On Real Estate

After Crypto, is Real Estate the next bubble to burst?

Regular readers will be familiar with my strong belief in the cyclicality of the economy, which rests on human behavioral traits such as herd instinct or greed and fear. These are deeply entrenched in our nature, and therefore history frequently appears to rhyme, if not repeat

The current state of the economy is a reflection of this cyclicality, and after a frantic 2021, the hangover has set in for many asset classes. Prices have come down, from Stocks to Crypto or Fine Watches. This begs the question, what will happen to the biggest asset class of all - Residential Real Estate

In a post in April I concluded that US house prices would likely go sideways, with some downside bias. I have now revised this view to broad price declines, and today’s post lays out the reasons why. These apply to many global Real Estate markets, so the post will draw from examples across the world, rather than solely the US. As usual, it closes with a outlook on current markets

Let’s start with a quote. The German news magazine “Der Spiegel” writes:

This quote could well describe today, only in reality it was from 1984. Back then, just like today, people thought Real Estate could only go up. So they built and bought, until the market broke. In hindsight the mistakes were clear. Yet while the bubble was underway, no one saw it

Why was that? The reason can be found in what George Soros calls Reflexivity

Reflexivity describes how we think fundamentals are a rational given. However, in reality they are vague and uncertain, and our perception of them is heavily distorted by prices going up or down, in a reinforcing relationship.

In other words, if prices go up, we interpret fundamentals in ways that justify prices going up further, and vice versa. Below quote from a seminal lecture by George Soros in 2009 summarises this:

The bubble then bursts when the Emperor with no Clothes Moment arrives. Such as in Canada, where house prices reached bizarre levels by global comparison (Canada also has a town called London, and no, it is not a metropolis…):

This eerily reminds us of the peak of Japan’s Real Estate bubble in the late 1980s:

Going back to Soros’ point on cheap credit fuelling Real Estate bubbles - exactly that happened during COVID-19:

Interest rates were cut to historically low levels. A buying frenzy in Real Estate ensued and prices appreciated rapidly

Inflation required Central Banks to raise interest rates again. So today, with much higher prices and mortgage rates, Housing has become unaffordable → The emperor without clothes moment

The below chart illustrates the US, but this pattern was repeated in almost all OECD countries

It’s not only very poor affordability metrics that weigh on Housing demand. In addition, asset price declines, low consumer confidence and layoffs now keep buyers away:

All this would be enough to take prices down, but another issue looms: Much new supply will hit the market soon

Rising prices created an illusion of strong fundamentals and triggered furious new-build activity (see chart below for the US). In reality, demand was driven by cheap credit and FOMO

NB: Taking the decline in lumber prices as a proxy for easing materials bottlenecks, it seems likely that these houses can be completed

What happens when a product is so expensive that no one can afford it, and then new supply comes into the market? Prices go down. We see this now in many places, from Canada:

To the United States, where price cuts are most prevalent in the Sunbelt, despite strong local demographic tailwinds:1

To Germany, where negative interest rates and inflation fears lead to a mindless Real Estate buying frenzy:

Ok, yes, this seems all too obvious now. But why did no one see it coming? This brings us back to George Soros and Reflexivity

The below chart shows how house price expectations for Canada shot up just as credit was cheapened (again this is very similar across most Western nations)

As prices went up, expectations of higher prices also went up = “Fear Of Missing Out” visualised in data

Now, I’ve read many times that the reasons for hot Real Estate markets are structural, such as Millennial household formation or immigration

But take the US as an example. In 2019, before the market turned frothy, there were actually fewer houses per population than there are today, so the market should have been much “hotter” back then vs today

I believe there is strong evidence that the global Real Estate boom is rooted in Reflexivity, cheap credit and FOMO, rather than structural drivers, in particular:

First, household size decreased because of the huge wealth gains over COVID-19

Flatshares broke up, kids moved out, etc, which all means fewer people per household. However, the wealth gains driving this were illusionary, they created inflation. This likely reverses with higher rents, asset price declines and the economy slowing down

Second, FOMO removed supply from the market:

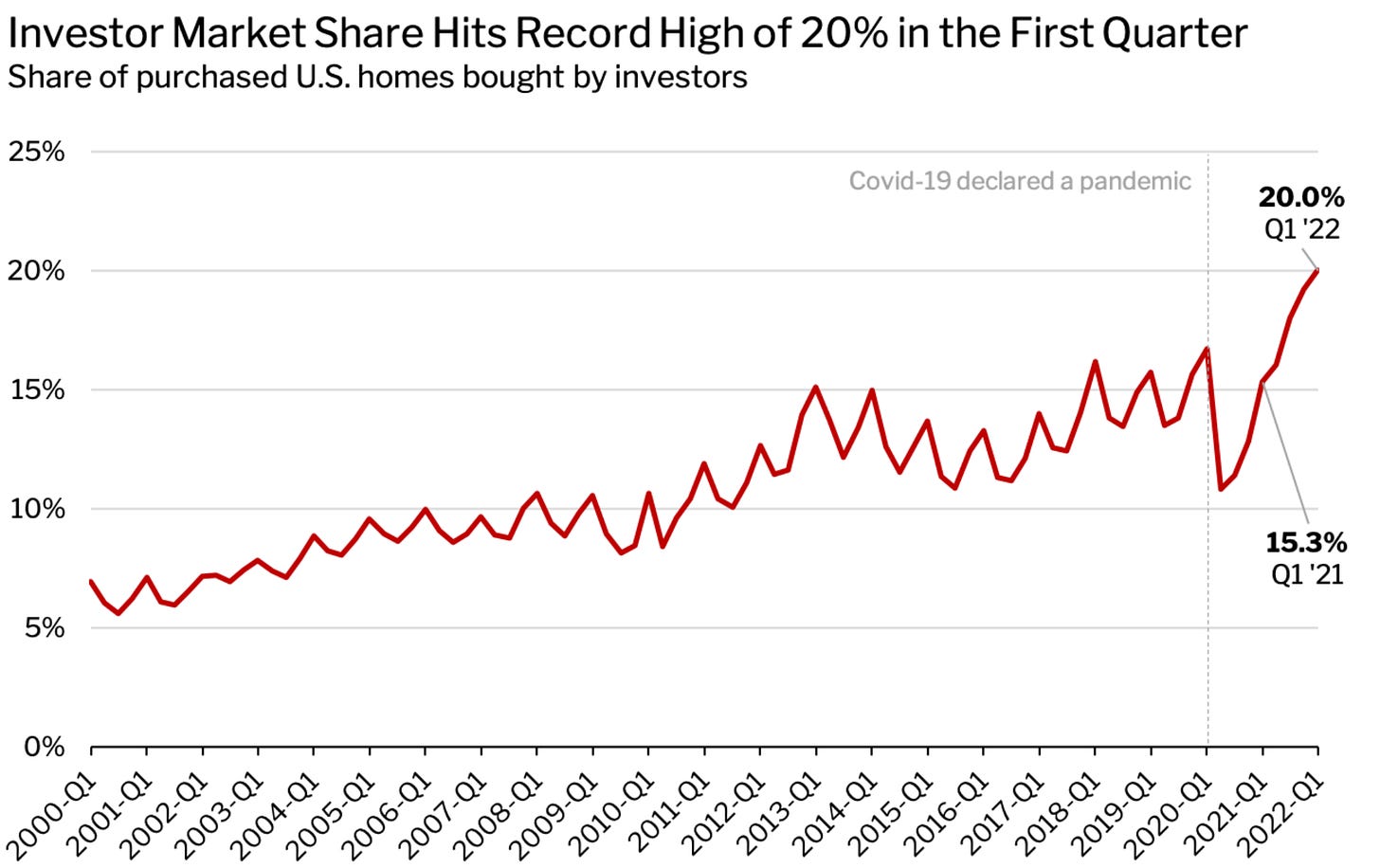

Why would anyone want to sell if prices only go up? You’d rather do the opposite. Accordingly, there has been a stampede to invest in Real Estate. In the US, the share of investors owning homes has reached a record 20%, it jumped 5% during COVID. Add to this the many private individuals who bought a second or third home, often left empty and thus leading to tighter housing supply

The “Retail Real Estate” investor has indeed been booming. Watch the TikTok video below and tell me whether this seems normal…

In 2006/7, as similar trend ended with many Retail investors going broke - well chronicled in this November 2007 NYT story

Now, the market has turned, and all of a sudden inventory appears, at a pace much faster than seasonally common. Take California as an example, where inventory is up 47% y-o-y. Or Ontario, where inventory has doubled:

On an international level, the US is likely not the worst. Looking at the chart below, Canada, New Zealand and Germany stand out with the amount of new housing supply, using residential investment as proxy:

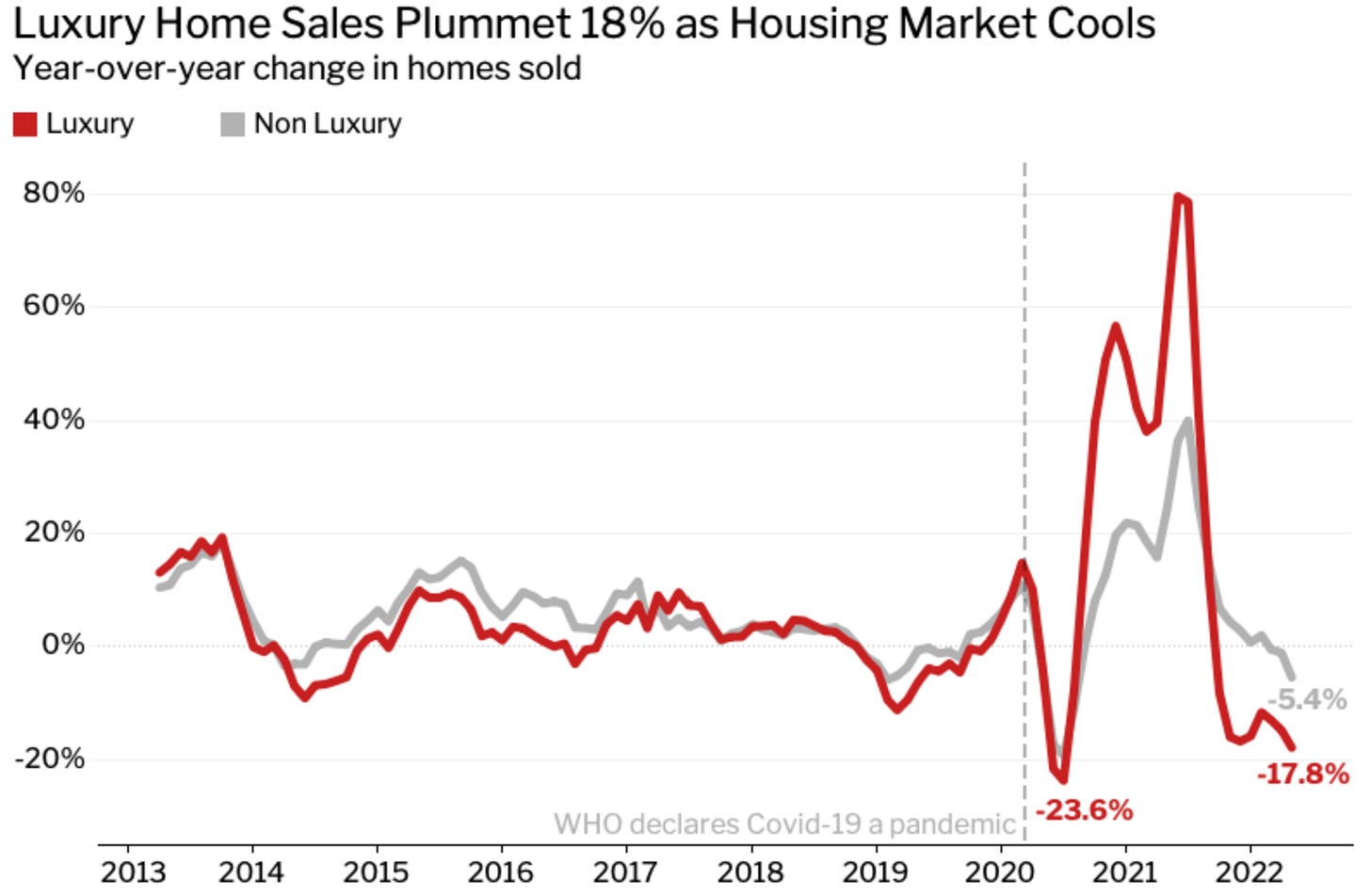

On this note, what Real Estate bubbles typically have in common: What’s been built is not what people need

Often, luxury units are overemphasised, because they provide much higher margins for builders. In a downturn, these decline first

Ok, Housing will slow, but what does that mean for the economy? As laid out in my cyclical framework “Consumer Cycle, not Business Cycle”, Housing leads the economy

Residential investments are ~4% of GDP. If this slows to previous cycle lows, it would reduce GDP by ~2%

More so, Housing affects many other sectors in tow. Think about all the fridges, furniture, TVs, moving vans etc. needed for a new home. The economy will likely be hit severely - a “hard landing”

Whether a slowdown in Housing turns into a deflationary bust, like in 2008, depends on how much leverage is involved

When asset prices fall, the debt to be repaid remains the same. This is an issue if leverage matches or comes close to the inflated asset value at the peak of the bubble (“LTV”)

This was a hallmark of many prior bubbles, from the German Gründerzeit Boom after the 1870 Franco-Prussian war to the 1980s Japan bubble, and the 2005-07 US subprime bubble

However, for US Residential Real Estate, while I see pockets of overleverage, there are no broad-based signs. See more details in this post. This may be different in other markets. I had mentioned before that over 10% of German Residential RE loans are >100% LTV

Conclusion: Whether the US, Canada or Germany, it is everywhere the same. Cheap credit and FOMO got people to buy. Now prices are sky-high, affordability is poor and new supply is on the way. In my view, this likely means notable price declines in most geographies

What does this mean for markets?

In the same lecture, George Soros describes how predicting the future involves decisions that haven’t even been made yet. As such, my views are highly uncertain, and I may well be totally wrong.

Personally, I take this into account by risk-managing all investments, with the primordial assumption that I may be wrong on all of them, and the sizing in such a way that I could tolerate the loss in that case

With this in mind these are my current views:

Housing- the confluence of very poor affordability, new supply and an economic downturn likely means that now is not a good time to buy a house, and we’re likely to see more discounting going forward. This view refers to housing for investment purposes, which is always different to considerations for a family home

Equity Market- Economic indicators are deteriorating very quickly (see chart below, also previous posts). After a steep decline in durable goods demand, the US consumer has now also started to cut back on travel and services

This has lead me to maintain my bearish positioning irrespective of now clearly pervasive negative sentiment. I remain short many mostly cyclical sectors where I expect steep earnings cuts, including Homebuilders (XHB), US Airlines (JETS), DAX, Materials (XLB), Metals & Mining (XME, SXPP), European Banks (SX7P), Semiconductors (SMH) Ethereum and Nasdaq 100. I have been stopped out of my only small long, Crude Oil Futures. See here for a more detailed review on Oil

Bonds- After May’s bad inflation data, US Treasury bonds spiked to 3.5% for the 10-year. In response, the Fed has become very aggressive in its most recent meeting, with an unexpected 75bps hike and guidance for more. Counterintuitively, this likely puts pressure on long-term yields as it increases the probability of a recession. Together with fast-deteriorating economic data, this makes me think that 3.5% was likely the cycle high, and we’re likely to see a higher level only during the next upcycle. I’ve accordingly exited my short bond position (TLT)

High Growth Tech- this sector would be the biggest beneficiary from stalled or even lower bond yields (e.g. Software/IGV, Biotech/XBI or Solar/TAN). However, considerable earnings risk remains, and historically these sectors could not decouple from broad equities weakness, of which I expect more to come. I remain cautious but am watching these closely

Inflation- I continue to find the 1974 analogy the most fitting for the current situation. While the economy is deteriorating fast, the US private sector continues to maintain high cash balances - they rather cut back than burn these on overpriced goods. This makes a deflationary bust less likely, and once the inventory glut has been worked off, a new upcycle can begin (maybe toward the end of the year?). I find it unlikely that the structural inflation reasons disappear by then, or that the Fed would push the economy deeper into a recession, so inflation will likely still be around when the next upcycle appears. This means structurally higher bond yields

In my view, as before, the current environment remains one where Cash is King!

I hope you enjoyed today’s Next Economy post. If you do, please share it, it would make my day!

Further, on yesterday’s earnings call, Miami-based builder Lennar announced that it cut prices in some of its markets. They highlighted Seattle where tech-employed consumers have pulled back following declines in stock-based compensation plans. Also interesting is this chart on the number of price changes in Phoenix

Thank you. Would look at ism new orders and NAHB survey for upcycle leads. Fed obv too, if precedes this

Florian great article. Do you think we will persistently be in these short bursts of inflation-recession cycles this decade?

Also do you see some type of yield curve control-like tool being coordinated among the large central banks at some point over this potentially inflationary decade? (Ie. High debt loads and high inflation are a tough mix to handle together, and it is still hard for me to see nominal yields rising above 4-5% without serious impairment of the financial system.)

Thank you!