Tremors

It may not be imminent, but a financial earthquake is on its way

We are currently witnessing financial history. It was just a week ago when I wrote about the UK’s tax cuts, and how the market would force the Bank of England to abandon QT, and Liz Truss to abandon her plans for debt funded “trickle-down economics”. It only took some days for either to happen. This past Wednesday, the BoE announced it would resume buying UK government debt in order to drive down the yield on long-term Gilts. Higher yields would have caused mass bankruptcies in the UK insurance industry. Yesterday, the government scrapped the tax cut from 45% to 40% for high earners, the signature piece of its tax legislation

The UK episode sent a tremor across the financial world. Over time, an earthquake likely follows. The tectonic plates in tension are higher interest rates needed to tame US inflation, and an overlevered financial system that won’t withstand these higher rates

This post explains why the dynamics likely intensify from here, and why the BoE did early what the Fed is likely forced to do later - reverse course and print money again, in order to avoid a financial meltdown

As usual, the post closes with a current outlook on markets, where I explain why in light of these tremors I have reverted to a defensive stance, despite the nascent bear-market rally

What do past weeks’ events tells us? In summary, we learned that a 4% yield on the US 10-Year Treasury Bond blows up the UK economy

Following poor August US inflation data, and with the Fed embarking on its $95bn QT program, the US 10-Year yield shot up like a rocket and touched 4%

A brief reminder: The US 10-Year government bond yield is the world’s “risk-free” rate, all global financial assets are priced off it. If it increases, other, higher-risk assets also have to offer a higher rate

This includes UK government debt. If the US 10-Year is at 4%, UK government debt (“Gilts”) needs to offer at least 1% more to find free-market investors. As the BoE was out of the Gilt market, free-market investors set the price

It turns out, a 5% Gilt yield was too much for the UK pension system, which threatened to collapse. The Bank of England had to intervene. It restarted the printing press and bought long-dated UK government debt to bring Gilt yields down

Was this a single tremor or a harbinger of things to come? That depends on the following question:

Is 4% for the US 10-Year Treasury Bond yield high enough to bring down US inflation?

After all, that’s why the Fed let yields rose so much in the first place. Let’s look at some recent the US consumer data in search of an answer:

Near-time credit card data shows spending levels near post-Covid highs, a visible step-up from Spring/Summer 2022

Based on this, the US consumer has in fact visibly improved.

Why is this a problem? Remember, the US economy is overheated. We need US consumer demand to weaken for inflation to come down

High consumer spending is unsurprising when we look at the labor market - it remains hotter than ever. Initial jobless claims, which lead unemployment data, have reverted to previous lows

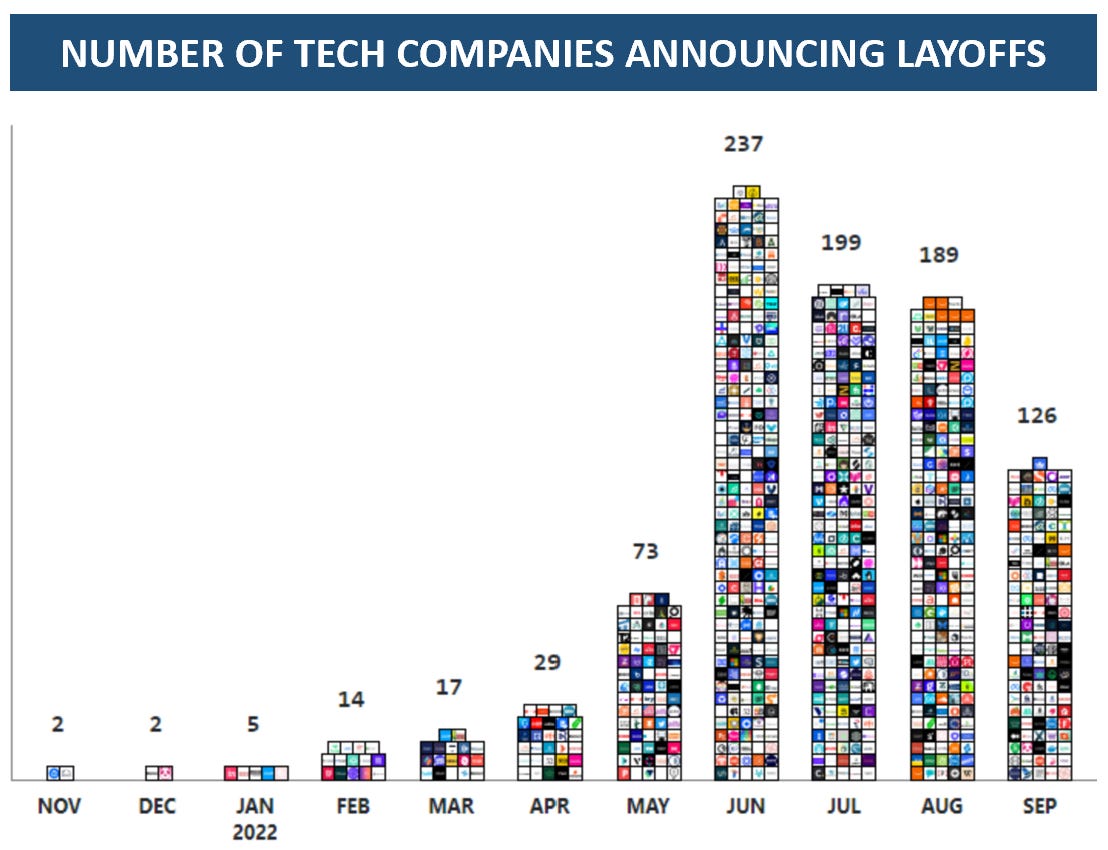

Now, there is an element of post-summer seasonality1, but either way, these are exceptionally low levels. It is also notable that layoffs in Tech slowed down significantly, one of the most obviously overstaffed industry

Improved consumer confidence is also reflected in strong hotel bookings. The week post-Labor day saw the highest room demand ever!

Similarly, airfares are on their way up again after a summer lull

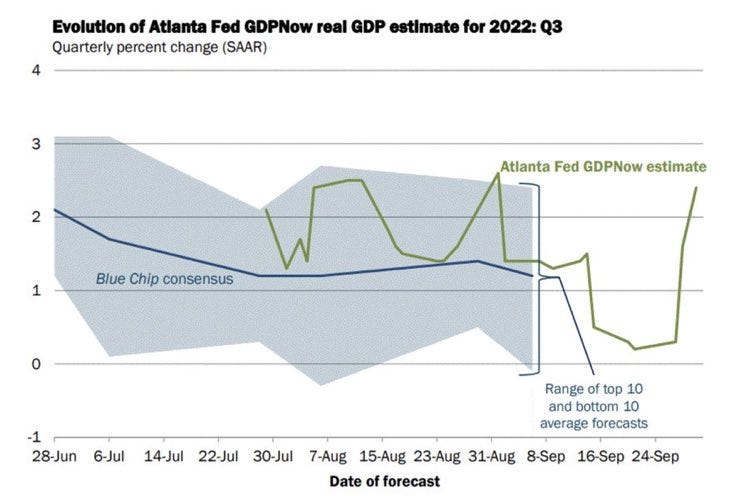

Unsurprisingly, the strong consumer data lead the Atlanta Fed to improve its much-followed GDP forecast for the quarter

It now expects the US economy to grow by ~2.5% in Q3, from barely 0% a few weeks ago

Ok, so the US consumer is in good shape. But we know that US higher rates are causing much damage around the world, so why not at home? Two reasons stand out:

First: The US consumer still sits on >$2tr post-Covid excess savings. While the lowest quintile has used them all up, other demographics maintain comfortably high cash positions

Second: US private sector gross leverage has come down from its peak, and more importantly most household debt is mortgages. US mortgages are 30 year duration and fixed. A stark contrast to the UK, where mortgages are floating after 2-5 years and higher interest rates affect consumers’ pockets after that

High savings and a non-existent mortgage transmission channel mean the US consumer is not very sensitive to higher interest rates. So the adjustment pain that slows consumer demand has to come from job losses. But here is the issue with that

The US labor market is extremely tight, with 11.4m job vacancies and 6m unemployed, a unprecedent ratio of ~2:1 vs <0.7 historically

Looking at historical precedent, a spectacular recession twice as deep as the financial crisis would be needed to reduce job vacancies by ~5m, for a still tight 1:1 ratio, at which point some slack might be created in the labor market - I am not sure whether this is a realistic scenario

Nike’s recent results are a good example of these dynamics. After a 44% y-o-y inventory build (+66% vs 2019) and higher labor and input costs, its 2022 expected earnings have been cut by 25%. This earnings destruction would historically be accompanied by mass layoffs - no word on that from Nike at this time

Please see my previous posts “Capital vs Labor Pt 2” and “A Historic Agreement” on why the coming downturn will be felt much more starkly in corporate earnings than employment

It is noteworthy that while consumer demand remains strong, retail inventories once again grew in August. Corporate America produced too many goods and consumer demand has shifted to services

Summary: The US consumer remains in good shape and is spending near post-Pandemic highs. High cash balances and fixed long-term mortgages provide resilience against higher interest rates. Only job losses can slow consumer demand, but there is a record number of open positions. All this speaks for more inflation for longer, and thus yet higher US Treasury Bond yields

Ok, so over the medium term, the US 10-Year Treasury Bond yield likely goes higher than 4%. What does that mean for the rest of the world?

Let’s return to the UK for a moment. Following the tax plans, the public’s perception of the new government imploded

In the latest YouGov poll, Labor gained a 33% lead over the Tories, a historic divergence in a single poll!

Now, tax cuts for the rich seem tone-deaf when the poor are getting crushed by inflation. But this poll shift is dramatic

The pros and cons of “trickle-down economics” might be a subject of academic debate. But what really shocked the public was the explosive Gilt move, and the dawning realisation what it might mean for everyone’s mortgages

A 5% yield on the UK 5-Year Gilt translates into a into a ~7% mortgage cost. Most mortgages switch to floating rates after a 2-5 year fixed interest period expires. At 7% rates, mortgage payments would consume 57% of UK average take home pay!

Add to that higher energy bills and higher food prices. Suddenly and the public’s strong reaction becomes very understandable

The reality is, the UK economy cannot function with higher interest rates - it would cause an epic depression and mass defaults as households struggle to service debt. So how will things evolve from here?

The Bank of England’s current emergency support runs until the 14th of October. It seems highly likely the BoE will need to continue after that and keep rates low through intervention

As UK inflation is currently very high, this debt monetisation will translate into further inflation. The balancing valve will be the British Pound

I had written last week how the Pound was oversold and would likely bounce. This has happened, I find it likely it resumes its slide from here

With that, we resume the feedback loop → A weaker Pound means higher imported inflation → Higher inflation requires higher interest rates → The UK economy has too much debt to handle these interest rates

Summary: The UK situation is unsustainable. There will be more tremors after this past week. A debt restructuring involving the IMF seems the eventual endgame

The UK is not the only country that used the Fed’s $8tr QE liquidity firehose since 2008 to lever up to an unsustainable degree. Somewhere else looms very large - Europe

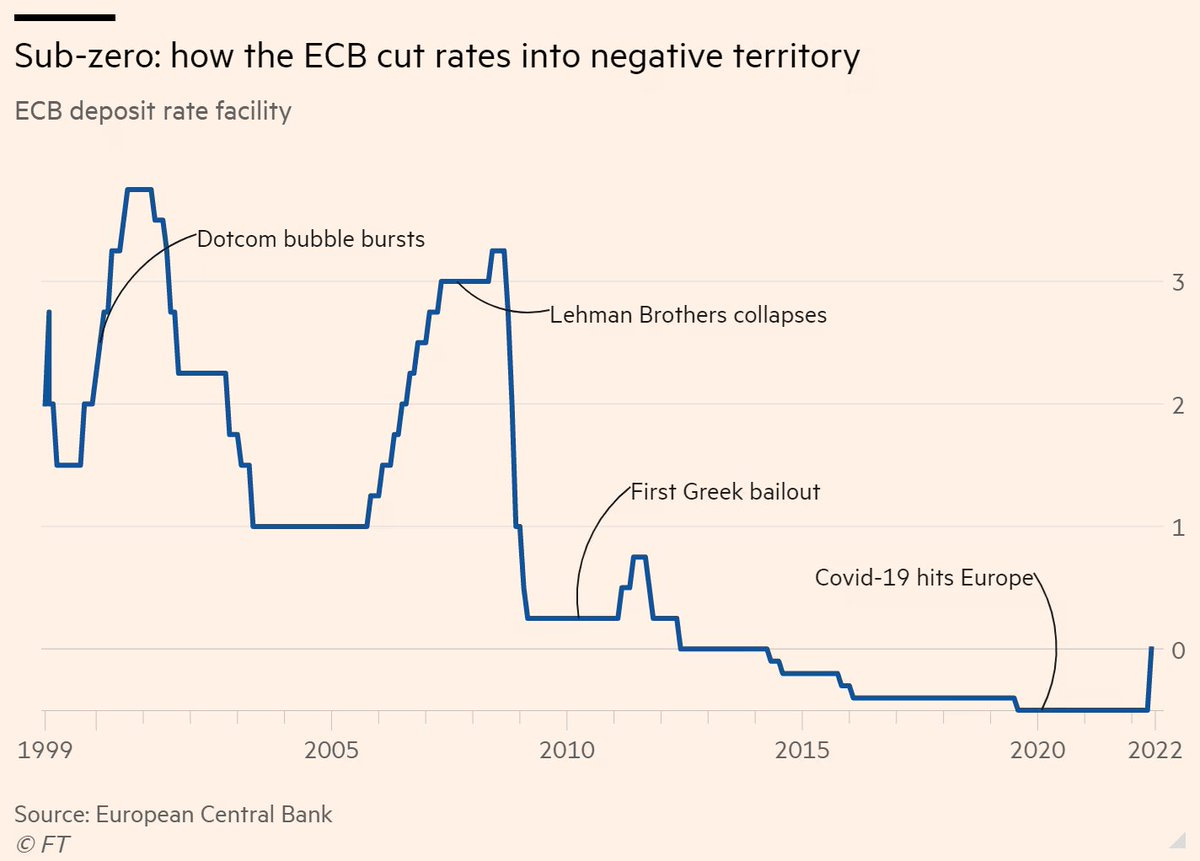

ECB benchmark rates went to zero in 2012, were cut to negative territory in 2014 and stayed there until very recently

Ten years of “free money”, of having to pay back less than borrowed are coming to an end. Ten years in which a certainty of the end of inflation, the end of higher interest rates established itself and all kinds of actors adjusted to it

Who will be seen to swim naked as the tide goes out, when higher US yields force EU yields higher? We will likely find out over the next year. There are many candidates, just to highlight some: (1) Italy hasn’t sold its debt to anyone but the ECB since 2015, (2) 10% of German residential loans are >100% LTV, (3) Dutch, Danish and Finnish pension funds are structured like their UK counterparts, (4) Since 2016, the ECB has been buying corporate debt, distorting the same market with abnormally low financing conditions

Now, why is it an issue for the US if Europe and the UK crumble under high US bond yields? After all, it’s their fault, they made all these bad choices over the years?

Most obviously, 40% of S&P 500 revenues are from abroad. A meltdown in the rest of the world hits US businesses hard

Less obviously, but equally important: What did Europeans do with all that cheap cash? They returned it to sender, by buying US assets. The below chart shows the share of US equities held by foreigners, it has quadrupled since the financial crisis!

It’s simple - over the past decade, would you have rather owned German government debt with a -1% yield, or shares in Tesla and Apple?

Last week’s weakness in equity markets, despite exceptionally one-sided positioning, is owed to the unwind of some of that after the UK pensions’ near-death experience

Summary: If US yields continue to rise, it is highly likely that more, similar assets sales are required for European institutions to de-risk exposure

Sure, the stock market keeps suffering, but as long as inflation is high, why would the Fed care?

The one financial market the Fed particularly cares about is credit. If credit markets become dysfunctional, then existing debt cannot be refinanced. This can create a cascade of unwanted second order effects, with the ‘08 Lehman bankruptcy the most prominent example. It is highly unlikely that credit can stay healthy while equities suffer. Add to that a deteriorating global economy impacting corporate cash flows

Credit markets are definitely stressed, but not at extremes that would warrant the Fed to change its stance. This in particular when keeping in mind that during previous pivots (2016 Janet Yellen, 2018 Jerome Powell) inflation was not an issue

Conclusion: Outside of US households, pretty much everyone is overlevered, from EU governments to UK pensions to US commercial real estate. US interest rates will need to rise further to tame inflation driven by US consumer spending. This will cause more turmoil, as overlevered entities struggle to adjust to higher rates. In an interconnected world, this will eventually reach US credit markets, which will likely, eventually force the Fed to pause

What does this mean for markets?

As always, below is my personal attempt at connecting-the-dots for my own investments. Please keep in mind - I may be totally wrong, nothing is more important than risk management, and none of this is investment advice

On broad trends vs countertrends - For my investments, I first and foremost try to understand the broad trends. Is the economy in a cyclical up- or downswing? Is monetary policy supportive or contracting? Is a turning point on either likely in 3-6 months? These broad trends (think years) can be interrupted by short-term counter trends (think weeks/months). For broad trends, the likelihood to get them right is higher, they are more powerful and trades can accordingly be sized larger. Counter trends are riskier, as the fundamentals work against them, so trades in those should be smaller

Today, as discussed many times, the broad trend remains down. This is the reason I was short most of the year. Liquidity is very poor, with the Fed conducting QT and raising rates. The economy will slow well into late 2023, as today’s housing slowdown and higher cost of corporate capital permeate the economy with a lag. However, positioning is also important, when everyone has the same view, there is no incremental seller. As discussed last week, positioning has once again become very one-sided, in my view, this is now a very risky time to be short equities

Software - Last week, given said positioning, I saw an opening for a counter-trend rally in equities, for which I chose Software (IGV) as vehicle of choice. Software has remained flat over the past week, while the market sold off as the UK episode triggered forced selling out of European institutions. I feel uncomfortable with this backdrop, and as laid out in today’s post find it likely that there is more to come. Even if the timing of it seems uncertain, I have decided to exit this position again (see here), even at risk of missing out on the nascent bear-market rally. The danger antennas are up, and it is always better to avoid a loss than miss a gain

Gilts - As laid-out on Twitter in real time, I bought long-dated UK gilts (2073 1 1/8 or ETF:GLTL) before the BoE started its historic U-Turn. The logic was simple, as laid out in last week’s post - 5% Gilt yields are too high for the UK economy to bear. An intervention was only a matter of time, though I frankly had no idea it would be so imminent. Bonds with long maturities swing big if circumstances change, the 2073 1 1/8 rallied 35% after the news

US Treasuries - As I suspected last week, 4% for the 10-Year provided strong resistance, big US domestic buyers showed up (here and here) and a consolidation seems under way. As laid out today, I believe US bond yields will resume their march higher soon. As they do, financial market jitters are likely to return. I am leaning to short the long end again (TLT/IEF)

China - Many signs point to an end of Zero-Covid. The Beijing marathon is scheduled after a 2-year hiatus, Xi and fellow politicians attended a conference without masks, Hong Kong quarantine rules have been lifted and flight data is up. This will likely be supportive for all China proxies (FXI, KWEB, XME, XLE, Oil, Copper) and increase inflation pressure. I am considering longs in these proxies

Cash - US 1-Year T-Bills yield 4% right now. I frankly find this the most compelling investment opportunity, and am happy to have cash working this way. I believe the moment to go all-in on the long side is either when the economy turns, front-run by markets by 1-3 months (mid-2023), or just before Fed pivots, which likely coincides with large and loud selloff, and more noise in credit. When that moment is, I do not know, I do not expect it to be imminent, but then also markets often move gradually, then suddenly

I hope you enjoyed today’s Next Economy post. If you do, please share it, it would make my day!

Initial Jobless Claims are seasonally adjusted, yet still typically show are pattern of post-summer strength, followed by weakness from mid-November

Thank you Florian, great article, much appreciate your views. I have difficulties trading the short term market swings, and thus try to focus more on the broader picture. It looks like FED is focused on bringing down inflation and they will continue hiking until unemployment gets higher or something breaks in the market, the second alternative having IMO higher probability. But what then? If Fed rates are at 4 %, you see the Fed cutting rates? Or they will try to keep rates up and intervene with QE? Do you expect then risk assets to rally hard with 4 % rates (FANG stuff) or you would go all in in inflation regime assets (energy, ags, (precious) metals?

I would also be interested in your opinion on the German real estate market. Do you expect prices to come down hard in the very expensive regions (e.g. Munich, Stuttgart, Frankfurt, Hamburg, etc)? Most people bought with fixed rates for at a least 10-15 years. Maybe the market trends sideways, slightly down for a while? To have a sharp correction I think unemployment would have to rise a lot, so people are forced to sell in the downturn. Any comments are much appreciated!

great analysis...

I just don't have the mental fortitude to play either long or short...given a the extreme moves in the market (especially 10/3-4), I'm happy to sit to the side and watch the fireworks...

the move up just doesn't make sense...what is the thesis to drive indices up over the past two days, especially on lower volume? If volume is lower today, especially after a gap-up, then I've got nothing and can only conclude market participants have gone nuts...or the PPT has gone full retard and pushing the bid...

To me, it's just "buy the rumor..."

in short, I agree with your thesis...always a great read!