The Observer Effect

Inflation is dead, that's why it is coming back

Since the start of this year, financial markets quickly shifted to accept the demise of inflation, something I predicted in several posts late last year. However, markets are a complicated science, in particular because they share a surprising parallel with quantum physics. There, the person conducting the experiment influences its outcome, and so the path of quantum particles differs depending on whether they are observed or not (an effect made famous by Schrödinger’s Cat)

This “Observer Effect” also applies to financial markets and illustrates the challenge in forecasting them. Awareness of forecasts changes the subject’s behavior, a dynamic termed “Reflexivity” by George Soros. We just witnessed a positive example in Germany, where collective awareness of the gas crisis created a situation that now, in fact, makes gas oversupply likely next year, unless the rest of this winter turns out materially colder than expected

In a similar reflexive notion, collective observation of inflation’s demise creates the groundwork for its return over the coming months. As everyone from investors to the Fed or the US government change their behavior based on the updated view, they invite a resurgence, with oil as possible conduit, which remains the primordial input for both industry and transport. Thus, the Fed likely applies more tightening beyond its next meeting, something most currently rule out

Today’s post walks through the reasoning for a potential inflation resurgence in the coming months, and as always closes with an outlook on current markets

Let’s dive in. With the most recent CPI print, which was deflationary on a month-to-month headline number (-0.1%) and low for the core (+0.3%), markets declared the inflation topic dead

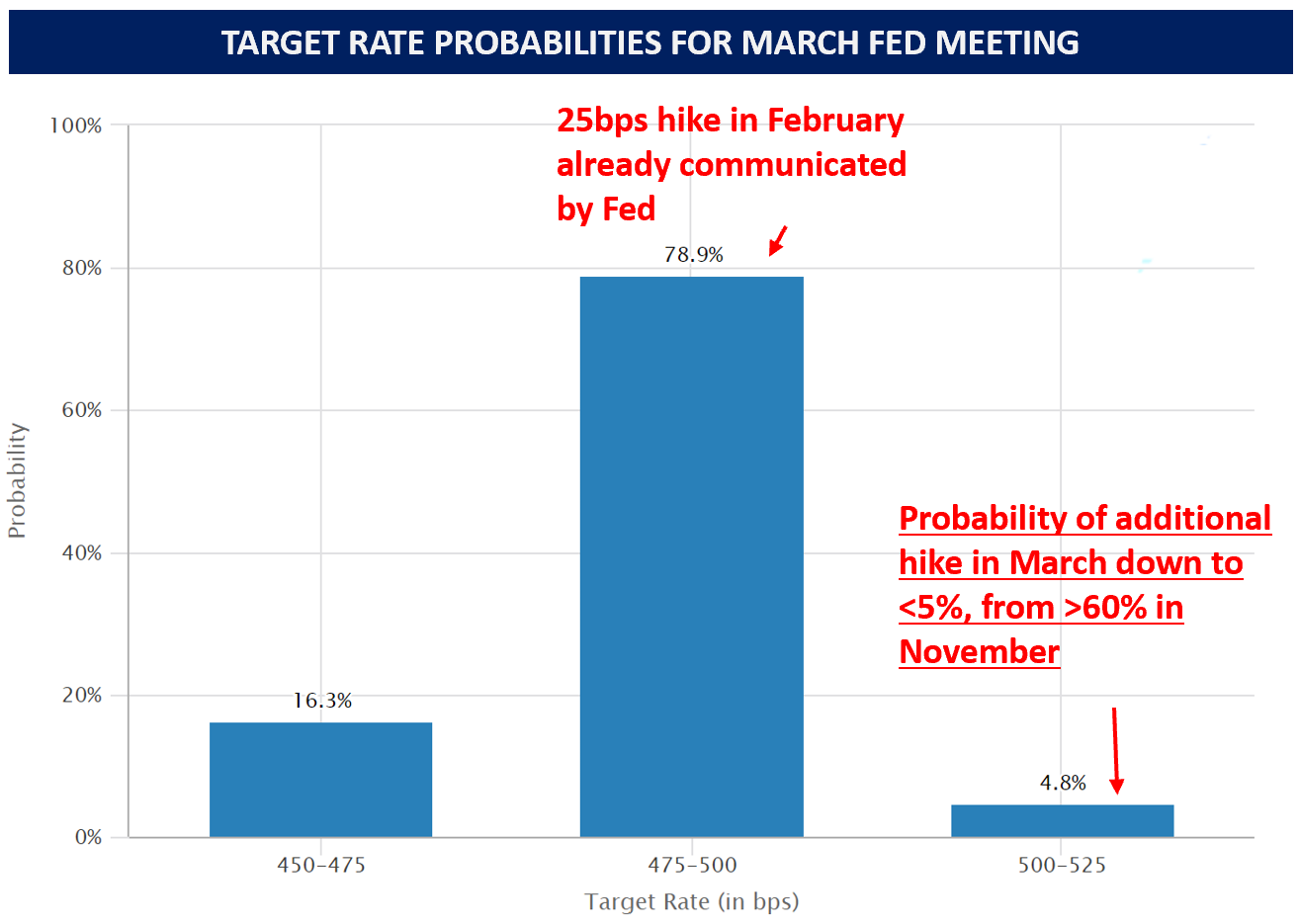

Bonds, which I highlighted late last year in “On a Personal Note”, rallied further, and markets reduced their probability of a second 25bps Fed interest rate hike after February to low single digits, from near certain a few weeks ago

This collective assumption of inflation’s death reinvites its resurgence via four avenues

1 Financial Conditions

The Fed continues to maintain a hawkish stance. However, it only controls short term rates

Financial conditions, a holistic measurement of the “cost of money”, are set by a much broader array of metrics, such as 30-year rates which determine mortgage costs, or stock market prices, which determine the cost of raising equity. Most of these metrics are set by the market in anticipation of future Fed policies

As expectations for inflation came down, expectations of future Fed policy accordingly softened. This lead to significant easing in “financial conditions”

A specific example: US residential mortgage costs came down from 7.4% at their peak in the fall, to touch 6% last week. Keep in mind - the housing market is key to keeping inflation in check. Should mortgages drop further, it is bound to reflate, as the enormous financial markets liquidity created over the past decade would pour into housing again, taking rents up with it

Summary: The “cost of money” has significantly improved over the past few months, despite several additional interest rate hikes, as markets expect softer Fed policy ahead

2 Monetary and Fiscal Policy

As mentioned, the official Fed line remained hawkish. However, behind the scenes, some important developments are occurring with regards to liquidity

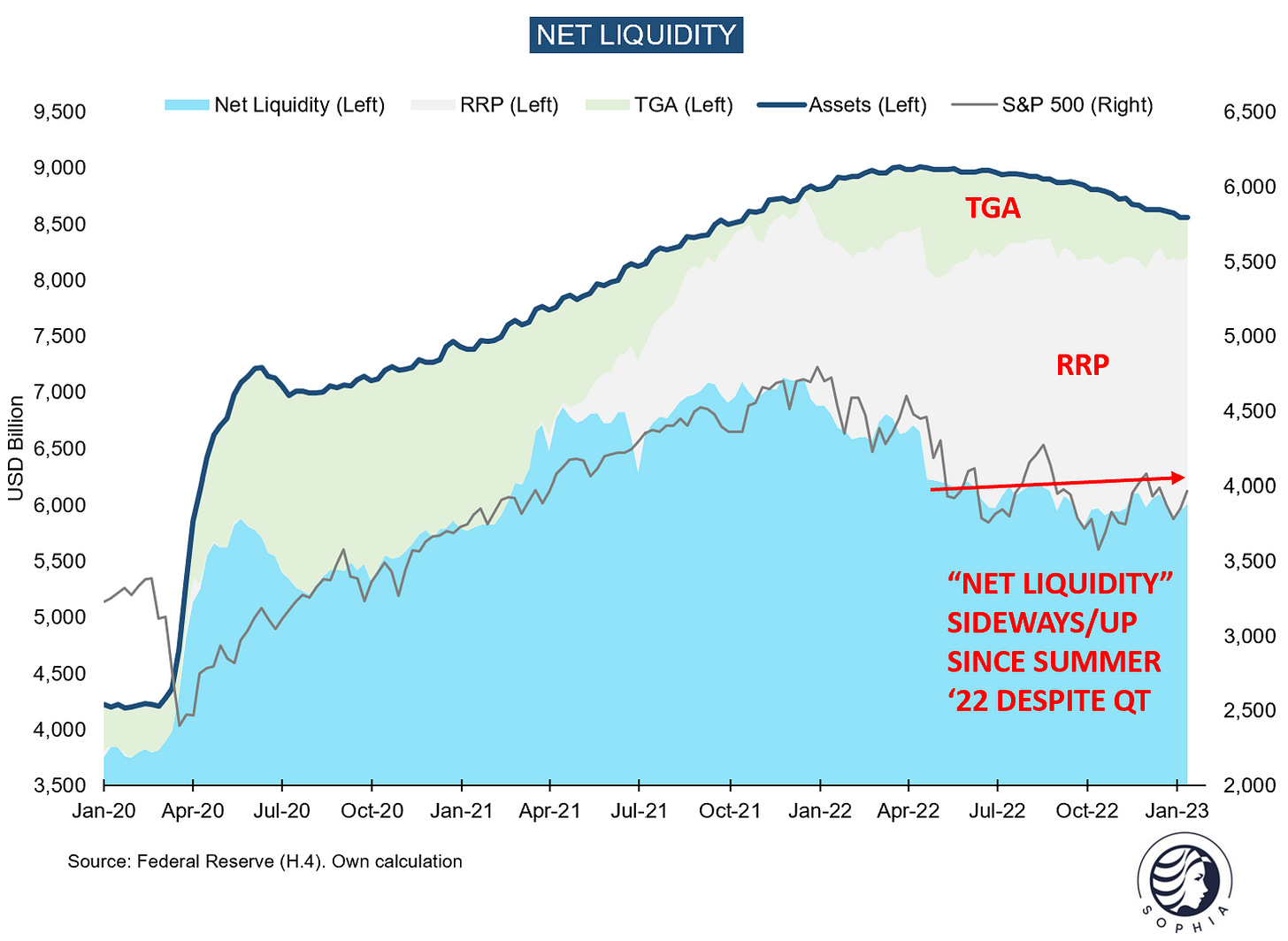

Currently, Net Liquidity is meant to shrink by $90bn per month, the size of the Fed’s quantitative tightening efforts (QT). Net Liquidity is a proxy for financial markets funding capacity, measured by deducting the Treasury General Account (TGA) and Reverse Repo Facility (RRP) from the Fed Balance sheet (Please see more details in “On Liquidity" from August last year)

Looking at the chart below however, Net Liquidity has not shrunk at all since the Fall, it has in fact gone up

What is going on here? The answer has to do with the debt ceiling

US federal debt reached its legal limit. Without the approval of both chambers of Congress, Janet Yellen cannot issue additional and only replace expiring debt. Less debt issuance means less drain of private sector finances. This effect cancels out the drag from QT on Net Liquidity

The Fed never adjusted its QT size upwards to address this dynamic. As a result, the efforts to shrink the Fed’s balance sheet and reduce Net Liquidity are currently neutralised, and will likely remain ineffective until the debt ceiling is lifted. This is unlikely to occur before the summer

There is more to it. In fact, it is possible that Net Liquidity increases in the coming months. Why?

To keep the government going, Janet Yellen can enact emergency funding efforts, which have to solely be funded with T-Bills (instead of the usual mix of bills and bonds). With a higher supply of T-Bills, their yield goes up and now exceeds the yield offered by the RRP, a “parking lot” outside the banking system for excess cash, drawn up by the Fed in 2021 and used by money market funds. The yield delta likely pulls funds out of the RRP into the banking system, this likely cancels out the Net Liquidity drag from T-Bill issuance. At the same time, recurring Treasury spending increases Net Liquidity

Summary: While the Fed stayed hawkish in its official communication, behind the scenes it has softened its stance by not counteracting dynamics that significantly boosted liquidity available to financial markets

3 China Reopen

As laid out in my last post, the Chinese consumer sits on ~$800bn excess savings after spending most of 2022 in lockdown. After a gruelling year, the Chinese are likely keen to indulge, just like their Western counterparts in ‘21

The spend down of China’s excess savings can be seen as global liquidity infusion. This has certainly the most pronounced effect in China itself, where stimulus also emphasises domestic goods and services. But even then, external pre-products are needed, in particular commodities

Other Asian countries provide some guidance as to what can be expected for goods demand after the current Omicron wave is over:

Summary: China’s reopen provides a meaningful liquidity infusion to the global economy. While unlikely to turn around the existing economic trend, it can amount to a “speed bump” on the road to disinflation

4 Animal Spirits

The Fed successfully created an alternative for investors to park their money, with short-term T-Bills and money market funds offering ~4.5% interest rates

However, FOMO is one of human’s most powerful emotions, and as many investors sit on high cash positions, the urge to deploy this cash is strong, despite the attractive interest rates paid for doing nothing

More so, in a classic “Reflexivity” pattern, the urge to deploy cash grows stronger with rising market prices. Equity long-short hedge funds are just one of many groups of market participants with historically low net exposure, and cash burning a hole in their pocket

Summary: There is a lot of cash on the sidelines that feels fear-of-missing-out, despite the current attractive yield on cash

Let’s put everything together:

Financial conditions loosened and the “cost of money” is lower today than a few months ago

The Fed did not counteract recent developments that improved financial markets liquidity

China’s reopen will provide more liquidity to markets in form of excess savings being spent

Hedge Funds and other investors are looking to deploy cash out of fear-of-missing-out

Where does this incremental liquidity go? I believe financial markets allocate money to whatever is currently “hot”

Thus, I think market participants will use their cash to chase commodities, which have their supportive narrative with China’s reopen

While some commodities such as copper already had a good run over the past month, oil stands out as lagging, and it now has a narrative that buyers can endorse (China reopen + end to the US selling barrels from its Strategic Petroleum Reserve, this Monday was the last day)

As I mentioned many times, commodities are highly cyclical and the world economy is slowing. However, a limited time window exists where China accelerates while the US has not slowed hard yet, where excess liquidity and still positive commodity fundamental overlap constructively

One needs to once again point out Reflexivity at work here. Higher prices beget higher prices, as the desire to hoard/hold back supply increases. The US-China-Russia conflict also turned commodities into geopolitical weapons, another incentive to hoard supplies

Oil is to this day the backbone for much industrial activity as well as transport. Should it rally from here, many CPI components will be affected. Most acute however is the transmission to higher prices at the pump. Gasoline is 20% higher than its December lows

Will it go higher from here? I think so

Conclusion:

In a circular reference, rapid disinflation led to many financial market participants changing their behavior, which created significant incremental liquidity

This liquidity could lead to an unexpected increase in inflation over the coming months, in particular via higher oil prices, which affect the cost of many other goods and services

It seems plausible that the Fed reacts to this with more additional hikes than expected, until said liquidity is removed again

My view of a hard landing of the US economy remains unchanged for now, as a highly levered economy unlikely withstands the drastic increase in interest rates. This brings me back to the principal issue of the current situation

The interest rates the financial system can tolerate are probably significantly lower than the interest rates needed to quell inflation

There is only a very narrow path for central banks to kill off inflation without killing the economy, and the endgame is highly likely a prolonged period of higher inflation, even if this year might see a hard landing and some deflationary prints

What does this mean for markets?

As always, below is my personal attempt at connecting-the-dots for my own investments. Please keep in mind - I may be totally wrong, nothing is more important than risk management, and none of this is investment advice

My current views by topic and asset class:

Bonds - As already mentioned last week, after a strong start to ‘23, my sense is that some consolidation is in the cards now for both long-term nominal bonds (TLT) and TIPS, especially if I am right with the thinking laid out today, which likely increases short term inflation expectations and with it yields. However, I continue to think that 2023 will be a year with many good opportunities in this asset class for agile investors

Equities - While many positioning metrics now appear overstretched, I think some further upside still exists, lead by FOMO and benign seasonality. The ice is getting thinner, but this does not appear a market to be short for now. Longs on the other side need to know that they are betting against economic gravity, as many lead indicators continue to deteriorate, pointing to a hard landing. Sometimes doing nothing and waiting for a clear picture is best. The more time I spend in markets, the more patience seems to me the most critical skill. This market likely sets many traps for both bulls and bears, and I would expect equities to turn down once everyone is again convinced that the bear market is over

Oil - I changed my recent view on oil, at the time driven by concern over a slowing world economy, and as laid out today am constructive and think oil has upside from here. I’ve opened a long position, see various tweets late last week

Labor Market - The evolution of unemployment is tough to call, as demographics have changed the game with mass retirement of the Boomer generation. Therefore, for much of last year, I expected it to stay tight even in an economic slowdown. However, I cannot deny the incoming data. Especially for the US, labor market lead indicators point to layoffs ahead in the coming quarters, see below chart from yesterday’s Empire Manufacturing Survey, or some data I shared last week. However, there may be regional differences, the UK labor market in particular strikes me as still extremely tight

Credit - Spreads are too tight. This is true in particular in investment grade, but also high yield for the stage of the economic cycle. Everyone is jumping into the pool here currently, so it is pretty crowded. I would expect some unpleasant price action here over the next quarters

US Dollar - I am often asked my view on currencies. I find them the hardest of all asset classes to predict, especially in the short term. However, it is worth highlighting that some patterns frequently repeat themselves. The US Dollar is typically bid at the onset of a recession, as US investors repatriate overseas cash in wobbly markets. The reverse is true in the later stages of a recession, when risk appetite returns. Right now, the US Dollar Index is down ~12% from recent highs and we are likely at the onset of a recession. As such, now is a decent risk-reward moment for long dollar on a short term view, in particular against the Euro. Medium-term, there is no way out of the US debt load without growing US Dollar supply, which is why I highly rate gold (though currently overbought) and remain open minded on Bitcoin

2023 likely shapes up to be a volatile year that traps both bulls and bears in many instances. With this in mind, please remember that US-Dollar cash pays 4.5% interest with 1.5% real rates - an offer unique in recent history, and stress-free

Regarding China re-opening causing inflation, I find it interesting that people also used China's lockdown as source of inflation (people not going to work and supply chain disruption). Also, unlike other Asian countries that give out money directly to help the people, China doesn't do that. China stimulates generally by making borrow condition lose for the business so it's more of a supporting on the supply side. So, we only look at the demand side of the equation without looking at the supply side.

Thank you for sharing your thinking. Could you explain why liquidity as measured by Fed balance sheet - TGA - RRP should explain equity returns? The overlay chart makes a point, but over longer periods, the relationship is weaker. Some would argue it's better to look at duration supply (which shouldn't be affected by the TGA rundown) ...