Is the Honeymoon Over?

Several signs point to an end of immaculate US disinflation

Over the past months, capital markets have come to accept the Fed’s new dovish doctrine, which demands rates cuts to close the gap between the 5.3% benchmark interest rate and inflation as measured by the Fed’s favourite gauge, Core PCE (<2% recently). With the concept now wholeheartedly embraced and understood by market participants, this has become old news, so the important question is - where is the puck going next?

This post lays out why the market’s next narrative could take a vastly different path, as various trends suggest that immaculate US disinflation may have run its course. As always, Reflexivity plays an important role in this possible shift, as the Fed’s dovish reaction to the growing gap between the Fed Funds rate and Core PCE likely set the stage for increasing inflationary pressures via various channels, some of them still quite under the radar

As always, the post closes with my current outlook on markets

Let’s dive straight in - these are the five dynamics that in their aggregate are likely to challenge current US disinflation:

Cyclical Turn in the Goods Economy

As I had laid out in several posts over the past months, there are several strong indications that the global goods economy has turned a corner

One of the longest goods slowdowns on record has likely ended, as bloated inventories due to overordering during the Covid-19 stay-at-home boom have been worked off. At the same time, US residential housing is picking up

Below chart compares South Korean Semiconductor exports to the ISM Manufacturing index, and suggests further recovery on the horizon

Unsurprisingly, oil (40% industrial demand) and other commodities have started to trade more constructively, and regular readers will be familiar with my view that more upside may be ahead

Summary: The global goods economy has likely ended one of its most severe and prolonged slowdowns. More goods activity likely leads to higher input prices such as oil or other commodities

China

As I had written in “On Blind Spots” recently, many market participants turned a blind eye to the world’s second largest economy and assumed that the Middle Kingdom would just perpetually languish in a deflationary slump

Indeed, Chinese domestic consumption lagged its long-term trend since Covid-19, with the gap widening dramatically over time:

This also showed in corporate results, where traditionally stable categories saw significant volume declines (e.g. below detail from Procter & Gamble’s latest earnings call)

While this was always unlikely to continue forever, last week the market woke up to the possibility of a sea change, as the Chinese government for the first time showed its hand with aggressive support

Further, what many China observers fail to consider, the global goods economy recession had a particularly painful impact on China, which remains the world’s workbench. Should it recover, it would also lift domestic Chinese activity

Summary: China exported deflation to the Western world via sluggish domestic demand and underutilised factories amidst a global goods slump. This may be nearing its end

Geopolitics

Much ink has been spilled over geopolitics being the driver of a new inflationary age. This usually made for a good read, but remained abstract theory. Now, the proof has arrived as the Iran-supported Houthis shut down the Red Sea as global shipping route

C. 12% of global trade and 30% of global container shipping (!) passes through the Red Sea. The Houthis wage a Guerrilla war that is hard to come by unless boots are on the ground. Iran and its allies have found an Achilles heel where the West is vulnerable and struggling to take measures that work

Again, we face a “blind spot”. Many observers fail to either pay attention to what is currently happening in the Red Sea, or to realise that congestion is cumulative. The longer it lasts, the larger the back-up, the larger the costs. The impact on Western goods pricing will continue to increase as long as this global trade artery is clogged

Summary: The impact of shutting down the Red Sea trade route appears vastly underestimated. Shipping costs will continue to increase unless, and until the disruptions are resolved

Rents

US housing costs are measured via the 12-months lagged OER method in the CPI. While the usefulness of rents as sole determinant of housing costs may be debatable in a country when >60% own a home, nevertheless it seems unsurprising that rent increases loom again on the horizon as the Fed’s pivot likely stokes significant house price inflation for 2024

The Penn State Marginal Rent index measures the year-on-year increase in most recent rent agreements. OER rents (as the CPI tracks them) are bound to follow with some lag. More broadly, it seems very probable to see rents follow house price increases, as home rental and ownership markets are closely connected for obvious reasons (e.g. arbitrage of own vs rent etc)

Summary: As house prices squeeze up, rents are likely not far behind

Early-Year Effect

During the first months of every year, countless contracts reset automatically to the previous year inflation rate, from wages, rental and lease agreements to utility bills or social security payments (“COLAs”). In January, 71m Americans will receive a 3.2% bump on those COLAs that likely filters through to consumption in the following months

Consequently, core CPI inflation forecasts for January now range between 0.3-0.4% month-on-month, i.e. ~3.5-4.5% annualised (e.g. MS, GS, Omar Sharif)

Summary: Inflation has historically often been sticky due to the lagged effects of many contractual arrangements. This should not be ignored going forward

Conclusion:

The global goods economy has inflected upwards after a long slowdown, China shows signs of life and geopolitical stress has turned from theory to reality. A revived US residential housing market will likely see rents eventually follow, while early-year effects will likely push inflation readings up in Q1 ‘24

In combination, these dynamics suggest that immaculate US disinflation has probably runs its course, and inflation is likely to trend higher from here, in particular should the US labor market cooperate (see next section)

While all of the above are inflationary, there is one big disinflationary trend - the current US labor market weakness. US consumers have slowed spending as “everything is expensive”, which has impacted corporate pricing power. As margins are threatened, hiring is dialled back

I shared many indications for weak labor market conditions in the past weeks, below is another recent one which shows a drop off in temporary staffing

How does that correlate with the various signs of a re-accelerating US economy, in particular across the goods economy and residential housing?

Latest US data has once again surprised to the upside, including a 3.3% 4Q ‘23 real GDP print

I have no great answer for this paradox. However, one has to keep in mind that just like inflation, employment data is very lagging

Corporates decide to slow hiring due to weak demand several months ago, which then shows up in employment statistics several months later, so the labor market data we see today has been decided upon ~3-6 months in the past

I also have to highlight that some near-term data is not nearly as growth supportive. As written last week, the US Regional Fed Surveys all came in at very low levels

The key question is whether the US economy will pick up steam fast enough to revert the current labor market trend and thus avoid it spilling over into unemployment

Should unemployment rise, many inflationary trends would likely be stopped in their tracks

What does this mean for markets?

The following section is for professional investors only. It reflects my own views in a strictly personal capacity and is shared with other likeminded investors for the exchange of views and informational purposes only. Please see the disclaimer at the bottom for more details and always note, I may be entirely wrong and/or may change my mind at any time. This is not investment advice, please do your own due diligence

In light of the above, I have sold some US 2-Year on Friday, as the market currently prices in 140bps of cuts for 2024, which seems at odds with a potentially 3-4% (annualised) January inflation print, positive real growth surprises and various inflationary trends kicked in motion

I would expect the Fed to pick up on this and guide to a slower cadence of cuts than the market expects at Wednesday’s FOMC, especially as recent economic data suggests Fed members would need to revise their growth expectations for ‘24 upwards in their Summary of Economic Projections

However, this may all be obsolete with negative labor market data, in which case I would expect the Fed to prioritise employment over inflation and cut quickly and forcefully. Accordingly, this is a short-term that I may exit quickly

Aside of the 2-Year short, my book currently looks as follows:

Oil major equities, hedged with small caps. Should Wednesday’s QRA announcement be bullish assets, I will remove the hedge

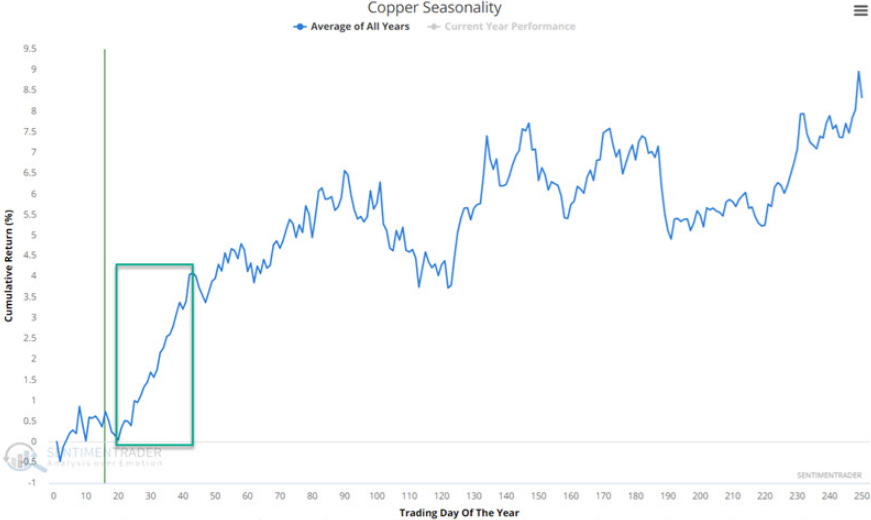

I added a small copper position today as seasonality is now supportive, while CFTC positioning data shows a high number of bearish bets

Still long China equities from near the recent lows

Mostly T-Bills ahead of this week’s QRA release (bill/coupon split this Wednesday)

Still waiting for an entry to robotics

I continue to see some odds that equities have either put in a top last Wednesday (4903 in the S&P 500), or will make one this week

As discussed last week, I have no strong view on the QRA details and plan to react to them, rather than anticipate them. I do note however Janet Yellen’s latest statements on the uncertainty of the interest rate path ahead

*YELLEN SAYS 'JURY'S STILL OUT' ON RETURN TO LOW-RATES ERA

This suggests to me that it is unlikely that the Treasury uses a belief in lower long-term rates as pretext to dial down coupon issuance

Thank you for reading my work, it makes my day. It is free, so if you find it useful, please share it!

Florian, I think you did an admirable job highlighting the reasons that inflation is unlikely to continue to decline as the bulls/doves currently believe. while timing is everything in life, it is very clear that Yellen and probably Powell, will do all they think they can to help Biden get reelected, and if they believe that means cutting rates, they will do so. but it is much harder to accept that housing prices are falling, at least based on the anecdotal evidence I see directly in the Northeast. My take remains that the fed funds futures markets are not actually expecting 5 or 6 cuts, they are pricing either 0-1 cuts as inflation reaccelerates, or 250-300bps of cuts if the bottom falls out. in the latter case, I don't see risk assets performing well. in the former, I suspect they may struggle too.

Interesting perspective. I’m cautiously on the other side of the equation, in that inflation has trended down enough for them to start cutting. The 3&6 month annualized inflation prints are looking good.

Furthermore, the US fiscal situation is a total mess. They NEED inflation to get them out of the massive debt to GDP hole. Other options are much worse. Inflation running hot (especially in asset prices, CPI can be gamed/goalseeked lower, as it has been in the past) is likely. Long risk assets?