On Liquidity

A forecast for the coming quarter and the remainder of the year

Liquidity is an often cited but in reality obscure concept used to explain the economy and financial markets. Without a clear definition, it serves a cottage industry of market explainers as easy sell of proficiency. Yet, it speaks to us because intuitively it makes much sense that the amount of money in circulation matters for stock prices and economic activity

Today’s post reviews what I could observe as liquidity metric with the closest relationship to markets - bank reserves, as well as its outlook for the coming quarter and beyond, including the possible implications for equities

As always, the post closes with my current outlook on markets

A long list exists of metrics measuring the amount of US Dollars within the various circuits of economic and financial markets activity. Most of them, such as the well known M2 Money Supply, with little explanatory utility

Since the pandemic however, one liquidity metric stands out with close correlation especially to US stock market activity - bank reserves

I plotted the Billion $ level of bank reserves held at the Fed by US banks against the country’s total stock market capitalisation below, the relationship appears obvious and too immediate for coincidence

Let’s recap quickly how bank balance sheets work:

On the liabilities side, a bank mostly borrows money from consumers and corporates (via deposits), and from capital markets (e.g. via bonds). On the asset side, it then lends out these funds to whoever wants credit, or invests them in securities

On the asset side, each bank will also keep some of the money in a cash account at the Fed - these funds are called reserves. They are set to ensure there is always sufficient liquidity in the banking system, e.g. to provide funds to bank customers wishing to withdraw cash

Should the level of reserves fall to a worrisome level, then the bank would be forced to turn other items on its asset side into cash, e.g. by selling or not renewing one of the loans it made

Conversely, with reserves at a high level, the bank could easily give out new loans, should demand for them exist

The US is currently in an “ample reserves” regime, which simply means that banks - on aggregate - have significantly more reserves than necessary. However, as previously discussed, loan growth is anaemic due to high rates, so the stock-market/reserves correlation is unlikely due to that

Yet, coming back to the above chart, the close correlation between US bank reserves and risk-taking since 2020 seems obvious. Why?

Since 2020, the amount of consumer deposits on banks’ liabilities side has increased dramatically due to Covid-19 stimulus. This has turned the US economy into an income-driven economy, rather than one constrained by leverage

Thus, fluctuations in income are much more important for the economy and markets than credit expansion or contraction. Just as an example, the amount of new mortgages has collapsed since Covid as mortgages rates shot up to ~7%. Still, housing is booming due to cash payers as well as builders subsidising buyers

The evolution of income across the economy is well reflected in the level of deposits on banks’ asset sides. As deposits go up or down, reserves follow

Consequently, if reserves decline, bank risk appetite declines. Even with ample reserves on aggregate, some regional banks in particular are much closer to tight reserves levels and shed assets each time these go down

Summary: The level of US bank reserves is highly correlated to equity markets for good reason. In an income-based economy, reserve fluctuations mirror deposit activity, with a direct influence on risk appetite

As an example, in 2022, deposits declined due to large tax payments and a government budget surplus in Q3 ‘22. The stock market fell

In 2023, deposits rose due to government deficit spend, which pumped billions into bank reserves especially in Q4, coinciding with an equity bull market

The next important question is then, where do reserves go from here? My expectation is that they decline in Q2 ‘24, to then rise again for the remainder of the year. Here is why:

The rapid increase in reserves over the past five months has been closely correlated to the Treasury’s decision to predominately finance itself with bills over the same period. This high supply of bills pushed their yield above that paid of the Reserve Repo facility and drained it:

The money parked in the Reverse Repo facility first moved into the Treasury coffers, then from there onto private sector bank deposits as the government spent it

This effect will likely reverse in Q2, as bill issuance actually turns negative. In other words, $245bn more bills will be retired than issued

Further, just as in 2022, tax payments which are mostly due in April, will likely be considerably higher than expectations, which again moves deposits from the private sector to the government. There are three reasons for it:

First, due to the roaring stock market over the past year, capital gains tax payments will likely be above expectations

Second, the IRS has been staffed up to collect previously unpaid and overdue taxes more aggressively

Third, nominal economic growth over the past quarters has come in significantly higher than expected, with previous budget deficit assumptions based on ~3.5% nominal growth (vs recent run rate of 6-7%)

Take all of the above together, and a decline in bank reserves over the coming quarter appears likely

What about the remainder of the year though? I would expect these dynamics to improve again from Q3 onwards, for the following reasons:

The negative bill issuance will likely only be temporary, to return to high net issuance again once tax payments have passed

With the election looming in November, the government is incentivised to maintain market-friendly policies

Some growth strains have again appeared in the economy, in particular within the labor market. This may be amplified by the likely deposit drain ahead and thus see more liquidity subsequently (e.g. via higher deficit spend etc.)

Summary: Negative bill issuance, lower deficit spend and higher tax payments likely see bank reserves decline in Q2. This likely reverses in the following quarters, with a positive “liquidity” outlook as measured by bank reserves for the remainder of the year

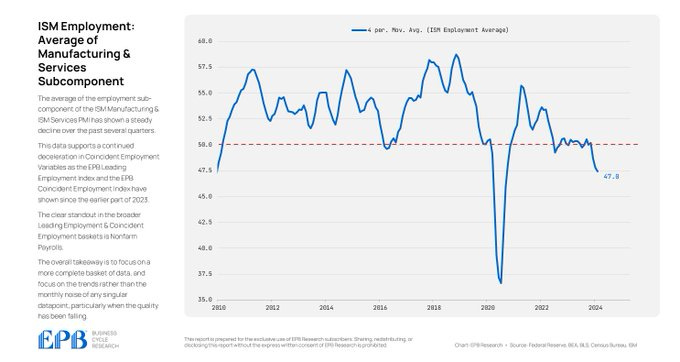

On possible growth strains for the US economy, one cannot ignore recent employment data which under the hood now shows a clear deterioration in many metrics

While the US labor market was “red hot” for the best part of the past three years, it has now moved to resemble the mid 2010s - a state of balance, however with little margin to the downside

Some chart relay the message best:

The unemployment rate is drifting up and now the highest in 2.5 years…

…while part-time jobs are holding the baton…

… the household survey shows job declines…

…the quits rate is dropping sharply….

…while surveys imply more weakness ahead

I had pointed out the possibility of a peak in the market’s growth optimism in the tweet below, with Treasury yields down 30bps since

The Fidelity fund dumping all Treasury bonds was just a proxy for the predominant market view, which leaves plenty of scope for adjustment

Summary: The US labor market is slowly deteriorating. It is a very slow moving tanker, with cycle spans of several years. As such, a rapid worsening is unlikely. A rapid improvement seems equally improbable, even as the cyclical economy shows signs of life as previously discussed. But cyclicals are only ~12% of the economy, with services today the far dominant part

Conclusion:

While most liquidity measures show little explanatory utility, since the pandemic, an undeniably close correlation exists between US equity markets and bank reserves

Bank reserves are likely to decline during Q2, as negative bill issuance, lower deficit spend and higher tax payments create a drag on private sector deposits. For 2H however, this particular “liquidity” outlook is constructive

This Q2 deposit drag may coincide with, or in fact amplify strains on economic growth, with recent labor market data continuing a trend towards soft employment conditions

This ties into my view that capital markets likely experience an overall weak Q2, followed by a bullish second half of the year as “liquidity” returns, and is potentially even emphasised in response to growth worries

Like most correlations, one can also expect the one between the US stock market and bank reserves to eventually disappear as the economic make-up changes. For now, in my view, it continues to be relevant and I would encourage anyone with interest to explore and track it closely

What does this mean for markets?

The following section is for professional investors only. It reflects my own views in a strictly personal capacity and is shared with other likeminded investors for the exchange of views and informational purposes only. Please see the disclaimer at the bottom for more details and always note, I may be entirely wrong and/or may change my mind at any time. This is not investment advice, please do your own due diligence

While there are many ways to investment, the two most dominant strategies in public markets can be summarised as trend following and contrarian

Trend following bets on a continuation of recent price patterns, and especially in equities applies most of the time. The biggest risks are to jump onto the bandwagon late and then lose as the trend turns, or to exit too early in the belief that the trend is over

Contrarian bets on a reversal of price as most of the crowd has piled in. It frequently applies to bonds and FX which are more range bound, and less frequently to equities which are higher one year from today c. 70% of the time, however where turns can cause very significant swings. The biggest risk is to see turns when in fact trends continue. Regular readers will know that much of my work has focussed on catching these turning points

If well executed, both in combination become very powerful. Equally, there are many lessons to be drawn from either. For trend following, the most important one is perhaps not to be the exit liquidity for the smart money that sells. I see some vibes of that right now in semiconductors, where in conversation with sector specialists I see trimming in some favored names in light of valuations that already anticipate a fair share of AI development. Concurrently, the drastic volatility expansion in the sector is a sign that the easy money has been made in the near term. Semis have lead the market on the way up, and dragged the momentum factor with them, with some US high quality stocks now sitting on extreme valuations (e.g. CostCo or WingStop on 50x PE). In other words- don’t be exit liquidity!

With this in mind, below my current stance across short-term and long-term allocations:

Short-term book (Active Trading, Long & Short, Changes Frequently):

The Tech Insurer I mentioned in my last post (see link to write-up again by Value Investigator) has more than doubled since. Even if I can see the case for further gains as it has just reached breakeven with its net cash holdings, I’ve sold it as I’d expect profit taking ahead. I’ve also exited the remainder of this book with only the S&P 500 puts left, concurrent with my outlook for the next 1-2 months, though Natural Gas continues to look technically interesting. With regards to Google, I notice that 3rd party data continues to confirm stable Search, even as the Perplexity.ai userbase keeps rising. Perhaps they are more complementary than thought Please keep in mind that this is a high turnover book and it may already be different by the time you read this - always do your own DD

In summary:

S&P 500 puts May expiry

Long-term book (Asset Allocation for Medium & Long Term):

No changes here, I hope to add to Equities in the Spring, following the logic of today’s post. As mentioned, my next write up will be on Private Credit

86% T-Bills

14% Equities (5% DAX, 5% XLE, 4% China Equities)

Thank you for reading my work, it makes my day. It is free, so if you find it useful, please share it!

Thank you! you bring action oriented clarity in the macro blogsphere... really impressed and grateful

Good article as usual, Florian! I guess Gold got the memo too...

I am not as bearish on US equities (duration-wise), but this is definitely the time for a correction.

Thanks.