Inflation and the Serf-Economy

How deep economic imbalances triggered an over-reaction and what's next

We are facing a period of painfully higher inflation as a result of excessive stimulus programmes in the wake of COVID-19. This will have deep repercussions on the economy and financial markets. The below shines light on the background for this development as well as its consequences

In a moment exemplary for our times, this recent viral video shows a Grubhub driver in the trendy NYC neighborhood Williamsburg who wades through hurricane Ida to deliver dinner to the app’s customer:

The video, which has been watched more than 12 million times, is symbolic for what could be called the “serf-economy” - a hallmark of the economic structure of the past decade with its ultra-low interest rates, globalization and rising asset prices

It alludes to a labor market split into a large lower segment where wage-bargaining power is absent in light of global competition. They serve a small upper segment that benefits from strong demand for skilled labor and rising asset prices

New business models adapt to this new form of capitalism. They are financed by ultra-low interest rates, only reach profitability at market-leading scale, and pay most employees minimum wage (Amazon, Uber, Grubhub etc)

Over the years, this and many other unhealthy dynamics of the ultra-low interest world left their mark in several ways:

Real wage growth has stalled for the largest part of the population since the mid 1970s

US life expectancy has stagnated and since 2014 even reversed, in contrast to most other OECD countries

As a consequence, the political climate has become much more radical

In light of this, a broad backlash formed across the political spectrum. Political assumptions changed, in particular along these three dimensions:

De-globalisation: A free world market is no longer seen as universally positive. Trump’s trade war with China (which is continued by Biden), Brexit, and re-shoring initiatives all aim to reduce competition for the domestic labor force

Deficit spending: Concerns about deficit spending are no longer relevant, with the highest government deficits since the second world war. Both Republicans and Democrats underwrote significant debt-financed increases in expenditure

Central Bank policies: With price stability historically the primary focus of central banks, the focus has moved to employment. The Federal Reserve now explicitly states full employment in every social segment as part of its mandate

This is the political context that both allowed for the unprecedented measures during COVID-19 and now contributes to the inflationary pressures

With the context in place, let’s come back to inflation:

Inflation happens when there is more demand than supply for goods and services. Prices increase to balance the market

This can occur when extra money has been added to the economy.1 It can also occur when supply is impaired e.g. because factories cannot operate

If there are drastic changes on either side, one speaks of a demand-shock or supply-shock

The political paradigm shift, combined with COVID-19, laid the groundwork for both a demand- and supply-shock

First, let’s look at the demand side

As discussed last week, US government support over the past 18 months was 6x larger than during the 2008/09 crisis, amounting to 30% of GDP. However, COVID-19 caused much less structural damage to the economy. While the reaction of 2008/9 was probably undershooting, politics now overcorrected and massively overshoot

The chart below illustrates direct transfers from the government to the private sector since 2006. It also overlays the amount of bonds bought by the central bank over the same timeframe

To call a spade a spade, it is not coincidental that both lines resemble. This is the dreaded debt monetization, where central banks print money to fund government expenditure. In the past this has always been inflationary

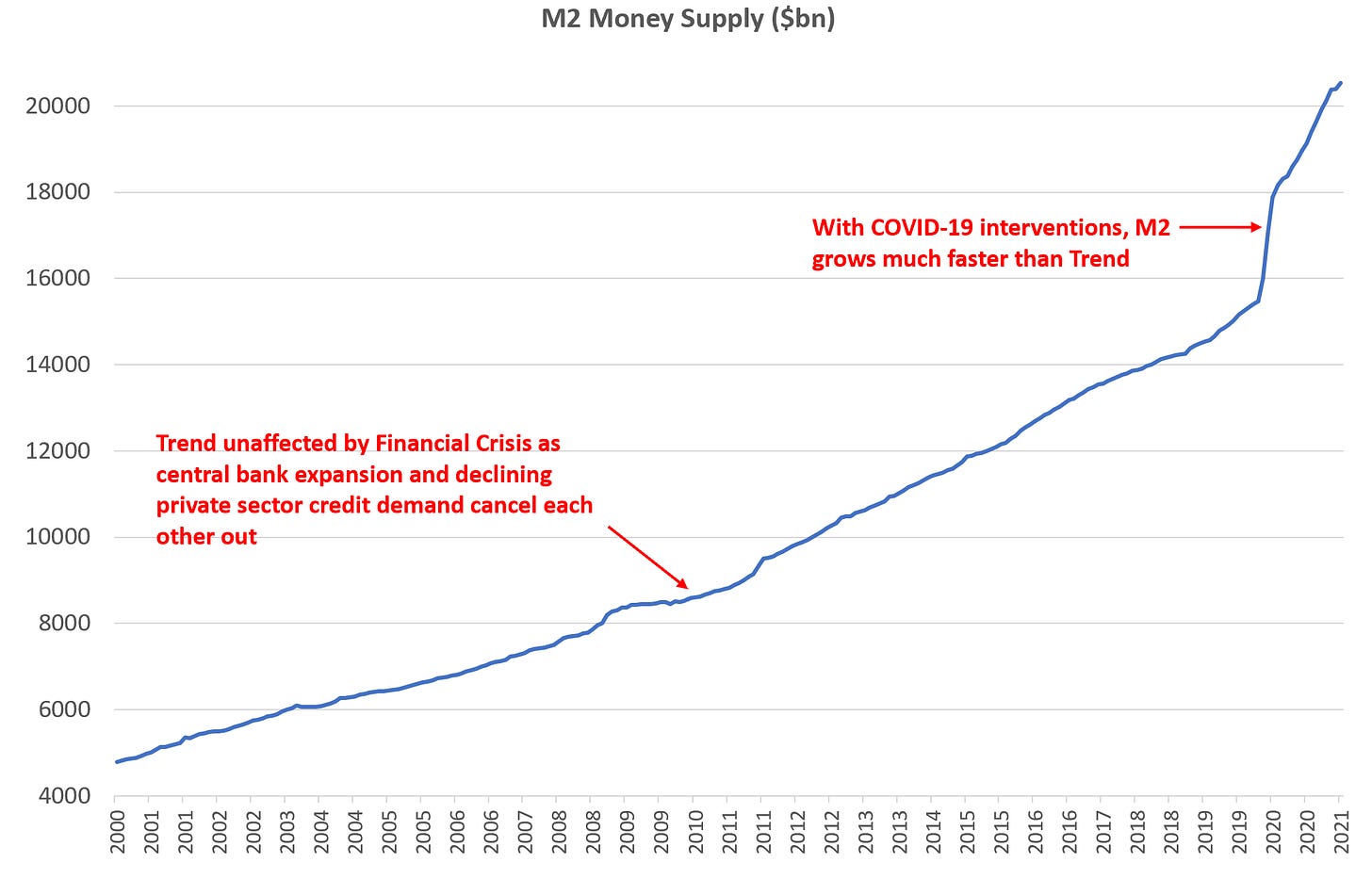

Measuring the amount of money in the economy via a metric called M2, the results of this splurge are again very visible in the chart

Let’s turn to the supply side:

Labor market: As discussed last week, the labor market is now very tight, despite still elevated unemployment. Walmart just announced its third wage increase this year. This is a structural shortage that will remain once COVID-19 is resolved

Political decisions: The new “cold war” with China has implications on many levels. For example, it reduced the number of semiconductor providers for Western customers, taking Huawei and SMIC out of the equation (=less supply). Western companies will feel less comfortable to build export-capacity in China than in the past. Brexit shows similar dynamics on a smaller scale, as the reservoir of suitable workers has been deliberately shrunk. These are also structural shortages that will remain once COVID-19 is resolved

Delta-variant: With China’s zero-COVID-19 policy, any local flare-ups result in factory or port shut-downs and temporarily create bottlenecks. This will be fixed once COVID-19 is resolved

Unsurprisingly, with ample cash in the system and shortages all around, businesses are jacking up prices at a pace last seen in the highly inflationary late 1970s

One can look at hundreds of metrics or run big, complicated models. But in the end it is very simple common sense:

There is now a lot more money in the economy than pre-COVID-19. However, supply hasn’t increased in the same way and won’t for the foreseeable future. Accordingly, prices go up

What are the consequences from this development?

Continuous high inflation is both very painful for low income earners and runs the risk of getting out of hand in self-reinforcing spirals. It’s no coincidence that Western central banks have price stability as part of a dual mandate

Inflation has a debilitating effect on consumer confidence, which is already well visible and will create pressure to act as the dynamics intensify

In an ideal world, the Fed would act soon, abort its bond buying programmes (QE) and increase interest rates

However, the high debt load on all sectors of the economy and in particular the government creates a high risk situation

Withdraw stimulus and increase rates too fast, and the economy won’t be able to handle the increased cost of debt and the market crashes

We are in a situation with little margin for error and a high risk of policy mistakes in either direction. In my view, the most likely scenario is that the Fed eventually reacts to higher inflation numbers, but remains behind the curve for a while

So the most likely path for inflation is higher. What does that mean for financial markets?

Bond yields should increase from current low levels which imply a disinflationary world. As all assets are priced of “risk-free” US government debt, this will shake things up across the board

Equities: In the near term they probably do well, lead by cyclicals and commodity stocks. In the medium term, there is tremendous risk down the line if the Fed is forced to raise rates faster than anticipated

High growth equities/VC: The current nosebleed valuations are incongruent with higher bond yields, nominal or real. This area is very, very vulnerable and very crowded

Cryptocurrencies: Bitcoin shares the same characteristics as gold and has now been broadly accepted as an inflation hedge. However, the entire sector is also ground zero for the most speculative, high risk assets that again will be very vulnerable to higher bond yields. Solana, which I highlighted in April, is up 7x since then. It is frankly unclear to me how this will shake out, my best guess is that the liquidity drain from higher yields will prevail

Real estate: Historically the strongest inflation hedge, this highly levered sector will this time face the crosscurrent of higher rates that make mortgages more costly

Europe: Inflationary pressures will present a big challenge for Europe, as they affect the Northern states much more (Inflation currently runs at ~3% in the Netherlands and Germany and ~1% in Portugal and Greece). However, higher interest rates to combat inflation will affect the South the most. How will the ECB react if inflation increases from here?

Gold: As inflation hedge with the longest history, Gold should do well if the Fed remains behind the curve, particularly in light of its underperformance since the beginning of the year

As you can tell from my recent writings, for my own investments, I focus on a contrarian investment style looking for opportunities in oversold conditions such as Chinese internet. However, I did buy gold recently to hedge against the risks outlined in this post

A final word: In terms of government support during COVID-19, the first round in 2020 was probably justified. No one knew what was coming or how quickly the world would bounce back, and many people found themselves in very difficult situations. The second round this year, another 15% of GDP in form of mostly direct transfers (stimulus checks, benefits etc.) into an reopened economy was just too much. A better form of support would be investments that raise the economy’s long-term potential. Money spent on better education, infrastructure etc. would yield returns for decades to come, without inflationary side-effects

To be precise, money is usually added to the economy via credit creation. Banks hand out new loans to the private and public sector, this money is newly created. Equally, repaying debt destroys money. This is why periods in the wake of burst credit bubbles are deflationary, everyone is busy repaying and not interested in assuming new credit