Before getting into detail: please continue to consider donations. Two million Ukrainians are displaced, thousands are dead, homes and infrastructure are destroyed. You can find the link to UNICEF Ukraine again here

I had written this past Friday that a cornered Putin faces no good options. The next few weeks would show whether he’d take the “rational” route and seek a ceasefire, or the “irrational” route, fighting all the way to the end - his very own end

Things continue to evolve very fast, so I am sending this post in close sequence. I believe there has been movement on the Russian side, toward the “rational” route. Connecting the dots, I believe we may be close to a ceasefire, maybe even this week

The case is laid out below

It has only been four days since the last update, what has happened since that would cause this movement? A brief recap in two steps:

1 - The extent of the huge economic damage is becoming more palpable

This is true not only for Russia…

As discussed, the Russian import of Western products has ground to a halt, from BMWs to Microsoft Office, Airbus or Nike. This be it through sanctions, or through companies “self-policing”

The lack of spare parts, together with the cut-off from international capital market means the Russian economy faces a crisis that rivals the implosion of the Soviet Union in 1991. Aluminium oligarch Oleg Deripaska summarises the situation to be “three times” worse than the 1998 economic crisis that led to Boris Yeltsin’s eventual demise

… but also for the world economy

Sanctions and self-policing have also removed the biggest commodity producer from world markets overnight, from aluminium to nickel, oil or neon

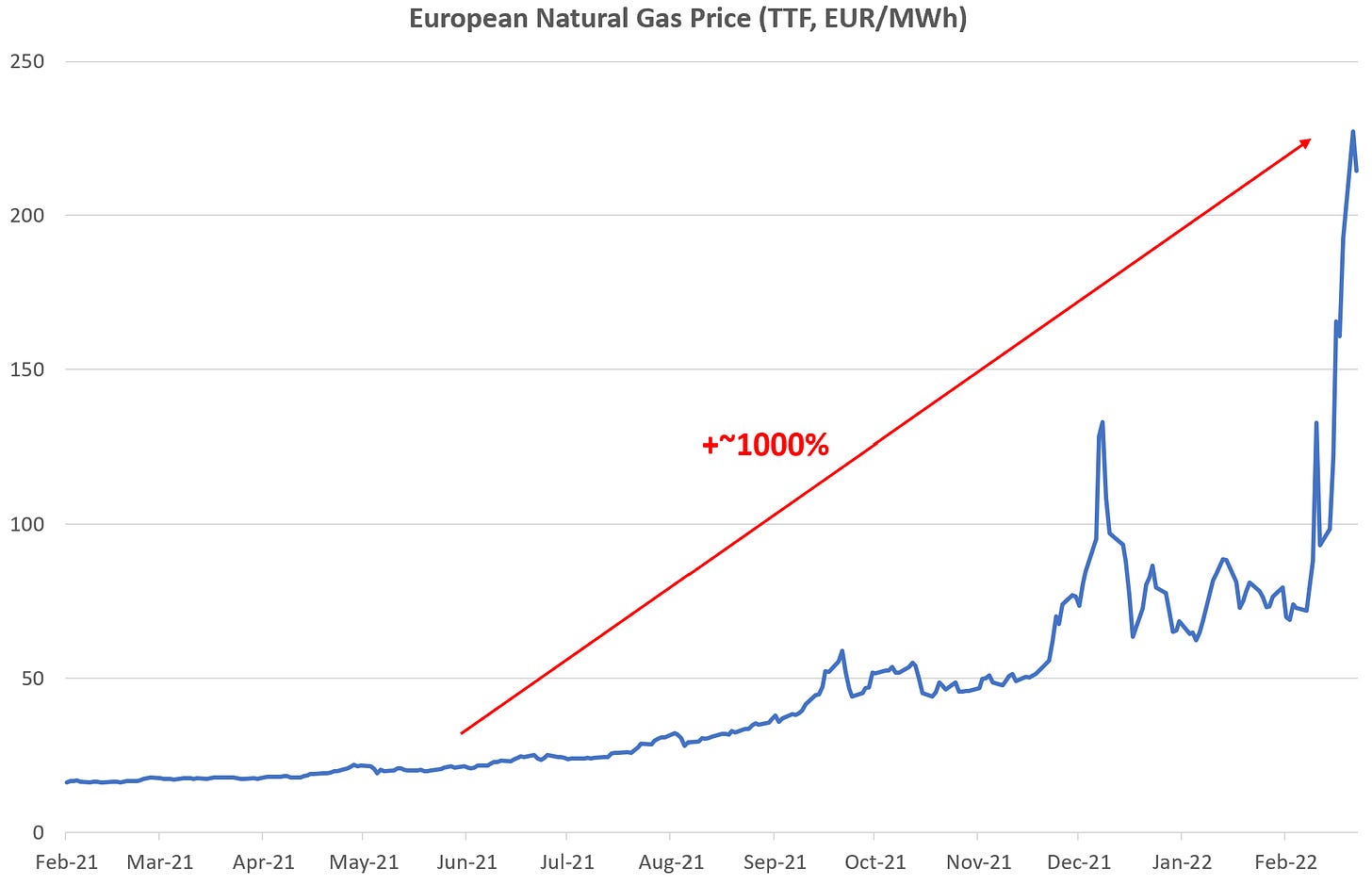

The reaction has been nothing but drastic. Commodities are inelastic goods, if supply is reduced, prices go to extreme levels before demand adjusts. On Monday morning, European gas prices went to 600€boe, from 45€boe a year ago (!)

With prices literally “off the charts”, demand adjusts in painful ways. How? Governments and companies move to ration whatever supply can be provided, a war-time measure

Shell yesterday rationed heating oil sales in Germany, an move last seen during the 1970s oil crisis

The CEO of French energy company Engie warned that gas would have to be rationed next winter. Minister for the Economy Bruno Le Maire went on television this weekend to ask French citizens to conserve energy.

Supply chains are heavily affected, they face disruption not seen since the Second World War

As discussed, for a just-in-time value chain, it only takes a few missing parts for everything to break down. Over the weekend, more companies came out with production stops, e.g. Michelin, Porsche or Wienerberger

As upsetting is the development of prices for several grains such as wheat, where the Ukraine and Russia command domineering market shares

Ukraine announced over the weekend it will halt exports of many food staples and limit exports of others

If Odessa is conquered, the country couldn’t export much anymore anyways. 60% of exports of export pass through the coast with the main ports Odessa and Mariupol (which is already cut off)

Escalating food prices caused the Arab Spring. Compounding this, there is a drought in China and Brazil, increasing local import needs. There is already famine in Ethiopia, what more will come?

Keep in mind, with fertiliser shortages and Ukraine a warzone, the current crop will yield much less, even if the war ended tomorrow

If there is no peace, both the Russian and the world economy will face an enormously challenging period ahead

2 - The past weekend was full of bad news for the Russian military

Since Friday, there have been no territorial gains. Instead, the Russian army was thrown back in various places such as Mykolaiv on the way to Odessa. It lost a significant number of fighter planes and helicopters. A high-ranking commander was killed near Kharkiv

The notorious 40km long column of army vehicles outside Kiev is frequently being ambushed, it’s turning into a gigantic metal graveyard. There are historical parallels for this kind of military disaster - the “highway of death” in Kuwait 1991 and the botched Allied landing north of Rome at Anzio in 1944

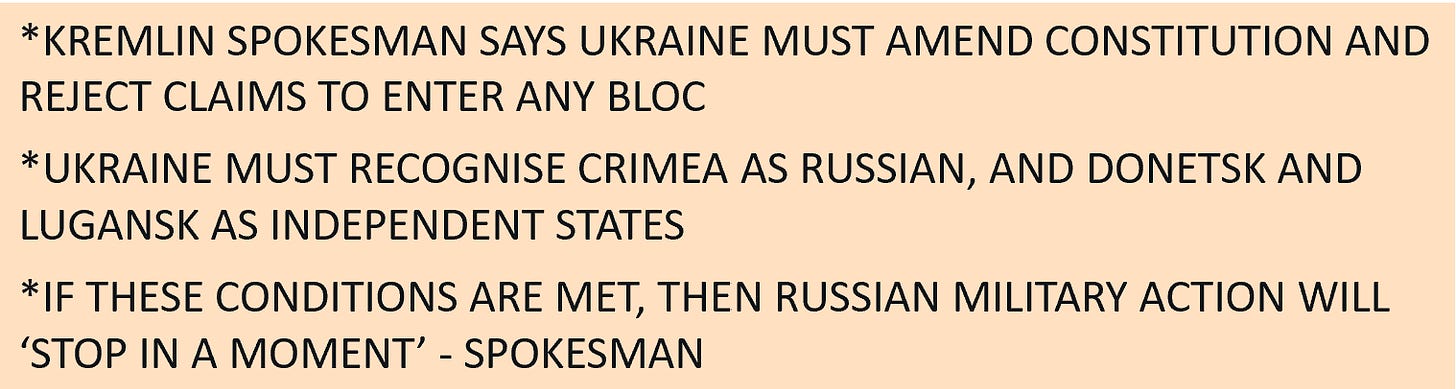

Into this context, these headlines hit the tape on Monday, following a press conference by Kremlin spokesman Dmitry Peskov:

It’s the first time Russia has been specific with its demands, and the previous language about regime change (“denazification”) and “demilitarisation” is conspicuously absent

Let’s walk through these two main demands1

Ukraine not enter any block: This is obviously aimed at EU- and especially NATO-membership. A compromise seems possible. In fact, the Ukrainian negotiator declared this weekend that the country was open to “non-NATO models”

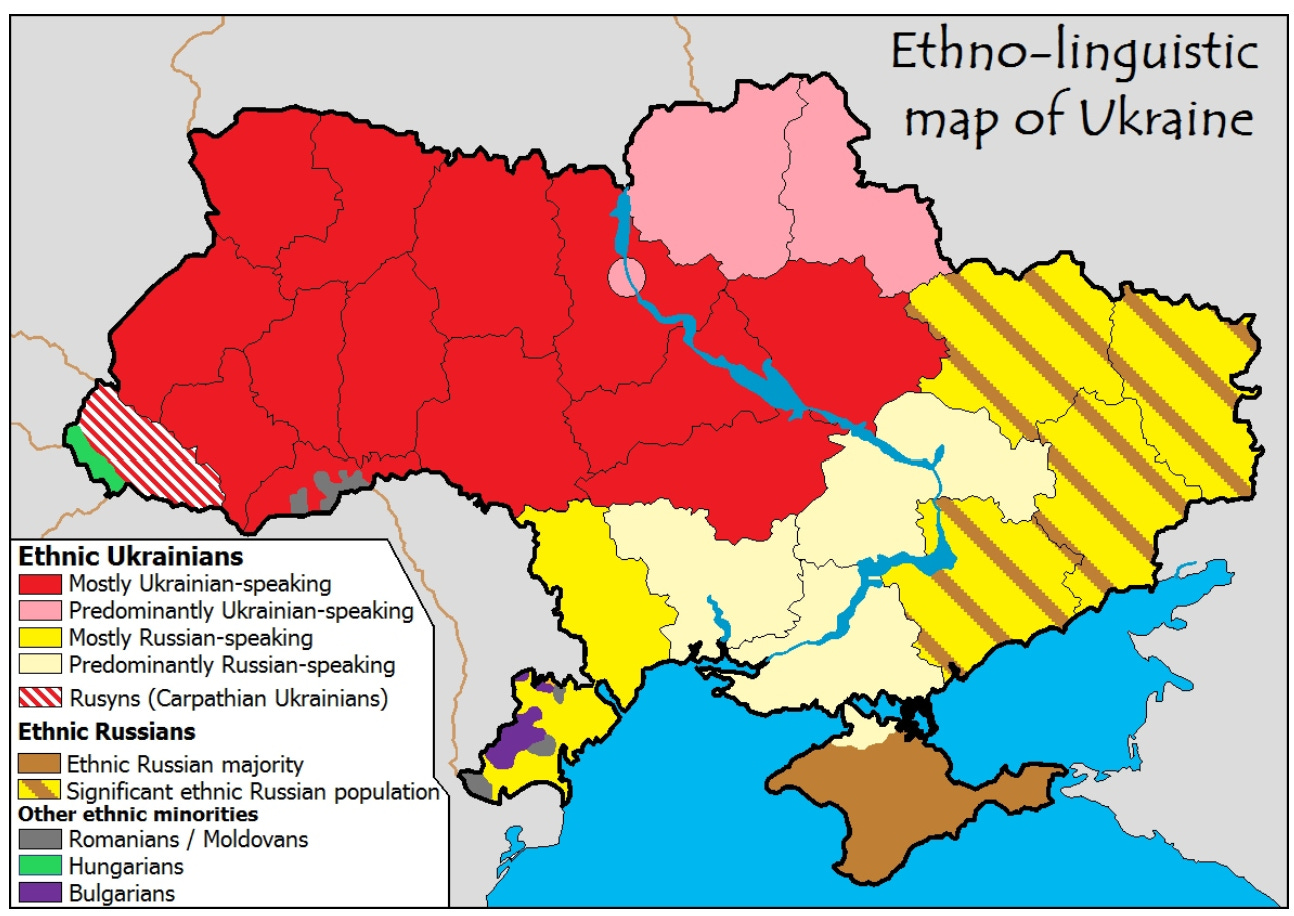

Recognise Crimea, Donetsk and Luhansk: Donetsk and Luhansk are under Russian occupation since 2014. Crimea’s population is by vast majority ethnic-Russian (see map below). Again, a compromise seems possible. President Zelensky stated in an ABC-interview today that “we can discuss

and find the compromise on how these territories will live on”

On this basis, a compromise seems possible, even if it’s difficult

Given the disastrous state of Russia’s military campaign and the suffering of their country, Ukrainians may want to push for more. Russia has shown its hand as warmongering, so why trust it with anything unless its political leadership changes

However, continuing the war would also mean thousands more innocent victims. The international sanction toll also grows by the day, so expect Ukraine’s NATO counterparts to press for a deal once a compromise is in sight

Part of any deal will have to be an unwind of sanctions. Why? Because they kill global GDP, they hurt the poorest around the globe the most (see wheat above), and if they are maintained, why would Russia stop? This unwind may occur in steps, with some sanctions upheld until the regime changes

Two further datapoints lead me to believe that negotiations may be much further than the Western public realises:

This Thursday, a meeting in Turkey is scheduled between the foreign ministers of both countries, Lavrov and Kuleba. This is a higher level negotiation than the previous talks in Belarus, which indicates progress

Further, an article appeared in the Jerusalem Post (a reputable source), stating that negotiations between Russia and Ukraine may actually be quite advanced, following feedback from Israeli PM Naftali Bennett’s trip to Moscow on the weekend (which was initially reported as fruitless)

Summary: A ceasefire may be close. A historical reference comes to mind: In the 1939/1940 winter war between Russia and Finland, Russia experienced a disastrous campaign with 10x as many casualties as the brave Finns. The war ended with some territorial concessions by Finland, after Stalin realised that any further gains would only be possible under further enormous losses

The sad part of the story is that none of this will do anything to bring back the victims of the conflict. A lot of damage has been done, and the cry for revenge and reparations will last for decades. As discussed in the last post, Putin is extremely damaged, whatever the outcome

What does this mean for markets?

A ceasefire and subsequent peace deal will provide a short-term reprieve for markets

With its export-heavy orientation and obvious European focus, the German index DAX provides the most direct exposure to a potential solution, and it is down 20% from its recent peak

However, medium-term, the structural picture for asset markets has worsened. The crisis emphasised inflationary dynamics I’ve frequently discussed before (here or here). The upward pressure on interest rates and corresponding downward pressure on asset prices likely continues

De-globalisation will only accelerate. Supply chains are brought home, which drives up cost

Geopolitical mistrust will lead to a desire to diversify or replace commodity sources, which drives up cost

More so, corporates will hold more inventory to buffer future crises, which again drives up cost

On Friday, I mentioned Oil services (ETF:OIH) and highlighted the change in tone for Western oil production, with the CEO of shale-player Pioneer as example

This past weekend, Elon Musk demanded an increase in US oil production with national security as concern. Given he’s the CEO of an electronic vehicle manufacturer, it’s telling how the debate has shifted

As the oil price curve for 2023+ has moved up, shale producers are now locking-in these prices via hedges, which provides them with cash-flow certainty to increase production

While OIH has rallied hard since Friday, it likely cools off over a ceasefire. However, medium-term, these weeks will have changed the game for oil field services

This is also true for Renewables, in particular US solar (ETF:TAN), which has the easiest avenue to growth (high sunshine hours, less intrusive than onshore wind)

A demand that wasn’t published but apparently also part of the negotiations was to keep Zelensky as President, but install a Russia-aligned prime minister alongside him