AI and the Labor Markt

Is a Rise in Unemployment Next?

It has been a year since I wrote the last Next Economy post called “Service-as-a-Software”, focussing on AI buy-and-build, a topic that by now has become the go-to investment strategy for venture capital firms. A lot has happened since, both in the economy and markets. From my side, I am fortunate to share the successful close of both the fundraise and first acquisition of Empower, the UK Trades Services rollup my partners and I incubated over the past year. With CEO Nick Manning who last honed his skills at European PE buy-and-build leader Waterland, a first asset with exposure to the fast growing UK water utility services sector and several more targets under LOI we are off to a good start

With this I return to write again at the intersection of technology and macroeconomics where today I explore the hot topic whether AI will lead to mass job losses in the years to come. As always, at the end you can find my own market views as I invest, putting my money where my mouth is

Anthropic CEO Dario Amodei recently warned that AI could push U.S. unemployment to 20 % within a few years by automating many office jobs. With the US labor market already soft, his prediction hit a nerve - it would have very drastic social and economic consequences

Now, how realistic is that outcome? In my view, the best way to answer this is twofold:

First, let’s look at how employment fared during periods of comparable technological step change. Over the past 150 years, there were four episodes of breakthrough innovation

Second, we review the impact of already available AI applications on current jobs and workflows

Let’s dive in, starting with the historic comparison:

Technological innovation becomes visible in economic data when it significantly lifts total factor productivity. In other words, when the economy produces more goods and services than before with a similar amount of capital and labor

This is typically enabled by a transformational technology such as:

Electrification (1890-1930s) which greatly increased the energy available to the economy

Refrigeration & Farm Modernisation (1915-50s) which increased food production and availability

Highways and Appliances (1950-70s) which connected urban centers and brought industrialised goods into homes

PC and Internet (1990-2000s) which improved communication

Over time, the AI era should be comparable to these periods. AI allows us to perform many tasks faster and more efficiently, eventually to a degree that should show up in total factor productivity. So let’s walk briefly through these historic comparisons to see what happened to employment each time and why:

Electrification (1890s-1930s)

What jobs were reduced or eliminated by the new technology?

Steam-engine tenders, coal-stoker crews, gas-lamp lighters

What was the long-run labor market outcome?

By the late 1920s, US total non-farm payrolls were significantly higher than in 1890 despite output per worker doubling (!)

Refrigeration & Farm Modernisation (1910s-1950s)

What jobs were reduced or eliminated by the new technology?

Farm employment reduced by c. 66%

What was the long-run labor market outcome?

The 1930s saw very high unemployment and a shortage of job opportunities in agricultural sectors (e.g. as described in John Steinbeck’s Grapes of Wrath). However, the cause is mostly ascribed to severe fiscal and monetary policy mistakes that ultimately triggered the 1929 stock market crash and Great Depression. Full employment returns by the 1940s

Interstate Highway & Appliances (1950s-1970s)

What jobs were reduced or eliminated by the new technology?

Some rail & freight jobs. Highway construction once it ended

What was the long-run labor market outcome?

Falling transport time and cost triggered a boom in big-box retail that overcompensated job losses in traditional logistics

PC & Internet (1990s-2000s)

What jobs were reduced or eliminated by the new technology?

Travel agents, print ad-sales, mail

What was the long-run labor market outcome?

Payrolls grew 24 million from 1990 to 2007. New industries (e.g. online travel, ecommerce) and strong economic growth overcompensated job losses in outdated industries. Sluggish 2010s followed due to aftermath of the subprime mortgage bubble, back to full employment by late 2018

Summary: History tells us that step-changes in technological innovation were overwhelmingly positive for overall employment. Typically, the economic gains translated into growth in existing in new areas, which far outweighed the employment losses in outdated industries

Moving on to the evidence already available today, we can split this into three groups:

First, applications that entirely replace, or dramatically reduce employment in certain sectors. This is the analogue to the steam engine tenders replaced by the electric locomotive

Second, for many professions AI will function as support that allows users to focus on core tasks, while delegating menial and time consuming ones

Third, the broad everyday adoption which is analogous to electricity for the home, or a typical office worker using the internet

Turning to each:

It is highly probable that AI will eliminate or decimate entire professions, in particular via autonomous driving (e.g. Tesla/Waymo/[Baidu]), advertising/movies (e.g. Google Veo 3) or software development (e.g. Cursor/Lovable). This will likely be employment negative, however the degree should be contained. The sectors mentioned amount to ~3.1% of total US employment, compare that to 31% working in agriculture in 1910

AI working as significant support is already the case today in many sectors, from investment banking (e.g. Rogo) to call centers. Just expanding on the latter:

Early evidence from Agentic call center apps such as Crescendo shows a better consumer experience due to faster and more helpful responses. Staff turnover declines as the call center job becomes more pleasant (typical 33% turnover within a year) and employees can be upskilled. Employment is steady, but margins grow and that extra profit can be spent elsewhere in the economy. This describes a classic positive productivity cycle. Sector specific AI agents match productivity patterns of previous technological breakthroughs and will likely be employment positive as economic gains outweigh job losses

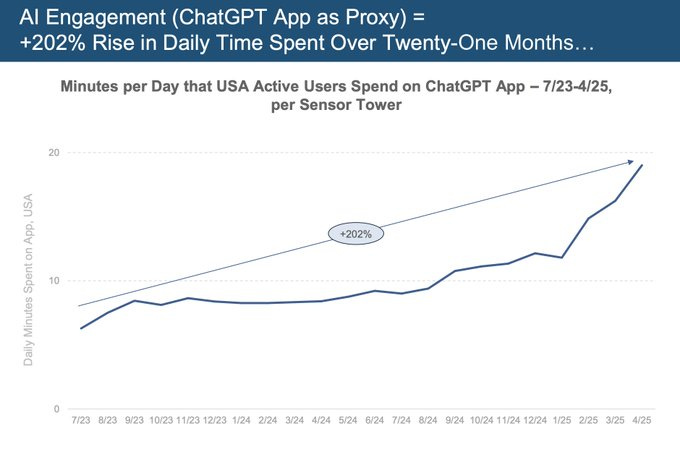

Finally, ChatGPT has achieved broad consumer adoption, not only with a parabolic user curve, but also with the time that users spend on the app. I like the analogy to electricity in the home, which made everything a bit easier at the time. So does ChatGPT, which shortens the time to resolve queries and provides knowledge faster and with more ease. This will likely be employment positive as the countless small efficiency gains across the economy add up to more aggregate time spent more productively

Summary: Early evidence from current AI applications suggests we follow the historic precedent. Employment in some industries will likely be severely impaired, but mostly AI looks to increase productivity across the board, which creates more economic growth

Conclusion:

History and early examples suggest that AI is unlikely to lead to a wave of mass unemployment. It is much more likely that, over time, the effects are employment-positive as growth overcompensates jobs made redundant by AI

However, these effects will take time to play out and equally can be overruled by monetary, fiscal or other business cycle dynamics. The Great Depression (1929/30) and the Great Financial Crisis (2008/09) occurred during periods of technological step change, as did many other periods of more moderate economic slowdowns

The current weakness in the US labor market is very likely owed to these larger cyclical dynamics, in particular the overhang of Covid-stimulus which first created a sugar-rush and is currently in a long, drawn-out process of counterbalancing, as the chart below well shows

Current Market Views

The following section is for professional investors only. It reflects my own strictly personal capacity and is shared with other likeminded investors for the exchange of views and informational purposes only. Please always note, I may be entirely wrong and/or may change my mind at any time. This is not investment advice, please do your own due diligence

While 2025 appears to be the most challenging year in over a decade for global macro strategies and CTAs, I am so far very content with my trading over the past six months, which would put me comfortably into the top percentile of that group. I plan to share more details on that at a later stage, in particular the long list of learnings over time which can be summarised as “If you touch the hot stove often enough you eventually learn to put a kettle on it, instead of burning your hand again”

Either way, I’ve shared some of these views already more actively on X, where I’ve called for the market correction in February just before the sell began, predicted Trump’s tariff walk backs near the April lows (here), the recent high in bond yields to the day (here) or as per last week the outperformance of US Small Caps, which I continue to see as the dominating narrative for the very near future

In particular, one always has to recognise that there is an economic truth, and what the market wants to do. All we really care about is the latter. Since if we are right on the economic truth and wrong on the market, it just means losses. Further, most often the economic truth is ambivalent, and our judgement of it far from perfect. What do I mean by that?

At this very moment, the totality of the economic data shows an US economy that is slowing, somewhere between very gradual and perhaps a bit more concerning, depending on whether your bias is glass half-full or -empty. This is the current economic truth, and as I already allude to, there is ambivalence to it

Institutional investors in particular are positioned for the glass half-empty outcome, which can be seen in the below two charts which show big overweight in defensives vs growth/cyclicals, and very little exposure to Small Caps which are very sensitive to economic growth assumptions. More so, short interest in the later is very high

I’ve seen this movie many times before, and my sense is this gets solved in a very painful short squeeze that forces hedge funds out of cyclical shorts and into an overall more net long position. This will likely be accompanied by a “goldilocks” or “growth is fine” narrative, which justifies the price action (but may or may not match the economic truth)

Once that squeeze reaches its apex, equities likely correct. This correction could be shallow if hard data holds in, or it could be more significant if hard data weakens. I refrain from predicting which one it will be and prefer to attempt judgement at the time

Accordingly, I am currently long US Small Caps. These are my further positions and views by asset class:

Emerging Markets - China, India, Taiwan and South Korea (the biggest constituents of the MSCI EM) share many positive dynamics incl. growth, tech exposure, low valuation and ROW flows that are diverted from the US and looking for a new home. I am long MXEF, and see this as hopefully longer-term position

AI - Today’s AI story is well understood, from the data center value chain to Nvidia’s earnings growth. It surely continues to be a great theme, just with some near term positioning headwinds to fight off. However, tomorrow’s AI story may soon be explored next as inference moves onto devices. I still see this story as underowned and am long ARM

Europe - My sense is that investor exposure to the Germany theme is currently sufficient, and it is now a “show me” story, where stimulus needs to be demonstrated in numbers. Some digestion may be in the cards. European Banks still look attractive as the ECB cuts and the yield curve steepens. I am long SX7E

Bonds - These appear as two-way risk to me, with the US deficit and global issuance as negative, and slowing economic data as positive (for bond prices). I think they are ok *for now*, but am watching this very closely. Another breakdown in long-term yields is the biggest market risk aside of a deterioration in hard data

US Dollar - The structural trends for a weaker Greenback are very strong, from deficit spend to policies driving ROW investors away from US allocation. However, this view is very consensus, with most major Wall Street Banks seeing the Dollar as a Sell. A shakeout of Dollar shorts seems possible first, but it should eventually resumes its way lower

Gold - In the near term some “tariff escalation premium” may still be removed as Trump and China continue talks. The structural drivers however appear firmly in place as economies across the globe dial up deficit spending, with the US in the lead. Same applies to Bitcoin

A very good investors once told me to think about the market as a sequence of episodes, each with their own narrative. In that vein, I’d think of the current episode as “goldilocks”/“growth is fine”, perhaps to be followed by “growth worries” or “yield tantrum” next. I hope to update you on the next iteration at the time

Thank you for reading my work, it makes my day. It is free, so if you find it useful, please share it!

Great to see you back, we missed reading your pieces Flo.

Great to have you back! Thank you!