Roses in a Garden of Tulips

Within the epic crypto bubble, new templates are formed that will eventually disrupt today’s oligopolistic social networks

As the tide of global liquidity recedes after an unprecedented year of central bank and government stimulus, the cyptocurrency bubble is bursting. Much like the Tulip bubble in Holland in the 17th century, the real-world use cases of most crypto assets don’t exist, and instead they are a conduit for rampant gambling and speculation within a zero-sum game, where experienced insiders arbitrage against naïve newcomers. However, some roses are emerging in this garden of tulips, and in the wake of the burst bubble, the use cases the world is waiting for will be created. In particular, they will challenge many of the oligopolistic networks that shape today’s online economy

As discussed in previous posts here and here, we are past the point of maximum monetary stimulus. The gradual global removal of liquidity support is under way, through the reduction of central bank purchases as well as the increase of benchmark interest rates.1

The removal of liquidity can be portrayed as a game of musical chairs. The music stops and there are fewer chairs than participants in the game, so someone will be left seatless

This role is fulfilled by assets furthest out on the risk spectrum. They are sold first as their income is most uncertain and speculative. Cryptocurrencies, with no exogenous near term cash flows and all their promised return in the distant future, are on the furthest end of said spectrum, followed by SPACs, concept stocks and unprofitable Tech. All these assets have experienced substantial drawdowns in recent months:

As mentioned, today’s cryptocurrencies don’t produce any earnings derived from real-world applications, all income stems from funds reshuffled inside the ecosystem2. Accordingly, for their price to continue to appreciate, ever new sources of outside funds are required, akin to an inverted pyramid-like structure, where an ever broader number of new entrants is needed to absorb the selling from a smaller number of early adopters. This dynamic has now reached its end:

17% of Americans own cryptoassets. This number may seem low, but given the amount of anecdotal stories of Uber drivers or personal trainers boasting about their Dogecoin gains, TikTok “investors” and celebrities like Paris Hilton or Tom Brady adopting the laser-eyes sign of adherence, it is fair to assume that the reservoir of potential enthusiasts has been depleted, with the remainder of the population unable or unwilling to participate

However, with a peak valuation of $2.5tr, huge amounts of capital are needed to sustain price increases. This is the broad part of the pyramid, and it has become really broad. Just to compare, $2.5tr roughly equals to the GDP of France or India

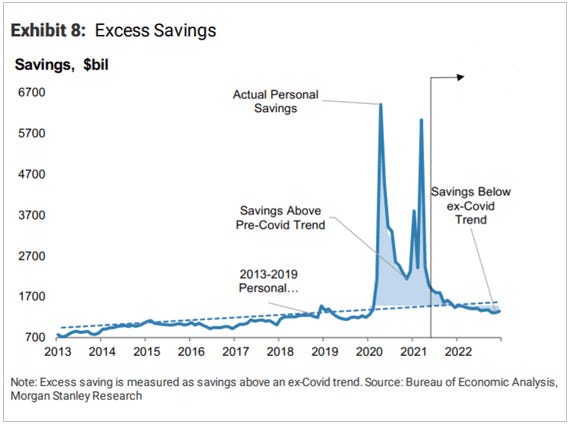

More so, household excess savings are in the process of normalising as the economy reopens. These savings provided the main source of demand (e.g., 91% of volume on crypto exchange Coinbase is retail-driven) as they spiked to unprecedented levels following lack of spending opportunities during COVID-19 induced shutdowns as well as the provision of multiple stimulus check rounds:

Now, institutional adoption has frequently been quoted as next source of funds. However, ESG concerns, volatility and in particular fast evolving regulation will limit their participation in the near term:

While the acceptance of Bitcoin by several corporations and payments systems as means of payment was largely a marketing gimmick to attract crypto-affine crowds (who wants to receive payment in something that can devalue by 50% within a few days?), Elon Musk has recently stated the obvious about Bitcoin’s energy problem. Hence, ESG concerns are now out in the open and will severely constrain any corporate desire to continue down that road

Regulation will fast become much more serious than many anticipate. As the liquidity tide turns, rampant scams and fraud are exposed, such as here or here, providing additional trigger points for regulators to clamp down on activity that has become too large to ignore. I highly recommend the recent speech by Fed governor Lael Brainard, who is the poised successor to Jerome Powell in 2022. Her language could not be clearer and charts the regulators’ course ahead

With retail investors maxed out and institutions constrained, there’s no new marginal buyer around; the crypto bubble will continue to deflate. With valuation absent as anchor, emotions are the key ingredient for price discovery, in particular the fear-of-loss and the fear-of-missing-out. Accordingly, the deflation of the bubble will gradually occur in a non-linear way of panicky sell-offs and subsequent equally panicky rallies

Not all is bad though. Yes, cryptocurrencies are a massively amplified mirror image of the human psyche and its Janus-like structure. On the dark side, there is relentless greed, gambling addiction, fraud and deception. But on bright side, incredible innovation, selflessness, cooperation and entrepreneurship appear as predominant character traits

The past 24 months have unleashed an innovative storm within the sector. There are now over 3,000 decentralized apps on the Ethereum blockchain alone, in comparison to just a handful two years ago. While many will falter, some are incredibly impressive in their ingenuity as well as the speed at which they came to fruition. To highlight a few:

Uniswap is a decentralised exchange running a so-called automated market maker on the Ethereum blockchain. Liquidity pools incentivised through a game-theory like equilibrium allow for frictionless trading and instant settlement (vs. t+3 on traditional exchanges). Volume has exploded from de minimis levels a year ago to >$2bn/day

MakerDAO is a decentralised lending platform on the Ethereum blockchain, where participants can borrow funds against cryptoassets posted as collateral. There is no head office, credit rating agency or other central instance incurring cost or slowing the process. Posted collateral went from $500m a year ago to now >$10bn

Serum is, like Uniswap, a decentralised exchange. It runs an order book like traditional exchanges, which is enabled by the significantly higher transaction speeds on Solana, its basis chain. Daily volume has recently exceeded $200m, having launched in October 2020

Nexus Mutual is a decentralised insurer, where members’ fees are managed by an algorithm and pay-outs determined again in a game-theory like equilibrium, similar to what Uniswap does for trading. So far, insurance is provided to the loss or theft of cryptoassets as well as crypto protocol failures

One might notice a common thread: First, these apps are all decentralised, they thrive without any middlemen. Second, these examples are, like the vast majority of crypto applications, related to finance (Hence the name “DeFi” or decentralized finance). In particular, they haven’t bridged to the outside world. They are all conduits to manage and re-arrange financial exposure within the ecosystem

In other words, so far, the human mind has found ingenious ways to structure the rampant speculation within cryptocurrencies. This reminds of the glass bead game in Hermann Hesse’s eponymous book, where participants become masters in an intricate game with no real world application

The challenge over the next years will be to migrate the technology behind DeFi into the real world where regulation, anti-money laundering rules and other obstacles await

These obstacle are there for a reason - just in August 2020 a North Korean hacker group stole $250m from crypto exchange KoCoin and subsequently, untraceablely, laundered the funds through Uniswap

In the mentioned DeFi examples, the key to innovation is how the blockchain allows for cutting out the middleman

Banks, brokerages, stock exchanges, insurance firms or payment providers are in the cross-hairs. Now, as mentioned, large sums of money invite fraudulent activities. In order to protect consumers, all these services are strictly regulated

This creates a challenge for networks without a central monitoring instance. Therefore, the end game may be that established financial institutions with trustworthy regulatory credentials adopt blockchain innovation internally

However, there are many more networks where middlemen take a large share of the individual’s contribution, and many of them require much less regulatory oversight. The below table gives examples of typical networks and the share left to the original contributor:

Social networks in particular stand out in the overview above. The individual contributor receives zero monetary compensation for providing their creative input as well as their data

The internet wasn’t meant to be like that. It’s first incarnation (“Web 1.0”) from 1993-2002 was dominated by by open browsing across hundreds of individual websites, as well as email (which is decentralized) and various chat programmes

Web 2.0 (from 2002-Today) saw the consolidation of time spent online from many small individual units to few proprietary social networks. The concurrent wealth creation rested with a few founders and shareholders, one of the many facets that contributes to Millennial discontent with today’s economy

In terms of technology, all the big social networks today could easily exist without the middlemen, they are by no means the bleeding edge of innovation anymore. Why are they not being replaced or challenged?

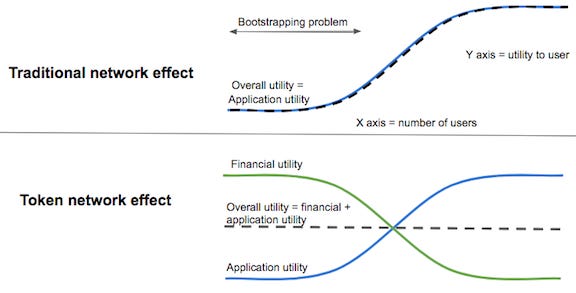

What protects them is the network effect, Metcalf’s Law, where the value of a network rises exponentially with the number of members. Any challenger has to overcome the hurdle of making the network interesting enough in the beginning, with a low number of members - a problem called bootstrapping

This is where Blockchain economics come into play, in particular around Tokens. Tokens are virtual currencies that reside on a blockchain, assigning ownership to the respective network in an easy and immutable way. In terms of their characteristics, they sit between equity and cash

They share the fungibility and liquidity of cash, as they can be transferred from one owner to the next instantaneously and with minimal effort

Just like equity, they also participate in network economics. Revenues e.g., from advertising or fees can be distributed to token holders in various ways, e.g. via buy backs (just like with traditional shares) or via a process called staking, which resembles dividend income

This makes them an ideal tool to shape incentive structures that align all participants in an economic endeavor in a fair and transparent way

Tokens can be given to anyone without constraints, whether in Argentina or Slovakia, mirroring what has become a global remote workforce. They provide liquidity from day 1 and anyone can become an early stage investor in new projects, not just Venture Capitalists

They also represent an ingenious way to overcome the bootstrapping problem in new social networks, as early adopters are incentivised to participate in the build-out by having been given ownership

More so, not only do they provide incentives to members to grow networks in their early innings. They also allow for the economic value of the network to be reassigned to the people who make it valuable on a continuous basis, as new tokens are distributed to the most active members. This is the combination that creates the disruptive potential of the Blockchain for social networks and the eventual threat to Facebook, Instagram, Google or Spotify

“Social tokens” are in very early innings in terms of their development. Their powerful incentive structure will make them a significant force going forward. The following are some of today’s notable examples:

Audius is a music player like Soundcloud or Spotify launched in September 2019. The platform is decentralised, based on Token economics ($AUDIO) and pays out a much higher share to its artists. The user interface feels like a mass product, not like a niche for nerds. Emerging artists with little visibility elsewhere are providing the initial supply, with some better known acts having joined more recently as the audience grows. With ~5m unique monthly users, running on Ethereum and Solana, it is the most compelling template for the successful implementation of a token-based real world business model

Braintrust is platform linking freelancers to potential employers. It charges a 10% fee from employers, there is no cut from the freelancers (vs ~30-40% on traditional competitor) and it uses its Btrust token to incentivise freelancers to collaborate in building out the platform, inviting new talent or vetting existing talent. A hybrid approach is applied in terms of decentralization, with a foundation in control of key governing aspects

Brave is a web browser centered on privacy. It blocks transmission of private browsing data and instead assigns “BAT” tokens for viewing privacy-respecting ads. This direct attack on Google and Facebook has now reached ~25m monthly active users

To summarise - make no mistake, just like the internet bubble of 1999/2000, the cryptocurrency bubble of 2020/2021 will deflate, and it will do so with much collateral damage, particularly for retail investors. But in its wake, transformational innovation will be born, with real-world applications that will make an everyday difference

Canada, New Zealand and Iceland were the latest central banks to announce rate increases, plans of such or a reduction in their quantitative easing programme. While these countries hold little economic weight on a global scale, their central bank decisions are often precursors to the heavyweights Fed and ECB

It is often stated that e.g., Ethereum (ETH) has generated $8.6bn of network fees in Q1, which when annualised would equal a “P/E-Ratio” of ~30x. One has to keep in mind that these fees are in their overwhelming majority paid by apps providing speculative uses cases (e.g. posting ETH as collateral to buy other coins on leverage), and also are paid out in ETH, not USD. I.e. if the value of ETH declines, the equivalent USD-fees also decline. In essence, this remains an intra-ecosystem circular reference