On Crypto

Checking in on the state of the industry, and what that means for markets

The Crypto industry continues to polarize. Believers laud its transformative potential and individual empowerment in light of unhinged governments. Sceptics see an industry hijacked by ruthless promoters who would sell anything, taking advantage of gullible investors with FOMO about the future

The truth, as often, may be somewhere in the middle. But for now, the outlook for Crypto is likely bleak. This post aims to explain why and what might be next. As usual, it closes with an outlook on markets

Over the past weeks, the $60bn collapse of Terra/Luna has sent shockwaves across the industry. Within that, two headlines took my attention:

First: It appears that Terra operators allowed several large holders (~$2.7bn) to exit the token at face value, while retail holders were wiped out. It turns out, just as in the “centralised” world, not everyone is equal

Second: Ethereum co-founder Vitalik Buterin called for Terra smallholders to be made whole, citing the $250k FDIC guarantee for bank accounts as precedent. The FDIC insurance is a key feature of today’s centralised financial system

With insiders bailed out, and calls for centralised support, it begs the question, what does Crypto truly stand for? Decentralization, Innovation, Store of Value? Today, this question matters more than at any point in the last 15 years. Why?

The reason has to do with the value of money. And today, and likely for the foreseeable future, money has become expensive

Mathematically, this is expressed in interest rates, which central banks around the world have raised to fight inflation

Practically, it is expressed in the need of more money for everyday needs

I want to illustrate this point with two examples:

First, from the US, where the CEO of Walmart commented how consumers now prioritise food and cut back on other products

Second, from Sri Lanka. Here, the situation is much more serious. Consumers aren’t just changing their behavior. The country has actually run out of fuel, and food stocks are dangerously low. The President calls for help:

Money has become scarce because it is needed for essential goods

When consumers don’t have enough money to buy food and gasoline, and when governments need to spend to secure these supplies, and to defend the supply against external threats, every expense, every investment is questioned for its utility

So the question arises, what is the utility of Crypto, what can it do? In an attempt to answer this, for the sake of simplicity, I’ve split the Crypto-universe into two halves

On the one hand, there is the Bitcoin-Story

Bitcoin is a tremendous macroeconomic innovation. It allows individuals to protect against monetary debasement, and with that is more accessible and transferrable than gold. So whatever your view is on the evolution of money supply, good or bad, Bitcoin provides a way to express that view

On the other hand, there is the Technology-Story

This is the story of everything Crypto outside Bitcoin, mainly decentralized applications that remove middlemen. It’s the story of DAOs, frictionless payments, in-game tools or decentralized cloud computing. It is sometimes referred to as “another layer of the internet”

Here sceptics argue, these applications mostly solve problems that are already being solved by traditional means

Personally, I have spend months looking for a real-world use case. Something that improves people’s lives, and is not already satisfactorily solved. I haven’t found a single one. Of course, that doesn’t mean they don’t exist, I may have just missed them. However, I’ve come across plenty of examples that promise much, but are very, very far from working as promised:

Bitcoin as a means of payment doesn’t work. It’s too slow, volatile and expensive, and its layer-2 solutions aren’t safe. FTX-CEO Sam Bankman-Fried, arguably the biggest voice in Crypto aside Vitalik Buterin, agrees

El Salvador has introduced Bitcoin as a means of payment, and the payment app Strike has made much noise. However, usage has plummeted since and El Salvador is on the verge of bankruptcy

Dogecoin consumes more energy than the state of Vermont. It has also caused huge losses for millions of retail investors. What is its purpose? Its market cap: $12bn ($120bn at its peak)

Solana aims to provide transaction speeds that exceeds Visa’s. However, it has been plagued by outages at a fraction of the supposed volume. Its market cap: $18bn ($100bn at its peak)

Ethereum promises to be a decentralized super-computer. A beautiful thought, yet it’s 1.6bn times (!) more expensive to run than Amazon’s AWS (see below). Its market cap: $260bn ($550bn at its peak)

Ethereum’s co-founder Vitalik Buterin, who in many public appearances has demonstrated an admirable humbleness and objectiveness, summarised similar concerns in range of tweets this week. He calls these concerns “contradictions” - this one in particular caught my eye:

With this, he addresses one of the biggest issues with decentralization. Collectives (or “DAOs”) have been around for centuries, but there is a reason why most organisational forms, from businesses to the military are structured in a centralised manner. If everyone has a voice, it slows things down, and the collective voice may not always be what’s right

I understand the beauty of NFTs, and their role in assigning a higher, fairer share to the originator of creative works. But again, there is a reason why creative industries have middlemen. Their services help consumers with choice

Many of us listen to music using Spotify on our mobile devices. It’s a great app and functions well. Spotify pays artists ~$0.004 per stream, a pathetic number it seems. But looking at their financials, they barely break a profit. It will be very hard for a decentralized challenger to offer the same quality of service to consumers and pay artists more

On Crypto-gaming, and people in Indonesia and the Philippines earning a living by creating in-game avatars for Western adolescents, to me this seems much more a COVID-19 stay-at-home dynamic than something that makes long-term sense

Aside from NFTs, the biggest potential for Blockchain appears to be in exchanges and settlement, where traditional methods remain anachronistic. FTX is a great exchange, could it emerge as rival to NYSE or NASDAQ? It’s certainly possible, and they did move into tokenized stock trading a few months ago. But keep in mind - while based on blockchain, FTX is a centralised business

Summary: Outside of Bitcoin, I struggle to find real-world use cases that improve everyday people’s lives

Returning to the scarcity of money, the current issues are still far from being resolved. Take gasoline in the US as example

With refining capacity permanently removed over COVID-19 and demand back to pre-pandemic levels, US gasoline inventories have been depleted to a seasonal multi-year low (see last post)

The summer driving-season is coming up, and existing capacity is maxed-out. So it seems likely that US gasoline prices will go higher, until consumers capitulate and drive less. Driving is an essential activity, from school runs to shopping, so that’s a painful point to arrive at

The only plausible relief could come from China, which has plenty of excess refining capacity. However, China has banned all refining exports at least until August. This is certainly no coincidence. I recommend this article on how China increasingly uses economic clout as a geopolitical weapon

Summary: In a world where money is expensive, Crypto faces a difficult outlook. Again, we can split this outlook into two halves

On Bitcoin:

Bitcoin is a macroeconomic instrument and its future path depends on central banks. We are past peak inflation, and the looming recession may be more severe than many expect, including central banks. In the near term, this argues for more near-term pressure on all asset markets, including Bitcoin

However, at some point, it may also herald a pivot back to loose monetary policy, which would in turn be supportive for Bitcoin

However, I would want to highlight three drivers that - in my view - lower the probability of this return to the monetary spigots:

First: Central Banks, like generals, are always fighting the last war. And the obvious learnings from the last war are that money printing and QE are a terrible idea

Second: While unemployment is very unfortunate, it only hits part of the population. Inflation on the other hand hits everyone. In a contorted dynamic, consumer confidence may increase from currently very depressed levels if unemployment increases, but inflation declines

Third: Gross leverage is indeed at an all-time high. However, this view excludes the enormous US private sector cash balances, which are the reason why we have inflation. After COVID-19, the US private sector has delevered and is in good shape (see this post for details), so the leverage issue may be smaller than expected. For Europe and the UK, it’s a different story

There is likely more downside for Bitcoin until central banks pivot. After that, it depends on what shape any pivot would take. I would not rule out an unexpected solution that deviates from historic playbooks of just more printing, given the recent negative experience

On the Crypto-Technology side, I think a lot more downside is likely

While the New-Economy bubble of 1998-2000 was driven by product innovation and occurred in-spite of high interest rates, the 2020/21 Crypto-bubble was driven by extremely loose monetary policy, and product innovation less obvious. I believe that most altcoins have downside to literally zero, I also think the downside in Ethereum is huge (see Vitalik’s comments above)

More fallout from the Terra/Luna collapse is likely. This may take months to materialise, keep in mind it took six months from the fire-sale of Bear Sterns to the collapse of Lehman. While Tether may not be the next domino to drop, I see uneasy comments from Binance and Celsius1

If more downside for Crypto materialises, while at the same time a deep recession occurs, I expect significant regulatory backlash once the dust settles. There will be many angry retail investors, the ESG issues look bad (see Dogecoin above) and the climate will be one of hunting for scapegoats

In my view, there is only one way for Crypto to prove its critics wrong: create real-world use cases that visibly improve people’s lives

What does it mean for markets?

While the Crypto downside is likely not systemic, any negative developments will temporarily weigh on markets. For now, however, we’ve likely seen a near-term top in bond yields, and inflation may surprise to the downside as economic activity declines fast than anticipated. This may provide some short-term supportive for equities, however, the medium-term remains firmly negative

While overall inflation may undershoot soon, some aspects of inflation remain very much an issue, see above’s discussion of US Gasoline. Cross-correlations always change, but for now, in my view, this is the most important metric to watch (XB1 for anyone with a BBG terminal)

With that in mind, these are my current thoughts:

Software (IGV) and Biotech (XBI) (see last post for details): These two groups have done well in a violent tape, which is a positive sign. I’m keeping recently acquired exposure, while being very cognizant of the fact that I may be too early, and too early is also wrong. For this I employ tight stops that I have now moved up, and I have also added Gasoline > 410$/bbl as exit signal

With a long-term view, the fundamental logic for Biotech remains compelling for anyone willing to stomach the volatility. Over 20% of XBI members trade below net cash value, and the sector is the prime avenue for Large-Cap pharma to replenish their R&D pipelines

This is different for Software, I’ve become more sceptical of their growth prospects following Cisco’s earnings, where customer orders declined which implies a slowing in cloud spend. This was also corroborated by comments from Coinbase, which intends to reduce AWS cloud costs

In general, Cisco’s CEO Chuck Robbins summarised the current state of affairs well:

This corresponds to analysis I laid out in a few weeks ago, including around growing inventory issues. It seems likely that the coming slowdown will be faster and harsher than expected

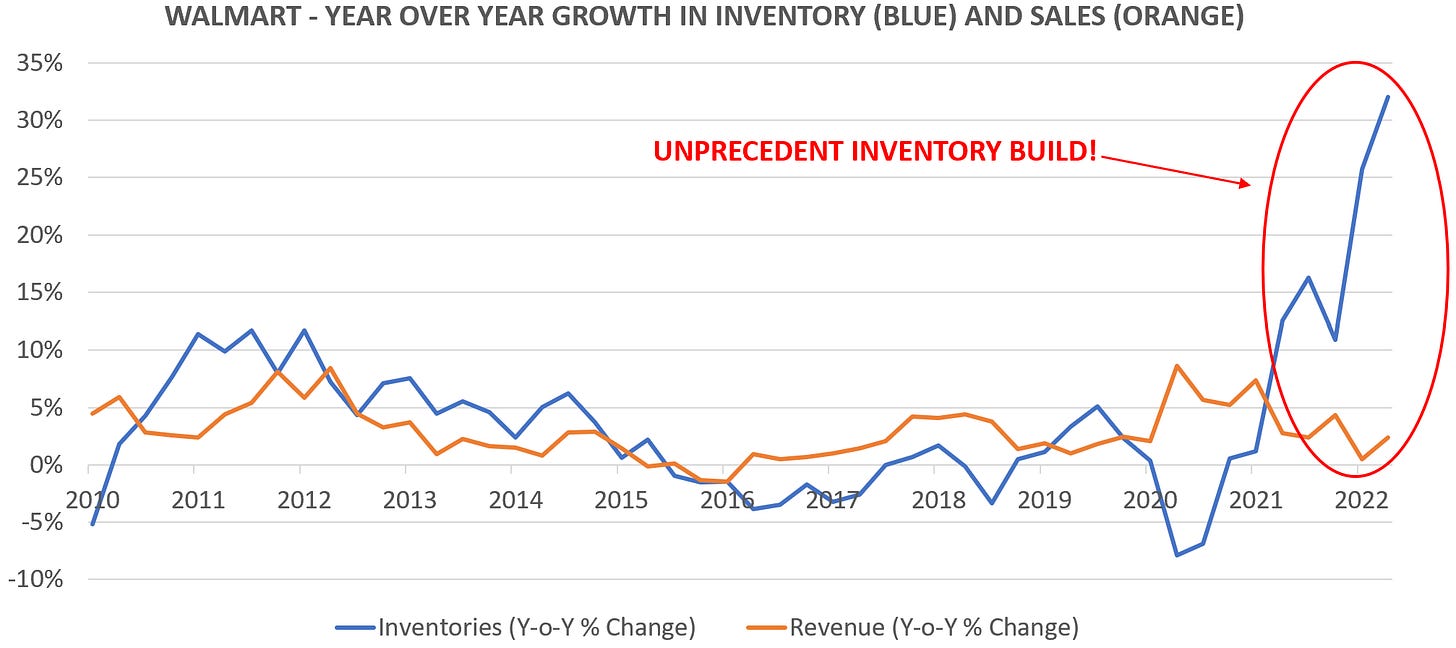

These Inventory dynamics continue to be confirmed at recent earnings at Walmart, Home Depot, Target or Lowe’s. See Walmart’s unprecedent inventory growth in the chart below:

Recent results from Walmart, Amazon, Target and Ross Stores also confirm what seems a natural suspicion when looking at the chart below. There is plenty of downside for corporate margins, and thus plenty of downside for corporate earnings

With this in mind, I have added again and am waiting for opportune moments to engage more in shorts, in particular in Homebuilders (XHB), US Airlines (JETS), Luxury and Stoxx/DAX

With regards to the latter, looking at economic history, things often “broke” after a drastic, unexpected move that exposed unsound investments. For that, it is less the absolute level and much more about the rate of change

The below qualifies as one of the biggest shocker moves I can think of. It’s ther German 2-Year treasury rate. And more is to come, judging from this morning’s German PPI inflation data

As such, it comes as no surprise that German building activity is falling of a cliff. Please see my post “Consumer Cycle, not Business Cycle” for the pivotal role of housing in the economic cycle

It seems likely that Europe and in particular Germany face a very challenging period ahead. My hope is that policy makers find the right answers to these challenges, and we emerge stronger on the other side

Good post.