Tectonic Policy Shift

Trump and Bessent guide to government financing changes that are still poorly understood, but of tremendous importance for global markets

The base layer of investing is politics. Consequently, we need to closely follow the decisions of policy makers. Most often, these are of limited impact for the global financial system. Sometimes, they are exceptionally important. Decisions communicated by the US administration over the past days belong to that second category

This post first reviews the particular events, followed by how I see their market impact and how I’ve traded it. It closes with a perspective on whether these actions are the right steps and what their longer-term consequences may be

What particularly happened?

First, in a press briefing this past Friday President Trump once again stated his dissatisfaction with Fed Chair Powell’s decision to wait with interest rate cuts. This has been well telegraphed. But this time, he also said that he told his administration “not to do any debt beyond nine months or so”, until a new Fed chair is installed

Second, yesterday in a Bloomberg TV interview Treasury Secretary Bessent reiterated the same idea. In particular, he said “why would we issue debt at current long-term rates” (Minute 5 video below)

In other words, Trump and Bessent are telling us that going forward, the US intends to change its issuance mix towards short-dated debt such as T-Bills (<1 year maturity), and away from long-term debt such as the 10-year or 30-year bonds, potentially significantly so

It sounds like some arcane financial plumbing detail, so why does it matter so much? We need to go through a few steps to understand this:

To start, we need to know that interest rates on long-term debt are decided by the market, and on short-term debt are decided by the Fed1

Next, if the administration installs a Fed chair who follows its interest rate demands, and it mostly issues short term debt, it can effectively decide the interest it pays on its debt

NB: Interest payments are currently the second largest item in the Federal Budget after entitlement spend, a lower Fed Funds rate would save the government a lot of money

Further, if the issuance of long-term debt is greatly curtailed, long-term yields likely drop below their “natural” level, i.e. what the market would decide is fair in light of growth and inflation expectations. This would be very stimulative for the economy, as long-term yields are highly relevant e.g. for corporate debt issuance (~7 year maturity) or housing (10 year maturity)

By installing a “friendly” Fed Chair and moving the financing mix towards short-dated maturity, the administration achieves two goals: (1) Reduce the budget deficit and (2) stimulate the economy via lower long-term interest rates. Great, so what’s the issue?

This policy mix is called Fiscal Dominance, as it subordinates a previously independent Central Bank to the needs of the Treasury. It is most well know from Emerging Markets where the government has given up on budget discipline and just prints the money it needs to finance the deficit, ignoring price stability risks

So indeed, these policies are successful in stimulating growth, but in the past have typically come at the expense of structurally higher inflation, currency debasement and ultimately political crisis

In the next sections I will first review what I see as immediate market implications, followed by whether this pivot was potentially the right decision, irrespective of historic precedent

What does all this mean for markets? In the below, I walk through the consequences by asset class as I see them, and the trades I put on in accordance after watching the Bessent interview:

Long-term Bonds: In past precedents, the immediate consequence from significantly lower bond issuance was - unsurprisingly - lower long-term yields. This is true for Japan in the 2000s/2010s, as much as it was true for the US in Q4 ‘23, when Janet Yellen took the first step towards Fiscal Dominance and increased the issuance share of T-Bills to ~50% from previously ~25%. Further, the 30-year real yield is still near a multi-decade high, while the US economy has visibly decelerated in both real and nominal growth in the past month. I am very long 30-year bonds

US Dollar: Fiscal dominance puts a lot of pressure on the financial system as the government inundates the economy with liquidity via cash-like T-Bills. With long-term yields neutered, there is only one escape valve left - the currency. I am very short the US Dollar (DXY)

Gold: A rapidly declining US Dollar will soon represent a major headache for other currency areas, especially if they are heavily export-driven, such as Europe or Japan. Their growth will slow down due to FX headwinds, so they’ll be forced to also cut rates and be dovish. This phenomenon is called competitive devaluation, and needs another escape valve. I am very long Gold

Equities: Here it gets a bit more complicated. US stocks in particular face a two-way dynamic:

Positive: In isolation, FX debasement is very supportive for real assets, as the amount of US Dollars (or cash-like T-Bills) in circulation grows much faster than the real assets around. This would speak for a run-away bull market in nominal terms

Negative: Historically, however, an imploding currency has lead to capital flight by foreigners who incur significant losses via the FX move. Foreigners indeed hold trillions of US equities and may be incentivised to sell. However, whenever they are done selling, the positive dynamics take over

To acknowledge this bifurcated risk, I am focussing on single names such as ARM which I mentioned in my last post, and has since been the best performer in the Nasdaq 100, and trade or hedge these opportunistically. I generally note that the strong July seasonality for stocks is well telegraphed and perhaps pre-traded, so maybe we sell first on the negative dynamics, and then get a panic bid later on the positive dynamics once some recent late longs have been washed out

As a general observation, in my view, capital markets have changed materially due to what is effectively the death of active management, which has been replaced with passive flows, retail, multi-manager platforms and “machine money” that mostly trades headlines

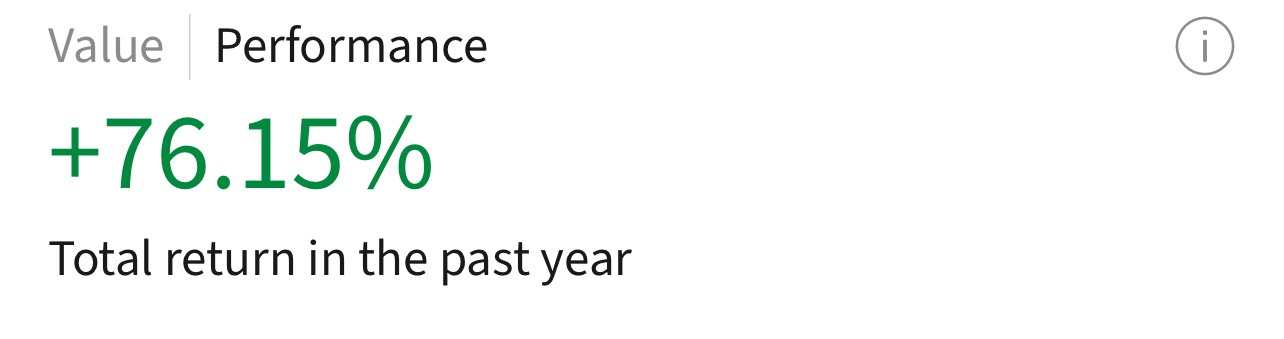

As I mentioned, I’ve been running my account in a style that fills the void these strategies leave, which could perhaps be described as “thematic macro”, properly documented since 15 Oct. ‘24. So far so good:

Either way, I am just scratching the surface on its potential and believe the material change in market structure opens the path to a new public markets investment paradigm, especially with AI, where advanced reasoning models such as O3 pro or Gemini can replace entire analyst teams at a very low cost. I will write more about this and the results in detail in the Fall, or when the Calendar year is over

As always for this section, please keep in mind the disclaimer. This in particular as macroeconomics is deeply reflexive, and today’s policy decisions impact tomorrow’s market behavior, which means the market always moves on and thus views can change any time:

Please note that any trades mentioned reflect my own strictly personal capacity and are shared with other likeminded investors for the exchange of views and informational purposes only. I may be entirely wrong and/or may change my mind at any time. This is not investment advice, please do your own due diligence

Now, the big question: Is this policy pivot the right decision? What are the political and economic consequences?

The gut reaction of most is one of head-shaking and disbelief, as it turns out after 2 months of trying via DOGE and “Main Street over Wall Street”, this administration has given up on that, and is instead going all-in with “Bidenomics on Steroids”, i.e. government-funded growth at the expense of inflation risks and higher inequality

However, it is not that simple. Some very important dynamics apply:

First, in contrast to Biden’s 2022-24, the US economy is now very clearly slowing. Especially the labor market has weakened a lot (see continuing claims below), and in the past, whenever employment cracks appeared, eventually a major downturn followed. In my view, it makes much sense to try and front run that, especially as inflation now appears subdued. I think Trump is right and the Fed should cut rates now

Second, of course, in a perfect world it would be ideal to reign in the humungous US budget deficit and bring it back to a balanced level. However, the path to that is incredibly narrow (aside from the fact that no political constituency wants to accept any cuts). The fiscal impulse has been the primary driver of US growth over the past years. Cutting it back would very quickly introduce a downturn, which would cause the deficit to expand again on higher social security payments and lower tax revenues. Not to mention the political consequences of a recession in an already deeply divided nation. In some ways, playing offense may be the only realistic way out

Finally, the historic precedent is not all bad. FDR and the post-war period was shaped by delevering via yield curve control - and it worked

In my humble view, the biggest risk of these policies is another significant increase in inequality. Newly printed US-Dollars typically end up with large asset owners, (“Cantillion effect”) as lower income groups need to spend all they have and don’t own anything that benefits from the increasing ratio of Dollars to Real Assets. If the US does not manage this not-so-small “side effect” well, the already deep divisions in the country, between Coast and Flyover, Millennials and Boomers, Left and Right, Men and Women are very likely to grow, and eventually spill over into political instability. There is still time to avoid that outcome!

Thank you for reading my work, it makes my day. It is free, so if you find it useful, please share it!

Their short duration means barely any impairment on the principal in case growth or inflation expectations change

The market doesn't always set the price for long term Treasuries:

"Operation Twist is a monetary policy tool where a central bank sells short-term government bonds and uses the proceeds to buy longer-term bonds, aiming to flatten the yield curve. The Federal Reserve used this strategy in the past, including in 1961 and again in 2011, to lower long-term interest rates and stimulate the economy without increasing the overall size of its balance sheet, according to the Federal Reserve Bank of New York. The goal is to encourage borrowing and investment by making long-term debt less expensive."

And, "in 1947, the Federal Reserve (Fed) purchased long-term Treasury bonds and had effectively capped long-term Treasury yields at 2.5 percent. While the specific yield might have fluctuated slightly, the 2.5 percent level served as a ceiling during this period. "

I am presently being eviscerated by inflation. I own beach house rentals, and my city and county property taxes are going up close to 300%, as I get taxed for unrealized, inflationary gains. Additionally, both my homeowners insurance and FEMA flood insurance are heading decisively North, even as FEMA is running out of money for storm damage payouts.

The flip side is that 62% of US counties are seeing year over year sale price reductions. So as property tax payments and insurance premium costs move higher, property prices move lower. People are being driven out of their homes by PITI payments and HOA dues moving higher, their home values move further under water.

Glad you’re writing again!