Introducing Dominant Driver Theory

How I achieved a 101% LTM return in the world's hardest asset class - Global Macro

As many of you know, I haven’t been writing as much this year. My team and I had been busy setting up a UK blue-collar acquisition firm, and, as mentioned before, over the past few months I’ve concentrated on articulating my macro trading strategy into a coherent framework, in order to share its results once a full year of trading had passed. This is what today’s post is about

Before going into further details, a brief reminder: I am not selling anything. My posts have always been and will always remain: free. There is no vehicle to invest in or subscription to be paid. I have learned a lot from others who have freely shared, and enjoy doing the same now

So let’s get to it - from Oct 17th ‘24 to Oct 13 ‘25, the strategy returned +101%. Some further details:

This is a classic macro trading strategy primarily focussing on hyperliquid futures such as equity index (e.g. ES, NQ), rates (SOFR, 30Y), FX and commodities/precious metals. Single stock contribution is <5% (so no quantum or other yolo stocks), no crypto, and as you can see from the chart, a negative correlation to equities (!)

It is my only funded account and the majority of my net worth, which means that it carries the full psychological weight of being wrong

With c. 5 trades a day and a hit rate of ~50% I am indeed wrong a lot. However, winning trades produce gains on average ~3x larger than losers

This compares to the average macro fund being up ~8% this year

Becoming a profitable trader in global macro was the hardest thing I’ve ever done out of a reasonably wide range of things I’ve done over time. It took several years and many very humbling episodes to get there

The first paragraph of today’s post explains why - in my view - this investment approach is both so hard, but also so rewarding

The key insight for me was that (1) global markets are connected and moved by a shared dominant driver and (2), that it is often possible to identify this driver in time to benefit from it. Hence the strategy name Dominant Driver Theory (DDT)

The below will introduce the details of DDT. I tried to keep it very light reading, you can skip to each of the subsequent sections directly

WHY IS MACRO BOTH SO HARD AND SO REWARDING?

THE SIX PARTS OF DDT

NARRATIVES & THEMES

PRICE

CROSS-ASSET SIGNALS

POSITIONING

RISK MANAGEMENT

RADICAL JOURNALING

ADDITIONAL OBSERVATIONS

CONCLUSION & OUTLOOK

WHY IS MACRO BOTH SO HARD AND SO REWARDING?

Two reasons: (1) complexity and (2) psychology

First, on complexity

Macro is highly complex because pretty much everyone participating in capital markets is a macro investor. This ranges from the corporate that defers bond issuance because they think rates are too high, to the Tech hedge fund that takes up its net because they feel bullish, or the retail investor who yolos into altcoins as their only hope to catch up on society - in other words, the competition is endless

This means that whatever you perceive as obvious is likely in the price. Convinced interest rates will be higher forever as inflation is sticky? Likely in the price. Strong belief that markets are a bubble but we are in the early innings? Likely in the price. Seems obvious that Europe will forever underperform the US? Likely in the price. Etc. This pushes successful investing both into the counterintuitive which goes against the default wiring of our brains (“be fearful when others are greedy”) and into the second/third derivative (“have to take a variant view to the market”)

Throw in the fact that price action influences future outcomes in a reflexive way, and you get a set of constantly changing and interdependent variables. The best that one can do here is to accept to be wrong often, but look for asymmetry - make more when you are right than lose when wrong

This brings me to the second part, psychology

While fundamental stock analysis can often lead to high conviction conclusions (“I am 95% certain that Microsoft is a great company”), Macro hit rates are much lower, and at the same time the turnover of ideas much higher

This creates a fast and emotional setup, for which evolution has given us the reptile brain where fight or flight sits. Since everyone’s brain works the same way, we all feel greedy or fearful at the same time and this is what makes prices go up or down. Thus, your emotional reaction will be your biggest enemy in doing this well

Rewiring your brain away from fight or flight is incredibly hard. It mostly works via experiencing the pain of getting it wrong and vowing to never do “that” again. As this is highly unpleasant, you really need to love it to go through these episodes over and over again, until it finally gets better

Complexity and psychology in combination create a “high barrier to entry” to the strategy, where a small handful of experienced market participants print extraordinarily high returns (the investors with the highest long-term track records are mostly macro investors) while a long tail churns out inconsistent results. This is reflected in the allocators’ dilemma around macro funds, where the few desirable ones with outlier returns have long converted into family offices

Now, what makes it so rewarding? The reason is simple: Global capital markets are intimately interwoven with both the real economy and politics. Dealing with these topics every day gives you a better glimpse of how the machine works - a treat for anyone with intellectual curiosity

THE SIX COMPONENTS OF DDT

NARRATIVES & THEMES

The basic foundation for DDT is a thorough understanding of the many narratives and themes that can drive markets. The way to acquire this is simple- read, read, read

A brief list of current narratives and themes that is far from exhaustive:

Expansionary fiscal policies across all major economic blocks (US, Japan, Europe and China)

First signs of AI having a positive impact on corporate productivity and thus margins, and a negative impact on hiring

Competitive devaluation, with the major economic blocks showing little regard for a decline in the purchasing power of their currency

Central Banks actively acquiring Gold to diversify their FX holdings

Private Credit issues related to a US low end consumer slowdown

Now, the important part is that there will always be many, usually conflicting, narratives available at the same time. More so, with hindsight many will turn out to be wrong! So which one is it then?

Without any further process, we typically default to bias. Everyone’s bias is different, we just love to hear what we want to hear, so we stick to that

In macro, this is the sure most way to get run over. Stick to a narrative that is wrong, while price continues to move in the other direction

Which brings me to the next component

PRICE

For a good while, I was in the narrative-only camp. I spent most of my time analysing the often un-analysable (“Where will interest rates be in one year?”) and then stuck to a narrative that I liked

The first major breakthrough away from that was when I started to integrate price in a structured way. We often perceive “technical analysis” as child’s play of drawing lines on a chart, but this could not be more wrong. It helps unveil an incredibly rich information surface shaped by millions of informed market participants. Today, I start every day by going thru the same set of ~100 charts to shape an initial, intuitive view of what is going on

Reading price action is its own science (I think it is fair to describe it as science rather than art). The patterns in which asset prices move have remained the same for centuries (just compare a chart of the Dutch tulip bubble with some altcoin charts from 2021), as they are largely a reflection of the human psyche. While the details here are endless, I can point to the two seminal books on the topic by Schabacker (1932) and Edwards & Magee (1948) that still stand the test of time

Investing solely based charts works for some. In my experience the their potency really comes from the combination with narrative

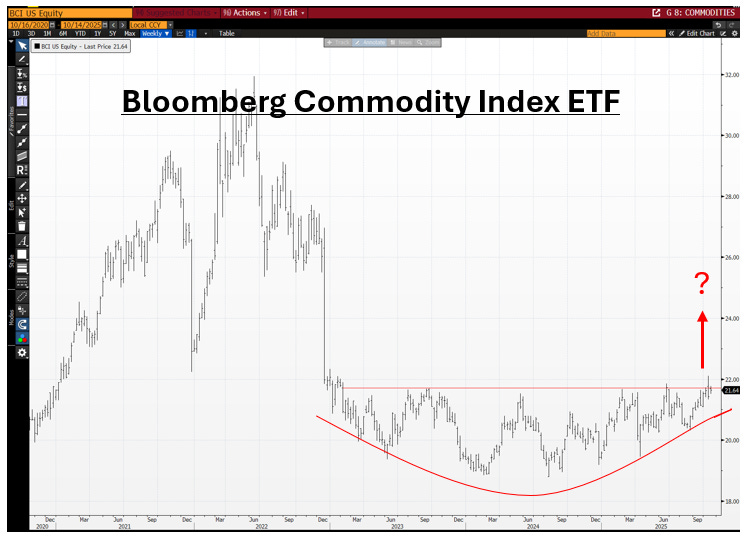

Simplified example: The narrative of fiscal stimulus across the major economic blocks should translate into higher commodity demand. Can we see evidence of that in price? Yes- the BBG Commodity index looks to break out higher after having formed a multi-year base

CROSS-ASSET SIGNALS

It is not just price action within a certain asset that has a lot to reveal. Another way to crosscheck the likely accuracy of your views is to look at the behavior of related assets

This as the market’s dominant driver is usually visible across asset classes. Some cross check examples:

If you are long bonds because you think a recession is coming, but oil and cyclical stocks are rallying, that view is probably wrong

If you are short US equities because of liquidity issues ahead, but Japanese and European stocks are ripping, that view is probably wrong

If you believe Powell was hawkish so you short SOFR, but Gold is up 3%, that view is probably wrong

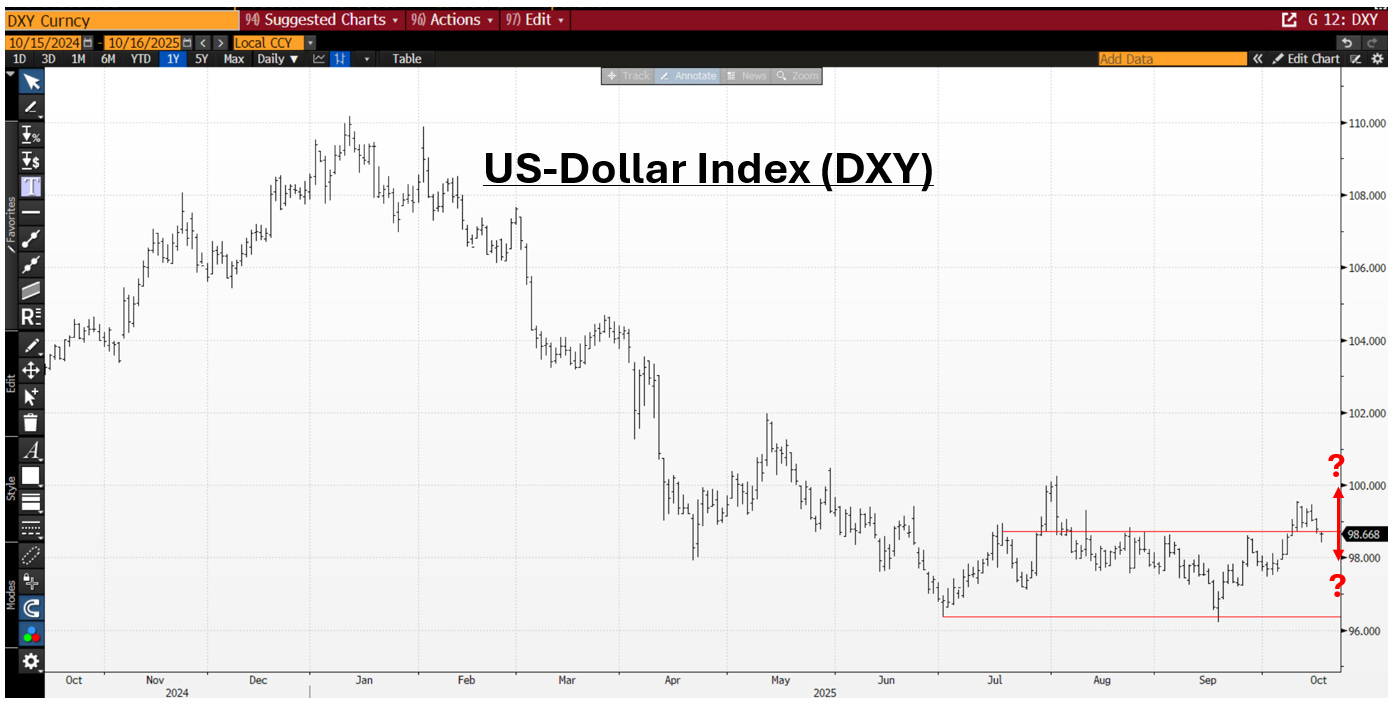

Simplified example: Are cross-asset signals confirming or rejecting the commodity price breakout thesis? Commodities (often, not always) need a weak USD to work. The greenback appreciated recently, it appeared to break out of a consolidation pattern but has now stalled. While not outright supportive, at the very least this does not appear to be a headwind

POSITIONING

This component addresses the fact that a marginal buyer/seller is typically needed to advance price momentum further. Extreme crowdedness is what we need to watch out for, as it negates that dynamic, instead indicating turning points. Various inputs can be applied here:

Prime broking data which today can be found everywhere online (X etc.)

CFTC data that shows futures positioning between speculative and commercial investors

Surveys and anecdotal conversations with other investors (“if all my friends are bearish maybe that’s bullish?”)

CBOE Put-Call data

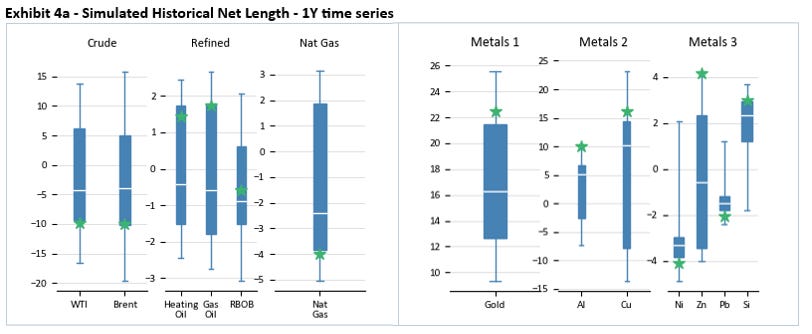

Simplified example: Looking at the CTA positioning for major commodities, there is no extreme crowdedness in either direction

RISK MANAGEMENT

Even with all the above, any macro view will still be wrong a lot. This is also in large part because not only do you want to get the narratives, technicals and cross-asset signals right, but also the timing

Thus risk management takes paramount importance. The following are my guiding principles:

Only ever bet a small part of the overall portfolio (0.25%-2% on one individual trade)

Never double down (this can annihilate a book when it goes wrong)

Never move a stop (this is you tricking yourself into not taking the loss)

Never average up (this is often greed rather than a good plan)

Slow down when things are not working (protects you from compounding a bad state of mind)

And most importantly, never deviate from the process. I have learned over time that no matter how tempting and obvious any situation looks, if I deviate from my process nothing good awaits

Simplified example: Establish a long position in the Bloomberg Commodity ETF with a stop 4% away from the breakout line. Given the neutral DXY signal with a small portfolio risk of 25bps = 6% NAV size

The DDT process elements are based on extensive iteration of frankly doing things badly first, then noting that, thinking on it and trying to improve. Iterate, iterate, iterate. This brings me to the perhaps most important, and most personal part of DDT:

RADICAL JOURNALING

Macro investing resembles playing timed chess while someone is punching you in the face. Only in this case it is not a person, but your emotions. They will shout “greed”, “fear” very loudly and aim to trigger your fight or flight response when you are meant to think clearly

This is what makes process so important. The easiest way to “think” in that situation is by having the plan ready at hand. As everyone’s emotions, biases, information etc. are different, each process is highly personal

For me, the way to get there was the concept I call “radical journaling”. Radical because it involves observing and noting down every possible aspect of the decision-making process, from the emotions I experience at the time, to the time of day and of course the fundamental context around it

I do this every day, grouped into (1) general observations, (2) breakouts to go in depth on a particular topic or theme and (3) daily learnings of which indeed every day there are many, small and big. Finally, (4) all time learnings, which are mostly actions of utmost importance, to either never or always be repeated :) E.g. “Don’t short the rebound after a hole” “Always take profit after a X% move etc”

Over time, this process has not only created a database with many thousand lines that I can eventually use as context for an LLM. It also helped me tremendously in identifying patterns and biases that I was not aware of before, or worse, did not want to acknowledge. As an example, I noticed that I often came into the day thinking “what can I short today” (=bearish bias) which made me miss good longs, that my decision making quality was significantly worse after very short night’s sleep (often thanks to the kids ;)), or that one major bad decision often lead to others as the emotional equilibrium was thrown off

I would think this approach to the be good for any type of frequent decision making, or in fact for life generally. For macro it appears particularly useful as the feedback loops are very short, so a new insight can often be applied a few days or weeks later. Even in the chart at the very top this progress is visible

ADDITIONAL OBSERVATIONS

This is the synopsis of DDT, and hope you found some inspiration reading it. A few additional thoughts on pushbacks I frequently hear:

The market has changed and has gotten dumber

I agree, as the share of active investors has declined significantly, to be replaced by passive and retail. But why not just take advantage of it rather than complain about it?

How can anyone compete with the information access of large investment firms?

Historically, information was indeed limited and hard to access. Today, I’d say the quality of output you can find outside the traditional buyside-sell side network is actually much higher. There are countless substacks, X feeds or discords full with stellar investors that you may have never heard of just because they did not go to Wharton. In fact, this has tremendously levelled the playing field

AI will soon replace active management

Sure, maybe, but I see no indication of that happening any time soon. However, in the interim I believe that anyone incorporating AI tools into their process will see huge advantages, and as the cost of coding collapses anyone can do that

If I take my personal approach as an example, I know that I am still only scratching the surface of what is possible, with the primary constraint my attention capacity. I have and am actively working on incorporating more AI tools into the workflow to unblock that bottleneck

All this together leads me to believe that public markets investing is currently undergoing a quiet revolution. While I come from “inside the system”, I don’t think there was ever a time like today where superperformers can emerge outside of it, and it seems likely to me that we will hear of many such success stories over the coming years

CONCLUSION & OUTLOOK

Getting good at macro investing requires plenty of time, introspection and internal honesty. You always have to be on top of your game and need to absolutely love it

However, it can be very rewarding once you reach a satisfactory level. You learn a lot about yourself (principally by being humbled a lot), you start to understand the economy much better and you acquire the life skill of intelligent asset allocation - in the end, everything is a macro trade

From here on, I will again resume to write notes with observations on markets and the economy, though these will be significantly shorter than in the past. They will remain free, and I look forward to the continued dialogue with many of you

Hey Florian, I’ve been following you for a while and just wanted to say that your work is great.

I have a question (actually, many more, but let’s stick to one) regarding DDT. I follow a similar process in my trading, but unlike you, my background is technical. Over the last 3–4 years, I’ve been trying to incorporate global macro (narratives) into my setups, especially for longer-term (from a few weeks to a few months) trades.

My thinking is that if something is visible on the chart, it should reflect some narrative or theme that’s emerging or already in play. Still, I find it difficult to read the market through the lens of narratives. How can I tell whether a theme is still alive, or if something new (or maybe just a nuance of the dominant narrative) is taking over?

I understand the importance of the trading timeframe, and mixing time horizons only makes things more complicated. But let’s leave that aside and assume the timeframe of the setup and the narrative are properly aligned.

Thanks Florian. I've gone down the journalling approach and feeding it into a LLM as well. Did you use specific research or books for it to draw or to analyse the journalling? I don't think I'm getting the best out of the LLM in terms of pattern recognition and think it's related to asking it how to behave