The Curious Case of Tesla

World-changing company... or giant hoax?

Tesla is a remarkable company. It has singlehandedly disrupted a capital-intensive industry thought to be immune to disruption. It has demonstrated the viability of electric vehicles as mass products, and it bears much responsibility for an industry-wide push in that direction. It is also running an unique PR-engine that thrives on provocation and hyperbole. With liquidity in financial markets rolling over and competition getting closer, reality might catch up fast with this well-oiled hype machine

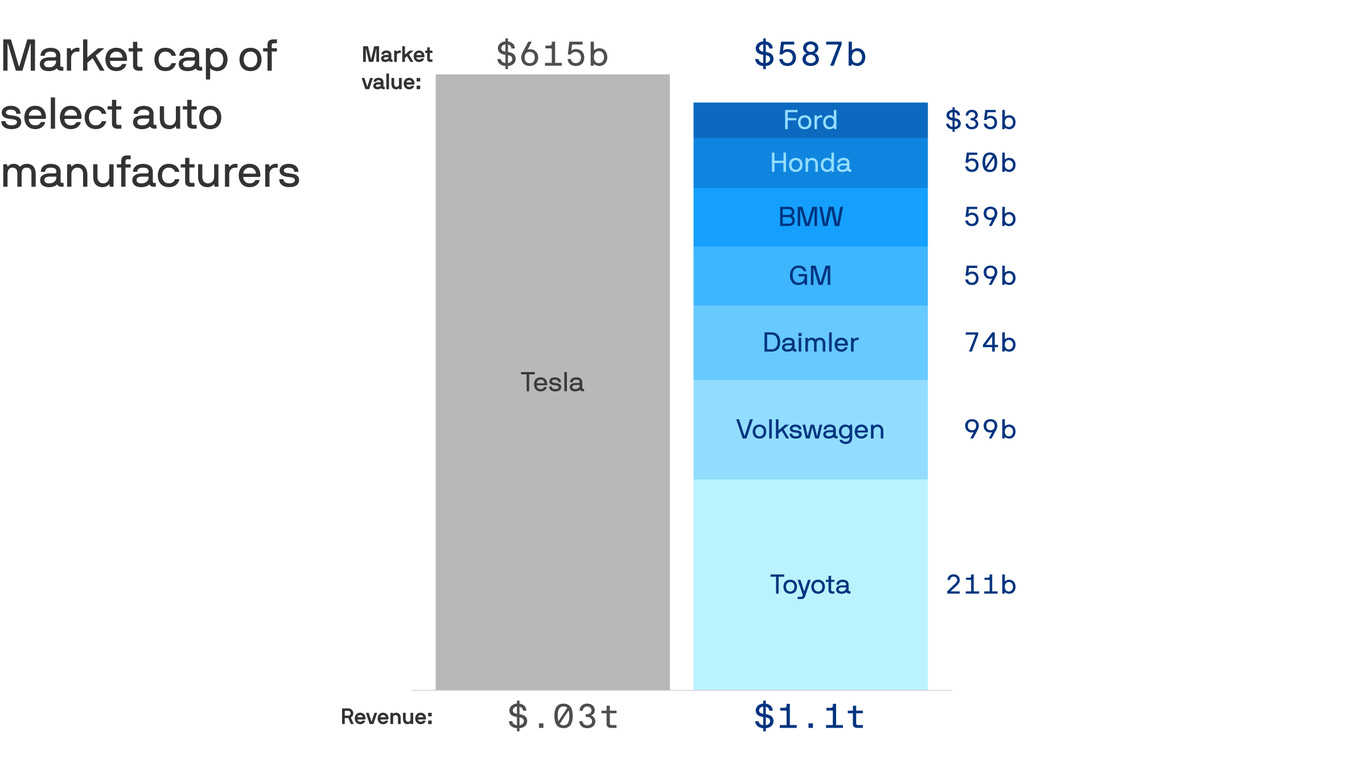

Today, Tesla’s valuation exceeds that of its 7 biggest competitors combined, despite achieving only a fraction of their revenues. It is valued at 20x EV/Sales or 120x EV/EBITDA, a level usually carried by growth businesses that are asset-light, highly cash generative, and exist in niches with little competition. None of which seem to apply to Tesla. So how did that happen?

Tesla is a fantastic business, but even more so, it is a fantastic PR machine

CEO Elon Musk plays a central role in this effort, his tweets and style make him hero of Millennials looking for leaders. (See my recent post and also this FT long read on the challenges that generation is facing)

Elon Musk’s 53 million followers put him amongst the Top 25 on Twitter, a list that is otherwise populated by popstars, with Bill Gates the only other business personality. His style is rebellious, non-conformist and provocative, which jibes with young people frustrated by the status quo

In order to shape this image, Elon Musk deliberately pushes moral boundaries in an often juvenile way. Here are some recent examples:

Smoking pot on Joe Rogan’s radio show:

Peddling bitcoin in this explicit and religiously provocative image (I had written about the link between Bitcoin and religion before here):

Or promoting Dogecoin1, a cryptocurrency with no intrinsic value beyond a party joke that has now reached a >$70bn valuation

In the above image, he skilfully exploits the narrative of the “global financial system” stacked against the masses, with cryptocurrencies (and Tesla in association) the way to salvation, without mentioning that he is a huge beneficiary of said system, and that most buyers of Dogecoin will likely lose their shirt

Consequently, Millennials adore Elon Musk and Tesla, and see them as heroes of their generation. Now, most young people cannot afford the relatively expensive cars, so one might wonder why all this PR is aimed at them. The reason is simple: young people set trends and shape public discussion. It is then their parents responding to these trends and purchasing the product - the average buyer of a Tesla Model S or X is 54 years old

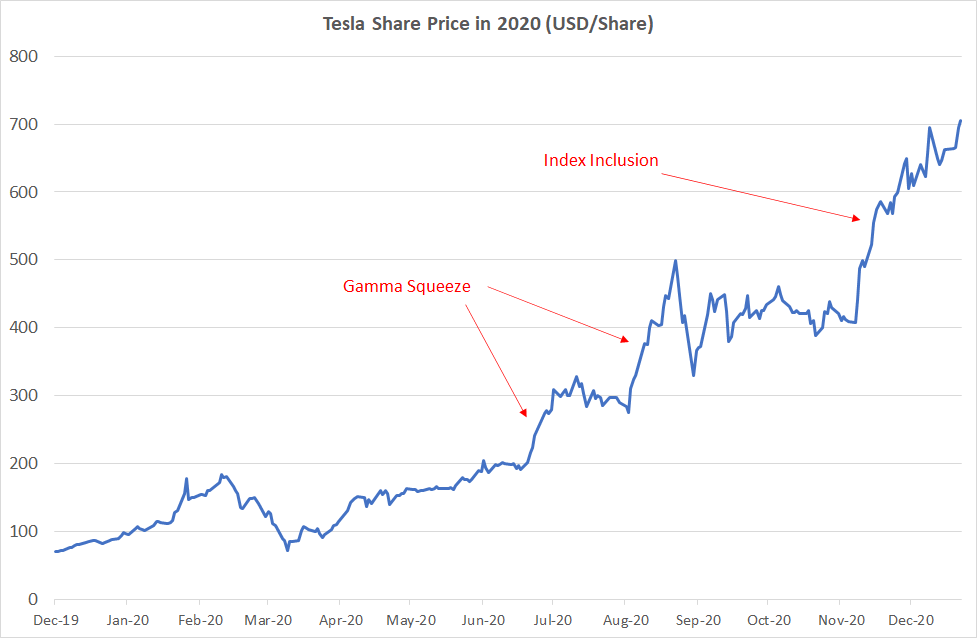

The same Millennial adoration has also played a role in the dramatic ascent in Tesla’s share price over the course of 2020, especially after the COVID-19 related stock market crash and subsequent rally driven by the Fed’s firehose of monetary support:

Over the summer of 2020, dramatically elevated Tesla call option buying caused multiple gamma squeezes, a dynamic where options activity causes prices to appreciate akin to a self-fulfilling prophecy. This typically requires some kind of news-flow as trigger, in this case provided by Musk’s frequent tweeting about Tesla’s various achievements (not always entirely accurate), which set off Robin Hood-armed retail investors responding to them with buy orders oblivious to valuation

As the company’s market cap increased, it became eligible for inclusion in the S&P 500 in December ‘20. This created an additional $110bn buy demand2 levitating the stock further

Like hot air being pulled upwards in a chimney, similar technical effects were at work here. No doubt about Tesla’s achievements, but it seems clear that the company’s valuation had reached an extreme degree. Let’s have a look what would be required to justified these levels:

Unique battery and range: The company’s biggest achievement has been to create an electric vehicle with a long enough range to be competitive with traditional vehicles running on gasoline or diesel. Tesla was the first to offer such range, and until last year its models still offered 2-3x the range of competitors such as the BMW i3 or the Nissan Leaf.

However, the advantage is reducing fast. VW’s latest EV model, the id.4, comes with a range of 287 miles vs 343 for Tesla’s Model 3. The new Mercedes EQS available towards the end of the year will have a range of 478 miles vs 520 miles for Tesla’s Model S Plaid+, also to come to market next year

EV battery costs have fallen ~97% over the past three decade. As with many other industrial products, Wright’s Law is in effect, in other words, costs decline rapidly as production volume increases. EV batteries are fast becoming a commodity

Unique charging network: While 80% of charging is done at home, Tesla is the only carmaker offering a US-nationwide charging network right now, and the network is exclusive to their cars. This represents a meaningful competitive advantage, however, it is unlikely to last for long. Part of the Biden clean energy plan is to add 500k brand-independent charging stations across the country until 2025

Autonomous driving: Tesla has promised an imminent release of a Level-5 equivalent self-driving function (=no human interaction) since 2016. Today, it seems further away than ever before, and the company itself has just added a reference in its risk disclosure that it may never be possible. While that may just be a caveat, it points to broad challenges emanating for artificial intelligence (“AI”), which is the basis of self-driving:

The truth about AI is that mimicking human intelligence is incredibly hard and complex - summarised excellently in this recent research paper “Why AI is harder than we think”. AI today mostly equals a computer memorising thousands to millions of historical samples to then make a probability based judgement on a similar sample. The challenge lies in novel situations, where humans can make a quick, accurate call based on common sense, but the machine is lost if it’s not in its inventory

Robotaxis: In a call with investors in May 2019, Musk said to expect 1 million Teslas on the road by the end of 2020 that are able to function as “robo-taxis”. Autonomous driving, which would be the pre-requisite for robo-taxis, turns out to be harder than thought. More so, several industry participants judge other self-driving programmes more advanced, with Tesla significantly lagging Waymo or GM’s Cruise

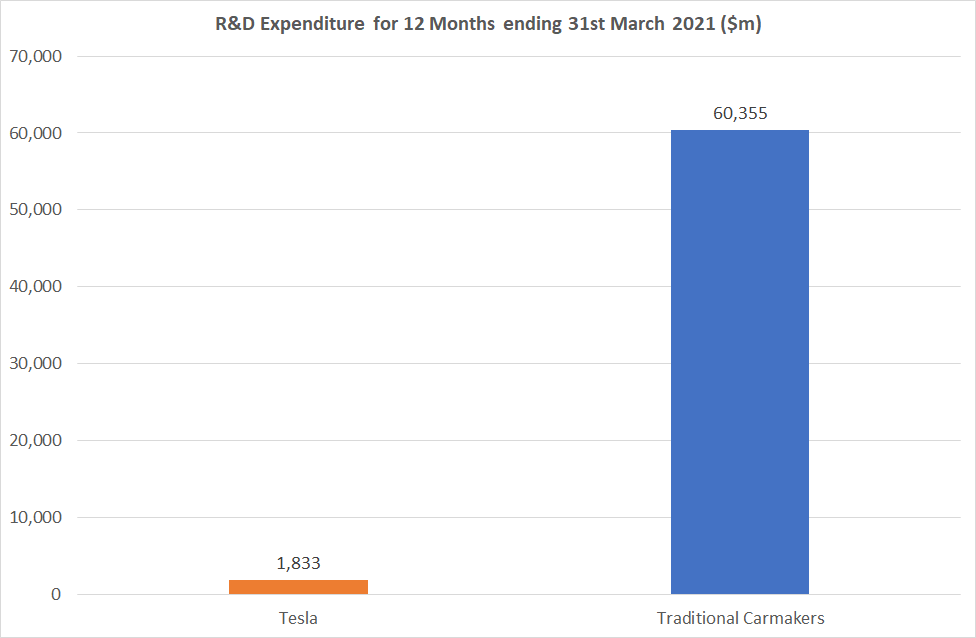

The blue-sky assumptions necessary to support the stellar run in Tesla’s shares seem unlikely to become a reality any time soon. Even more so, competition is heating up. While Tesla didn’t have any legacy assets and could thus design everything from scratch, enabling it to go further with less funding, the amount of money traditional carmakers are now throwing at the problem is literally mind-blowing:

The established manufacturers together are spending 30x more on R&D than Tesla. Volkswagen alone intends to spend $86bn on electric vehicles, hybrid tech and digitalization until 2025

It is incredible that Tesla managed to challenge an industry with so much aggregate firepower. And true, there are many obstacles in the way of traditional carmakers, as outlined in this extensive WSJ article on the example of VW. But the first products out of this herculean catch-up effort are coming to the market, and they suggest established players are catching up fast:

While VW’s first mass market EV, the id.3, received largely negative reviews, had many software bugs and an underwhelming range, the new VW id.4. is much better received. Eyebrows were raised when the influential US car magazine Edmunds recently called it a superior alternative to the Tesla Model 3:

Mercedes-Benz is launching its electric flagship model EQS later this year. Again, reviews have been universally positive. Aside from the mentioned on-par battery range, the below side-by-side image of the EQS interior compared to Tesla’s Model S shows arguably more refined aesthetics and comfort, unsurprisingly given Mercedes’s core competence of luxury automobiles honed over many decades

Finally, in terms of its valuation, as discussed in previous posts, aggregate liquidity in financial markets is rolling over. This suggests that the “free money” period that has benefited concept stocks, SPACs, cryptocurrencies and other assets with high terminal value is coming to an end

While the US Treasury has issued less debt than the Fed has hoovered up within QE during the first four months of this year, this dynamic is now reversing with $1.26tr debt to be issued between May and September vs 720bn to be bought by the Fed. That represents ~$540bn of liquidity drained from the markets, in contrast to a similar amount being added over the course of March and April, when the Treasury General Account was run down as stimulus cheques were sent out

Janet Yellen’s comments suggesting that interest rates could rise in light of increased public spending are also likely not uttered without thought, and aimed at taking froth out of financial markets, similar to recent comments by Dallas-Fed President Kaplan or Jerome Powell himself

While Tesla has achieved incredible progress in a previously ossified industry, the pendulum has swung too far. Taken together, more competition, a complicated stock market and significant challenges in autonomous driving signify tougher times ahead for both Tesla and its shares