The End of Covid?

Some good news out of South Africa. Plus a follow up on "House Money"

It has shown to be very difficult to forecast the progress of COVID-19. However, recent data from Gauteng in South Africa, the epicenter of the latest variant Omicron, provides reason for cautious optimism. If confirmed, COVID-19 may follow the path of its predecessors and evolve into a much less harmful virus

Grim headlines speak from UK newspapers these days. Omicron has reached ~50% of cases in London, and the health minister conceded that currently 200,000 people per day are catching COVID-19

This is a preview of what awaits Continental Europe and the US, which are 2-3 weeks behind

And indeed, Omicron is incredibly infectious

In a quarantine hotel in Hong Kong, where people are only allowed to open the room door to receive food, it was transmitted across the hall without contact

Estimates point to 4x higher transmissibility than the currently dominant Delta variant. This implies that practically everyone will be exposed to Omicron over the next few weeks and months

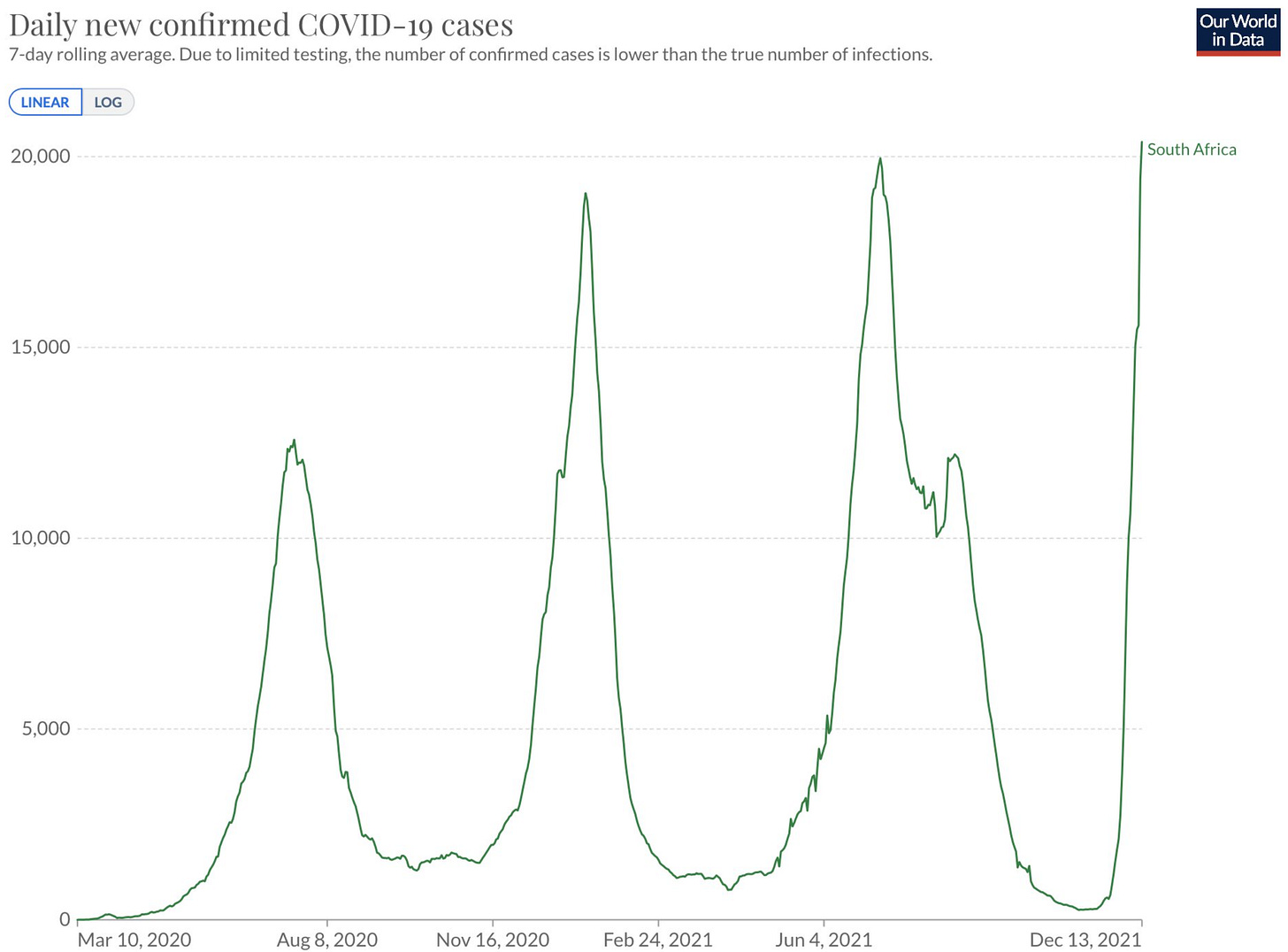

Now, let’s look at South Africa in more detail, where Omicron is most advanced. At first glance, the recent outbreak seems to continue to go vertical

However, looking at the providence of Gauteng, the local Omicron epicenter, cases have reached the frequently perceived saturation level of ~30%1 of the population and are now stalling

And after a month into this wave, there’s now enough data to draw some conclusions:

Looking at the charts below, there are significantly less hospitalised patients than with Delta. Of those hospitalised, fewer come into ICU, and of those again fewer require ventilation

This data corroborates many anecdotal reports that Omicron would cause significantly milder disease than its predecessors (e.g. here or here)

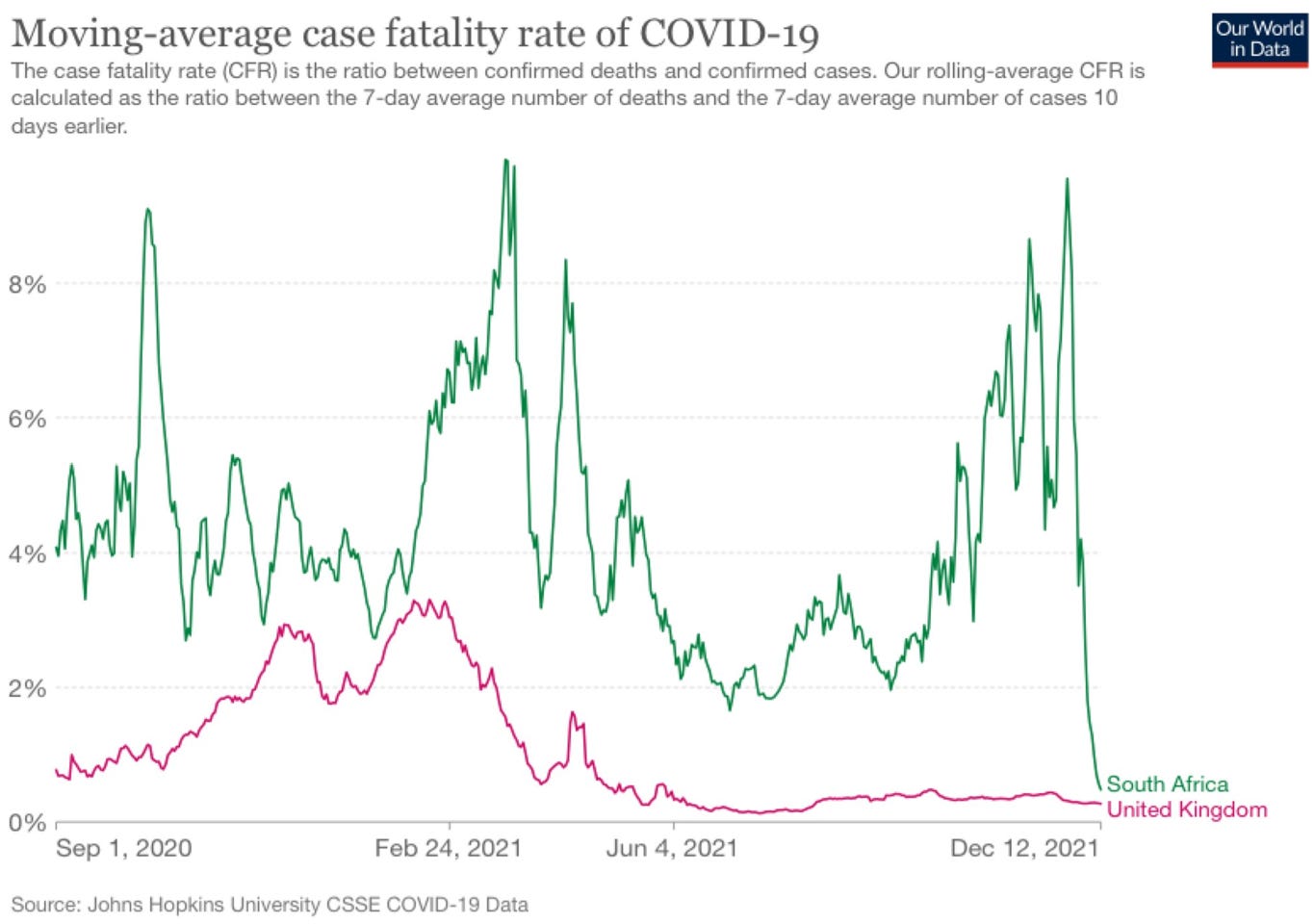

Most importantly, with regards to fatalities, extrapolating these trends means 25x fewer deaths than Delta

The chart below displays the number of cases against number of deaths, both in South Africa and the UK. As can be seen, the ratio has collapsed in SA, which means there are very few deaths on a staggering number of new cases

While this is obviously somewhat skewed (deaths lag infections by 4-6 weeks), it is still instructive of the dramatic difference in lethality

How is this possible?

Several reasons may be behind these dynamics:

Omicron might have developed in an immunocompromised patient (e.g. HIV). In this situation, the virus can linger and mutate for a long time as the patient can’t shake it off. It also means that the virus likely evolves to be less lethal, otherwise it would quickly kill the already weakened host

South Africa has a young population with very high natural immunisation, 70% of the population had COVID-19. While prior exposure does not prevent re-infection (mainly as antibodies wane after 5-6 months), it seem to play a substantial role in preventing severe illness. This is due T-Cells, the body’s strongest line of defense. They last much longer than antibodies, however also take more time to activate, so you get a bit sick first

Prior coronavirus epidemics evolved from lethal to harmless over several waves

The Russian Flu of 1889-1894 killed 1 million people (world population was 1.5 billion at the time). It was likely triggered by coronavirus HCoV-OC43, which is one of four coronaviruses in circulation today. They are together responsible for ~15% of common cold cases, with generally benign outcomes

From the virus’ perspective this makes total sense. Its goal is to replicate itself as often as possible. A high mortality limits proliferation

In South Africa, Omicron has run over the country with no restrictions in its way. It’s current vertical (not exponential, vertical) path suggests that the wave will break very soon

Europe and the US with their older population (and in some pockets high vaccine hesitancy) will face a tough test in the next few weeks, as the sheer numbers of omicron patients will drive up hospitalisations even with lower severity and fatality

However, given the data from Gauteng, there is reason to be cautiously optimistic that the virus has embarked on the path of its ancestors and we’re facing the last big test now. Two facts further support this dynamic:

Vaccine uptake has rapidly improved over the past few months as both governments become more aggressive with mandates and public acceptance has increased

There have been dramatic improvements in treatment - news that were somewhat drowned out: Pfizer’s new treatment pill cuts hospitalisations and deaths by 89%, and it is effective against Omicron

Follow up to last week’s post “House Money”:

Last week’s outline of the porous underbelly in high-growth tech was my most read post yet - this is flattering, but also a sign of the exposure many of my readers have to this area

Just to recall, ever-increasing returns ushered in a degree of carelessness in tech investing. Now, the sector faces a negative catalyst with the Fed’s changed monetary policy stance. This in turn is caused by inflation, which is upsetting everyday Americans who want it to go away

In that context, I would like to highlight that inflation continues to accelerate, confirmed by recent data here and here

Yes, production bottlenecks will be resolved and some commodity prices might come down (even though lumber prices are increasing again). But durables account for only 15% of the inflation index

The vast majority is housing and services. Housing costs enter inflation statistics with a lag - it takes some time for old rents to expire and higher new rents to be signed up. This alone will contribute ~4-5% to CPI over the course of next year. Services are driven by wages (think of waiters in restaurants, nurses in hospitals etc), and wages are going up fast in an empty labor market

All of this is just a reflection of one simple phenomenon - there is way too much money in the system. $2 trillion excess savings, $5.5 trillion parked in money market funds - and how many people have you spoken to recently who are worried about their cash and want to put it into real estate (= more inflation)?

The Fed has now very obviously recognised this dynamic. However, the market is still underestimating what will be necessary to tame it. It took years and a painful recession to get inflation out of system under Fed Chair Paul Volcker in the early 1980s

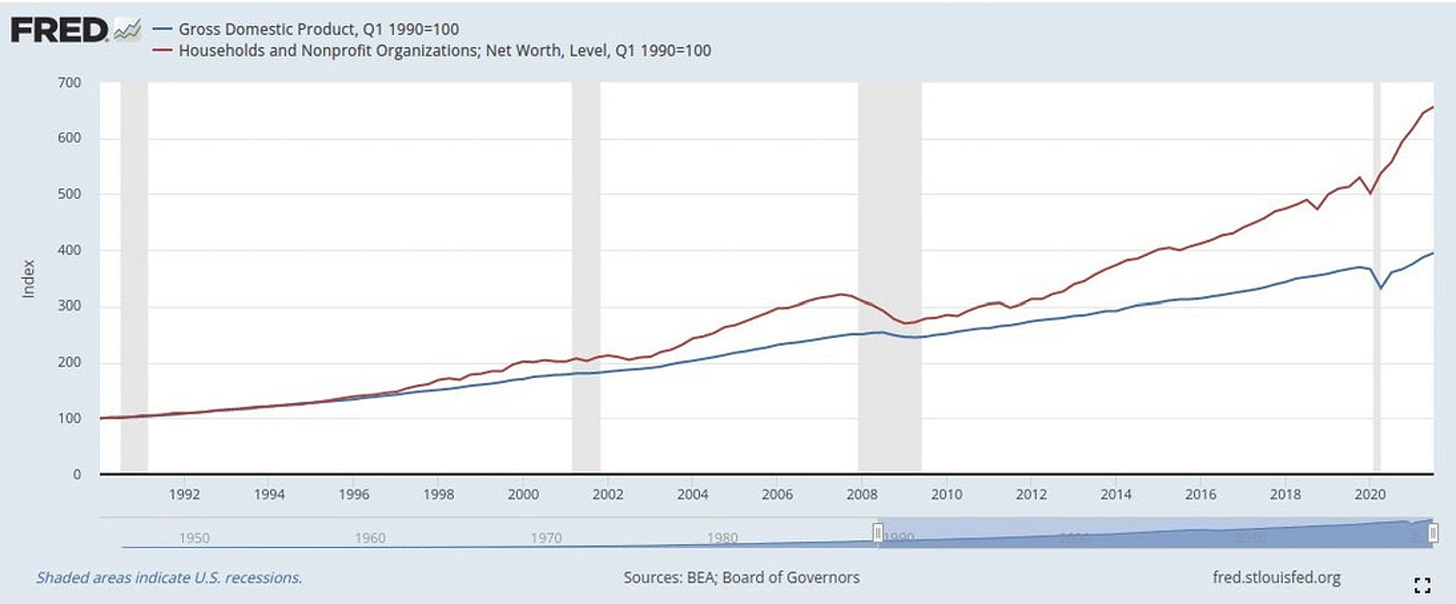

If one regards stocks as quasi-cash (given the ability to sell them instantaneously), one easy way to remove liquidity from the system is to bring asset prices down

The chart below compares US GDP (blue line) with US household net worth, of which are large portion is invested in stocks and the S&P 500. It’s visible how much out of sync the gap between the two has become (and how much scope there would be for a downward adjustment)

The Fed is likely very aware of this lever right now. As such, the old market adage of “Don’t fight the Fed” remains true, just in a new meaning. I continue to recommend to sell anything with high negative exposure to rising interest rates

Prior waves with no restrictions have topped out at around 30% of population (e.g. Delhi, Heinsberg, Bronx NY), which is likely due to a mix of pre-existing immunity and asymptomatic cases not getting tested