Pay Less, Get More

Introducing a big real-world use case for crypto

Cryptocurrencies remain a highly polarising topic. Sceptics argue that their aggregate market value of 2 trillion USD is mostly driven by central bank liquidity, with little going on beyond speculation and hype. Proponents point to broken trust in traditional currencies, but also to the ecosystem’s rapid pace of innovation, much of which takes place in open communities. For me, the litmus test would be a real-world use case that makes a difference to everyday people

I believe the building blocks for such a real-world use case are now emerging. Today’s post is an introduction to that idea

At their core, cryptocurrencies and blockchain technology are about cutting out middlemen

Banks, stock exchanges, real estate brokers, social networks, search engines and governments are all middlemen that sit between economic actors. They take their cuts and influence activity

Middlemen usually aren’t evil or malignant. They provide a valuable service to the economy as they enable interaction that otherwise wouldn’t be possible

However, some of them have turned into oligopolies or monopolies. They charge outsized prices, and their services are inefficient or out-of-date

Let’s look at an industry that suffers from overly powerful middlemen: e-commerce

Below is the typical cost split of an e-commerce marketplace:

As can be seen, a shocking proportion of revenue is spent on payments and advertising, both areas where suppliers wield excessive power:

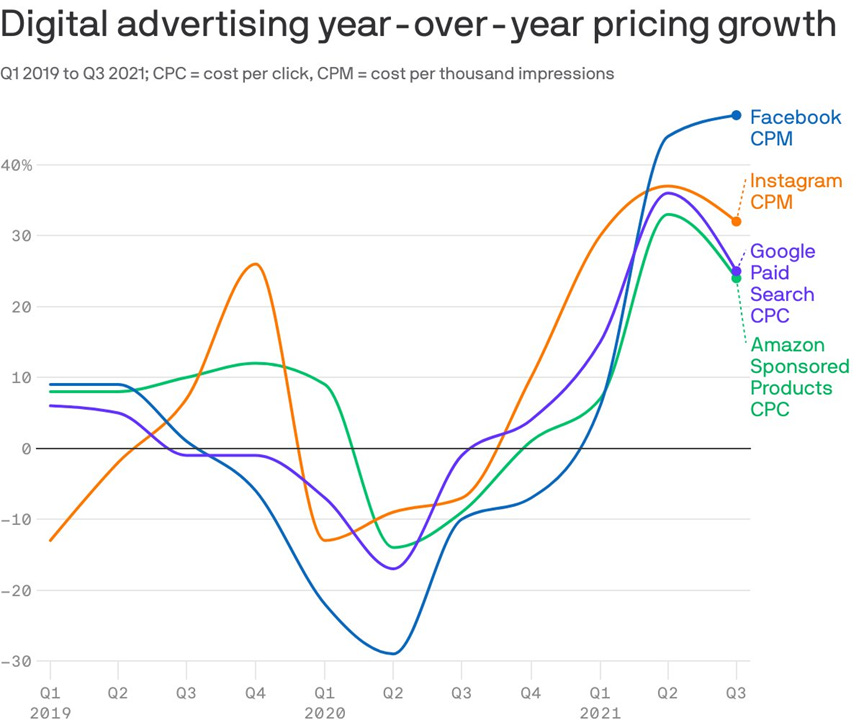

To acquire customers online, there is no way past paid search on Google or targeted advertising on Facebook, Instagram and now TikTok. These are outright monopolies (Google) or oligopolies (social media). Accordingly, customer acquisition costs are exorbitant and represent up to 35% of revenues. Just look at how these companies increased prices over the past two years:

For payments, card issuers and processors such as Visa, Mastercard, Paypal or Stripe charge between 2.5%-3.5% of the total order value for the simple service of moving money from A to B. Thus, with a typical e-marketplace take-rate of 30%1, payment services represent ~10% of its revenues

While Google is indeed the world’s best search engine, it has become a glorified catalogue of the main e-commerce brands, with their paid search results on top and actual search results somewhere far below

The cost for search keywords is determined via an auction, with up to US$50EUR per click for the most valuable terms

The auction system squeezes the last cent out of the strongest bidder. In other words, the entire value of the customer acquisition process falls to Google

An analogy would be that the power to your home only comes from one provider, is sold to you in an auction, and you pay as much as it would be worth to you to keep your lights, fridge, hot water and TV on

Given the cost, only the strongest brands can afford the top keywords. As such, Google search results resemble a very expensive catalogue of the top 5-10 e-commerce brands, as visible in this example. What sense does that make?

Taking a look at the payments industry, we find a sequence of middlemen involved in payment processing, all wanting their cut, from banks to card issuers

Regulation, economies of scale and high switching cost contribute to an anachronistic web that, with a c. ~3% charge on each online transaction, seems wildly expensive for what it does

At the same time, EBITDA margins of payments processors are sky-high2, indicating excessive pricing power for a menial task

Below is an example of the various steps involved in a single credit card payment:

Together, these two areas with their anti-competitive structures represent a significant tax on a fast-growing segment of the economy

This also furthers monopolistic tendencies within e-commerce itself, as larger players can cope better with the high cost

But what does that have to do with crypto? How can cryptocurrencies help solve these issues?

New payments systems were a much discussed use case since the emergence of Bitcoin in 2009. However, so far nothing has come of it, for the following reasons:

Too high cost: It costs ~US$10 to validate a Bitcoin transaction and ~US$5 for Ethereum. More so, until recently, it cost ~4%+ to transfer US-Dollars from your bank account into the crypto-ecosystem (the so called Fiat-Crypto onramp)

Too slow: The Bitcoin network can only process 7 transactions per second (tps). Ethereum can process 13 tps. Visa can process 65,000 tps

Not safe enough: Theft and fraud was and still is rampant

Too volatile: The price of most cryptocurrencies is too volatile to use as means of payment

Just like for Uber, which combined existing building blocks around mobile technology when the time was right, things are now coming together for crypto and payments. In particular:

The onramp cost, i.e. bringing “Fiat”-currencies into crypto, has come down to 0.5-1% (e.g. Wyre in the US, Ramp in Europe)

Both speed and transaction cost are impoving

Ethereum is changing its validation mode in December, increasing speed by 64x

There are now multiple so-called layer-2 alternatives that aggregate many transactions into one block to save cost, with only fractional cent costs for individual transactions (e.g. Bitcoin Lightning, Near)

Newer layer-1 blockchains offer processing speeds similar to Visa (e.g. Solana, Fantom)

Safety has improved as custody solutions mature (e.g. Prime Trust in US or Solaris Bank in Germany). They also offer insurance against theft and fraud

Importantly, the stablecoin ecosystem has exploded, with a total market cap of ~US$115bn vs ~US$15bn a year ago. Stablecoins are a 1:1 mirror of US-Dollars and other currencies, just on crypto-infrastucture3. This avoids volatility but keeps the benefits of decentralisation

As crypto has grown to >US$2 trillion market cap, with many mature financial institutions participating, there is significant demand for leverage. As a results, short term interest rates within the crypto-ecosystem are currently between 5-8% for lending to lower-risk counterparties4

Now, let’s put all these building blocks together. This is what a Google/Payments killer-app could look like:

First, an application that is focussed on consumer benefits. Use crypto as the rails, but keep it in the background

The first consumer benefit is to offer 2-5% p.a. interest rates on deposits. How?

Customer deposits are converted into equivalent stablecoins which are held at custody firms, where they are also insured against theft and fraud. These deposits are now inside the crypto ecosystem, which makes payments much cheaper in step 3. below

Within the ecosystem, these deposits can be lent out at a 5-8% p.a. yield to regulated financial institutions such as investment banks or hedge funds.5 The counterparty risk could be further reduced by lending only to highest-quality institutions in turn for a lower yield (said 2-5%)

The second consumer benefit is to offer 5-10% cashback at e-commerce outlets. How?

Once the funds are inside the crypto ecosystem, online retailers can be paid over these rails, avoiding the traditional payment networks altogether

More so, consumers could directly connect with online retailers thru this app, bypassing Google and Facebook (come for the yield, stay for the cashback). Chinese D2C-aggregators like Tmall come to mind for this

The retailers drastically save both on payment cost as well as customer acquisition costs. They can pass these savings on to consumers

In terms of execution, payments can be done via corresponding stablecoin wallets on the retailer side, or via codes (akin to gift vouchers) that are offset with bank wires6

With regards to paying with codes, many retailers offer 5-10% discounts on gift-voucher sites like shopmate.eu. However, these sites struggle to attract traffic in a crowded marketplace. This is where the interest rates on deposits come into play again, they are a no-brainer in attracting traffic

Similar to traditional credit card businesses, a rewards programme can be installed and consumer data can be tracked for tailored offerings

This hypothetical business could finance itself by selling tracked data, rewards programmes or margins on the interest paid

That’s it. No need for Visa, no need for Mastercard, no need for Stripe, no need for Paypal, no need for Google, no need for Instagram. Consumers get more on their deposits and pay less for their purchases, and the e-commerce businesses save a lot of cost

There is also no need to ever mention crypto, this is simply applying blockchain technology to an existing problem

This sounds too good to be true. What are the risks?

This hypothetical business has bank-like characteristics. However, it is not a bank and its deposits are not insured. Will consumers be comfortable with this?

Europe seems the most interesting market, as it is much less crowded in terms of nascent crypto-activity, yet has a very sizeable e-commerce market. However, there is currently no fully-backed Euro-Stablecoin7

Regulation may evolve in an adverse way. Coinbase abandoned efforts to roll out its USD-stablecoin lending programme after the SEC intervened

The currently high interest rates paid on deposits inside the crypto-ecosystem may fall if excitement for the space cools down for whatever reason

Irrespectively, the political tailwinds will eventually be there. Everyone is unhappy with the internet monopolies, particularly in Europe where there are no domestic equivalents

In terms of start-ups operating in this area, I’ve only found two notable companies active in this direction. Both are located in the US, none in Europe

Strike has focussed on hyper-low cost money transfers using the Bitcoin Lighting network. This has caught on in El Salvador, which receives US$6bn in remittances every year at a cost of US$400m (or ~7%) to remittance handlers like Western Union. Strike heavily emphasises Bitcoin, potentially alienating consumers with no crypto-affinity

Eco is taking a different route, focussing on potential savings for consumers and using crypto mainly as technology. It has has received ~US$100m in VC backing, and is active in 40 states in the US, with a current 180k waitlist for accounts

Conclusion: The building blocks have been created for crypto real-world applications that can make a big difference to everyday consumers. Who will build them in Europe?

A take-rate is what the online merchant keeps from the total order value. Example: A pair of jeans is bought for 100 USD. The online merchant keeps 30% (i.e. 30 USD) for its services, the other 70 USD go to the jeans producer. This either directly, if the online merchant is a marketplace, or indirectly, if the online merchant first acquires the jeans into its inventory. (In the latter case there are also warehousing and logistics costs, in some cases the e-commerce business is also the producer, e.g. Asos, Boohoo)

Example EBITDA margins: Visa 67%, Mastercard 57%, Paypal 29% (all 2021E)

There are two variants of Stablecoins. First, 1:1 backed by fiat currencies. In this model, for every dollar of stablecoin a real-world dollar is kept in reserve, and these reserves are audited on a regular basis. Examples are Circle or Tether. Second, algorithmic stablecoins which use a mathematical formula to keep the exchange rate pegged to 1. While these may be more intellectually rewarding, several of these imploded as the algorithm was hot-wired, and appear much less safe

Lending only to regulated financial institutions suchs as investment banks or hedge funds, no retail

The yield would be 12-15% p.a. or more if lent to retail, which is higher risk

Bank wire is much cheaper than Paypal, Stripe or card processors Visa and Mastercard

The reasons for the absence of a fully-backed Euro-stablecoin: The ECB currently charges negative interest rates on deposits above a certain size. A fully-backed stablecoin would have to hold the equivalent reserves in the original currency, in the case of the Euro this would incur said negative interest payments. This may obviously change as interest rates rise, regular readers will be familiar with my views on the topic