The Treasury Blinked

What yesterday's QRA release means for the economy and markets

In a beautiful moment of Reflexivity, as communicated in yesterday’s Quarterly Refunding Announcement (“QRA”), in response to unsettled bond markets the US Treasury broke character to its typically predictable ways and adjusted the amount of long-term Treasury bonds (“coupons”) to be issued materially below its previously communicated plans, to instead prioritise very short-term debt (“bills”)

This post explains why this is a huge policy decision and likely a significant step towards a structurally higher inflation world

As always, it closes with my current market views. I am now long Russell 2000 for what could be a short squeeze on looser financial conditions, but see this as a trade only until inflation concerns likely come back

As I have written many times in the past months, the excessive US budget deficit created an issue for both the economy and markets as long-term yields started to rise in a disorderly way. Thus, bond investors tensely awaited yesterday’s Treasury’s quarterly funding schedule, which breaks down how the larger than expected $816bn funding needs for Q1 were to be financed:

The Treasury now plans to sell $348bn coupons for the quarter, with the remaining 58% bills. This is much lower than the initially guided $396-$460bn, and only a mere $10bn step up in coupon issuance vs Q4

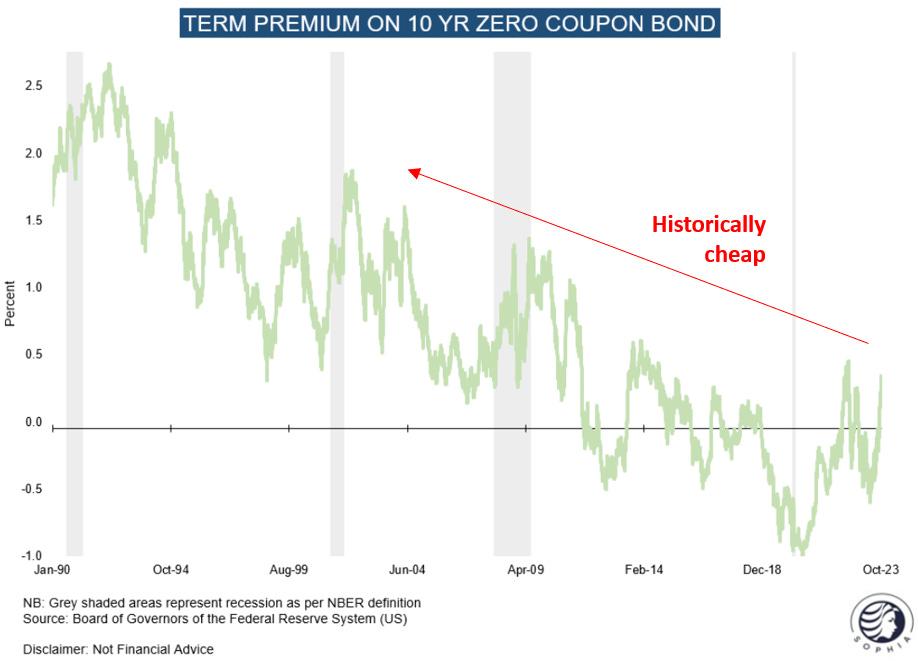

This is a huge policy decision. Per its own mission statement, the Treasury aims to be regular and predictable and to seek the lowest cost for the taxpayer. In order to stick to these principles, the Treasury would have had to prioritise coupons, which are still historically cheap as measured by their term premia

However, the Treasury’s private sector advisors (“TBAC”) acknowledged in their report that there was just not enough demand for these long duration bonds. This comes as no surprise as every investor in the world can see the deficit wall ahead, with a 6-8% budget deficit for years to come

Now, the prudent move would be to address the deficit either via revenue raises or spending cuts. Alternatively, the Treasury could let long-end yields drift higher so they can take the sting out of the inflation created by excessive fiscal spending

The path of least resistance however is a different one. It is a path that has been taken by many inflationary Emerging Markets before: If the market does not want the long end, and no political party is willing to address the deficit, one simply switches to very short-term debt (i.e. bills) instead

Why is that an issue? With maturities of under a year, bills are akin to an overdraft credit that the Treasury receives from its funders. And as any overdraft, it is more expensive and provides less financial stability than longer dated loans. Per the Treasury’s own guidance (!), these should be reserved for emergency funding such as during Covid, when a large sum needed to be rapidly raised

Particularly in an environment of higher inflation, a high share of bills entrenches said inflation in a reflexive way. How?

With very short maturities, bills carry little risk of losing purchasing power. For the private sector these are cash-like, just with interest; they do not translate the market’s disciplinary force in case of high inflation. Coupons, on the other hand, require private sector confidence that inflation stays low, given their long duration. By prioritising bills and reducing coupon supply, the Treasury can overlook private sector inflation concerns in its funding. There is no free lunch of course, fewer coupons lower the yield on long-duration bonds, which loosens financial conditions and is thus inflationary. Further, due to their cash-like nature, bills are in fact liquidity-positive and also loosen these conditions. By changing the bill/coupon mix, the Treasury effectively undoes the Fed’s work

In addition, during a period of structurally rising inflation, the government should prioritise coupons, as it locks in lower rates for a long period of time when interest rates trend up. More so, if it prioritises bills, short term rates need to rise more as the economy is stimulated. This increases interest payments on private sector cash holdings, and with it its spending power

The proper remedies - letting long-end yields drift higher, cutting the budget, or raising taxes - all involve some degree of pain on the economy - the price to be paid to get inflation out of the system

But after a decade of rising inequality amidst the QE-era, there is absolutely no political will for this to occur. Ironically, this is very different to the aftermath of the Great Financial Crisis, where the Tea Party and their radical budget cutting plans had a large following, while instead big spending would have been much more in order back then

So after several poorly received long-end auctions, the Treasury moved away from its goal to bring the share of short-dated bills down to its historical range of 15-20%, and they will make up 58% in Q1 (!)

With ~$340bn quarterly issuance seemingly a hard ceiling, I find it hard to believe that this bill share will not drift ever further away from the 15-20% goal. Eventually, the bill/coupon mix probably resembles the 1970s when average maturity was a mere 2.7 years, down from 9 years+ in 1946

Finally, to rest with my ever-guiding theme of Reflexivity, I think it is quite likely that as a result of yesterday’s decisions, over the medium term, long-duration Treasury yields will in fact end up being higher, despite less supply. How so?

A high share of bills is stimulative to the economy, while a low share of coupon issuance neuters the inflation-taming effect of the long end. Consequently, in an inflationary context, the current policy choice should increase long-term inflation expectations. In turn, these should drive up the yields of long-term bonds

Thus, after the current shakeout is over, long-term yields likely drift up again anyway, and we could see poor auctions return, possibly at even smaller auction sizes. Eventually, the coupon issuance size would have to be reduced more and more, and you end up with ever more bills

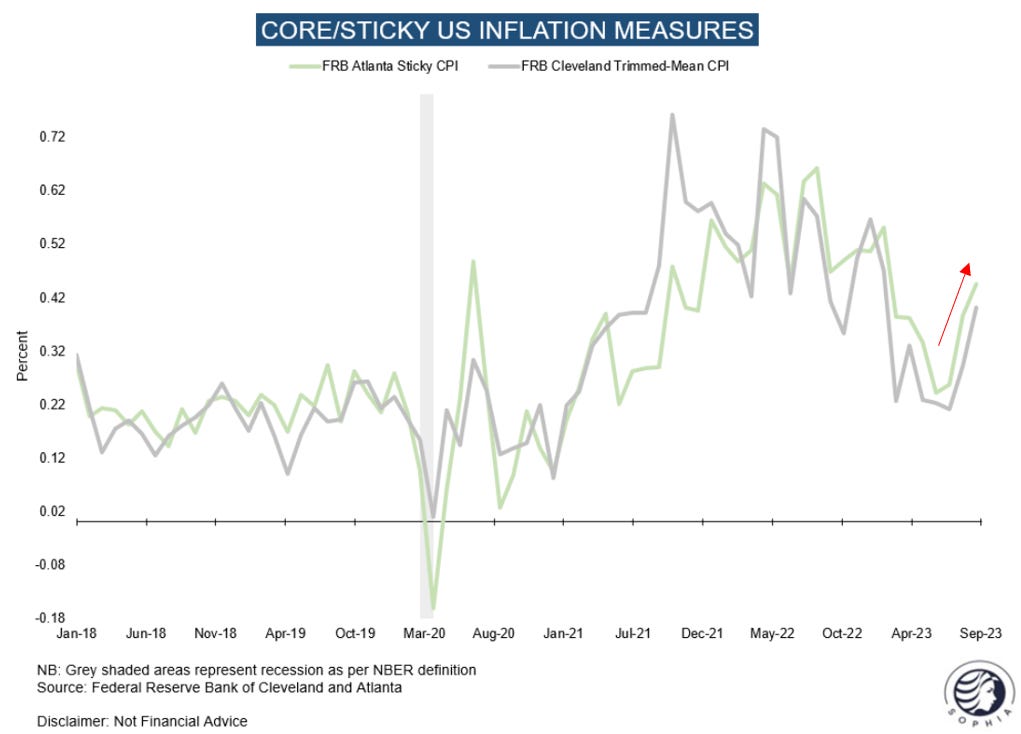

But that is of course a process. The loosening of financial conditions comes first, and we likely see that play out in the coming weeks. As a result, my bet is that this chart below continues to drift up, and thus eventually triggers another round of Fed tightening in response to undo the Treasury’s work - push and pull

Conclusion:

Yesterday, politics panicked and substantially loosened financial conditions by prioritising bills over coupons in its debt issuance for Q1 24 and very likely beyond

This is another step up the ladder towards the “Emerging States of America” (see my previous post from May ‘22 on this notion). It likely contributes to entrenching inflation further, and likely, ultimately leads to higher long-end rates

In the near term, the loosened financial conditions should stimulate all risk assets. In the long-term, higher inflation will be bearish for them

What does this mean for markets?

The following section is for professional investors only. It reflects my own views in a strictly personal capacity and is shared with other likeminded investors for the exchange of views and informational purposes only. Please see the disclaimer at the bottom for more details and always note, I may be entirely wrong and/or may change my mind at any time. This is not investment advice, please do your own due diligence

As laid out above, the Treasury decision is positive for risk assets, so I closed all equity downside trades. To participate in what I deem a likely intermediate rally, I’ve bought the Russell 2000 (US value/small caps). My thinking is as follows:

This index got hammered the most and is down 20% from its previous peak. It is near the 2022 lows, and now prices in a severe slowdown

The looser financial conditions and high bill issuance will stimulate the economy, and, at least for some time, work against recessionary trends, the expectation of which has again shot up again. NB: always fade a market that is convinced of a recession IMO - it usually either has already happened, or will happen later than everyone thinks

If inflation expectations creep up as per above, the Russell will initially benefit from it as it means higher sales and pricing power, again vs now quite bearish expectations

Hedge funds are short these stocks as per PB data. They also have low net exposure. Their worst outcome is a rally lead by beaten down areas

I obviously could be wrong with this for many reasons, e.g. inflation expectations could jump so quickly that it invalidates the risk-on rally in its nascency. I am using a tight stop-loss accordingly, near past week’s lows (~-3%)

There are many ways to play this loosening of financial conditions, from TIPS to bonds to the Nasdaq to Oil or long Euro. The Russell is my pick for the fastest horse. I also think Biotech and Unprofitable Tech are good candidates for it and I may add them as well

Ultimately, I perceive this rally - should it occur - as not durable, as it will bring inflation back with it. When that happens is unclear. It could be in mid/late November, or in the New Year. My bet is earlier rather than later, especially as sticky inflation measures are on the way up again. But as always I could be wrong, or something entirely different could happen

There is another big reason why I will have a foot out of the door with this trade. That reason is positioning. It is still way too bullish equities according to my favorite measure (CFTC) for a durable low to be in

This rhymes with a year-end rally view currently so pervasive that I think the market might do what it always does best, trap as many people as possible into a narrative and then do the opposite. This would mean a weak December after a good November

Thank you for reading my work, it makes my day. It is free, so if you find it useful, please share it!

very interesting as usual,

if I I undestood correctly this "implicit easing" is also potentially bullish for gold as

1) bearish for usd

2) real rates (= nominal - inflation) could be unchanged or lower

This appears to have aged well - excellent post.