The Trillion Dollar Question

The market is telling us a secular change is underway. Few are prepared for it

The US Treasury bond market is the world’s largest and most liquid asset market. It is also the most important, as interest rates on “risk free” US government debt determine the valuation of practically all other global assets. Over the past two months, it has posed us a question that might sound cryptic and technical, yet its answer likely holds the key to understanding our economies for the coming decade

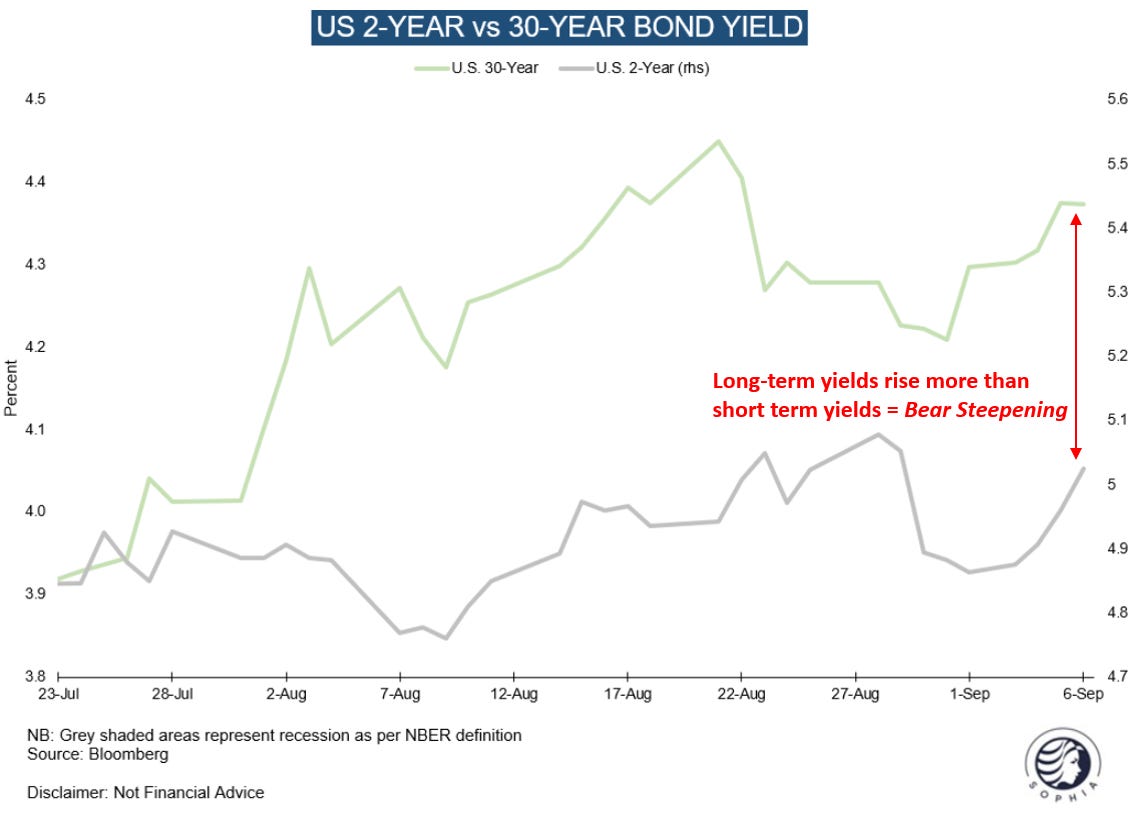

The question is: Why has the US Treasury yield curve bear steepened?

The answer to that question will shape the economic livelihood of millions, have huge implications for asset prices and it might transform an entire industry that was built on a world of low real rates - alternative asset management. Deciphering the reasons for the bear steepening will help us understand what kind of economic regime we’ll enter, just as the US economy faces a moment of indecision, as laid out in last week’s Crosscurrents

As always, the post concludes with my current outlook on markets. As laid out in recent posts, I expect September and October to be stormy. I have raised more cash and added shorts in European equities, which I perceive as globally the weakest link

Let’s start with the simple basics - bear steepening, what does that even mean?

It means that long-term interest rates, such as for 10-year or 30-year bonds, rise faster than short-term interest rates, such as for the 2-year note

Any why is that in any way interesting or relevant?

The long end reflects the market’s view of long-term US economic conditions. In contrast, the short end is controlled by the Fed’s rate setting policies. The delta between the two gives us hints as to what kind of economic regime we might be in

As I’ve laid out in “On Reflexivity”, while the bond market, like any market, is by far not perfect, it is the most sophisticated, and the collective wisdom of thousands of smart participants. It pays to listen to it very closely

So what does the bear steepening tell us about the future of the US economy?

There are three reasons for the yield curve to bear steepen:

Inflation expectations get revised upwards - this is the classic Emerging Markets case. Fiscal policy is irresponsible so the market does not want to own what has long duration and is thus more exposed to said risk

Technical reasons - for example, a surge in long-end relative to front-end supply

Economic growth expectations get revised upwards - this is the classic Developed Markets case, usually as the economy comes out of a recession. In this case, real rates rise (real rates are interest rates adjusted for inflation). The higher real rates are, the higher the growth that’s expected

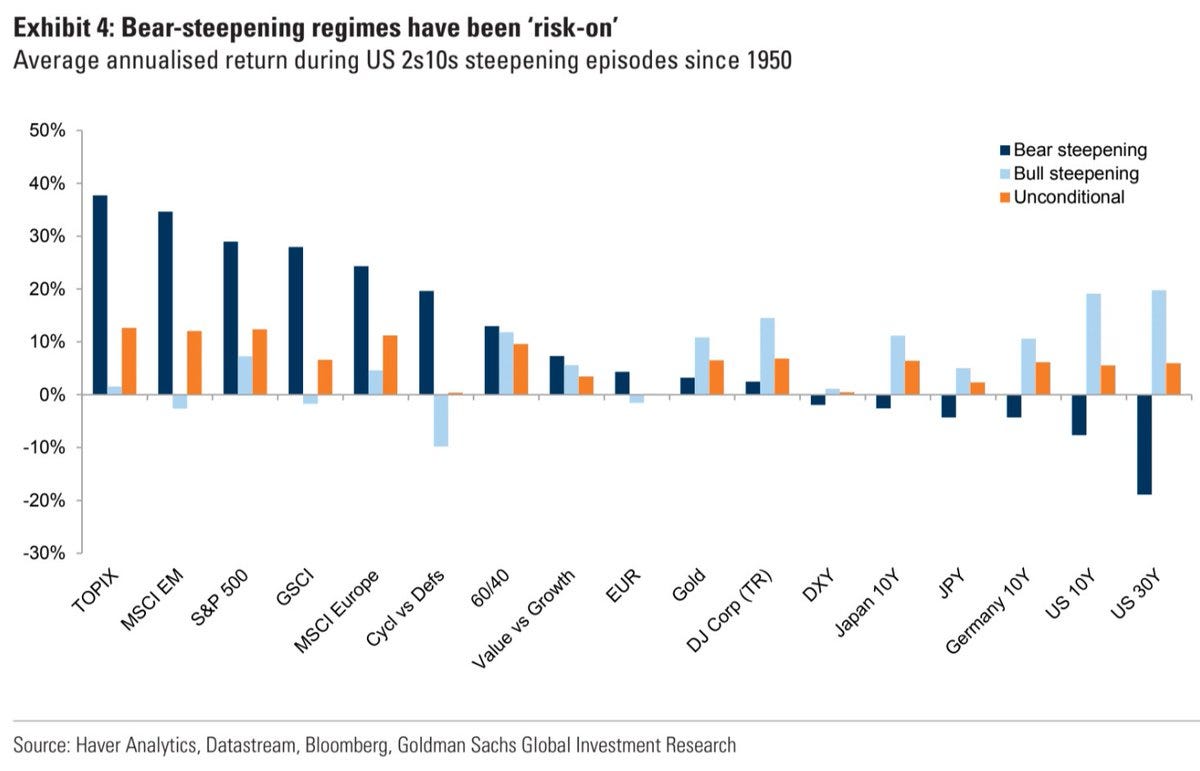

For exactly that reason, Bear steepening has historically concurred with huge Developed Markets bull runs:

Now, one has to note that most of these episodes, as mentioned, were in the aftermath of a recession, with front-end rates low

But we’re not coming out of a recession. A soft patch yes, a technical recession maybe, but front-end rates are at 5% not 0%. So what is the bear steepening due to this time? Let’s walk through the different possible reasons:

Higher long-term inflation expectations

Contrary to expectations and also common sense vis-a-vis an exploding deficit, the market is not worried about higher inflation over the next decade

As the below chart shows, 10-year inflation expectations are stuck at ~2.3%, pretty standard in historical comparison, and in fact well below their peak

Technical Factors

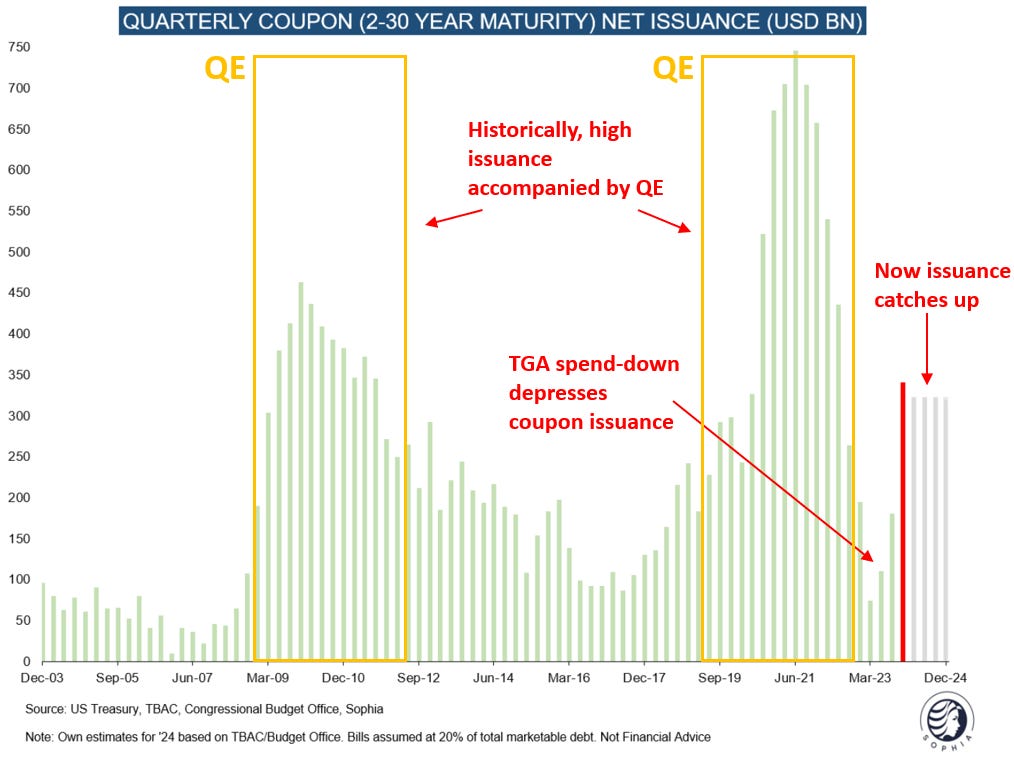

As I had written in various recent posts, long-end supply has grown enormously this past quarter. The deficit needs to be funded, and a catch-up is necessary after the debt ceiling has passed

There is no doubt that more supply requires incentives for more demand, so all else being equal yields should go up

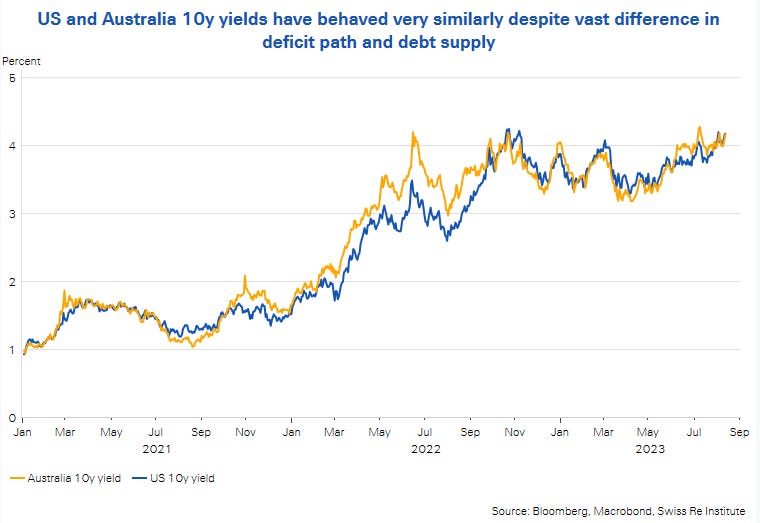

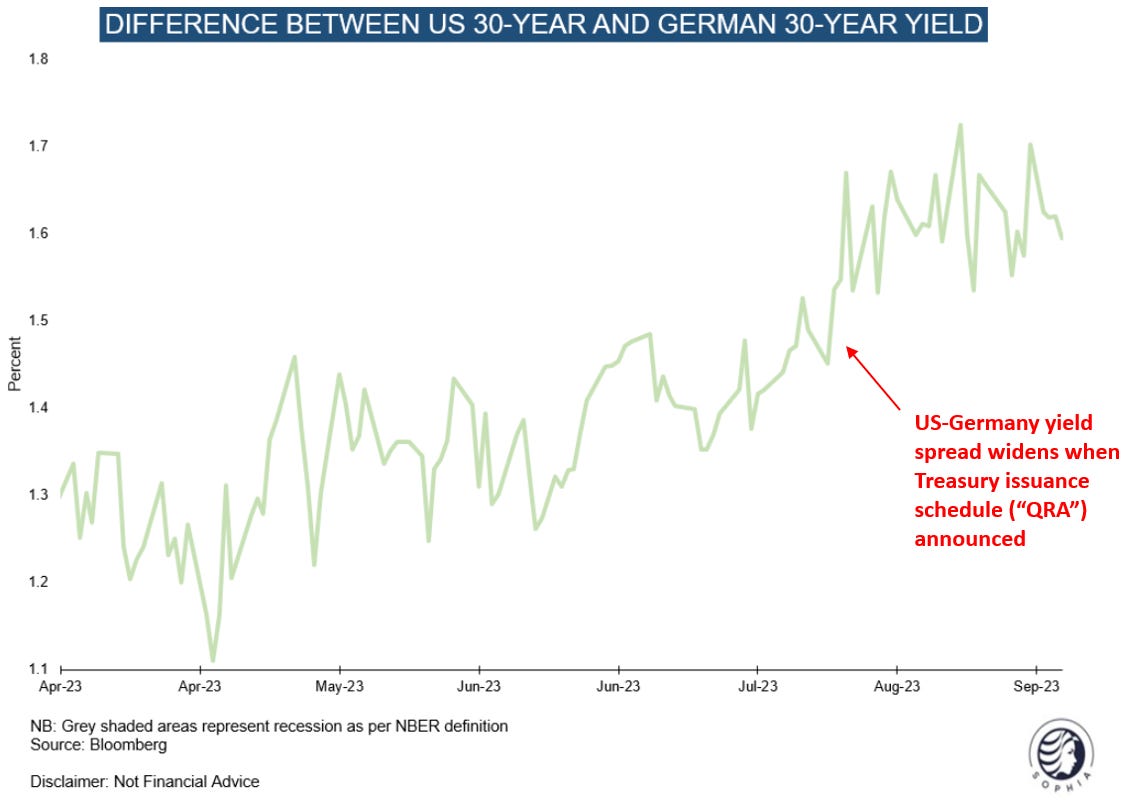

But by how much? How can we determine what share of the recent yield rise is due to supply? A comparison with other bond markets can point to an answer

Australian 10-year yields evolved almost identical to the US. Unlike the US, the country is on track to have a budget surplus. So no sign of supply impact there

However, Australia is a niche economy with many idiosyncratic drivers. Comparing the US to Germany’s 30-year interest rate indeed shows some deviation, exactly around the time the Treasury supply calendar for Q3 was communicated to the market

So the answer is, most likely there is some impact. But it does not explain the entirety of the move, far from it. I see the supply dynamics as follows, using an analogy from equity capital markets:

If a stock is going through a big equity raise, and the company is everyone’s darling, the raise will be easily absorbed and the stock might even go higher. If it is a stock everyone’s bearish on, even a small raise will crater the price

In my view, similar applies to bonds here, the supply is an issue and drives up yields, but only because the fundamental context allows for it. Which brings us to the next possible reason for the Bear Steepener

Real Economic Growth

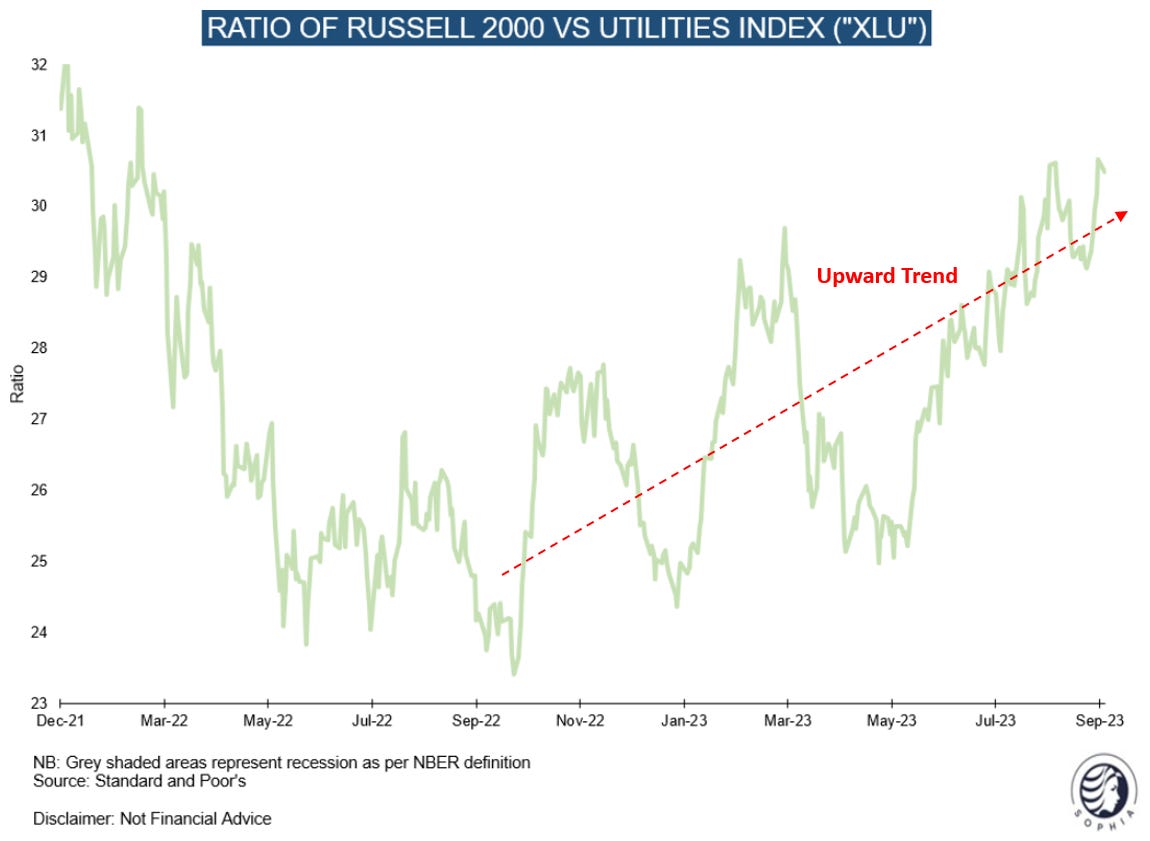

So is it growth after all? Let’s go through some charts to answer this, using the “guts of the market” which Stanley Druckenmiller called the best Economist

Since the summer, the market has continuously preferred equities over bonds, or said differently, as bond yields rose, equities also rose, despite a higher discount rate. This implies that corporate earnings expectations are rising faster than higher bond yields weigh on the valuation multiple. While this may change in a volatile September/October period, the overall trend looks strong, and odds are it continues

Similarly, comparing growth sensitive sectors to their opposite suggests a pick up in growth is under way (Russell 2000 vs Utilities below). Again, this ratio unlikely moves in a straight line and the Fall may see another ebb after the recent flow, but the primary trend appears up

Moving on from what the market tells us, let’s look at some economic data

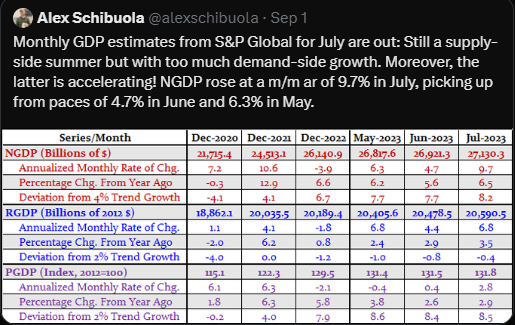

Coincident economic data is running hot, such as the July US GDP print that S&P Global sees running at an annualised 9%+ (!)

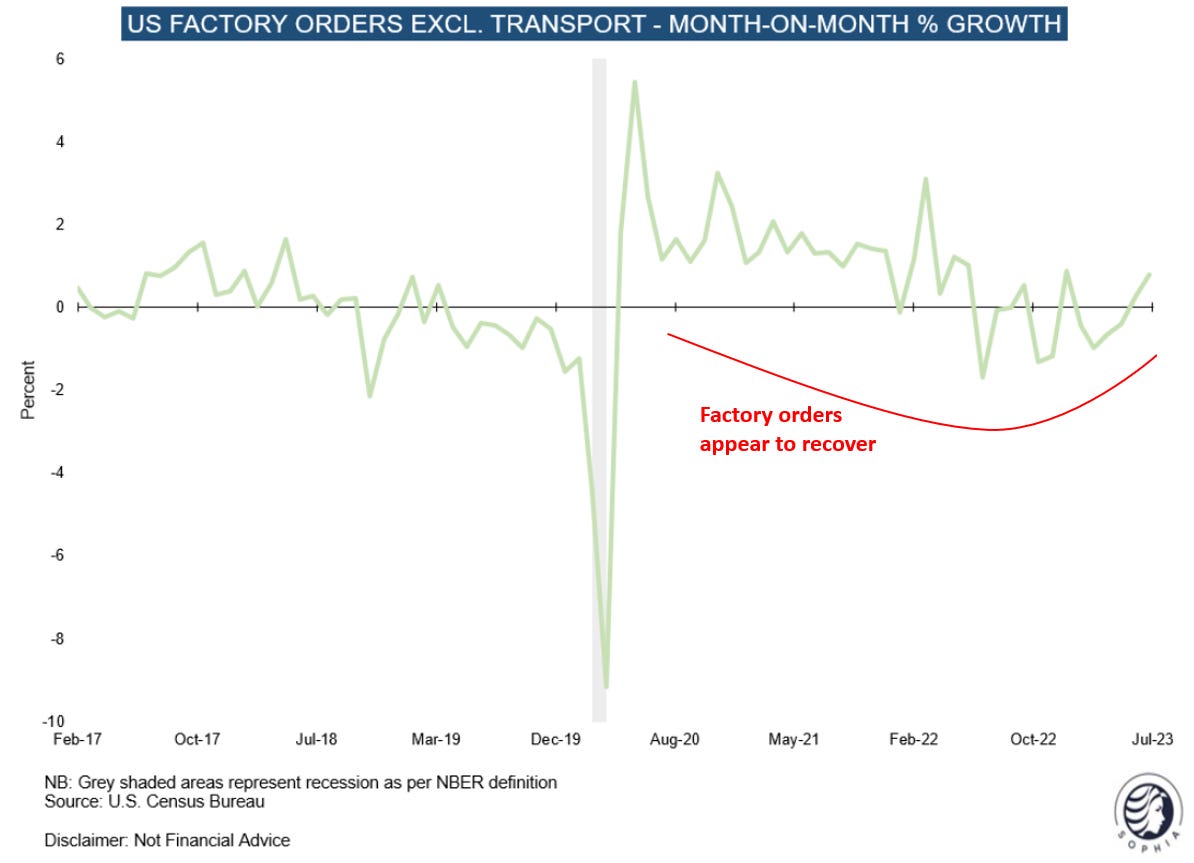

More so, the apparent upturn in US Manufacturing that I’ve been going on about for a while is also visible in hard data, such as US factory orders

However, employment trends are poor and decelerating, something I’ve discussed in my last post “Crosscurrents”

So what to think? With Reflexivity in mind, I go to what is probably the biggest tell of all as to whether growth will surprise to the upside or not - the market’s expectation of a recession within the next 12 months

As I’ve laid out in great detail in “On Reflexivity”, the many feedback channels between financial markets and the economy make a recession unlikely when everyone expects it, as many forces will then be set in motion to prevent it - “A watched kettle does not boil”

The recession expectations are still running very high, and sure to increase again should we see a wobbly Fall in asset markets. This makes me think that US economic growth is still, likely, vastly underestimated

Summary:

The reasons behind the US yield curve’s recent bear steepening are unlikely to be higher long-term inflation expectations. It is mostly driven by higher growth expectations, which in conjuncture dampen the market’s enthusiasm to absorb all the long-term supply coming to the market

As mentioned in the last post, there is Reflexivity in higher yields, where at some point they harm the economy. Where that point is, I don’t know. I suspect we could get a confluence of recession expectations fading and yields topping out, and that is the moment where the economy tips over. Looking at the above chart of the market’s recession expectations, that moment does not seem imminent

How to make sense of this?

The bond market is telling us that the US economy appears to embark on an era of significantly higher growth. A very different world to 2000-2020, which was plagued by “secular stagnation”. How can that be? I see various reasons:

First, Reflexivity in public policy - a 180-degree turn from austerity to war-time economy

The US economy of the Obama years saw little growth and widening wealth inequality. At the same time, the worry about government debt was omnipresent, just think of austerity imposed on Greece and the Tea Party’s crusade against higher budget deficits. As it turns out, high debt and deficits didn’t matter, whereas inequality and austerity stoked huge discontent

So in response, the pendulum swung the other way. Both Trump and Biden regarded the deficit as irrelevant and massively expanded government spending. In fact, the only appropriate parallels to the spending deluge are the war time efforts of WWI, WWII and the Korea War. It is no coincidence that we’ve been talking about the War against Covid in this context (see this good paper for a comparison between all these periods)

Second, monetary policy dynamics appear to function very differently in a world awash with liquidity

With 100% government debt/gdp, interest payments from the government to the private sector amount to a huge economic subsidy ($1.5tr at full Fed Funds run rate) that stimulates the economy. The only way to offset this would be for the government to cut its budget, which is unlikely to happen

More so, banks hold $3.3tr of reserves at the Fed, on which historically no interest was paid. Today, banks receive the full Fed Funds rate on reserves, directly from the money printer. This cash is unencumbered and banks are usually levered, so they can pour that “gift” from the government back into the economy with 10x-20x leverage1

What would really be needed to see monetary policy be effective is more Quantitative Tightening. For financial stability reasons the Fed seems to have little interest in pursuing this path

As a result, higher rates slow the economy on one end, liquidity is poured in at the other, while government spending continues to be rampant. In combination, these dynamics still seem to be the biggest blind spot in the investing world, where the thinking of many is still stuck in the zero-interest decade of 2010-20

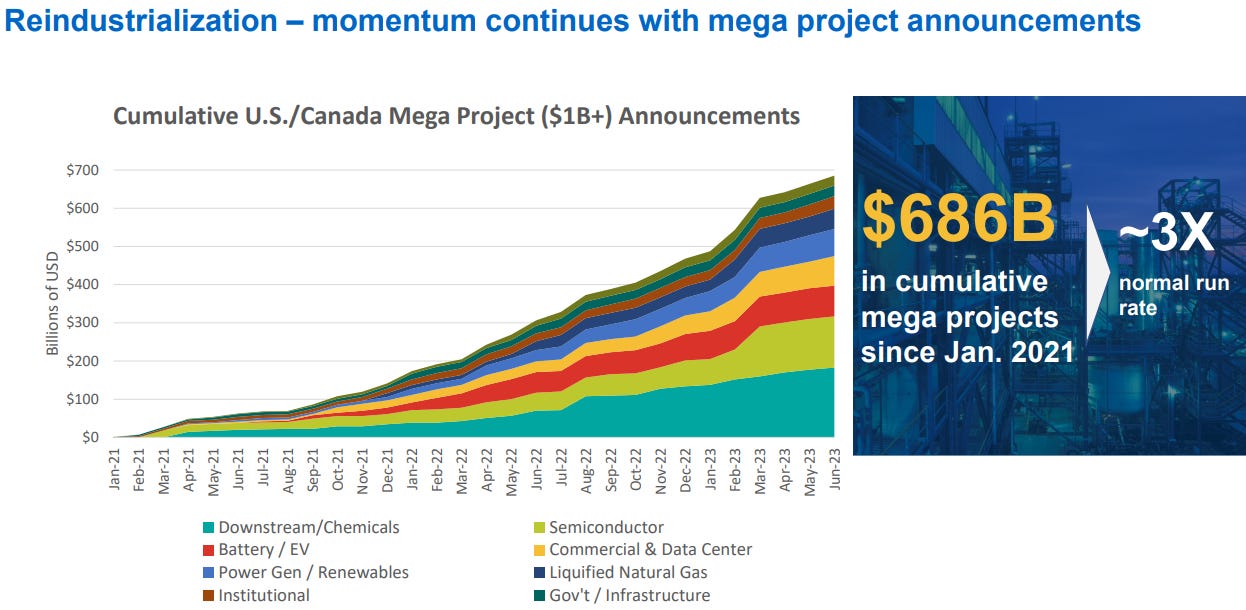

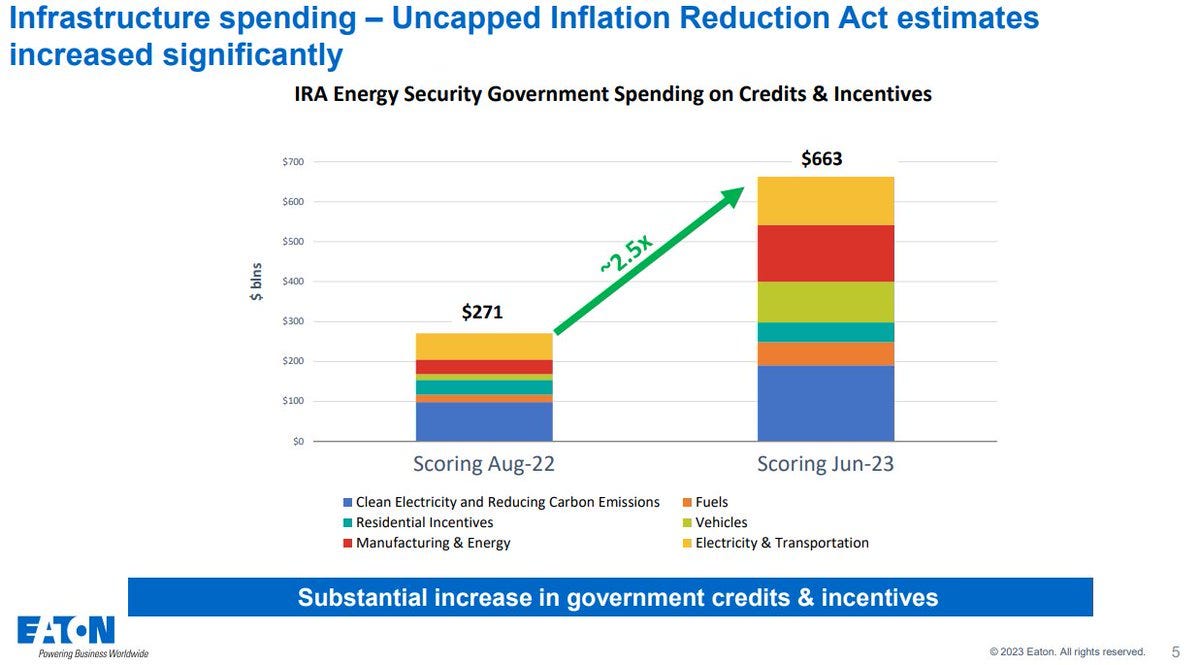

Just take the Inflation Reduction Act as an example, where subsidies for new manufacturing capacity continue to grow rapidly given the programs uncapped nature - its size has almost tripled in less than a year! (slides below from Eaton Industries, one of the biggest beneficiaries of said trend)

Conclusion:

The bond market is telling us that the US economy may enter a period of high secular growth, a complete mirror image to the past decade

The biggest driver behind this possible watershed moment in economic history is a mindshift from austerity to war-time stimulus. It is executed with unbridled enthusiasm by the current US administration

Contrary to common perception, monetary policy so far has done little to stand in the way

This brave new world of higher nominal and real growth at the cost of structurally higher (but not unhinged) inflation is likely welcomed by the electorate, which means it is likely to persist. Who can blame them, after a decade that clearly did not work for so many

At risk of stating the obvious, should this secular policy change continue to show traction, the one left behind will be Europe, where debate is still stuck in the 2010’s austerity mindset

What does this mean for markets?

The following section is for professional investors only. It reflects my own views in a strictly personal capacity and is shared with other likeminded investors for the exchange of views and informational purposes only. Please see the disclaimer at the bottom for more details and always note, I may be entirely wrong, may change my mind at any time and this is not investment advice, please do your own due diligence

General Eisenhower once said that “planning is everything and the plan is nothing”. This very much - in my view - also applies to investing, where things rarely turn out as expected, however it still pays to be prepared

As mentioned in recent posts, I expect September and October to be a stormy period. This is not based on calendarial superstition, but because some individual and corporate tax payments are due over that period, which drains liquidity from the private sector. At the same time, we have seen a deluge of new issuance announced, from the ARM IPO to new high yield bonds. For this reason I have raised more cash by cutting the small regional banks position as these breached their upward trend, and added Euro Stoxx 50 shorts as various EU indices have dropped below the 200-day moving average, while the area is globally the weakest and likely the first to be sold should liquidity contract further. I am keeping my holding in China Tech which is volatile but I see no reason to change my thinking, and some small energy

A note on US Treasuries - if we indeed see market turbulence, the front end of the yield curve should then catch a bid as investors switch from equities to bonds in a flight to safety. Whenever that period is over, I would expect the bear steepening to return

The above tells me - and this is my plan - that when the eye of the Autumn storm comes, I want to deploy the cash into what is (1) positively aligned with US economic growth and government spending, (2) and carries a moderate valuation where higher rates matter less. I see many US small cap fitting that bill, but also metals/mining (IRA!) or some US-domestic focussed industrials

Moving beyond the short-term, the implications of higher growth and especially higher real rates are substantial:

There used to be a time when everyone could just put their savings into “risk-free” US government bonds to see them grow, adjusted for inflation. The growth stagnation of the 2000s ended that time, and gave rise to the “Alternative Asset Management” industry, which - as the name spells out - provided alternatives to low real rates

What alternatives are still needed if US economic growth truly re-rates to higher levels and takes real rates with it? We would likely see some tremendous changes in the investing landscape:

It would be bearish for any asset that rely on negative real rates, such as gold, TIPS, crypto, or anything that flourished in a ZIRP world without having an income stream, or anything that needs leverage to generate returns decent returns

It would be bullish for energy, manufacturing and broadly the old economy, but also Large Cap-Tech, which is closely tied to high nominal growth and where some companies are actually very reasonably valued

In summary - the market’s black swan, something that few have on their radar, but that has tremendous implications for everyone involved is exactly that - higher real rates2

I am by no means certain that this secular change occurs as I spell it out today. But the signals are there. It pays to closely consider its thought-provoking implications, for which I hope today’s post can provide some contribution

Thank you for reading my work, it makes my day. It is free, so if you find it useful, please share it!

DISCLAIMER:

The information contained in the material on this website article is for professional investors only and for educational purposes only. It reflects only the views of its author (Florian Kronawitter) in a strictly personal capacity and do not reflect the views of White Square Capital LLP and/or Sophia Group LLP. This website article is only for information purposes, and it is not intended to be, nor should it be construed or used as, investment, tax or legal advice, any recommendation or opinion regarding the appropriateness or suitability of any investment or strategy, or an offer to sell, or a solicitation of an offer to buy, an interest in any security, including an interest in any private fund or account or any other private fund or account advised by White Square Capital LLP, Sophia Group LLP or any of its affiliates. Nothing on this website article should be taken as a recommendation or endorsement of a particular investment, adviser or other service or product or to any material submitted by third parties or linked to from this website. Nor should anything on this website article be taken as an invitation or inducement to engage in investment activities. In addition, we do not offer any advice regarding the nature, potential value or suitability of any particular investment, security or investment strategy and the information provided is not tailored to any individual requirements.

The content of this website article does not constitute investment advice and you should not rely on any material on this website article to make (or refrain from making) any decision or take (or refrain from taking) any action.

The investments and services mentioned on this article website may not be suitable for you. If advice is required you should contact your own Independent Financial Adviser.

The information in this article website is intended to inform and educate readers and the wider community. No representation is made that any of the views and opinions expressed by the author will be achieved, in whole or in part. This information is as of the date indicated, is not complete and is subject to change. Certain information has been provided by and/or is based on third party sources and, although believed to be reliable, has not been independently verified. The author is not responsible for errors or omissions from these sources. No representation is made with respect to the accuracy, completeness or timeliness of information and the author assumes no obligation to update or otherwise revise such information. At the time of writing, the author, or a family member of the author, may hold a significant long or short financial interest in any of securities, issuers and/or sectors discussed. This should not be taken as a recommendation by the author to invest (or refrain from investing) in any securities, issuers and/or sectors, and the author may trade in and out of this position without notice.

Interest paid on assets in the RRP ($1.6tr) is also paid by the Fed’s money printer. However, unlike interest paid on bank reserves, it is not passed onto the economy with leverage

I attribute this elegant thought to my friend Le Shrub, who coined it over a delicious Beijing duck lunch

"Trees don't grow to the sky". I am very sympathetic to your view in the very short term but there are long term implications that are not currently priced in the market.

Current stance of monetary policy is very accommodative in your scenario. Really doubt inflation will be around 2.25% as implied by 5 year breakeven. Fed funds priced at 3.5% in the long run. I am afraid we are approaching peak real yield. FED doesn't have the guts to raise to what is needed and interfere with next year election.

We are not living in a new era of productivity. This is just unstainable fiscal spending on steroids in a decade when US fiscal imbalances will really start to show in the numbers. Markets showing already signs of panic when it comes to supply. How can this be sustained consistently without implementing de facto real yield curve control? Can't really see real yield staying positive. Surely an environment where equities perform better than bonds. Not sure about crypto and gold as combination of positive nominal rates and negative real rates is a very different environment compared to last decade. Very bullish USD in the near term but just looking at purchasing power parity how can stay this high vs JPY and EUR?

Really interesting times. This is a new market environment and market participants will test multiple narratives over and over again. Rules of the game have changed. Better to stay open minded!

Thanks for sharing your thoughts. Really appreciate the time you dedicate to produce such good quality content. All the best!

Excellent, thought-provoking post, many thanks!

What you write is easily compatible with Peter Zeihan's analysis. U.S. is now in a historically unprecedented phase of re-industrialization. Add cheap energy to that, and understand that only the U.S. (and New Zealand) have good demographic perspectives, and then the nay-sayers' doubts become quite unattractive.