Hot, Hot, Hot

A brief update following yesterday's inflation data

Yesterday, the US issued inflation data for January. The data continues to confirm the tremendous risk to markets I’ve outlined since the Fall, and it increased the need for urgent action

This post briefly walks through the main highlights and summarises their implications

While the 7.5% year-on-year headline number caught much attention, the most important datapoint was the month-on-month “core inflation” - it’s the live snapshot, rather a look back into last year

For this, the market expected a sequential slowdown to 0.4% or ~5% annualised, with peak inflation thus in the rear mirror. But the “core” accelerated to 0.6% between December and January, an annualised pace of >7%

More so, it broadened substantially, as can be seen in the grey “Other” column, which includes everything but pandemic-specific items

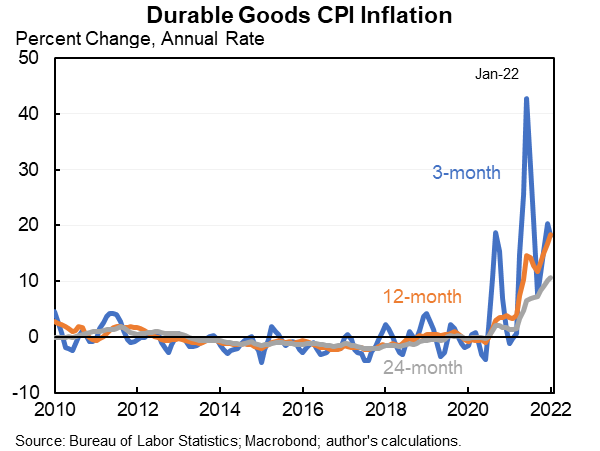

Looking further, while sharp price increases in Goods have extensively been discussed…

…it’s Services that are concerning. Services are a 5x bigger part of the economy than Goods. They are mainly driven by domestic labor costs, not supply bottlenecks abroad. Services inflation is accelerating1:

Keep in mind, this is even before the economy fully reopened. Services demand is still running below pre-Covid levels

As restrictions expire, expect demand to surge, putting more pressure on prices for the category2

Summary: January’s inflation data is bad and broad. There is little hope for it to come down without intervention, and many signs point to a continued acceleration

Now, what’s driving this recent acceleration?

As discussed before, it’s the red-hot US labor market. The ratio of unemployed-to-vacancies, which has historically been the best predictor of future inflation, is as tight as never before:

The US is in a classic price-wage spiral. Additional data corroborates this conclusion:

On rising wages: The Atlanta Fed wage tracker rose 5.1% in January, up from 4.5% in December. Hourly earnings in January’s NFP report rose >7% annualised

On rising prices: Earnings calls this quarter were full of CEOs stressing their businesses’ pricing-power in light of cost increases (such as 3M, Tyson, McDonalds, Kimberly Clark etc). This excerpt from an interview with the CEO of Carrier (an aircon manufacturer) is a good summary:

Employees achieve big wage increases, companies have no issues passing these on via price increases = price-wage spiral

With the January data, the pressure to act has massively increased. It hasn’t escaped the Fed:

St. Louis Fed governor James Bullard yesterday shocked the market with demands for an aggregate raise of 100bps by July, including raises between FOMC meetings, and a start of Quantitative Tightening (QT) next quarter

He is right. The longer the Fed waits, the more inflation accelerates, the more painful the remedy

And because the sensitivity of the economy to interest rates has gone down (see this previous post), the reaction needs to be more forceful than markets expect

The conclusion remains the same as laid out in previous posts. I’ve summarised the main points again below:

The Fed has to slam on the brakes (= increase interest rates and conduct QT), likely harder than the market thinks, because the economy has become less interest-rate sensitive

This is negative for all asset prices, with few places to hide

Cash is king, and in a declining asset price environment cash does not lose its value

Uncorrelated strategies with some yield can provide a safe haven in the interim

Over the past 60 years, inflation has never been tamed without a recession. Accordingly, the probability for a recession in the next 6-18 months is high. While the “old economy” likely does well in this inflationary environment, they will get hit in a recession. Keep this in mind with any commodity, bank or other cyclical exposure

There likely is risk to corporate earnings from some of the exuberances in private markets, especially in Tech. This may only show with some delay

All of the above likely means a turbulent period ahead, with dislocations likely. These will present opportunities to deploy capital that is now saved

We’re in a bear market, which is a very tough environment to trade. Liquidations and relief rallies alternate in unexpected ways. For active traders or market shorts, this means to keep leverage low and take trade frequency down

Medium-term I expect structurally higher interest rates, as de-globalisation and less immigration lead to tighter labor markets

These views could be wrong, in particular if:

Inflation comes down for unexpected reasons. Monetary dynamics are complicated. The relevancy of some drivers may turn out to be different than expected or new drivers could emerge

The Fed remains behind the curve. However, as mentioned, this would only lead to a delay of the same outcome

The Fed achieves a soft-landing. Some in the market make the analogy to 1994, where Greenspan raised interest rates aggressively, but the economy and the stock market continued to do well. However, he did this before inflation emerged

Services also include cost of shelter, which last week’s post was dedicated to. Housing inflation will continue to increase over 2022/23 as an average ~15% rent increase is rolled over into expiring rental contracts