Preparing for a Cyclical Turn

We are not there yet, but there is light at the end of the tunnel for the US economy

The US economy remains in a broad downturn. More challenges lie ahead, such as the resumption of student loan payments for 40m+ consumers from early August onwards. Nevertheless, economic activity is cyclical. As such, in any downturn, the question should accordingly be “When does the upcycle start?”, even if it seems implausible to ask at the time

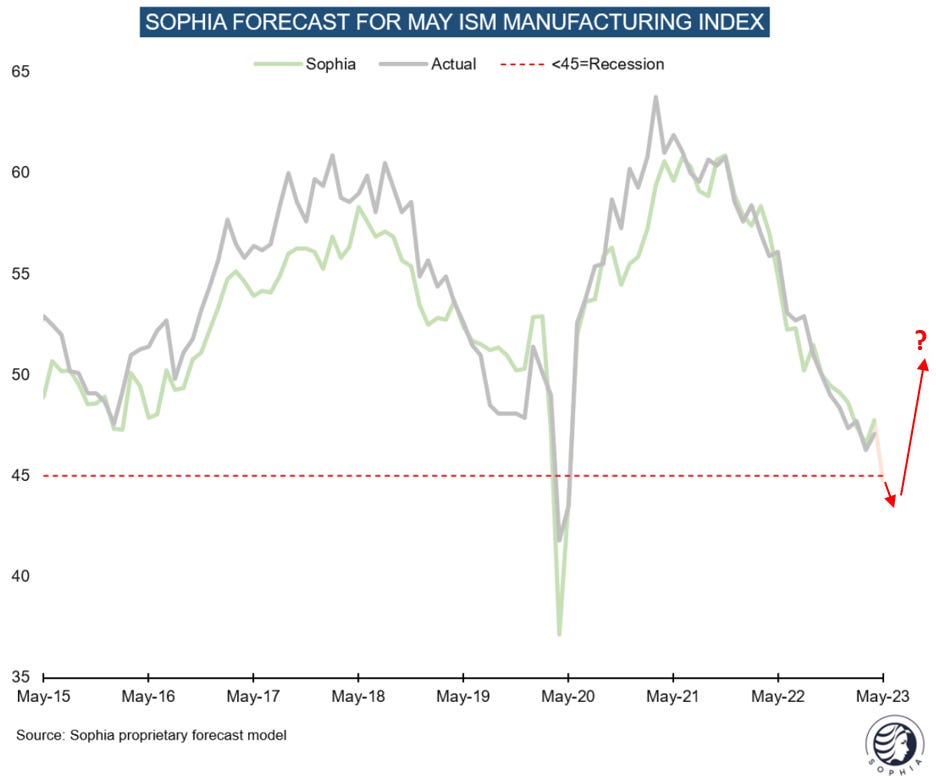

Last week’s piece “A Heretical Thought” outlines the potential for a trough in manufacturing activity this summer. Today’s post follows up with more observations, and details the implications of such a cyclical turn ahead

As always, the post concludes with my outlook on current markets. I see late June/July as possible window to engage in cyclical equities or commodities, where I could see negativity around them reach a peak. I’ve also included some more thoughts on AI as well as the Euro and Gold

While a recession likelihood remains hotly debated amongst economists, on some measures the US is currently already in one, and likely has been for the past quarters

The National Bureau of Economic Research’s recession definition includes averaging GDP with the less popular, but more precise Gross Domestic Income metric - using this method, the economy contracted in four of the past five quarters

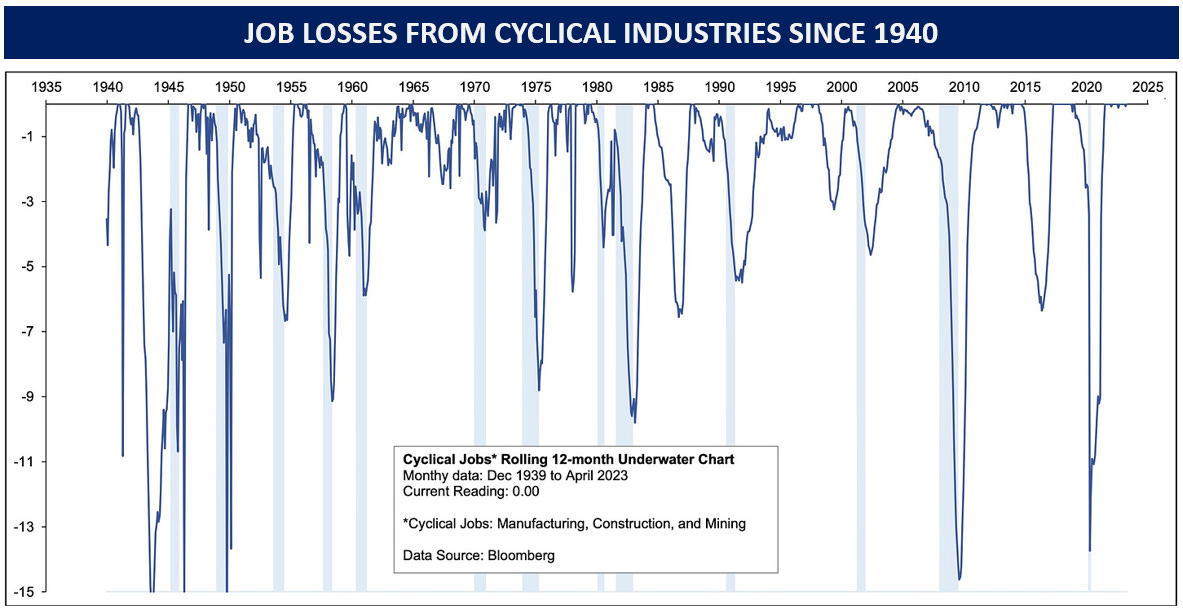

Contrary to expectations, this has has not translated into higher unemployment from cyclical sectors. In fact, residential housing sequentially improved this year (see last week’s post), driven by new build activity to provide affordable single-family homes, while the existing home market remains frozen

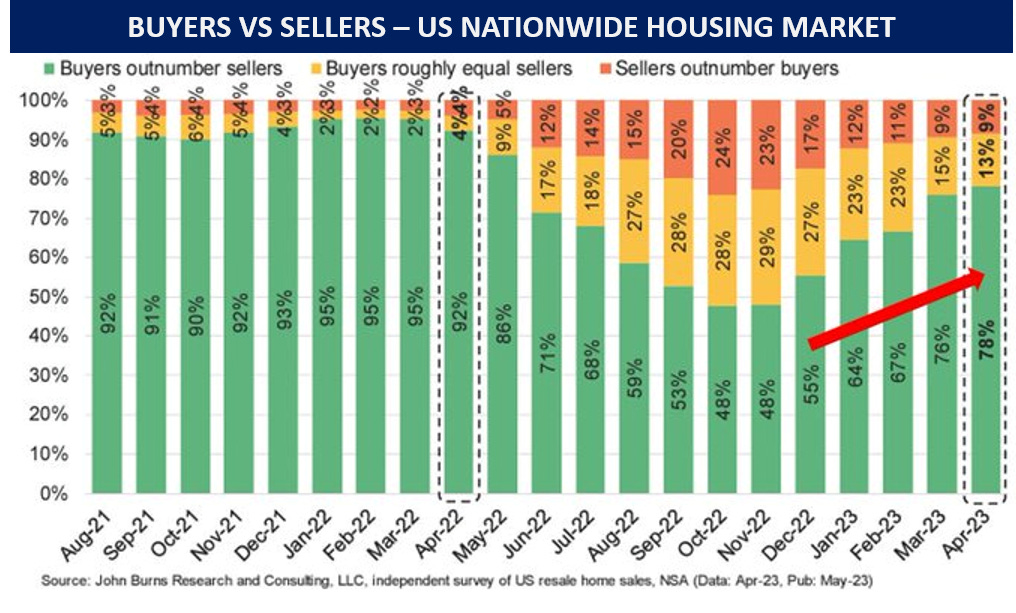

Despite 7% rates, buyers again outnumber sellers for most properties in the below survey. Why? There is no supply from existing homes because there are no forced sellers. The solution: Builders create new supply to sell at a discount to market prices = construction activity picks up

As a consequence of this and several other dynamics, job losses from cyclical industries simply have not occurred - yet. But are they still coming?

To answer that, we need to see how much further Cyclical industries (outside housing) could slow from here. Let’s take the Chemicals sector as an example, which is a key early-cycle industry

Chemicals are the pre-product for most goods, from cars to sofas, from toys to clothes, from paint to glue. Right now, business is mostly dead. Global capacity utilisation has passed the Covid-19 lows, and seems primed to soon take out the ‘08 Financial Crisis lows

A key industry for Chemicals is Retail, which drives ~1/3 of US consumer spend. Retail sales have been under pressure; consumers cut back as their savings decline. As a result, we see a “deflationary bust” in the goods economy, with heavy discounting across the board to clear stuffed inventories

I had laid out this sequence of events in a post last year. Having reached the middle stage of the chart below, many vendors now revert to heavy discounting

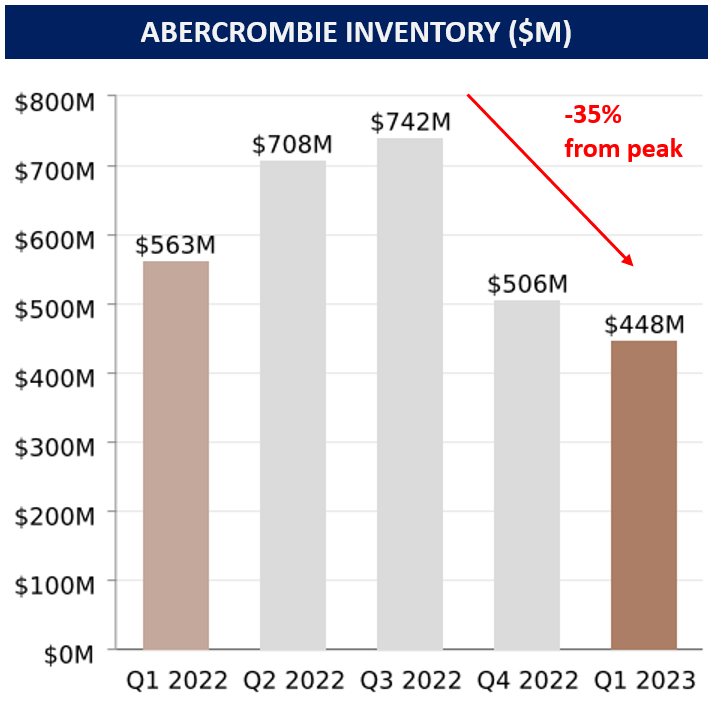

How far are we in the inventory clearing process? There is no scientific answer, but anecdotal evidence shows substantial progress at various retailers

Take Abercrombie’s recent earnings release as an example. The company showcased 3% sales growth amidst a 20% inventory reduction year-over-year, and a 35% inventory reduction vs. the recent peak

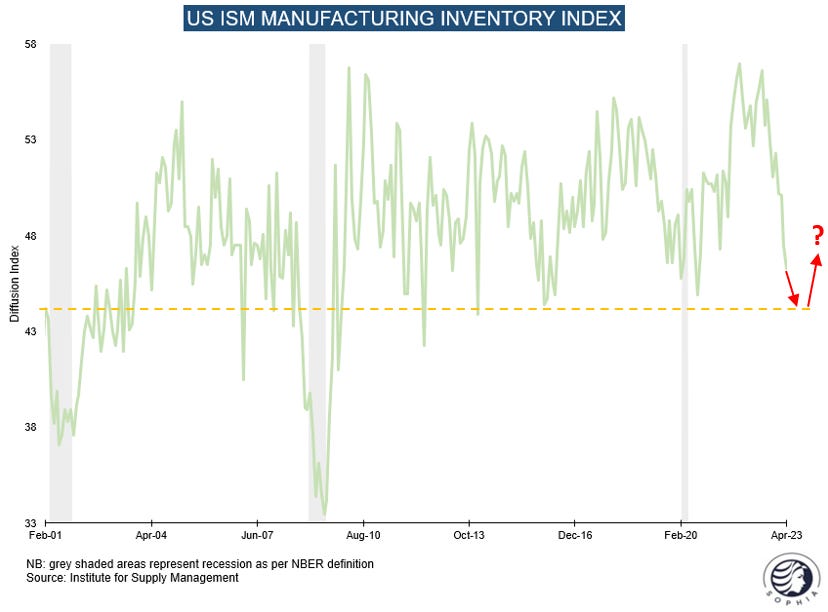

If we look at data from the ISM Manufacturing Surveys, we can see that inventories often turn up at a reading of ~45. They only durably fall below during periods when unemployment rise

Thus, again, the evolution of unemployment remains critical for this cycle. Should current solid labor market trends continue, then discounts are enough to entice higher consumer spend volume (not price), higher volume means destocking eventually runs its course, and with that production increases

This brings us back to the most critical question for this cycle. Will unemployment rise?

Given the intensity of manufacturing downturn, I have so far held the view that this is likely. However, with residential housing improving again and no large layoffs yet in manufacturing, I see a chance that we *could* make it to the other side, i.e. to the cyclical upturn without unemployment rising

Below overview shows various labor market lead indicators and their historically implied probability of a subsequent increase in unemployment. Aside of continuing claims, they all remain <50%

What’s the implication of all this? Simple - once inventories are cleared, volumes across the industrial value chain increase again. In tow, freight demand improves, commodity demand grows, etc. In other words, the industrial cycle ticks up again

Aside of unemployment, the biggest headwind for this outlook is the cessation of student debt forgiveness as part of the debt ceiling deal. From the 31st of July debt repayments restart at ~$400 per month for 40m Americans

Estimates of its GDP impact range around 0.3%, a digestable amount. However this hits a consumption-heavy demographic, so knock-on effects could extend beyond that

Conclusion:

A cyclical low appears plausible over the summer. Retailer destocking should reach its peak, with higher volumes to follow that should reverberate across the industrial value chain, from Commodities to Chemicals

This view is conditional on the labor market holding up. The jury is still out on that. Should it hold, then manufacturing likely turns. If it breaks, everything takes a considerable leg lower. For now, I think it holds, but I may be wrong on this and/or change my mind

While it is often stated that the US economy won’t be able to turn up without fiscal support, I need to point out that said support is already in place. The US government is running a 7% record deficit (outside of war and economic crisis), and interest payments on government debt to the private sector will amount to >$1tr (>4%/GDP) this year

What does this mean for markets?

As always, below is my personal attempt at connecting-the-dots for my own investments. Please keep in mind - I may be totally wrong, nothing is more important than risk management, and none of this is investment advice

Equities - I am now biding my time to buy cyclicals (e.g. Russell 2000, Copper, Chemicals) and look for the summer months (July?) as possible moment to catch the low. Cyclicals typically trough with the ISM Manufacturing Index…

…and while our own model forecasts for the ISM to still go lower, as laid out today I believe it is possible or even likely that it troughs in the low 40s in the coming months, bar an increase in unemployment

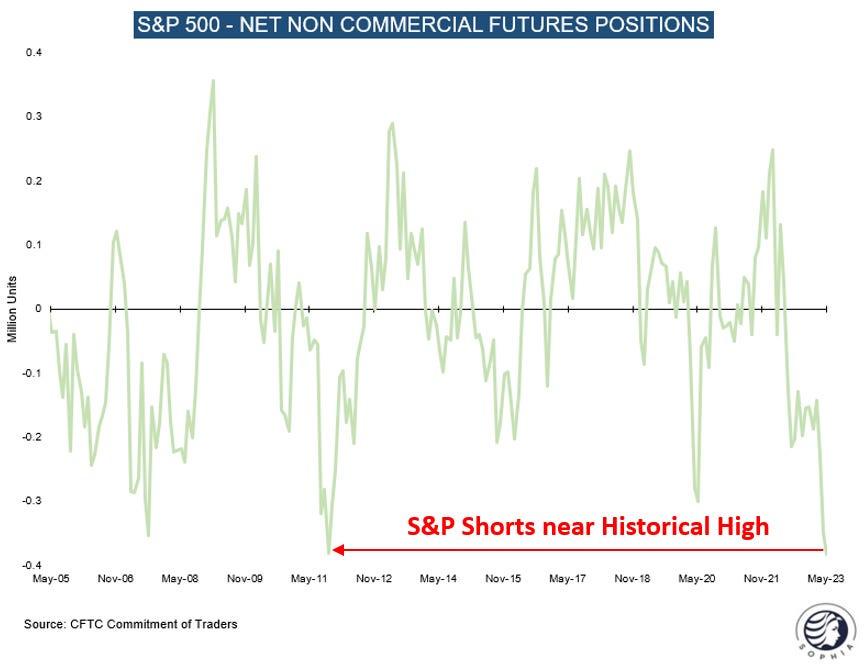

Equities are currently overbought with Retail investors once again chasing Tech and AI at the highs. However, more broadly stocks continue to be hated, with S&P short positions near historical highs. Until this is cleared, it seems unlikely that the market sees significant downside…

… as wall-of-worry dynamics remain in place, just as in 2009, 2012 or 2017 where no one wants to buy stocks, until everyone does. As such, I would expect any meaningful pull back to be bought, with cyclicals possibly assuming leadership alongside AI from the summer

Some further thoughts:

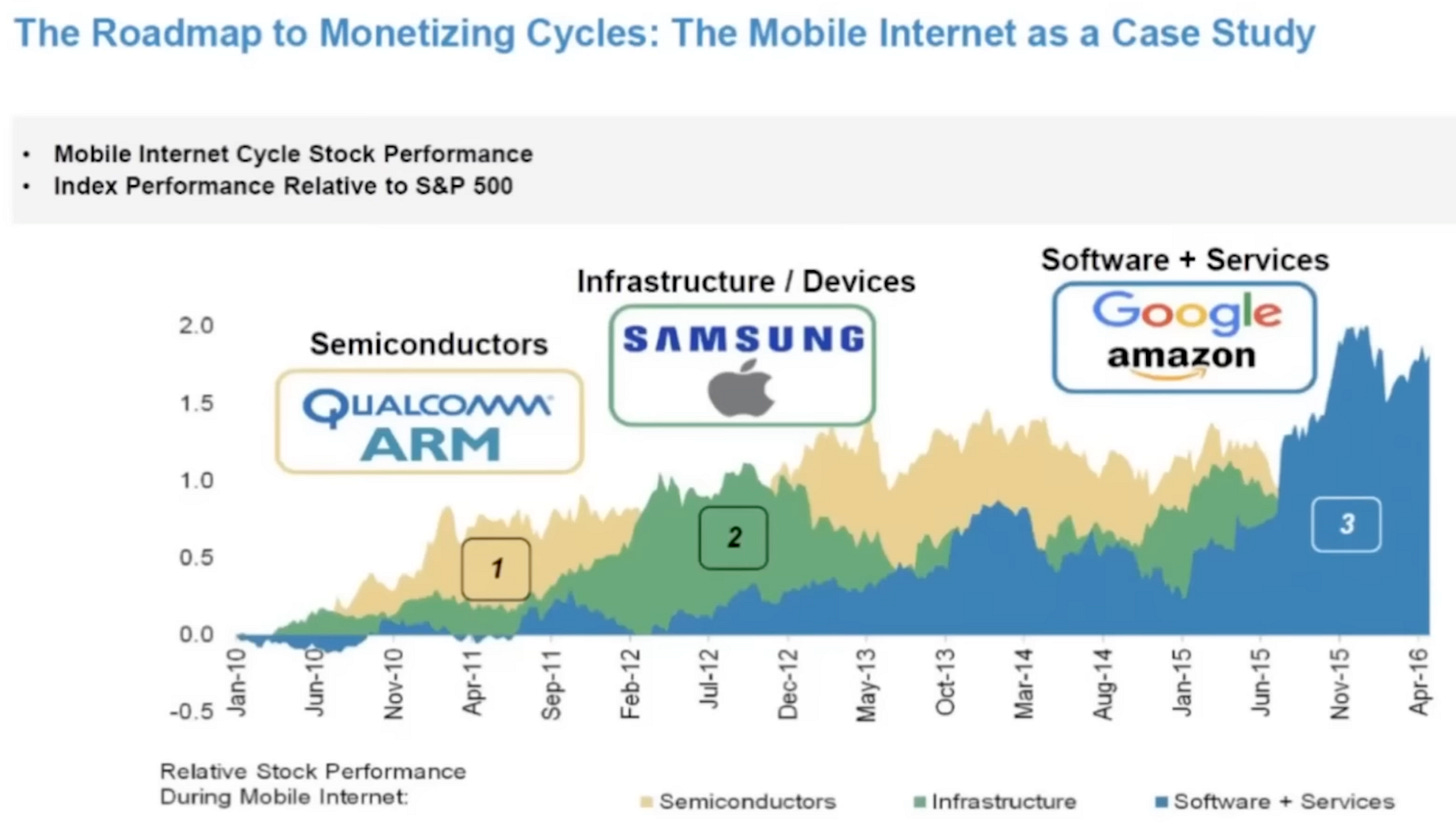

AI - Artificial Intelligence is now in an overextended zone, but it will be the defining trend for the coming 3-5 years, with implications on everything from creative industries to productivity (see previous post here). Aside of Google and Microsoft, with datacenters playing the key role in its proliferation, the semiconductor industry will be an interesting place especially for the first years (see analogy with mobile internet below), however likely with a much wider wide dispersion of winners and losers than the current broad advance in the Semis index implies. For now, I am focussed on laggards, which can e.g. be found in China’s only significant AI play Baidu (I am long hedged with KWEB), but expect AI to form a significant part of my exposure going forward

Euro and Gold - I remain short these two. Positioning is stretched, Euro area data should be worse than the US going forward (see previous post here) and the dollar debasement story is once again off the table, to be replaced with America exceptionalism on tech innovation (until that narrative eventually flips again…)

China - The Hong-Kong Index HSI has breached its 200dma, one of the few technical signals I feel worth paying attention to. I would expected further downside, until the government caves and provides more economic stimulus. China youth unemployment runs at 20%, so I doubt its political leaders have an interest in letting its economy implode. The possible timing of China stimulus could coincide with maximum pessimism on cyclicals and commodities in the coming months, and then provide a catalyst to the upside

To conclude, extreme US government stimulus (and the resilience it provides to the US economy) remain the underappreciated dynamic of this cycle, in my view. The US may tolerate higher real rates for longer than thought, with it catching off-guard many asset allocators in their assumptions and expectations

Hi Florian, interesting take. I noticed you never mentioned services and wages inflation. How would it go down if unemployment doesn't increase? What would the Fed do if core inflation sticks to a 3.5-4% range? I feel this is a missing puzzle piece in your otherwise bold take (bold since other smart people believe summer is when the recession finally accelerates).

You mentioned ISM manufacturing having good correlation with russell 2000. Why you choose ISM rather than Markit? You think ISM more accurate than Markit?