Housing vs Disinflation

The key battle for the future of the US economy. Plus more on China

The US economy is currently in a blurry intermediary stage, where opposing forces fight out the battle for its future trajectory. On the one hand, disinflation eats into corporate margins and weakens the labor market, with a continuation eventually leading to recession. On the other hand, the Fed’s autumn ‘23 pivot has put the spark back into the all-important US residential housing market, suggesting an activity pick-up in the quarters ahead that may (or may) not be sufficient to arrest the disinflationary trend

Today’s post contrasts these opposing forces, and attempts a judgement call as to who could emerge as winner and why

As always, the post closes with my current outlook on markets, where I follow up on China and the “Most Shorted”

As discussed in previous posts, we are currently in a period of strong disinflation. The Fed’s favorite inflation measure, Core PCE, will likely come in around 0.12% month-to-month this coming Friday, and has thus been running below the Fed’s inflation target for the past 6 months

Accordingly, the current 5.25% benchmark interest rates are highly restrictive. Unaltered, this trajectory would likely, eventually turn the current broad labor market weakness into higher unemployment

The Fed has this dynamic firmly on its radar and acted in anticipation. Late last year, it guided to rate cuts for ‘24. Even if it these haven’t happened yet, this step was enough for rates to come down across the curve, with an immediate stimulative effect on one of the most yield-sensitive sectors - Residential Housing

It only took a small decline in 30-year mortgage rates to provide a big demand boost. Single family-home starts shot up, and with them the share prices of US homebuilders

Why did the housing market react so dramatically to only a small decrease in mortgage rates?

Three reasons: (1) after 10-years of post-GFC underbuild, there is a severe shortage of single-family homes, (2) millennials are a big cohort in early-family age, and housing is a primal need, (3) at some stage you want to get out of your parent’s basement

Housing is very important, but is it sufficient to turn the economy around? Fixed Residential Investment accounts for ~4% of GDP, so even a 6% growth rates boosts GDP by only 24bps

More so, whatever else is going on in the economy likely also influences homebuyer appetite down the road. In other words, more is likely needed

Another big, yield sensitive sector is the automobile industry, c. 5-7% of GDP. Cars are usually financed, so high rates have made them very expensive for consumers and lower rates should stimulate sales. Again, let’s consult the market for the near-term outlook for this industry

Looking at how GM and Ford have traded over the past months, we see an uninspiring picture. The past summer highs have not been taken out, and the medium-term trend appears downwards

In comparison to Housing, it makes sense. Most people who need a car already have one, while many Millennials don’t have a house yet. The bar to get this industry going appears to be significantly higher

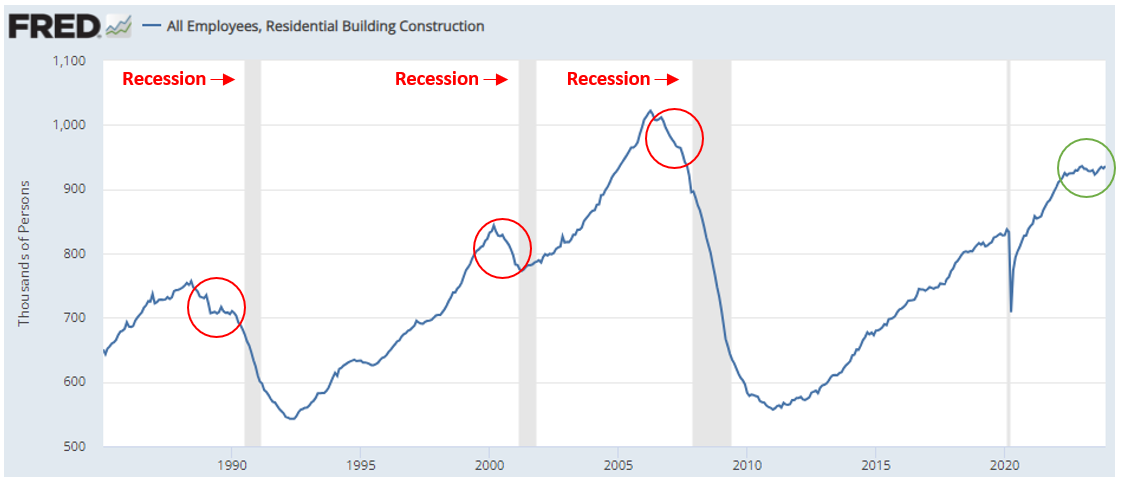

Zooming out to a long-term view, historically, Housing showed weakness in the lead up to a recession. Today, there is no sign of weakness, in fact we hear plenty of reports of qualified personnel shortages

Autos paints a different picture. Latest sales data was soft, and auto industry employment trends are softening, such as at Fiat/Chrysler’s Detroit plant where 4500 workers were just sent home

Summary:

Housing is a very important piece of the GDP growth puzzle and faces unique supply/demand features that quickly turns it growth-positive

To arrest the existing disinflationary trend, other sectors such as Autos will likely need to participate. For these, the growth hurdle appears much higher

But why is disinflation an issue in the first place? To recall, corporate revenues are price * volume, where inflation = price

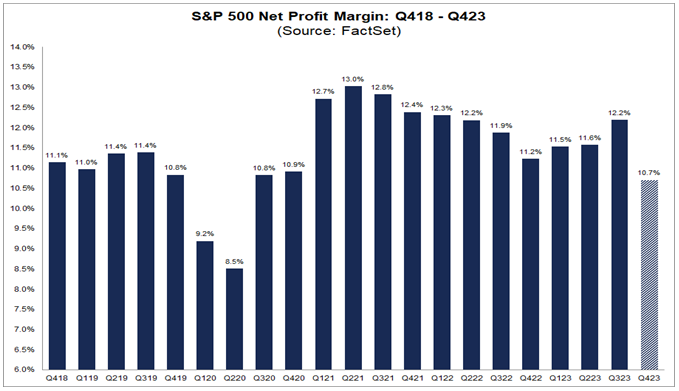

The recent collapse in inflation tells us corporate pricing power is gone, and there is no volume pick-up. At the same time, wage growth continues at a high pace, squeezing margins:

While the chart above may appear theoretical, it is corroborated by earnings outside Tech/AI, which continue to be underwhelming, in particular the guidance for ‘24

Danaher, GE and 3M (all industrial bellwethers) sold off heavily on weak guidance. More broadly, the current margin trend is clear from the below Factset data

Further, as I wrote in my post earlier this week, chances are that economic data surprises to the downside again. Looking at the Regional Fed surveys year-to-date, whose components can be used to forecast the next ISM Manufacturing Survey print, a pretty big step down seems possible…

…while state level employment trends are concerning and corroborate the picture of a weakening labor market that I have been going on about…

…with California looking particularly bad, where the unemployment rate is now a full percentage point off its lows

Conclusion:

The US economy is entangle in a battle between strengthening disinflationary forces and a reviving housing market

More support is likely needed bring more important sectors such as automobiles back into growth

The odds of a growth scare may be higher than expected, and one cannot rule out aggressive Fed cuts this year, should this battle be won in favor of the disinflationary trend

What does this mean for markets?

The following section is for professional investors only. It reflects my own views in a strictly personal capacity and is shared with other likeminded investors for the exchange of views and informational purposes only. Please see the disclaimer at the bottom for more details and always note, I may be entirely wrong and/or may change my mind at any time. This is not investment advice, please do your own due diligence

In my last two posts, I made two specific calls - I bought China equities last week as my view was the selloff would soon get the government to react

Exactly said scenario has played out. The Chinese government committed to buying ~$300bn worth of equities, roughly the combined market cap of Alibaba and Pindoudou together

Further, the PBOC announced a rate cut, and unusually so chose to broadcast this decision in a public press conference during market hours

In another possible sign of a bottom, a Asian hedge fund closed down due to heavy losses in Chinese stocks

In response, Chinese equities have rallied sharply. While many are still very doubtful, I would apply Occam’s razor to the situation, i.e. seek the simplest explanation

The Chinese government does not want the stock market to go down further and has acted forcefully. Betting on more declines means fighting the government, historically never a good idea in asset markets. Accordingly, I am keeping my China exposure. But please keep in mind, China is a risky geography, anything can happen, please do your own due diligence

I have also opened a small position in EU Luxury companies, hedged with the DAX, and I am keeping the oil major equities

The second specific call was that the “Most Shorted” equities would catch up with the main US indexes, as hedge funds regrossed the short side in the past weeks, while stable rates would permit a bid into this area

This process is now in motion, and probably has some further to go. Still and possibly too cautiously, I have taken the opportunity to sell my exposure in the correlated ARK ETF for the following broader reasoning vis-a-vis equities:

Coming back to today’s topic, initially, an economic slowdown is very bullish for equities. It allows the Fed to stimulate the economy by cutting rates, which boosts the valuation multiple. Initially, and often entirely, this outweighs the headwind of lower earnings

As an example, very roughly, if long-term yields fell from 4% to 3%, equity earnings would have to decrease by ~15-20% for stocks to remain at the same valuation relative to bonds

We are currently in that stage, a period where economic data has weakened enough for bond yields to come down, but not enough for earnings estimates to be cut significantly- the soft landing dream scenario

While it is entirely possible that this ends up being the case, I am very doubtful that it will be realised in a straight line. At the same time, the odds are significant that a less benign scenario materialises, or at the very least that the market worries about it for some time

Equally, we could see some meandering between opposing outcomes, e.g. a growth scare in February/March that leads to a sell off, which gets the Fed to cut more aggressively, which leads to a rally etc.

Equities are very frothy now, with retail enthusiasm running high, while institutions are looking to offload their books:

I prefer to join them and sell, rather than to buy from them. Accordingly, I am now mostly in cash aside of the positions highlighted above, to be able to act if higher volatility should lie ahead

It is of course as always uncertain whether this will be the right the decision, but it is how I weigh the risk-reward in light of both the market’s and the economic context

I think the odds are that the market tops over the coming 1-2 weeks, and that a bigger move will then follow, with the bond market possibly ground zero for that, e.g. if economic data rolls over unexpectedly. As mentioned in my last post, I already had a stab at the German 10-year, but have sold it again as the QRA and FOMC next week might still impact bonds in an adverse way. I continue to follow them very closely and may re-engage again soon

Should I be wrong and this turns out to be an uninterrupted bull market for the remainder of the year, then there will likely be plenty of other opportunities along the way within equity sectors, or across other asset classes

Thank you for reading my work, it makes my day. It is free, so if you find it useful, please share it!

Florian, the battle lines are across so many sides regarding future growth or slowdown, inflation or deflation, scarcity or surplus it is difficult to keep up. In fact, what makes this such an interesting market is that everyone has data points to highlight to support their thesis, whether bullish or bearish, hawkish or dovish. it is truly a muddle, but great call on Chinese stocks. LeShrub saying the same thing

Excellent piece Florian. What was your principal rationale for dipping your toe back in the Euro Luxury stocks? LVMH / $MC Eur675 seems like in interesting multi year point of interest. Should work if China works.