Is Inflation Over?

A brief review of this week's inflation numbers

About a month ago I wrote that US Headline Inflation should slow materially, to hit 0% month-on-month soon

On Wednesday, the July CPI data came out, and indeed, monthly Headline Inflation was 0%1. In other words, there was zero inflation between July and June

In another post on Monday, I wrote that I sold my Long-Term US Treasury Bonds (TLT/ZROZ) going into the CPI print. The bond market seemed to have become “inflation-complacent”. I also feared that Core Inflation might be stronger than expected

And indeed, since the CPI print, Bonds came under heavy pressure…

…but this perplexed many in the market, as not only was Headline Inflation 0%, Core Inflation also came in significantly weaker than expected

However, if inflation falls, then Bond yields should fall too, a lot. But instead they went up. So what is going on?

This post explores the conclusions from this week’s pivotal events. As always, it closes with an outlook on markets, where I explain why I’ve just added a long Oil position

Let’s start with a brief review of Wednesday’s inflation data. We already know that the headline was 0%. This might be driven by one-offs, so let’s focus on the sticky parts of inflation, to judge whether the trend has changed

First: Core inflation, which excludes volatile food and gasoline, has decelerated meaningfully, to 0.3% or ~4% annualised

Second: Core inflation was still skewed by outliers, airfares and apparel, two seasonal one-offs. So let’s look at Median CPI, which corrects for outliers. Still hot with ~6% annualised, but also a deceleration

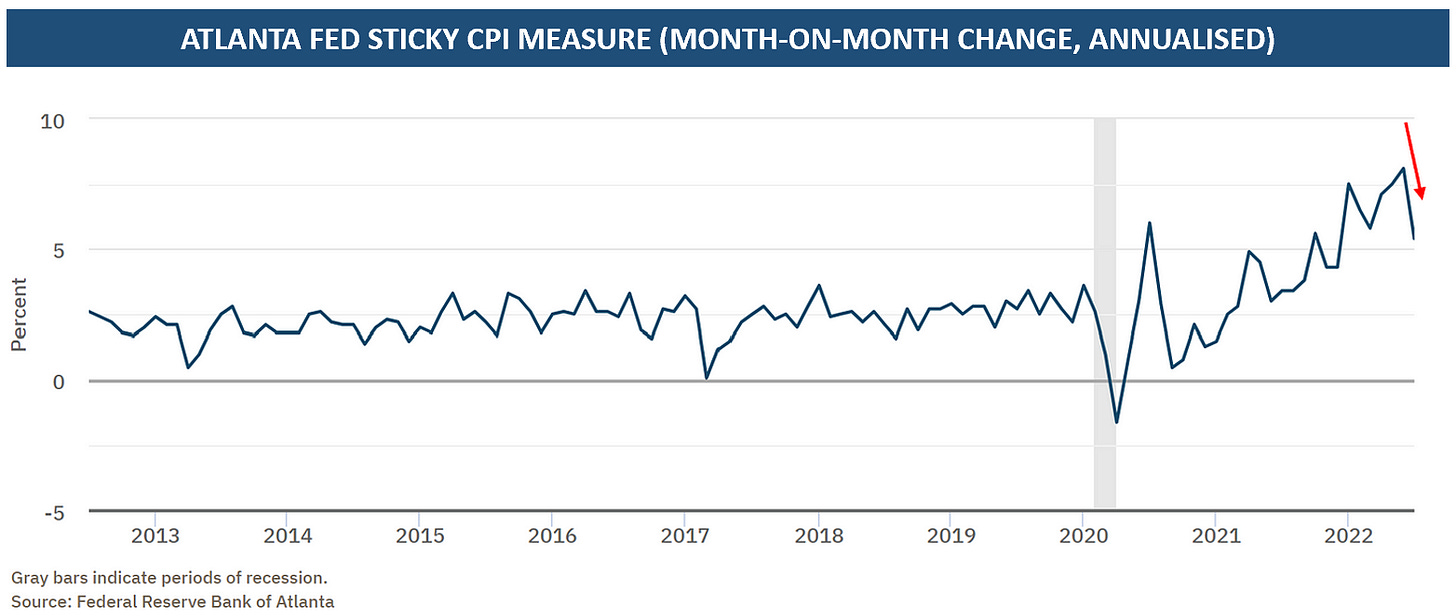

Third: An alternative to the median is the Atlanta Fed Stricky-Price CPI, which only measures items whose prices move slowly. With ~5% annualised, it is high, but also shows a decline

Summary: It is not only the Headline. Inflation overall seems to cool off, as the sticky parts of inflation also (somewhat) decelerated in July

Ok, great news. The peak is in and it’s downhill from here, right?

Not so fast, unfortunately…

First, let’s briefly remind ourselves, why do we have inflation in first place?

Over COVID-19, the US government printed an exorbitant amount of money and injected that into a barely scarred economy, with high stay-at-home savings. In particular the emergency measures in Dec-20 and the American Rescue Plan in March ‘21 overdid it

This gigantic pile of cash did not correspond to an increase in production capacity. As a consequence, productivity cratered, Emerging Markets-style:

Ok, there is too much cash for a limited amount of both goods and services. So the excess cash needs to be drained again, how can that be done?

First: The Fed could remove liquidity via Quantitative Tightening. In this process, the Fed sells its bond holdings to the private sector in exchange for cash. Thus, private sector cash goes down

Second: The government could increase taxes and pay down debt with it. Again, this would lower the private sector’s cash holdings

Third: The Fed raises interest rate so high that a severe recession follows. The private sector reduces credit demand, business capex and expenditure, which over time lowers private sector cash holdings

Let’s walk through these one-by-one: The ongoing QT program is only a few months old and just a roll-off2. There will certainly not be a $3tr tax increase. Finally, a US recession, if we are in one, is shallow so far - the unemployment rate is still at historic lows

Summary: Ongoing measures have likely not yet meaningfully reduced excess cash and thus brought down inflation

So, in light of this, why has inflation come down so much? In my view, we find the answer in two-fold reflexivity

First, reflexivity in financial markets: Commodity prices have plunged as markets have frontrun a deep recession on the back of the Fed’s aggressive anti-inflation communication. This was further helped by the slowdown in zero-COVID China and by Europe’s distress

In particular energy prices affect most other goods and services. Think of the nurse driving to work, asking for a wage raise due to higher gasoline costs. This happens with a 1-2 month lag. The commodity price decline from May to Mid-July caused the weak July CPI, and a likely weak August CPI

Second, reflexivity in the real economy: Tremendous price increases have shocked consumer sentiment, and demand retreated across the board, whether consumers could afford it or not. NB: The top 60% of Americans who account for 80% of consumption still have plenty of spare cash (see below).

Summary: Financial markets hammered commodity prices. Consumers retreated in sticker shock, even if they could afford it. In response, businesses slowed price increases

So what’s next?

First, the good news: US Real income went UP in July, for the first time in 9 months

In other words, adjusted for inflation, Americans had more money in their pockets in July vs June

And with more money in their pockets, US consumers can spend more

We see this already in gasoline demand, which the EIA provides on a weekly basis. Helped by a 20% decline in gas prices, US gasoline demand has bounced back

With improved spending, sentiment should also improve

It seems likely to me that business optimism turns up from from currently apocalyptic levels

And now the bad news: What follows from all that? With improved demand and sentiment, commodity prices likely go up again

And that’s what we’re seeing. Since mid July, most commodity prices have rallied. In fact, natural gas, which is a proxy for US power prices, is up 30% and near Year-to-Date highs, steel and copper are up 15%+

Gasoline is still an outlier to the downside, but I believe it could follow soon (more below)

I had mentioned how China’s zero-COVID slowdown helped push commodity prices down in the Spring

Has the country turned the corner on that? Recent mobility data suggests so (see flight stats below). This would further be supportive for commodity prices

More so, Chinese food prices have often preceded global food price inflation. They have turned up recently, indicating higher global food prices to come:

Conclusion: Lower commodity prices in May and June preceded slower inflation in July and August. As US real income improves, the pendulum now likely swings the other way again. Commodity prices rally, and inflation pressure returns in Q4

The underlying issue are $3tr excess savings in the US economy. They have not disappeared overnight. Until meaningful progress has been made in draining some of it away, the inflation ghost likely lingers

What does this mean for markets?

As always, this section just reflects my attempts of connecting the dots. Please keep in mind, I am wrong often, markets are humbling, risk management is most important and none of this is investment advice

Having said that, these are my current thoughts:

Oil - This is the one commodity that has not rallied yet, possibly in light of the the US government’s ongoing reserve release. Medium term, my view remains the same, we are in the early innings of an economic slowdown that will likely end in late 2023, and that will weigh on oil. However, as outlined in this post, this slowdown likely won’t occur in a straight line, but rather in yo-yo moves. Sentiment around oil is extremely poor, I expect improved US demand with lower gasoline prices and the market’s attention will soon turn to the end of the SPR release after the midterm elections. I have opened a long in front month futures (CL1) on Wednesday following the CPI data (see here), with a stop at 85$/bbl

Equities - If the conclusions of this post are correct, bond yields likely rise further as oil and commodities rise and the inflation ghost returns. This would weigh on equities, which are very overextended in particular in Tech, with heavy signs of FOMO and declarations of a new bull market. Corporates also likely face a profit margin recession even if the economy stayed strong (the inverse of the 2021 profit boom, e.g. see Google/Microsoft/Facebook complaints about overstaffing). In my view, the risk/reward is very poor at this stage and I remain short

Crypto - The same applies to this sector. Crypto was bid in recent weeks as the inflation ghost was discounted (also the Ethereum merge provided a tailwind narrative). Less inflation makes a return to looser monetary policy more likely. Contrary to popular belief crypto and Bitcoin in particular is not an inflation hedge, it is a monetary debasement hedge. Right now we have inflation, but the Fed contracts monetary policy. There will likely be a moment where loose monetary policy returns, and Crypto sees a lasting rally, but in my view it is not now or near

Finally, as you know, I follow a data-driven approach for my investments, and I share much of this data freely on Twitter

I hope you enjoyed today’s Next Economy post. If you do, please share it, it would make my day!

Keep in mind the monthly inflation comparison is all that matters, it tells us about the current state of affairs. The yearly numbers are a rearview mirror affair

From September, the Fed does not reinvest $95bn of bonds and MBS that mature from its holdings every month. This removes a buyer and cash provider from the bond market, but is not the same as the Fed selling its holdings outright

Florian- what's your view on inflation swaps? As in long TIPS and short unprotected bonds (I think there's some ETFs which do it for you)? Isn't that the best way to press your overarching view that inflation is higher for longer/and more structural in nature (which I agree with)?

Another top quality analysis.. Superb read. Ty for sharing