A Political Storm Is Coming

Markets are telling us big change may be under way

As I mentioned in my last post Introducing Dominant Driver Theory, it is my intention to again provide content on a more regular basis. I thought about the format for a bit, with reader-friendly brevity in mind, and how to share the information my work generates in a broadly useful way. Today introduces this new format, which is split into three parts:

I. The themes and narratives currently guiding markets as I see them - i.e. the dominant drivers

II. What they imply for politics and the economy - i.e. the high level context for everyday life

III. What they imply for investors - i.e. what I think will perform well or not

You can then always choose to skip to the section that interests you most. I hope you enjoy the read!

Current Dominant Drivers for Markets

Enterprise AI

Enterprise adoption is moving fast, with many corporates reporting meaningful improvements from AI initiatives

The general vibe here is that cost savings are coming through faster and are more significant than expected. Examples range across industries and include JP Morgan, Rolls-Royce, ABB, RXO and many others

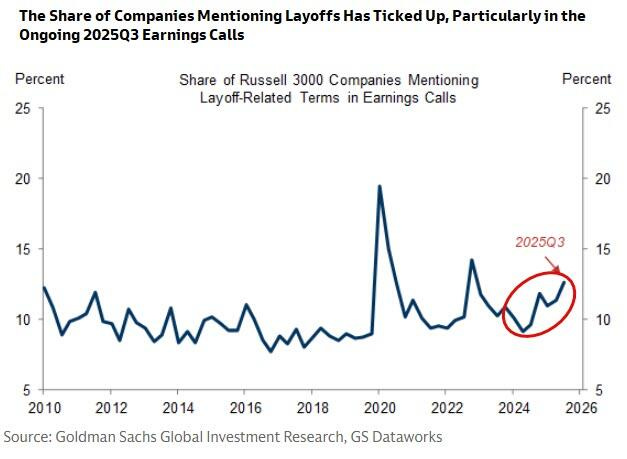

As a result, hiring plans are dramatically cut and layoffs are on the rise. The two largest private US employers, Walmart and Amazon, have recently both spelled out growth plans for the coming years that keep headcount steady (WMT) or even decrease it (AMZN). Verizon (100k employees) just announced it would cut its workforce by 15% for efficiency gains

The market theme of rapid enterprise AI adoption is reflected in broad corporate margin expansion and rising layoffs

AI Capex

The flipside of rapid AI adoption is the boom in AI infrastructure, i.e. datacenters where capex plans have grown to multiple trillion USD through 2030. This helped propel the S&P 500 to record highs this year, both via its -now very large- semiconductor component as well as higher earnings for the entire related industrial value chain

However, the increasingly obvious question is how will all this be financed? In particular, the market has started to challenge OpenAI, as reports surface that the ChatGPT owners’ expenses are running way ahead of plan, making it unlikely that its $1.4tr capex commitments could be fulfilled. Lack of financing would mean forecasts for the entire semiconductor space are way too high

OpenAI has done little to cast these worries aside. In fact, a desperate-looking pivot to include erotica as revenue source, a zesty answer by Sam Altman in a recent interview on the financing question and CFO Sarah Friars talking about the US government as guarantor of its spending moved the topic firmly into the center of attention

Potential risks to OpenAI’s ability to finance its capex committments are a major market theme affecting semiconductors and the datacenter value chain

US Low/Mid Consumer weakness

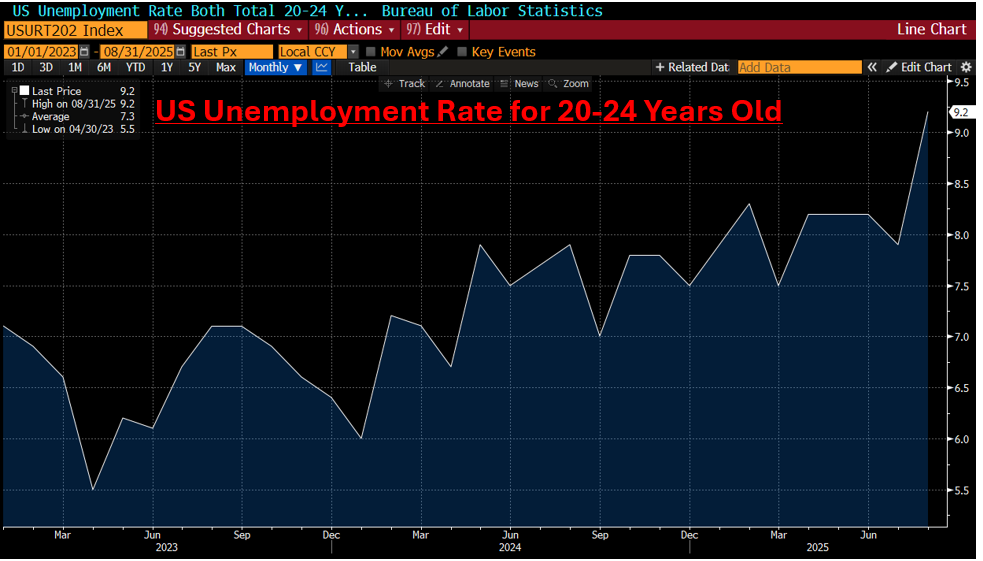

The immediate flipside of successful enterprise AI adoption is higher unemployment for easily replaceable entry level jobs, which are primarily young and lower income demographics. As a result, the unemployment rate for graduates has gone up sharply

At the same time, the asset price boom and very stimulative monetary and fiscal policies of the past years have massively pushed up the cost for basic services such as health insurance, childcare and increasingly utility bills which are driven up by AI datacenter energy demand

As a result, low- and now increasingly also mid-income consumers are hurting as they are squeezed from both the expense and job security side

The low/mid consumer weakness theme is visible in the poor recent performance of casual dining and some travel stocks

Global Fiscal Support

While the fiscal picture in the US is currently slightly contractionary, several economic blocks around the world are actively stepping up fiscal spending, including Japan, China and Germany/EU

Recall, every deficit dollar spent is a dollar of corporate profit

Fiscal support ex-US has driven recent outperformance of regional markets such as Japan, Europe and China

What Does that Mean for Politics and the Economy?

Let’s tie these themes together on a societal level first:

AI enterprise adoption means higher corporate margins & layoffs

AI capex means strong demand across the industrial value chain, but also higher utility bills

Higher unemployment for entry levels jobs and continued cost-of-living increases for basic services put pressure on low- and increasingly mid income groups

Strong global fiscal support has primarily two effects: (1) input price pressure via global goods such as commodities & (2) higher demand for US exporters

It doesn’t take a rocket scientist to realise that this combo only really works for you if you are long assets. And it does not work for you at all if you are young or low/mid income

We have been on this “K-shape” economic train for a while. It started with QE after the GFC, and under Bidenomics it picked up a lot of speed

However, a tipping points seems now reached, and a lot of Americans seem to have exhausted their patience

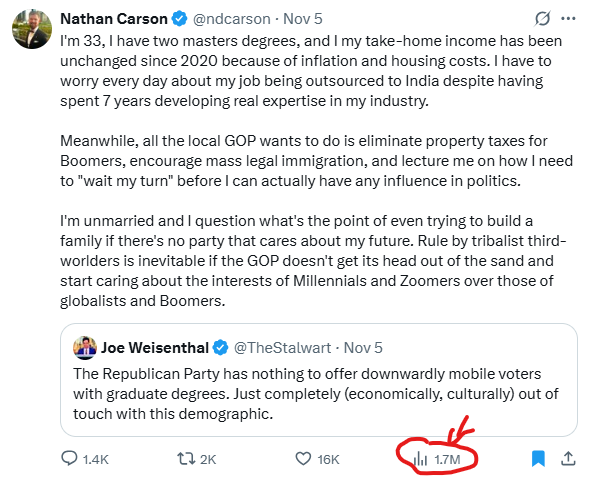

Over the past years, I’ve managed to fine-tuned my X feed into a good barometer of current vibes and moods. This helped me spot many trends early on, e.g. such as the retail mania around quantum stocks. Since the NYC election, this feed is now full of posts from very disgruntled and mostly young Republican voters, who seem to have enough of their current situation. Below just one example of an avalanche of similar ones (similar here, here, here or here), each with millions of views

In fact, this mass outburst of discontent seems way overdue if you consider the following:

The price of health insurance has reached comical levels, having grown at a 6% clip p.a. over the past 6 years. It now costs $26k to insure a family of four, while claimants often still receive the defer, deny, defend treatment first. Compare this to a median US household income of $83k (!!)

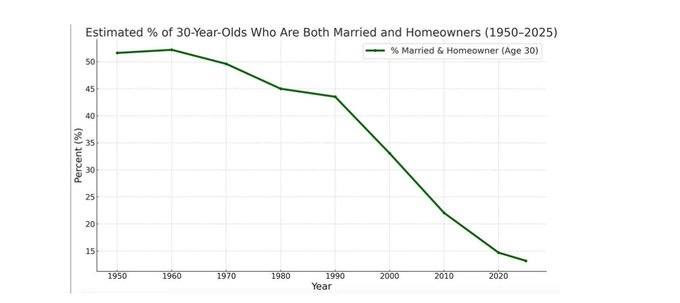

The median first home buyer age has risen to >40 from ~28 in 1985. Closely related, family formation has imploded

The S&P 500 has gone up 650% since 2000. Over the same time period food stamp recipients have more than doubled to now 41m. In other words, over one tenth of the US population struggles to feed themselves, including many people in the work force (the unemployment rate is 4.3%)

Add to this, OpenAI asking for government support while its technology eliminates jobs, costly foreign intervention, perceived corporate favoritism around H1-B visas or large asset managers emerging as mass home buyers are several other, smaller topics inflaming public mood

This post is titled “A Political Storm is Coming”. This storm is the Gen-Z and lower/mid income dissatisfaction that is now blowing into the open

This very large and energetic demographic was crushed by Bidenomics, then held hope out for improvement under Trump and is now at risk of a drastic swing to the far left as it looks for its state to finally improve. This makes AOC 2028 a real possibility

If that sounds wildly unlikely to you, consider the following: Mamdami won NYC on 4x mobilisation in Gen Z. He even has reasonable appeal amongst Republicans under 40 (!). Unsurprising, if you check the unemployment rate amongst the young again in the chart above

The clamor for change is getting very loud and many people finally want to see their daily lives improved. The difficulty, however, is how to achieve this. The standard trick of stimulating the economy via more printed money will make this affordability crisis only worse as prices likely go up more in response

What Does that Mean for Markets?

The following section is for professional investors only. It reflects my own strictly personal capacity and is shared with other likeminded investors for the exchange of views and informational purposes only. Please always note, I may be entirely wrong and/or may have changed my mind even by the time you read this. This is not investment advice, please do your own due diligence

Let’s tie the themes together for their investment implications

Equities

I currently see US equities as underperform due to both the low/mid income weakness which I expect to spread, as well as the unanswered questions around OpenAI capex trade, which affects a lot of market cap and is currently attacked from all sides (cf. MSFT CEO Satya Nadella comments here). I expect it will either need either a major shakeout or a positive catalyst to reset. Once that reset occurs, I will likely turn more constructive as the AI potential remains huge

Having said that, do not get too bearish near term. This trade has been in swing for a bit and will likely have several starts and stops. I would not chase it down here, in fact I have last night closed corresponding directional short exposure as some support levels were hit. There are also some important bullish policy developments in the pipeline, incl. $2k stimulus cheques for <$100k households and the Fed reverting to expanding its balance sheet. Irrespectively, the outlook for US stocks today is complicated, and political currents are now at work that could turn against it

I see Rest-of-the World equities as outperform, this includes Europe (yes indeed…) and China, where AI is making huge progress. One can put all this together into the EEM/SPY spread trade, which also has a favorable long-term chart

For sectors, I like the power theme which is a key bottleneck for datacenters, incl. gas and also solar and batteries which are increasingly less dependent on subsidies. I am currently bearish on alternative asset providers. I expect credit issues to grow, with more sloppy loans likely coming to the surface

Bonds

I see bonds in a 2-way pull between some inflationary dynamics (e.g. higher power prices) and rising layoffs. Usually, I would overweigh the latter and be long, but the CTA max long position in US 10y/30y keeps me away from it for now

FX

The US Dollar has strengthened for a while now as yield differentials moved in its favor. This period may come to an end, as a forceful political response is likely needed to stem the lower income bleed, and it will likely involve more printed money

Commodities

I had shared in my last post the BBG Commodity Index as example for the Dominant Driver methodology. This has now broken out and I see global fiscal and AI as continuously supportive for this major theme

Gold after a strong rebound in the past days I see as near-term choppy, but the secular themes of central bank buying, money printing etc. remain

Crude looks surprisingly robust technically, while the near-term fundamental narrative is difficult, with a huge supply overhang. However, looking further out, the current weakness could translate into tighter supply down the line - the medium term bull case is well articulated here

Thank you for reading my work, it makes my day. It is free, so if you find it useful, please share it!

Great post and everything is nicely put together.

There is one exception though, which is AI has nothing to do with layoffs. Youth unemployment is on the rise in "no degree" category, while it's about stable in "higher degree". It's just the economy being not great.

Guy Berger has discussed it in detail on his substack and on X

Say we assume AOC2028 (or some other socialist candidate). What happens then? Also, you need a crypto/Bitcoin section brah, it’s almost 2026…