On Reflexivity

The essence of what I've learned

As mentioned in “Summer Views” I’ve been using August as a period of reflection, to be summarised into a piece on Reflexivity. While I’ve written a lot on economic and market views, I haven’t written much about my framework, aside of “It’s all One Big Trade” last year. Today’s post addresses that and explains why I see the concept of Reflexivity as central to both the economy and markets, and how to best apply it

As always, the post concludes with my current market views, where I’ve added to China Tech. I’ve raised cash as I expected a volatile Fall, but kept some US Regional Banks and Energy, and am considering buying longer-dated TIPS as recent US data weakness suggests real rates may have seen their peak

My Background - How did I learn what I learned?

I started my career in Merrill Lynch’s M&A advisory group in 2006. I was top-ranked but the hours were gruelling, so after two years I looked to jump ship to the buyside. It was the middle of the financial crisis, so most buyside firms were in exactly that - crisis. Paulson however was the big winner at the time, I signed with them in the summer of ‘08

The following years I witnessed the Great Financial Crisis and its aftermath from front-row seats. In 2012, after an early promotion, I decided to try the entrepreneurial route, and together with a friend launched White Square Capital, a multi-strategy hedge fund focused on behavioral strategies

It turned out the world did not need another hedge fund, especially not one run by two 30-year olds with little experience. We launched with only 10m of capital and raising that was a lengthy, arduous process

With some luck, we got off to a good start. The track record was decent, with 7.1% for the last four months of 2014, then 32.9%, 33.8%, 5.5%, 0.3%, 8.5%, 26.0% gross returns from 2015 to 2020 in a market-neutral book (I am quoting gross as we had various fee classes). Our assets grew rapidly and peaked in 2018 at ~$450m, at which point we closed the fund to new investors as we were run over with demand and not ready to absorb it

However, we soon got to learn the dark side of the hedge fund momentum game. Many investors came in after the strong initial years and were disappointed when performance turned more pedestrian. Redemptions soon set in and accelerated when Covid broke out. Despite a stellar 2020 and no down year before then, we finished that year with much lower AUM

In January ‘21, Gamestop happened. It was only a small short in a quantitative long/short book, but I made the wrong call to ride it out. I was forced to cover into the squeeze and the fund was down meaningfully. The drawdown was still a lot less and the rebound much stronger than any of the prominent funds reported at the time. Still, it was a signal to take a break. My business partner had left during 2020 and I was personally exhausted from several years of playing defence

After closing the fund, which made good returns for most investors, with only a handful out around break-even, I took some time off to enjoy life again and then continued to invest my own funds, which I’ve documented in these posts since

As you can see, after ~17 years in capital markets, I’ve seen many extreme situations first-hand, from macro meltdowns to short squeezes to untamed bull market runs. What has all this taught me? I would summarise it into three most important learnings:

Experience: Just like medicine or law, investing is an experience industry. You get (much) better with age. More so, there is no better way than to learn than from one’s own mistakes, as any seasoned investor will attest to. For anyone with a career in the investing industry, I’d highly recommend to give yourself time to make all these mistakes in an environment that is forgiving, before forging out on your own. It is also critical to make the effort to learn, which happens by going back to analyse and integrate the experiences

Mentor: Learning from experience is closely followed by learning from a mentor. While there is no substitute for ingraining a learning in one’s memory through the pain of being wrong, a mentor can pass on a successful framework or intervene to course-correct. Today online resources provide access to world class investors, very differently to even a few years ago

Edge: Investing is a zero-sum game. And like in any game, you need to have an edge over the other side to win. To take an analogy from poker, you need to be able to point at the patsy in the room, otherwise it is likely you. An edge can consist of information, speed, access, legal/synergies or behavioral. Behavioral is the biggest edge, it is also the hardest, as it works against our intuition

First, why do I say zero-sum game? True, the economy grows over time, and with it capital market valuations. However, investment success is measured by outperformance. Therefore, by definition, for anyone doing better than average, someone needs to do worse

Now, outperformance is not evenly distributed (as in, 50% do be better than average, and 50% worse). Instead, like in Poker, Blackjack or Bundesliga soccer, outperformance clusters consist of a very small handful who are extremely good. The remaining 95% are either at the average, or most likely underperforming

This is complicated by the fact that outperformance is hard to detect. It can be obfuscated by excessive risk-taking that got lucky, by coincidentally riding a multi-year wave without skill, by drive that falters as success comes in, or by good marketing

Let’s walk through the different forms of of “edge” under the lens of liquid public markets

Information. Twenty years ago, understanding company fundamentals better than anyone else still provided a huge edge. Today, in large-cap equities, fundamental analysis has descended into outright pod-on-pod warfare, where PMs at multimanager platforms fight over who gets the first call from corporate Investor Relations to guide the next earnings for a 2% move in the stock. In Macro, funds spend millions of dollars for access to the best data and experts, and many end up blowing up every other quarter. In my view, the edge of fundamental analysis remains strongest (1) in small caps which do not provide enough liquidity for large participants, (2) in novel trends that aren’t well understood yet (e.g. AI, GLP-1) and (3) in sectors that are undercovered (for a long time biotech, possibly financials today)

Speed. Faster execution to this day remains a durable edge. However, given the enormous infrastructure necessary to compete, the alpha in this area rests with a very small group of players who can afford the very high expense necessary to be a nano-second faster than the rest

Access. In public markets, preferential access to information is usually deemed insider trading, and the policing of such is much improved. However, some variations are legal, e.g. buying a large stake in a company knowing someone wants to buy it and then lobby the board to sell it. In private markets, relationships play a bigger role. It used to be huge a decade ago, however today large deals and even middle market transactions are usually competitive. Rollups of small units below this competitive threshold into larger units above are a good example where a solid edge can still be found

Legal/Synergies. In some instances, one buyer has a competitive edge over others by design. This could be because they are the only bidder who’s allowed, or their synergies are larger than everyone else’s. Neither applies to Western public markets

So for liquid public markets, information, speed, access and legal/synergies are all very efficiently discounted. But even with this near-perfect efficiency we still see markets gyrate in extremes. So what causes these gyrations?

Behavioral. It is the market’s interpretation of said information. The future will always be unknown. So whatever is known today, can be read glass-full, or glass-empty. What drives the read? The most basic human emotions of greed and fear. As herd animals we are massively influenced by our surroundings, so the alpha lies in fading the crowd

Unsurprisingly, any of the track records of the few outstanding long-term investors is also rooted in this principle, from Warren Buffet to David Tepper. But why is so hard in practice what sounds so easy in theory - “Buy Low, Sell High”?

It is hard because when the moment comes to buy low, everything will speak against it, which is precisely why prices are low. In fact, all experts will agree that prices deserve to be there, and that’s what the rational analysis likely suggests

Now we are gradually approaching today’s topic. Wall Street legend Bob Farrell summarised this in a famous quote “When all experts agree, something else is going to happen”

But how can that be? Experts went to Stanford and Yale and spent their entire lives doing analysis, how can they all be wrong, when they all agree?

The answer is not some cosmic conspiracy. The answer lies in Reflexivity

But what does that actually mean?

Reflexivity - Definition

“Reflexivity” describes the circular relationship between financial markets and the real economy. It was introduced by George Soros, who mainly illustrated positive feedback loops as they occur during a bubble. His classic example evolved around real estate, where house prices rise → collateral value increases → banks lend more → housing demand increases → house prices rise more etc.

Today, I apply the term more broadly. For me, Reflexivity describes how financial market perception of the real economy affects outcomes in the real economy, to the degree that they may create opposing outcomes to what is perceived

This dynamic resembles the Observer Effect from Quantum Physics, where the outcome of a quantum experiment changes depending on whether the experiment is observed or not, a paradox made famous by “Schroedinger’s Cat”. My post “The Observer Effect” explored this notion before

Reflexivity between Markets and the Economy

All this sounds very theoretical, so let’s quickly move to practice. The prime example I want to use to illustrate Reflexivity is that of a recession

Let’s look at periods where - for whatever reason - financial markets were convinced that a recession would occur. Bank of America has asked Fund Managers their recession views for the past 20 years. We notice that three periods stand out - March 2009, April 2020 and November 2022

The stunning reality is that Fund Managers are incredibly good in detecting a recession either when it was already over, or when there wasn’t one at all. However, they were collectively unable to spot any recession in advance (e.g. the Great Financial Crisis started in December 2007)

How can this be? Fund Managers are one of the most educated and best informed group within the economy. They read and run all the sophisticated analysis there is. Why are they so wrong as a group?

The reason is Reflexivity. They are part of the same information cloud that steers the economy. Thus, these views directly and indirectly influence actors deciding on the path of the real economy, and these actors set action into motion that works against the predicted outcome

The following are the three most important feedback channels for this process:

Government - Any government has huge influence over the course of the economy. If everyone expects a recession, most governments will act against it - they want to be re-elected! Examples:

In the Fall of ‘22, when recession probabilities surged, the US Treasury enacted a significant change. It started to spend down the $900bn cash in its coffers, which provided a huge liquidity boost over the following months. See “A Free Lunch?” for details

In June ‘23, markets were worried about the liquidity drain from the Treasury Account refill and many predicted a market crash. The Treasury read the same research, was equally worried and decided to issue money-market friendly bills to refill the TGA, so liquidity would be taken from the RRP instead of the real economy. Instead of crashing, markets rallied

In May ‘23, with recession expectations high, the Republicans were very tame on their debt ceiling demands, avoiding to push for any significant cuts and agreeing to a compromise without much of a fight

In 2022, European government decided to hand out €800bn subsidies to consumers and corporates to avoid the universally expected recession which would be triggered by the gas price crisis. As a result, Europe avoided a recession in ‘22

Financial Markets - Markets incorporate probable future outcomes in their pricing. This changes the probability of exactly these outcomes. Examples:

Whenever growth expectations decline, long-term Treasury bonds are typically bid, bringing down their yield. A lower yield on 30-year treasuries cheapens mortgages, which stimulates economic activity

If the market expects a recession, it often heavily shorts oil. This drives down oil prices which then lead to lower gasoline prices, leaving more money in consumers’ wallets which helps the economy. This happened in H1 ‘23

Corporate World - If corporates expect a recession, they will prepare for it by battening down the hatches. Example:

US banks set loan loss provisions according to their cycle views. Given they’ve been expecting a recession for over a year, their provisions have shot up. If no recession comes, then these provisions can be release for further loans and investments. If a recession does come, banks may not function as the usual aggravating channel given they are better prepared

These three channels illustrate short-term dynamics working against a recession. However, especially on a governmental level Reflexivity also applies to long-term decision making:

The 2010s were shaped by the hollowing out of the Western blue-collar class, the erosion of the manufacturing base and the rise of the “Deplorables”, who made their voice heard in anti-establishment vote-casting. This was the negative legacy of well-intended policies from the 1990s, such as China’s WTO admission

Politics reacted with policies explicitly targeting these issues. The Covid Stimulus cheques, the IRA/CHIPS/IIA or tougher immigration policies all have in common the desire to stimulate both lower-class demand as well as the domestic manufacturing sector. The coming decade will likely be shaped by these late 2010s decisions, and turn out differently to many observers still stuck in the previous zero-interest era

NB: This is also the key reason why I expect structurally higher inflation for the coming decade. Aside from all the analysis, I perceive it as a deliberate political choice

If we look back to the mother of all recent Western recessions, the 2007-9 Great Financial Crisis, again we see a play-by-play of Reflexivity at work, both with long- and short-term effects

2000-2005: Excessively easy monetary policy aimed at stimulating the labor market after the 2000 Tech bubble caused US house prices to rapidly rise

2005- March 2008: The Fed raises rates to prevent overheating. The economy slows and Bear Sterns fails. Fearful of recession and more fallout, the government bails out Bear by underwriting JP Morgan’s takeover

March - September 2008: Markets and the oil price rally on “Chinese economic decoupling”, recession probabilities vanish, the Fed explores the need for rate hikes

September 2008: Lehman Brothers is hitting a wall. Having “learned the lesson” from Bear Sterns and without fear of a recession, the government lets Lehman fail (!)

September 2008 - March 2009: The economy goes into an artic winter. When recession probabilities peak in the Spring, the Fed dramatically increases its bond purchases, which brings the economy back onto a growth path

However, importantly, Reflexivity does not stop with recessions, far from it. There are countless more feedback loops between the economy and financial markets. Some more examples

Silicon Valley Bank went under in March ‘23 due to the steep increase in long-term interest rates. Its demise caused rates to contract to a level that would have avoided its downfall, and gave other banks in a similar position the window of opportunity to hedge or get rid of their long-duration risk

Artificial Intelligence saw a huge break already in November ‘22 with the release of ChatGPT. However, at the time, too many investors where still long Tech and dumping their shares in fear of higher rates. If was only in the Spring of ‘23 that Tech positioning was so washed out that stocks only had one way to go - up. Higher share prices and attention fed through to he corporate world, and fuelled the huge boom in NVidia GPU orders etc.

Germany has a housing shortage as new build consistently undershoots immigration. The ECB’s high interest rates have killed off any new supply, so rents now likely see a lot of upward pressure. In a perplexing effect (in this isolated channel), higher interest rates lead to higher EU inflation

In the past corporate earnings season, Regional banks stood out with big beats, while European earnings have been the weakest in three years1. What do each have in common? Extreme positioning, with hedge funds the most long Europe and most short Regional banks in years (see previous posts here). With everyone hating the Regional banks, they worked overtime to improve their earnings while expectations were very low

Similar might apply to US Retail for the coming holiday season. It is universally expected to be weak and retailers prepared accordingly with low inventory and orders. Meanwhile, US consumer real income has grown in recent months. Will discounts and a move away from services lead to a better than expected result?

More broadly, the 1H 23 equity market rally left investors with the impression that the economy is fine. This lead other markets to catch up on the view, in particular long-term bonds and oil. In turn, this created a market correction over August, as predicted in “A Warning”

Again, these are short-term feedback loops. There are also many longer-term feedback loops, just take Energy as an example:

With the stable provision of Russian gas, German power was cheap and it seemed an easy decision to exit domestic Nuclear power in 2011. As the exit occurred, power is now expensive and many citizens wish for Nuclear to be reestablished

As renewable energy sources and their perception rise at the expense of oil & gas, young graduate turn away from the latter much faster than its relevance declines. As a result, a scarcity of petroleum engineers leads to fewer projects executed and higher gasoline prices. This in turn increases the incentive to find renewable solutions even faster etc.

Summary: Reflexivity refers to the countless feedback loops between financial markets and the real economy. It is the key reason why outcomes frequently turn out differently to what all experts expect

Apply Reflexivity for Investing

So what do we do with this insight? We have established that much value lies in understanding what everyone thinks, and then applying the opposite as feedback loops between the economy and markets create contrarian outcomes. But how to apply this in practise?

First, accept that there is no certainty. Reflexivity is the key reason why it is not possible to forecast both the economy and financial markets with certainty. There are too many interlinkages that influence each other to make any economic forecast durable. In fact, the key to a successful approach is much more likely to fade certainty. Whenever the market prices in an occurrence with 100% probability, it provides both margin of safety and a higher likelihood of success in taking the other side

Second, listen the market. The market consists of millions of fundamentally very well informed participants. If a stocks stops rising despite a strong earnings beat, there is probably a reason. If cyclical stocks such as US Homebuilders go up despite recession expectations, there is information in that. In May I wrote in a piece “A Heretical Thought” that the Russell 2000 was extremely underowned, it was a tell that very bearish cyclical outcomes were priced in already

Third and most important, fade extremes. Every so often, the market will assume some extreme outcome somewhere. This is usually driven by people on the wrong side of the trade getting stopped out. Then, just as everyone has given up, Reflexivity gets to work, and forces set in motion to work in the opposing direction (e.g. the government might get scared by an imploding stock market and implement supportive measures)

Ok, sounds easy - basically do the opposite of what everyone else does, at extremes. However, it is not easy at all, for three reasons:

Understanding. Market structure is not easy to uncover. Positioning data is patchy and spread across many different sources, with some useful, some misleading. In addition, one needs to understand fundamentals to know when markets overshoot them

Intuition. It is very hard to do the opposite of what everyone else does. To take the other side of a market extreme means to understand, and yet ignore consensus fundamental information, which will only justify where prices currently are (otherwise they would not be there)

Patience. If one jumps on subpar opportunities, one foregoes both the mental bandwidth and capital to participate when the fat pitch comes. Many reasons stand in the way of doing nothing (boredom, investor expectations to be invested etc.), so this virtue is often much harder than it sounds

Understanding market structure

To fade extreme positioning, we need to understand other market participants

Role of Hedge Funds

This group used to be on the fringes of finance, making a killing arbitraging against sleepy mutual funds. Today, it has become the market’s by far largest active group. (see “It’s All One Big Trade” from May ‘22)

Depending on the measure, there are between 3’000 and 10’000 hedge funds, most run by smart people who attended Ivy League universities (or their foreign equivalent) and work day and night

Yet, given this group has grown to essentially become the active market, it cannot outperform as a group anymore. In fact, by definition outperformance is only possible by fading Hegde Funds as a group. NB: The QE years masked this dynamic for a while as everyone could do well with the Fed as incremental buyer. This seems to have run its course for now

As such, the most profitable trade is usually the “Pain Trade”, i.e. the market direction that causes hedge funds on aggregate the most stress. This could be the market going up while everyone has low exposure, it could be Tech going up after everyone has sold it, or any other permutation that goes against this crowd

Data sources such as the CFTC’s Commitment of Traders report, or Prime Broking data which today is widely available online shed light on the positioning of this group

Role of Retail

Retail investors are usually only part-time involved and often attracted by recent gains, or scared off by recent losses. This is the ultimate FOMO crowd which sells at lows and buys at highs, so whenever there is either extreme buying or extreme selling by Retail investors, it is usually safe to fade it

Role of Wall Street Strategists and Media

Talking heads on CNBC or Bloomberg usually are a good reflection of current market positioning. They are not held accountable, and their goal isn’t performance but reach, so they are incentivised to talk about what gets audience traction, which is usually what everyone wants to hear. Similar applies to sell-side strategists whose goal it is to get clients to trade with the respective bank. Again, their views are often what is already discounted in the market. Finally, media outlets also mostly run stories that describe where the puck is, rather than where it is going, which is why headlines and magazine covers are good contrarian indicators

Role of the Fed

There is a situation where the most consensus trade in the world still works, which is when Central Banks provide liquidity to financial markets, e.g. via Quantitative Easing. This creates a incremental buyer even when everyone is “full” and e.g. explains the bubble formation in Retail darlings during Covid-19

Role of Fundamentals and Macro

Do I say fundamentals don’t matter, on a company or macro-level? Of course not, they do. But getting in edge in them in today’s highly efficient markets is hard. I believe the following could be a good summary:

Fundamental analysis tells you what to buy, positioning analysis tells you when to buy it. With that in mind, the latter likely makes a much bigger difference to your performance. Which is why some skilled traders can invest well without fundamentals, but investors solely focussed on fundamentals usually get run over by behavioral biases

The “What does this mean for markets?” sections of each of my posts contain many practical examples of how to weave positioning and fundamental views together into trades

Finally, I believe the concept of Reflexivity to be highly useful in forecasting the economy, even though the research body on this topic is still astonishingly thin

At the core of this idea lies the notion that economic consensus views rarely happen, which in itself can be a strong tell in guessing which way things are going (i.e. invert consensus). Just think of the European recession forecasts for 2022, or predictions of China or Japan taking over the world in the past

As an example, if the market is heavily short oil, long bonds, short equities and long gold it means that a recession outcome is likely already priced in, and the market’s next move will be away from that to a better economic outcome

Merging positioning data into economic forecasting could provide a significant contribution to the latter’s accuracy, in one what might label “market-based economics”

Conclusion:

Applying Reflexivity to investing creates high odds of outperformance. By taking the other side of consensus at extremes, one creates margin of safety and higher success probabilities, as extreme pricing will trigger real-economy efforts to work against the implied outcomes

To successfully turn this theory into practice, a sound understanding of fundamentals as well as market positioning is necessary, with Hedge Funds as key group that dominates active trading

Given the role of Reflexivity in real economic outcomes, market positioning data may be an overlooked, but highly useful tool for economic forecasting

What does it mean for markets?

The following section is for professional investors only. It reflects my own views in a strictly personal capacity and is shared with other likeminded investors for the exchange of views and informational purposes only. Please see the disclaimer at the bottom for more details and always note, I may be entirely wrong, may change my mind at any time and this is definitely not investment advice

Applying everything outlined to today’s market, I see the most out-of-consensus view currently in long China Tech

This sector has been aggressively sold by foreign investment funds and once again been declared uninvestable. I believe this onslaught of negativity for the Middle Kingdom is likely to trigger further stimulus measures, while incremental sellers are now few and far in between - a classic case of Reflexivity

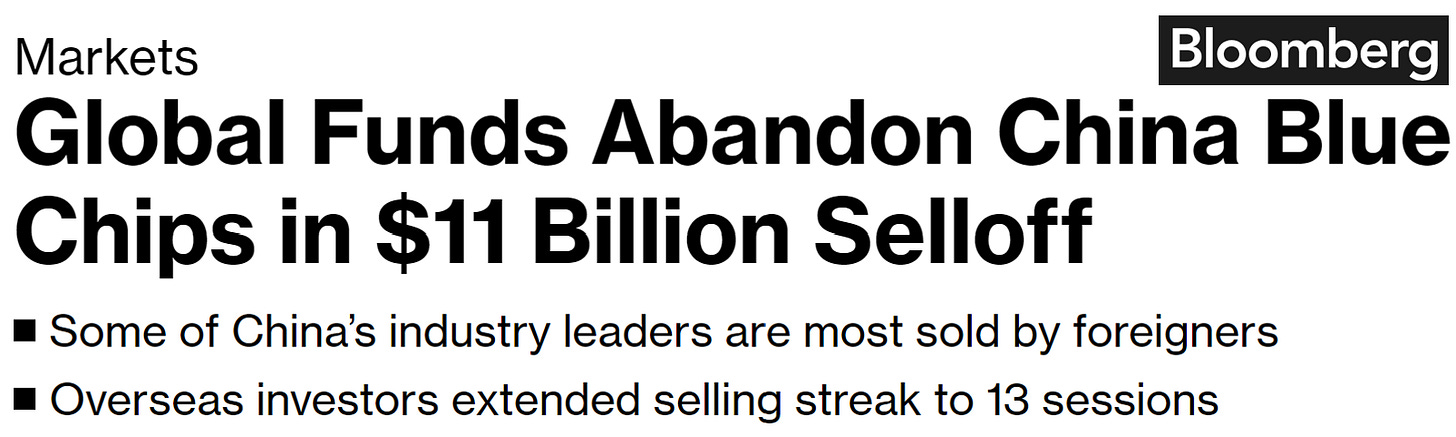

Specifically, funds dump their holdings at a record pace…

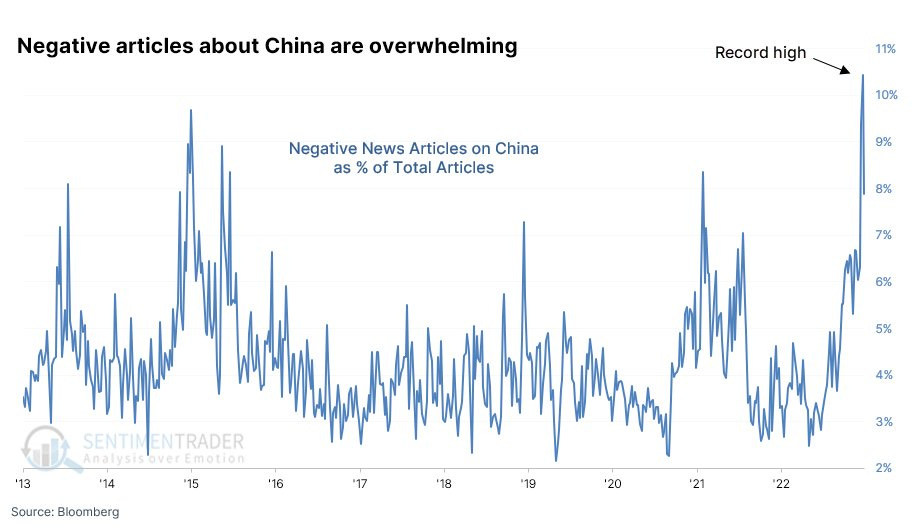

… in tow, share prices sell off and negative reporting shoots to a record high…

… triggering various supportive stimulus measures, and most importantly more liquidity provision by the People’s Bank of China…

… meanwhile, the economic situation does not seem as bad as reporting suggests, with domestic PMIs actually improving

I have substantially added to my China position (which was established at a previous similar low) in the recent sell-off for that reason

Moving on to the US, I see two arrows of development right now:

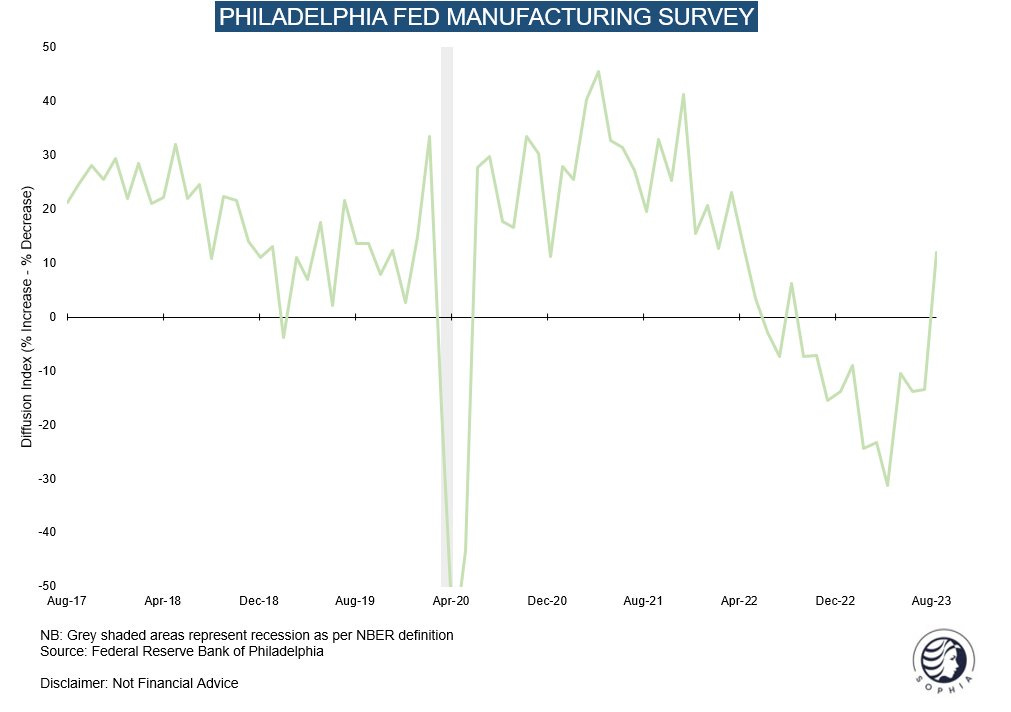

The goods economy continues to show signs of life, as I had forecast as early as May. This is likely due to retail inventories largely cleared, and the end of some very long lasting supply bottlenecks in automotive, so production and transport volumes increase again

In contrast, signs of a broader slowdown condense now. The fiscal impulse will weaken from here as coming COLA adjustments likely fall near/below inflation and state-level spending won’t grow to the same degree next year. More so, there are now clear signs of labor market deceleration. It is too early to tell whether this will translate into employment losses, but the likelihood has certainly increased. The UK and some European countries may be the template here, with recently rising unemployment while inflation stays high

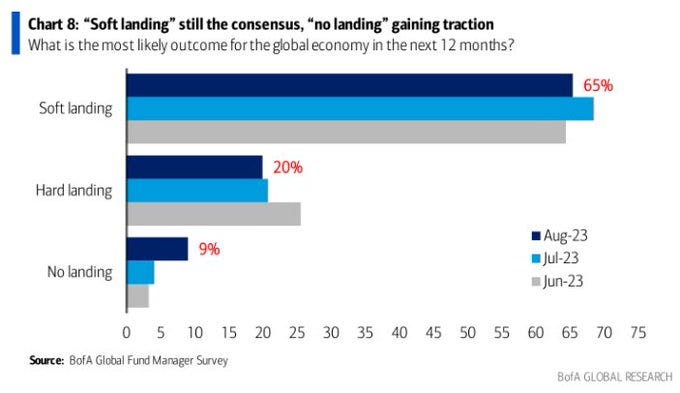

All this occurs just as the soft/no landing camp has grown in light of strong equity market performance:

Either way, the bond tantrum I highlighted in my last post seems to have passed for now, and if US economic data continues to deteriorate, bonds will be bid which helps equities. Conversely, should recent weak labor market data turn out to be a blip, the tantrum likely returns, as then concerns about high US Treasury issuance likely resurface

I do not see a clear path right now where positioning is decidedly extreme in Western markets, which is why I have exited most other positions aside of China Tech, some Energy (see below) and some US regional banks that I believe have tidied up their balance sheet and are prepared for either higher rates or a slowdown, while no one owns them

As such, I am currently running a large cash position, maintaining the ability to pounce when the market’s next irrationality comes across. Some thoughts on further assets classes:

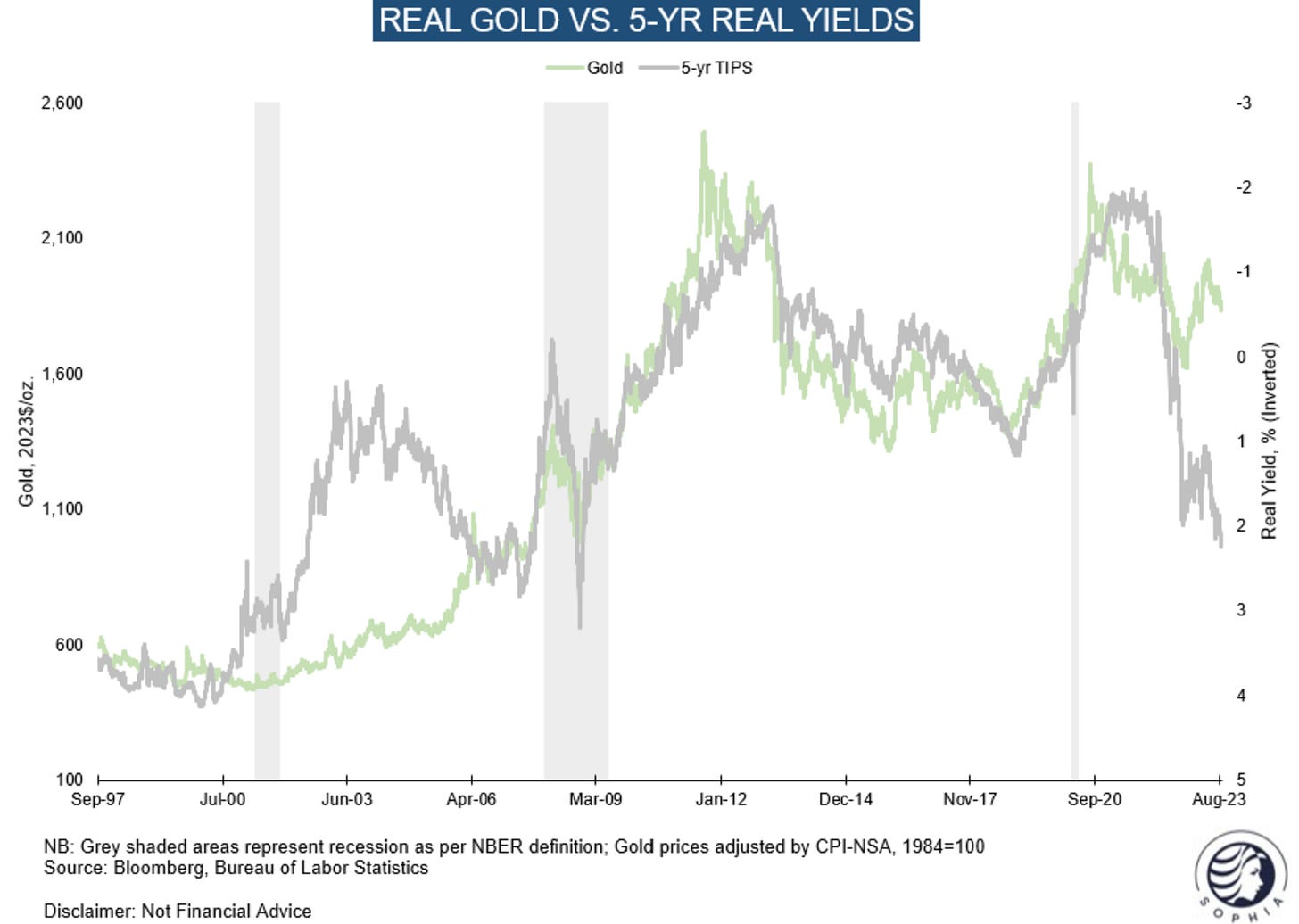

TIPS and Gold - If we’ve just seen the peak of US economic strength, then real rates have likely also just seen their peak. In that case assets closely tied to real rates, specifically TIPS and Gold should do well. For TIPS, the biggest bull case is stagflation, i.e. unemployment rises while inflation lingers, and the Fed cuts to help job creation, which then pushes up long-term inflation expectations. TIPS lose if economic strength increases from here, or if we see heavy deflation. Gold has defied real rates in ‘23 as the chart below shows, which makes me think that TIPS may now be the better vehicle to play the inflationary slowdown view, as they have more to catch up. I am considering adding longer-dated TIPS as the risk-reward strikes me as decent with real rates now at a 15-year high, and I do believe that long-term inflation expectations are too low

Energy - While energy is a likely beneficiary of a higher inflation world, it is also cyclical and a growth slowdown would weigh on demand. In contrast, China may pick up from here, and the US goods economy may see some restocking. I am on the fence at this juncture and have trimmed my exposure to leave some oil services holdings for now

US Regional Banks - This is the most hated sector in the world (aside from China). Yet, should US data continue to disappoint, the yield curve probably steepens via the short end coming down, a big boost for bank profitability. Provisions for loan losses are high, and given the SVB panic many banks are on high alert and worked actively to get in better shape. Loans have grown again as per the recent H.8 release and a higher rates environment generally means much higher net income

Tech - A pronounced economic slowdown is good for Tech, as earnings specifically in AI names see secular growth while lower bond yields boost multiples. Yes, a recession would also impact these names, but it is today far from certain whether we get that. On the other hand, a mild slowdown would likely see long-term bond yields rise further given the substantial supply, but for that data would soon need to start surprising to the upside again, which is less likely if everyone just revised their economic growth expectations upwards. Overall the backdrop is currently constructive, but as this group is very well owned, I prefer China Tech instead

Finally, Cash - The fall is a treacherous period in markets, when at the very least volatility can increase. I want to be prepared for these eventualities which is why I raised my cash position. I do not rule out some unexpected event that rattles markets to the up- or downside while right now everyone seems certain about a given trajectory. Front-end rates are pricing in max hawkishness, a view that could change quickly should the labor market crack, for which the risk as per some recent data certainly increased

Thank you for reading my work over the past two years. It is free, so if you find it useful, please share it!

DISCLAIMER:

The information contained in the material on this website article is for professional investors only and for educational purposes only. It reflects only the views of its author (Florian Kronawitter) in a strictly personal capacity and do not reflect the views of White Square Capital LLP and/or Sophia Group LLP. This website article is only for information purposes, and it is not intended to be, nor should it be construed or used as, investment, tax or legal advice, any recommendation or opinion regarding the appropriateness or suitability of any investment or strategy, or an offer to sell, or a solicitation of an offer to buy, an interest in any security, including an interest in any private fund or account or any other private fund or account advised by White Square Capital LLP, Sophia Group LLP or any of its affiliates. Nothing on this website article should be taken as a recommendation or endorsement of a particular investment, adviser or other service or product or to any material submitted by third parties or linked to from this website. Nor should anything on this website article be taken as an invitation or inducement to engage in investment activities. In addition, we do not offer any advice regarding the nature, potential value or suitability of any particular investment, security or investment strategy and the information provided is not tailored to any individual requirements.

The content of this website article does not constitute investment advice and you should not rely on any material on this website article to make (or refrain from making) any decision or take (or refrain from taking) any action.

The investments and services mentioned on this article website may not be suitable for you. If advice is required you should contact your own Independent Financial Adviser.

The information in this article website is intended to inform and educate readers and the wider community. No representation is made that any of the views and opinions expressed by the author will be achieved, in whole or in part. This information is as of the date indicated, is not complete and is subject to change. Certain information has been provided by and/or is based on third party sources and, although believed to be reliable, has not been independently verified. The author is not responsible for errors or omissions from these sources. No representation is made with respect to the accuracy, completeness or timeliness of information and the author assumes no obligation to update or otherwise revise such information. At the time of writing, the author, or a family member of the author, may hold a significant long or short financial interest in any of securities, issuers and/or sectors discussed. This should not be taken as a recommendation by the author to invest (or refrain from investing) in any securities, issuers and/or sectors, and the author may trade in and out of this position without notice.

Measured in terms of the breadth and magnitude of EPS and sales beats. Only 8% of companies have beaten consensus expectations at the top line, the lowest reading since 1Q18. Meanwhile, only 14% of companies have beaten consensus EPS expectations this quarter, below Q1 at 35%. Consumer Staples have been underwhelming. Similar to the US, price action around beats/misses has been negatively skewed. (Morgan Stanley)

This is a treatise to be read, saved, and referred to periodically when markets are in turmoil. Thank you!

Great educational piece. I was longing for a more nuanced & more recent version of Soros reflexivity concept. I can relate & learned a lot!