffs

as always, excellent analysis, Florian

Nice analysis, thanks for the article.