Short Term Investing

The Synthesis of my Learnings - Part II

In my last post I introduced the wave-pattern as most basic principle for investing. Economic activity and asset prices oscillate around their respective long-term trends; human greed and fear as well as ever-changing circumstances prevent an ideal equilibrium

This principle was then applied to the stock market, illustrating how the return distribution of the S&P 500 follows the ebb and flow of economic activity closely, when measured by Purchasing Manager expectations

Furthermore, it accordingly showed how we have just passed the top of a big up-cycle, with a more treacherous period ahead

Today’s post will apply the same principle to investment decisions with a short-term time frame (several months to years). The next post will focus on long-term investment decisions (years to decades)

When investing in public or private assets with a time horizon of several months to 3-5 years, the entry price matters greatly. And as such, it matters greatly where we find ourselves in the wave-like cycle of greed and fear

To give a stark example: internet equipment maker Cisco is a great company with high barriers to entry and a growing business. Unsurprisingly, its free cash flow per share has gone up 7x over the past two decades. However, if one bought its shares at the peak of the Tech Bubble in 2000, one would still sit on considerable losses today. For shorter time frames, the entry point matters a lot

This example already highlights the two ingredients for a good investment decision

Identifying the direction of the long-term trend. In Cisco’s case upwards, driven by the increasing penetration of the internet

Identifying the wave-pattern around that trend. In Cisco’s case 1999/2000 as extreme peak of ebullience

In determining the long-term trend, one’s biggest asset is common sense

Long-term trends are very basic, and driven by strong structural forces. Not rocket science, but common sense is all one needs to identify them. Examples include transition to the cloud, rising EM middle class, shrinking Western core demographics, ESG, knowledge economy, streaming vs cinemas etc.

Conversely, for maintaining one’s view on the long-term trend, one’s biggest enemies are noise, impatience and framework

Noise describes the daily onslaught of often irrelevant information, accompanied by many behavioural traps to increase engagement

Impatience is related to noise. The more time passes, the larger the window in which noise can seed doubts and overturn decision-making based on common sense. Think of this Stan Druckenmiller story of him investing in tech stocks in 2000 just before the bubble burst as he basically ran out of patience

Framework describes the context in which the investment is made. There are many examples where wrong frameworks impair decision-making, e.g. excessive leverage or focus on immediate returns1

Having established the long-term trend, we next need to determine where in the wave-pattern of excessive greed or fear we find ourselves. In particular, we should look for the turning points, where the pendulum has swung too far. But how?

For returns that beat the market and are therefore worth the effort of actively trying, one has to be in just before the wave turns, when all you read and hear is in pointing in the other direction

This is deeply uncomfortable, as it works against our hard-wired instinct to follow the herd both in case of danger or in case of promising pastures

The question is, how to measure this noise? If it were easy, wouldn’t everyone do it?

While there are many indicators that measure market sentiment (I can recommend here and here, also here on financial newsletters as contrarian indicator), media outlets can give strong cues as they encapsulate and mirror social mood in their headlines and images

It’s exemplary what the financial press had to say about the state of the stock market before and after the COVID-19 induced crash in 2020. Notice the bleak red and black on the Barron’s cover at the trough

No one knows what the future will hold. Depending on collective mood, the imagination of the future can be positive or negative. The collective mood makes the price on the stock market, and media is a mirror of said mood. It pays off to understand the current mood, stick to the long term trend derived with common sense and wait for the right moment to engage

Applying the above, let’s look at the currently hotly debated topic of inflation2

The chart below portrays the relationship between the US 10-year treasury yield and the Economist/Barron’s magazine covers

Reliably, whenever a yield-relevant issue has made the cover, yields turn in the other direction

Same for the last cover on the right on inflation. Again, notice the bleak red and big bold black letters on the Barron’s cover (The “I” Word), giving a strong hint that the topic may have seen its peak anxiety moment

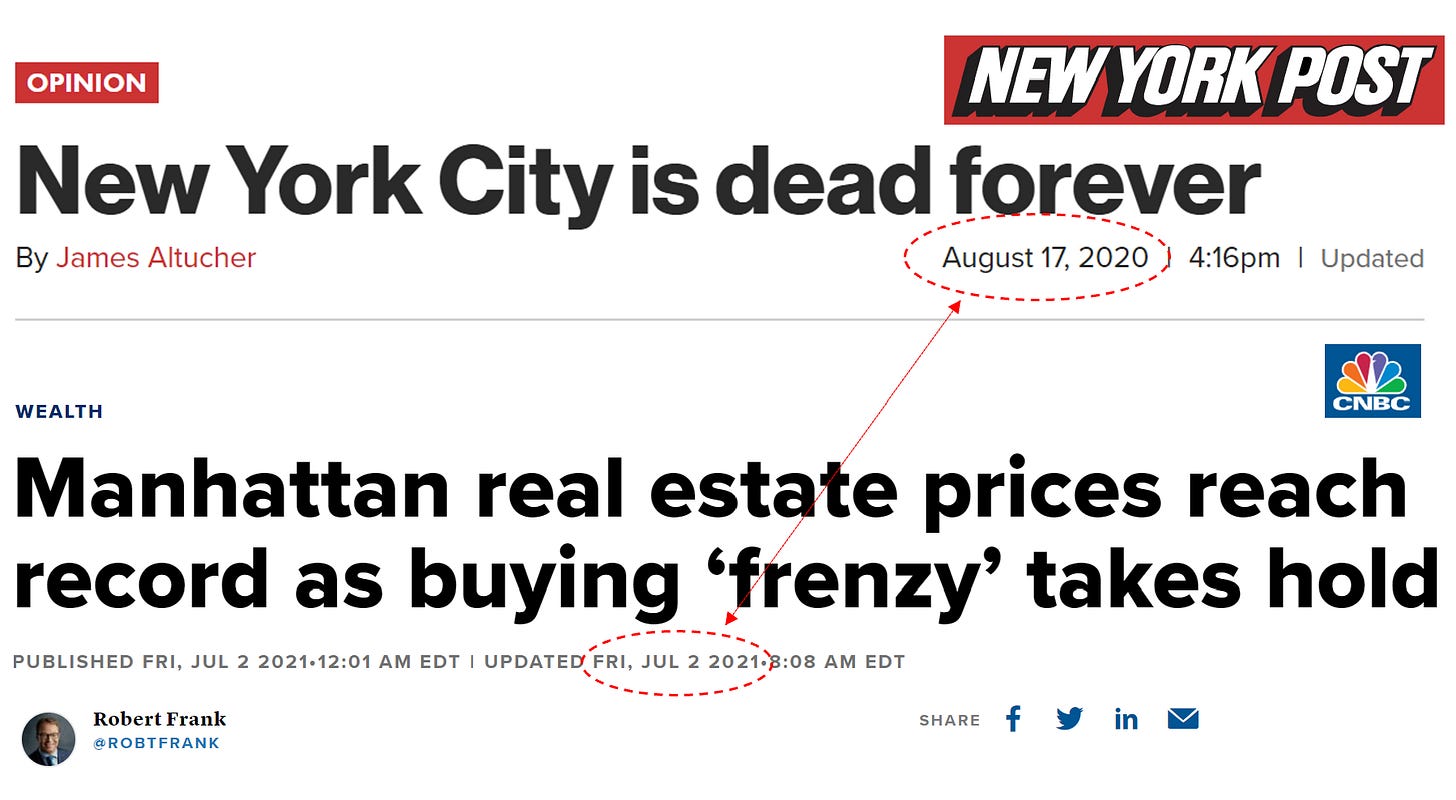

Another example, take the New York real estate market over the past 12 months

In the summer of 2020 residential real estate prices hit rock bottom as everyone thought that “New York City was dead forever”. Many reasons where given, from taxes to discovering the advantages of the slow life in the countryside

A year later, we see record prices in a “buying frenzy”

Common sense says that cities will always be amazing places to connect, but they won’t work for everyone’s needs. Both the dead forever as well as the buying frenzy are likely peaks of a wave to the first down- then upside

Now, let’s apply the same train of thought to some current situations, combining both common sense and the wave-principle:

Below is the share price of car maker Ford since 2014

Common sense: Ford is stuck in a long-term downtrend caused by aggressive competition, lacklustre demand in its saturated core markets North America and Europe, and the challenge of adapting a huge corporation to the electric vehicle age. These trends are likely still around and relevant

Psychology: Ford’s share price went up 4x from crisis lows and paints the picture of a new normal. This is likely just the effect of collective ebullience rather than reality

Conclusion: Ford’s share price will likely eventually revert to the downtrend

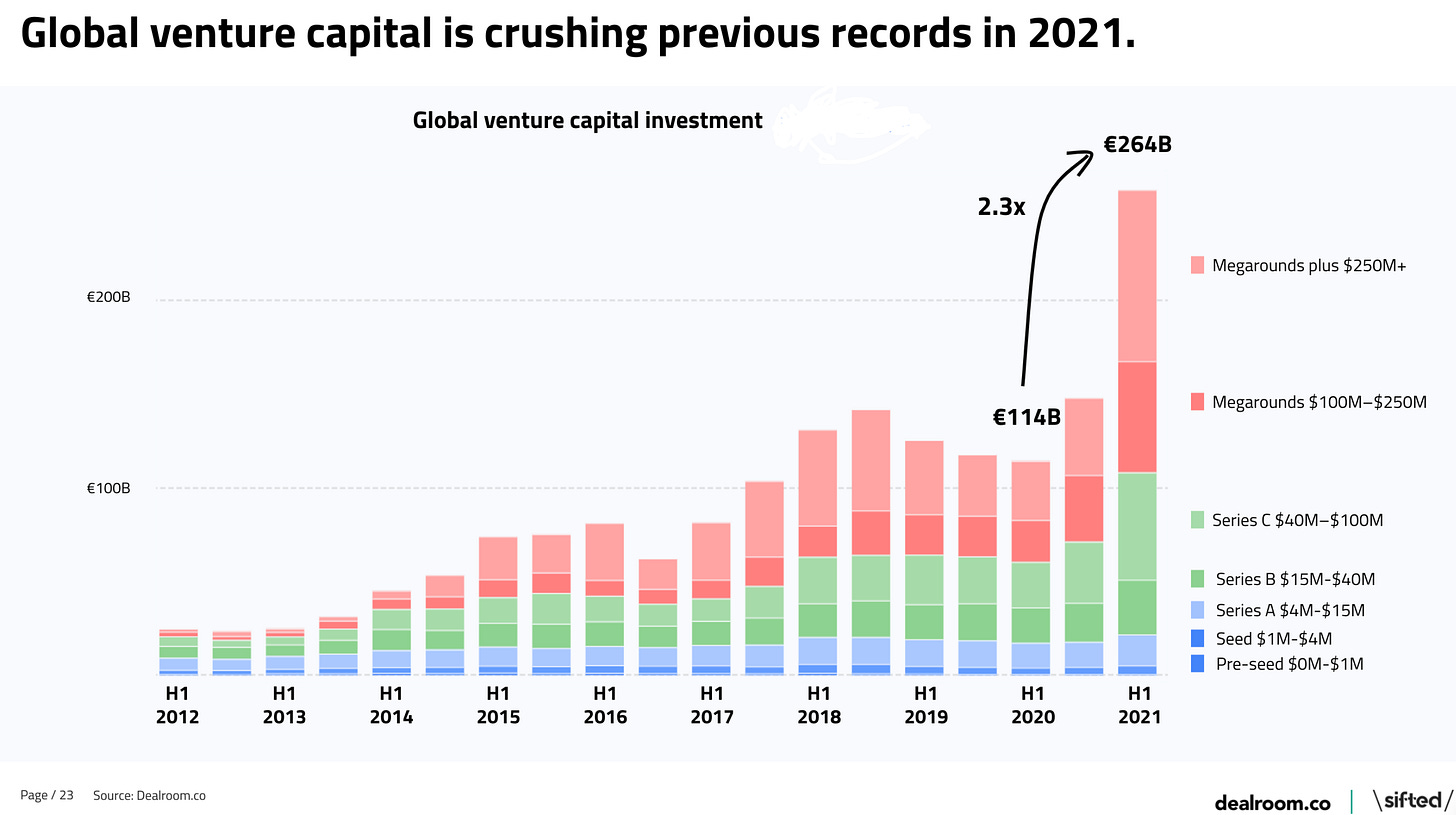

The current state of the venture capital market

Common sense: VC over the past 50 years has delivered returns in line with equity markets. Recent VC returns are super-charged from a decade of declining interest rates as well as IPO-exits into valuation-insensitive retail shareholders

Psychology: Everyone sees the returns from the past year(s), believes in a new normal and floods the VC market with capital

Conclusion: While individual start-ups can still do very well, too much capital as well as investor caution thrown to the wind will likely mean underwhelming returns from the 2021 VC-vintage

The US real estate market, as already touched on with the above example of New York

Common sense: Real estate prices are a reflection of supply, purchasing power, interest rates and demographics. They should follow a broad long term up-trend as the economy grows

Psychology: Prices have exploded, creating FOMO. But wage growth is not keeping pace, so affordability collapses (see second chart, UMich Survey)

Conclusion: Houses prices will likely fall back to the long term up-trend

A note on the side: all these examples show an exaggeration to the top, with a downward correction for these examples likely. I would have liked to draw up some examples that show the opposite, i.e. excessive negativity leading to upside opportunities

However, the time for that was last year, and this year is really just the inversion of the past year

Having said that, travel assets, which are under pressure from the COVID-19 Delta variant, might soon show exaggeration to the downside and provide opportunity. Over the medium-term the world will learn how to live with COVID-19 and people want to travel (relevant for EasyJet, Carnival Cruises, American Airlines etc.)

Conclusion: The point is to be positioned before the wave turns. This is uncomfortable as everything will scream differently. When the noise is the loudest, the turn is near

The next post will address long term investing

Great and well explained article. Thank you!